You can't start a restaurant without a plan. A restaurant business plan is one of the most (if not the most) essential elements in getting a new restaurant off the ground. There are a few reasons for this:

- A business plan is typically the first thing any lender or investor will want to look at

- Taking the time and energy to create one proves to others (and yourself) that you're serious about the venture

- You'll have a document to reference during the planning or opening of your restaurant.

Although it's an essential step in starting a restaurant, creating a business plan can be challenging for an aspiring restaurateur. But it doesn't have to be overwhelming. There are a few key sections that should be included...

What is a restaurant business plan, and why do you need one?

A restaurant business plan is a document that outlines the various aspects of your restaurant business. It can be used to secure funding from investors or keep track of your progress as you develop your business. A business plan should include information on your target market, competition, business model, marketing strategy, and financial projections.

A business plan is commonly associated with investors—it's what they will look to for a better understanding of a business, its concept, and its competitive advantage. It will also show how you plan to create a successful restaurant.

Restaurant investor Lauren Fernandez at Full Course keeps it simple: “It's to convince someone to give you money.”

“If you seek investment, it tells the story of the venture to potential investors and/or banks. For the business owner, it sets parameters as well as goals for both the pre and post-opening period. A good operator looks back on their Business Plan on a monthly or quarterly basis to gauge where they are in terms,” says Mark Moeller, president, and owner of The Recipe of Success, a national restaurant consulting firm.

That being said, a business plan doesn't have to be extensive. “Be detailed but not overly so,” says Moeller. “When a plan is too wordy, it tends to turn off the reader and can actually prevent them from finishing,” Lauren Fernandez adds that the business plan should be more akin to a sales document, not an A-to-Z tactical roadmap. At the end of the day, the main goal is to convince a lender or investor to give you money.

Restaurant Business Plan Template

Start creating you restaurant business plan with our free PDF template

Download now

The key ingredients of a great restaurant business plan

Section 1: Cover page and executive summary

This is the “elevator pitch.” An effective executive summary quickly tells the reader who you are and leaves them wanting more. Include items like:

- Your restaurant's name, concept, and cuisine—if you have a logo, use it!

- The management team

- Your market position and competitive advantage

- Your financial projections and the break-even point in sales and days

Section 2: Company description

This section gives a high-level overview of the business you're looking to start: tell investors what your restaurant is all about, who your team is, and how you're going to serve the market.

Restaurant concept

What type of restaurant are you looking to open? Here is where you'll want to give investors an overview of your business. Speak to what sets you apart from the pack, what food you'll serve, the service style (fast-food, fast casual, fine dining, etc.) you'll use, and what makes your new business special. Check out these successful restaurant ideas.

Mission Statement

Your restaurant's mission statement should boil down the essence of why you're starting this new venture in just a few words.

Some mission statements are short and to the point, like Ninety Nine's (“A Passion to Serve”). If you can't simplify your mission in just four words, there's no harm in elaborating. Here is Union Square Hospitality Group's mission statement:

At Union Square Hospitality Group, our mission is to enrich lives through the power of Enlightened Hospitality. This unique approach puts our employees first because we believe that attracting, hiring, and nurturing the right people is what sets our businesses apart. We aim to find “51%ers”, individuals who embody our Family Values of Excellence, Hospitality, Entrepreneurial Spirit, and Integrity. While much longer, it clearly speaks to the company's unique position and goals for the industry.

Management team

Tell potential investors who you already have on your team. It works in your favor to show strong connections to the restaurant industry. “Are they an island, or do they have good connections? The more people they have around them, there's something about that; there's an indicator of success that I can't put my finger on.” says Lauren Fernandez. Investors want to see that you have good people around you. If you have a great GM on board, introduce them here. An award-winning chef in the kitchen? Tell investors about them. Include a headshot, quick bio, and list of relevant experience.

Sample Menu

You don't, by any means, have to have a menu ready to go. But give an idea of some dishes or drinks with projected price points. A sample menu can go a long way in helping a potential investor imagine themselves eating at your restaurant. It also shows that you've done your research given the market, suppliers, and have an idea on menu design.

Section 3: Conduct a market analysis

This covers the customer base you're hoping to appeal to, your position in said market, and what you'll do to catch people's eyes. Describe the current restaurant market where you want to open:

Target market and demographics

Who is your target customer? Here's where you'll explain the tactics you took in conducting your market research and the results of those findings.

You'll want to highlight the most relevant statistics you found about your restaurant business. For example, if you're starting a coffee shop, you may cover that your primary research concluded that 24-36 year-olds make up 40% of your area's population. Research from other outlets suggested that coffee consumption for millennials continues to rise.

