The Connecticut minimum wage is already one of the highest in the country, and it’s still rising. While the state still allows tip credits, they’ll be fully phased out by 2027. That means local restaurant owners must prepare to pay the full minimum one year from now. Understanding these changes and future updates to Connecticut law can help you budget properly and stay ahead.

What’s the minimum wage in Connecticut?

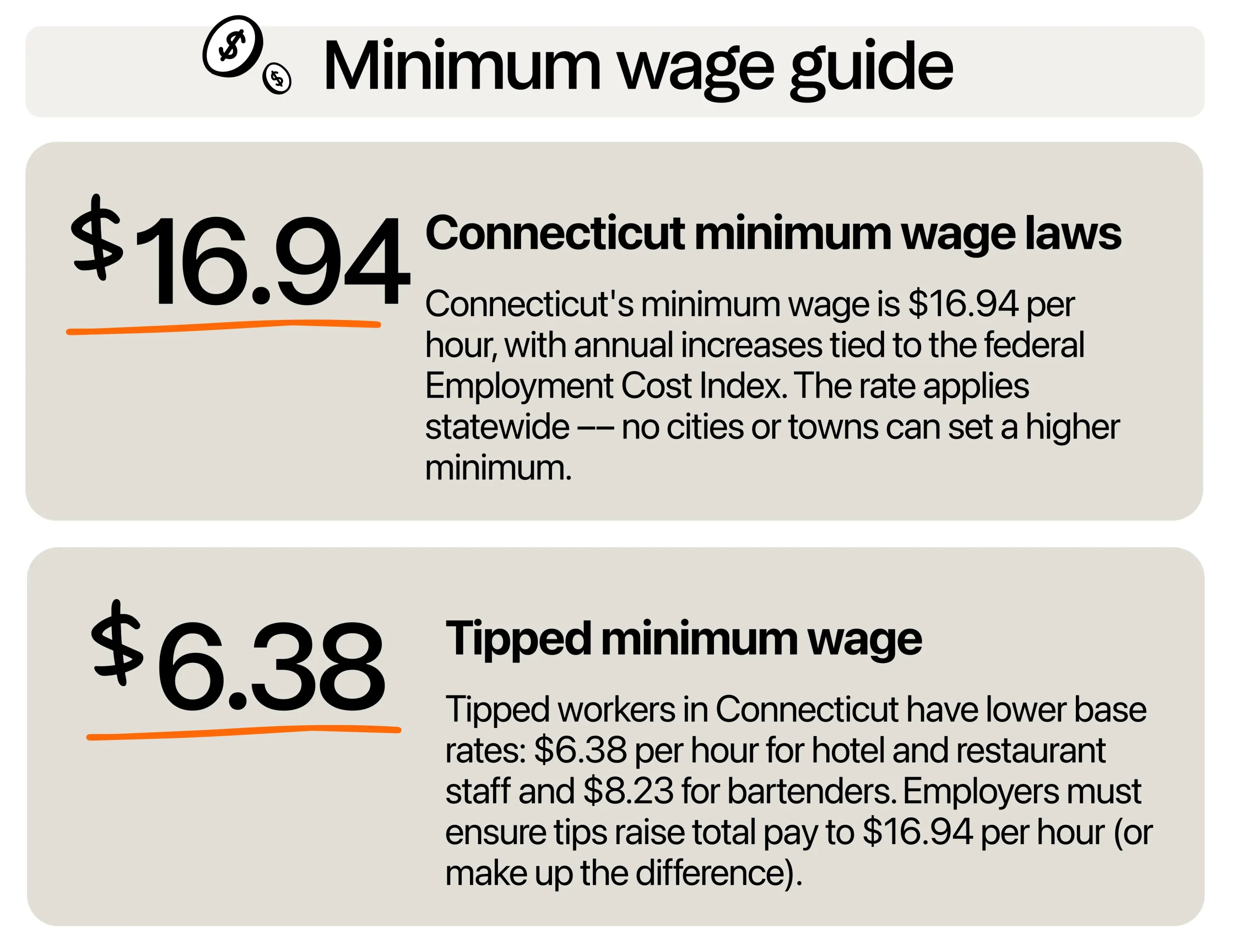

As of January 1, 2026, Connecticut’s minimum wage increased from $16.35 to $16.94 per hour. The rate applies uniformly across the state with no higher wages in towns or cities.

