Maine’s minimum wage is set to increase yearly based on the Consumer Price Index. This can be challenging for restaurant owners since it means higher costs and more pressure to stay compliant. Here’s everything you need to know about minimum wage in the state, not just to survive but also to thrive.

What is Maine’s minimum wage in 2026?

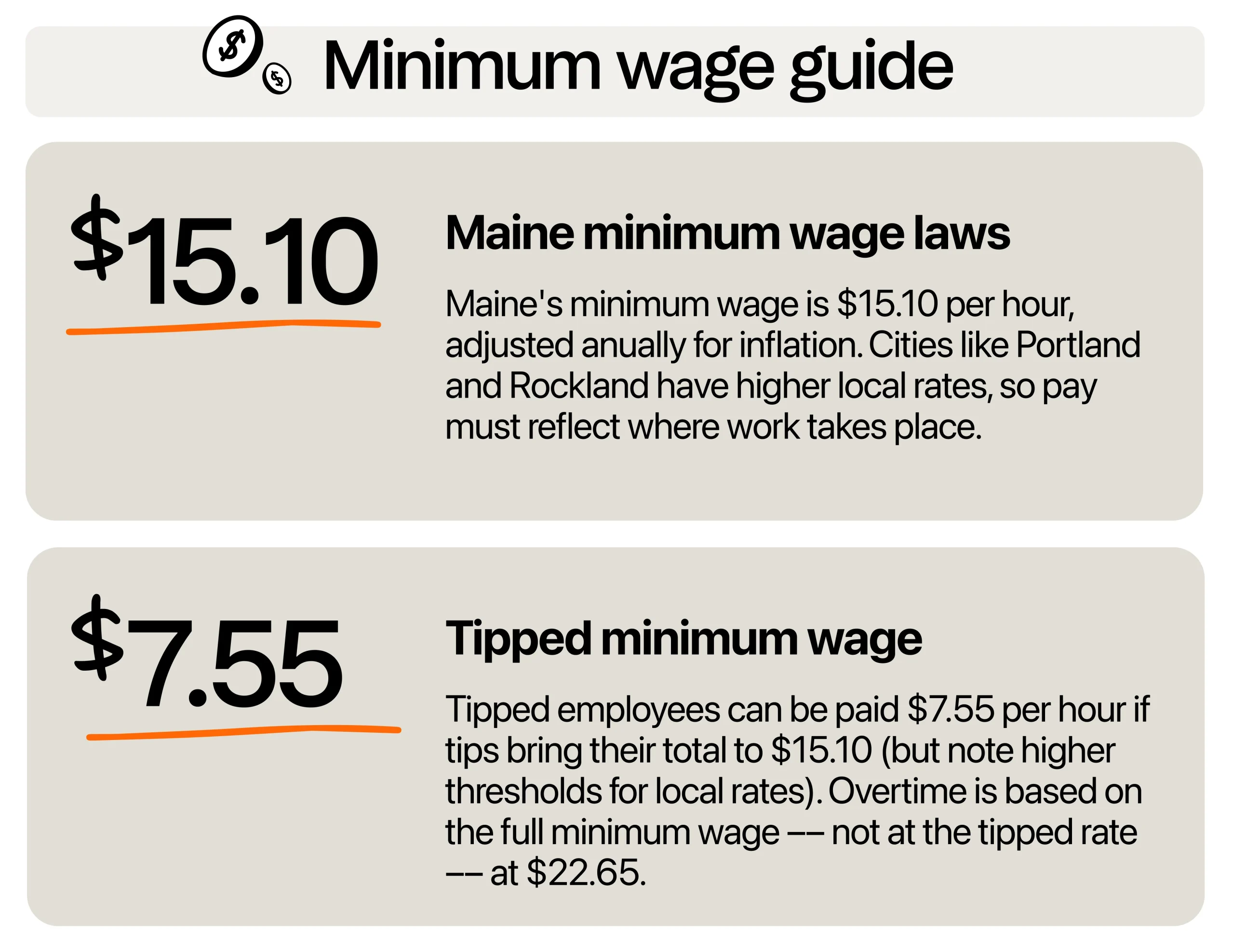

The state minimum wage in Maine rose to $15.10 per hour in January 2026, up from last year’s $14.65. The increase is tied to an automatic wage increase based on inflation. Each year, Maine’s minimum wage adjusts using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

If you operate in Portland or Rockland, you have a higher baseline. As of this year, the local minimum wage in those cities rose to $16.75 and $16 per hour, respectively, based on a separate inflation measure: the Consumer Price Index for All Urban Consumers (CPI-U).