This would lead to a convincing, research-based conclusion that the coffee shop could be a realistic and profitable endeavor for the area.

Location analysis

You don't have to have a specific restaurant location or address in mind when you create a business plan. Set your focus on the city or the general neighborhood you want open in, and why you're looking at that area.

Give an overview of the market conditions in your area. Talk about things like restaurant foot traffic, day-parts, local events, and what that part of the city looks like in the future. Is there a new stadium or highrise on the way? Outline it in this section.

Your location choice should align well with the market you intend to target. For example, if you're hoping that young professionals will make up a large portion of your business, ensure your chosen location has that density of people.

Competitive analysis

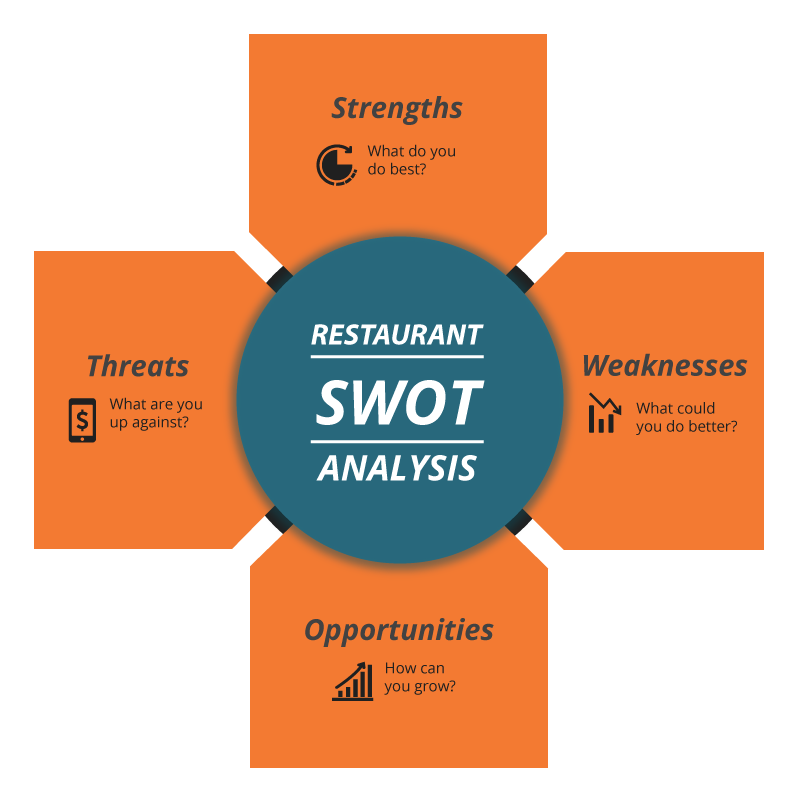

Explain how your restaurant will stand out in a sea of competition. A good idea is to include SWOT analysis for your restaurant, outlining the internal strengths and weaknesses you believe your new business would have, as well as any external opportunities and threats you'd face as an entrepreneur.

Here are examples of each:

- Strengths: Combined 30+ years of restaurant experience from the leadership team.

- Weaknesses: Needed ramp-up time for staff could set our financial projections back.

- Opportunities: Our location is near several office buildings, suggesting we would have a steady flow of white-collar lunch customers and after-work dinner guests.

- Threats: An established restaurant of a similar concept is close in proximity, posing a direct threat to our potential market share.

In your SWOT analysis, you should identify how you intend to overcome the weaknesses and threats your restaurant will face to reassure investors they won't be the downfalls of your business.

Source: Toast

Source: Toast

Section 4: Marketing strategy

How will you reach your target audience? Sticking with the above example of a coffee shop, you may want to talk about your restaurant advertising ideas for millennials, like using TikTok marketing to promote your menu items and an app-based loyalty program.

Marketing plan and channels

Talk about what marketing channels you plan to use to get butts in seats. Detail your plans for using social media, local advertising, promotions, and how you're going to reach your target audience.

Positioning

You'll also want to take a stance on how you'd like to position your restaurant's brand and how you'd like it to be perceived. 65% of consumers feel an emotional connection to brands, so the stronger your emphasis on yours, the more likely your target market will notice and identify with it.

Grand opening plan

You can't have a restaurant without a grand opening.

“Budget at least 2-3% build cost for Grand Opening marketing. You have ONE shot at making a splash in the market, and you must get the grand opening right,” says Lauren Fernandez.“Grand opening should be a week-long celebration, not just one day. Give loyal fans a reason to come back daily. The grand opening ramp-up should begin ~90 days to open, working the market and creating excitement,”

Recommended Reading: Simple Restaurant Marketing Plan + PDF Template

Section 5: An overview of operations

Some investors want to see how all the moving pieces will mesh daily with a detailed operations plan. This section should encompass your staffing strategies, what tech you'll use, and what your restaurant layout may be.