Connecticut’s minimum wage usually rises at the start of every year to account for labor cost changes. This wage increase wasn’t decided by lawmakers but is instead part of a 2019 law that indexes the state’s minimum wage to changes in the federal Employment Cost Index (ECI).

Each year, the Connecticut Department of Labor reviews ECI data through June 30. They then announce the new wage rate by October 15, and that rate takes effect on January 1 of the following year.

How do current wage rates compare with neighboring states?

Connecticut’s minimum wage currently ranks as one of the highest in the country, only behind Washington state, and a few counties in New York and California. At $16.94 per hour, a 40‑hour week costs $677.60 per employee before taxes and benefits. For restaurant owners, that’s a major line item, and it’s why staying ahead of wage trends matters, especially if you operate near state borders.

In Massachusetts and Rhode Island, the rate is $15 and $16, respectively, which makes CT more attractive for workers who want higher wages. This is particularly true for restaurants operating in cities like Providence or New Bedford, where workers can easily cross state lines for better pay.

For those operating near New York, be aware that in New York City, Long Island, and Westchester, the rate is $17 per hour. It’s slightly higher than Connecticut, while the rest of New York State sits at $16. Meanwhile, New Hampshire minimum wage sticks with the federal rate of $7.25 per hour.

Special wage rules in CT

Connecticut has rules that go beyond the base minimum wage to cover tipped workers, minors, trainees, and exempt employees. The state allows tip credits, at least for now, so servers and bartenders can be paid less than the full base wage, but only if their tips bring them up to it.

For example, waitstaff must be paid at least $6.38 per hour, and bartenders $8.23 per hour, assuming tips bring them to the full $16.94 hourly wage. If tips fall short, you, the employer, must cover the gap to ensure total earnings meet the state’s minimum. These rates have been in place since 2017, and tip credits are still allowed for now.

Employees under 18 can be paid 85% of the standard wage during their first 90 days. In 2026, that means they can earn $14.40 per hour. After the 90-day window or once they turn 18, they must be paid the full minimum wage.

Just like minors, trainees or learners can earn up to 85% of the wage for their first 200 hours on the job. After those initial hours, the full $16.94 per hour wage applies.

Additionally, some staff, like managers or administrative workers, might not be eligible for overtime if they’re “exempt.” It also includes any driver or helper whose qualifications and minimum hours of service are under the Secretary of Transportation.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

What the tipped wage phase-out means for your restaurant

Connecticut lawmakers are soon ending the tip credit to ensure income predictability and improve pay equity. Under the old system, earnings varied widely based on customer volume and individual tipping behavior. With a full minimum wage, tipped workers can count on consistent hourly pay and avoid shortfalls.

Now, restaurant owners need to rethink how tips are shared, especially to make sure BOH staff continue to get their fair share. Moreover, wages for tipped roles will need to reach the hourly minimum for 2027, which can be challenging for many establishments.

A gradual scale-up can help you adjust and reach the full wage requirements without abruptly increasing labor costs. For example, you can bump a server’s rate by 78% later this year, then schedule another increase sometime next year to 90%. Come 2027, you can be a bit more ready for the full minimum wage.

The best ways to balance the growing payroll are to introduce a service charge or update menu prices. Review your current operational expenses and use data from previous months to estimate how much the phase-out will affect your labor costs through the next two years.

You can opt to add a fixed 18% to 22% fee to every check, which can be shared across all staff. For the menu price increase, you can raise prices by 5% to 10% across key categories (entrees, drinks, and specials).

Whichever option you pick, be transparent. Add a short note to your menu or receipts so customers know where their money is going (e.g., “This service fee helps us provide fair wages to our entire team”). Additionally, don’t overhaul everything at once. Try a small price change or fee rollout on weekdays or specific locations first. Track guest reactions as well as ticket averages and tips. Then, refine your strategy before making it permanent.

Stay on top of rate changes

The minimum wage in Connecticut rises each year based on the federal ECI. Plus, the tipped wages phase-out means additional financial challenges for restaurant owners. Preparing now can help you avoid rushed decisions and protect your margins.

Managing wage changes doesn’t have to slow you down. Restaurant payroll software can help you track hours accurately while providing better information on your labor costs. With the right tools, you can make confident decisions and stay ahead of rising wage demands.

Also read: Connecticut tip laws for restaurants

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.