If you’re operating in more than one city, you may need to pay different wages depending on the location. For example, if you own two cafes, one in Augusta and one in Portland, you’ll be paying $15.10 per hour in Augusta, but $16.75 per hour in Portland. That’s a $1.65 difference per hour, per employee, which adds up fast.

Specific rules for tips and overtime

You can pay tipped workers, like servers, bartenders, bussers, $7.55 per hour as long as they get enough tips to reach the $15.10 per hour minimum. This number may be higher in regions like Portland ($8.38) and Rockland ($7.75), so be sure to double-check your location.

If their tips plus base wage don’t equal the full minimum wage, you must make up the difference. This tip credit allows you to pay a lower direct wage, but you’re legally obligated to ensure workers earn at least the standard minimum wage rate.

For instance, you have a server who works an 8-hour shift and earns $50 in tips. Their base wage of $7.55 per hour totals $60.40 for the shift. Since the minimum wage is $15.15 per hour (or $121.20 for 8 hours), the employer must pay an additional $10.80 to meet the legal minimum wage requirement.

Also important: overtime pay has to be calculated based on the full minimum wage, not the tipped base rate. So, for overtime, you’re paying 1.5 x $15.10, not 1.5 x $7.55. That comes out to $22.65 per hour for any time worked past 40 hours per week. This applies whether you’re paying biweekly, weekly, or by shift.

Other labor laws to remember are about breaks. Staff who work 6+ hours must receive a 30-minute unpaid break, while short breaks (5–20 mins) count as paid time.

Does the Maine gov have plans to increase minimum wage in Maine?

If you’re wondering whether Maine plans to raise the minimum wage again soon, the answer is yes, but not through new legislation. Instead, Maine’s rate increases automatically each year thanks to a law passed by voters.

In 2016, Maine voters approved Question 4, a citizens’ initiative that created a built-in system for annual wage increases. This system uses the CPI-W for the Northeast Region to calculate adjustments. The state minimum wage is reviewed every year and adjusted for inflation. New rates take effect on January 1st each year.

Here’s how the minimum salary has grown since the law passed:

- 2017: $9.00

- 2018: $10.00

- 2019: $11.00

- 2020: $12.00

- 2021: $12.15 (first CPI-W adjustment)

- 2022: $12.75

- 2023: $13.80

- 2024: $14.15

- 2025: $14.65

- 2026: $15.10

Aside from annual CPI-W increases, there have been recent legislative efforts to go beyond the current law. LD 853 proposed replacing the statewide minimum with higher, region-specific living wages.

For example, it called for a $25.11 per hour minimum in Cumberland and York Counties, and over $22 in other regions. The bill was voted down and declared dead as of May 28, 2025.

Another one was HP 890, which aimed to raise the state minimum wage to $15/hour starting in 2024. After that, it would increase by $1 or the CPI-W annually until it hit $23/hour in 2033. This proposal also failed and was declared dead in the Senate on December 4, 2024.

There are no new laws coming that will change how minimum wage increases work in Maine. The only thing that matters now is the existing CPI-W indexing system.

How does Maine’s minimum wage compare to its neighbors?

If you’re running a restaurant near the state line, it helps to know how the minimum wage in Maine stacks up against its neighbors. The New Hampshire minimum wage is still at $7.25 per hour, which is the same as the federal rate. This is good news for restaurants in Fryeburg and South Berwick since employees are more motivated to work in better-paying states.