Staffing

Hiring is routinely one of the most difficult tasks in food service. Recent statistics showed that the number of people working in restaurants is declining. Add to that rising restaurant labor cost and high staff turnover. Investors want to know your hiring and retention tactics, such as retention and engagement strategies.

Back of the house

Talk about the details of the back-of-house in your restaurant, such as the commercial kitchen equipment your cooks and chefs will be wielding during their shifts and what the kitchen layout and workflow will be. If you have mock-ups - such as a kitchen floor plan - you can include them here.

Here is also a good time to discuss processes you plan to adhere to in the back of the house, such as food cost control methods and who your inventory suppliers are.

Restaurant technology

Tell investors what technology you plan on using to run your business—and not just the POS (point of sale). Restaurants have access to a bevy of software to run their business efficiently, and investors want to see that you are a savvy operator. You may want to list out:

Recommended Reading: Everything to Know About Restaurant Management Systems

Section 6: The financials

Don't be offended if you see investors skip straight to this section. After all, a business comes down to making money.

So before you finalize this plan, quadruple check these projections, look over your graphs and tables, and consider running them by a hired financial professional in your area.

Startup costs

Any good investor will want to know what his or her money will be going to. Disclose how much money you'll need to get this project off the ground, identify the biggest expenses, and don't be afraid to put a line item in for working capital - which is a reserve fund for your first few (likely slower) months of operation. Also, disclose if there are any planned restaurant business loans.

Sales forecast

It can be hard to create an accurate forecast without a business. But a conservative yet confident restaurant sales forecast can show investors that you're doing the research and considering the right things. You should base this forecast on a few criteria: capacity, target market, delivery/takeout options, month-over-month growth expectations, hours of operation, and menu prices.

Projected Profit & Loss Statement

Use a projected (or pro forma) P&L statement to show investors how much money you expect to have made - or lost - by the end of your first year. This should be based on your sales forecast and your projected restaurant costs (both for opening the restaurant and operating it throughout the year).

Recommended Reading: Free Restaurant Profit and Loss Statement Template

Break-Even Analysis

It's an unforgettable day for a restaurant owner when the business becomes profitable - and you can determine that point in time with a break-even analysis. Calculating break-even will project the threshold to reach in time and sales to pay back investments and startup costs, thus reaching profitability.

Show investors how you reached your break-even point with a break-even calculation. You can reach this number by dividing total fixed costs by the difference between average revenue per guest and average variable cost per guest.

Alternatively, plug those projections in this formula to produce break-even dollars:

Break Even Point = Total Fixed Costs ÷ (Avg. revenue per guest - Avg. variable cost per guest)

You can then compare this number to your sales forecast to determine a timeline for the break-even point in days to let investors know what day they'll start seeing an ROI.

Recommended Reading: 15 Restaurant Metrics to Know and How To Use Them

Section 7: Appendix

The appendix and its contents are all optional, but this section could contain charts, plans, graphics, imagery, or any other material investors may find useful.

Floor Plans

As mentioned earlier, the appendix is the perfect place to include any mockups of your restaurant floor plans. These plans give readers an idea of how guests and employees will be able to maneuver through and interact with each other in the space.

Additional Financial Charts

Got supporting financial documents, like projected cash flow and a projected income statement? Awesome. Place them in here to show investors you really know your numbers.

Design Mockups

If you’ve worked with a building renovator and/or interior designer, include any graphic mockups of what the space would look like. Again, this section is completely optional, but it helps investors visualize the project you’re so passionate about and proves to them that you’ve gone the extra mile in your business research and preparation.

Restaurant Business Plan Template

Use this sample template to help you build your restaurant business plan. Feel free to copy and paste this entire section into a Microsoft Word file or download the outline sample in Google Docs. Then replace the explanations for each section with information about your restaurant business.

Restaurant Business Plan Template

Start creating you restaurant business plan with our free PDF template

Download now

Other Resources for Your Restaurant Business Plan

No great business plan is written in a vacuum. Use whatever you have at your disposal, from industry contacts to other entrepreneurs, and read up on more best practices. Here are a few resources that you can use to help you write a successful restaurant business plan.

Simple to set up, easy to use. Give your restaurant the team management tools they need to be successful. Start your free trial today.

Start free trial

No credit card required

D. J. Costantino

Hi! I'm D.J., 7shifts' resident Content Writer. I come from a family of chefs and have a background in food journalism. I'm always looking for ways to help make the restaurant industry better!