You’ll also have to consider Quebec’s minimum wage, which is at $16.10 CAD ($11.70 USD) and $12.90 CAD ($9.37 USD) per hour for tipped employees. New Brunswick minimum wage is $15.65 CAD ($11.37 USD) per hour. These provinces also have expected increases in 2026.

While these may be lower, you have to consider the additional incentive of universal healthcare, which could offset a lower direct wage. Nonetheless, workers would still have to go through the trouble of processing work permits and potential tax implications.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

How to keep up with mandated wage increases

Don’t wait until December to prepare your payroll. Planning ahead is the best way to manage mandated wage increases. Track labor costs closely, so you can be confident for the next year.

Set calendar reminders for local updates

Set calendar reminders each fall so you’re ready before the January 1 updates take effect. You can also subscribe to alerts and check the Maine Department of Labor website or assign a trusted manager to monitor wage laws in your area. Even being a few weeks late on a new wage could lead to back pay or penalties, especially if you’re operating in a city with different rules from the state.

If you manage multiple locations across cities, or even just across county lines, you must double-check local wage rates. A small dollar per hour gap between state and local wages might not seem like much, but across a 10-person staff working full time, that could be about $1,500 a month.

Review your pricing strategy

Check your prices and see where you can adjust. Instead of making one big jump that might turn customers away, consider small, steady increases over time. A $0.25 to $0.50 bump on select menu items is often enough to help offset higher wage costs without creating sticker shock.

Look at your food cost, prep time, and portion sizes. Are you undercharging for high-labor dishes? Is your top-selling appetizer actually making money after labor and ingredient costs? Use those insights to adjust prices where they’ll make the biggest impact with the least pushback.

Let’s say your burger sells for $13, and your food and labor costs combined is $10. If the state minimum wage rises next year, your labor cost on that dish may go up $0.10 to $0.15. Raising the burger price by just $0.50 would more than cover it, and most guests won’t even notice.

Invest in employee efficiency and engagement

Having an efficient and engaged staff lets you get more value out of every labor dollar spent. Start by making sure your team has the right tools and clear expectations.

Use task checklists, station prep guides, and shift notes to reduce downtime and confusion. If your crew spends less time asking questions or fixing mistakes, they’ll get more done during each shift.

Keeping them engaged also plays a big role in reducing employee turnover, which saves money in the long run. Replacing even a single FOH employee costs over $1,000 in training and lost productivity. This figure goes up to $2,000 for managers.

Invest in your team right at the start with clear onboarding and training. Show new hires exactly what success looks like in their role. Then, use performance tracking tools to recognize top performers and support those falling behind.

You should also rotate side duties to avoid burnout and keep routines fresh. Ask for regular feedback through surveys or team huddles.

Additionally, build a culture where staff feel heard, appreciated, and part of the bigger picture. Even simple actions, like posting shift shout-outs in your team app or offering flexible scheduling options, can have a big impact.

Train your managers

When FOH and BOH managers aren’t on the same page, it’s easy for someone to miss a break, get scheduled into unexpected overtime, or be underpaid for tipped work. That’s why training your managers is one of the most important steps in staying compliant with wage laws.

Teach your managers how minimum wage, tip credits, and overtime rules work in your state and city. They should know how to track hours properly and how to spot red flags like back-to-back split shifts or missed meals.

Strong communication is also key. Make sure managers know how to explain schedule changes, tip pool policies, and wage adjustments to their teams clearly. This helps reduce confusion, builds trust, and avoids unnecessary stress on busy nights.

Thriving through wage increases

As wages continue to rise in The Pine Tree State, restaurant owners need to plan ahead to stay profitable. That means staying in the loop for local updates from the Maine government and tracking your margins closely. You should also invest in building a reliable and motivated team.

Manage labor costs proactively by optimizing each shift. Restaurant scheduling software lets you build smart schedules based on demand and get alerts before someone hits overtime. With 7shifts, you can track breaks and tips automatically, all while staying compliant.

Also read: Tip laws for Maine restaurants

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.