If you’re starting a business in Minnesota or planning to open one soon, the state’s wage laws might seem like a lot at first. But once you take the time to learn how they work, you’ll find they’re easier to manage than you might expect. The rules follow a steady structure, and there are clear guidelines to help you make smart decisions from the beginning.

What is Minnesota’s minimum wage in 2026?

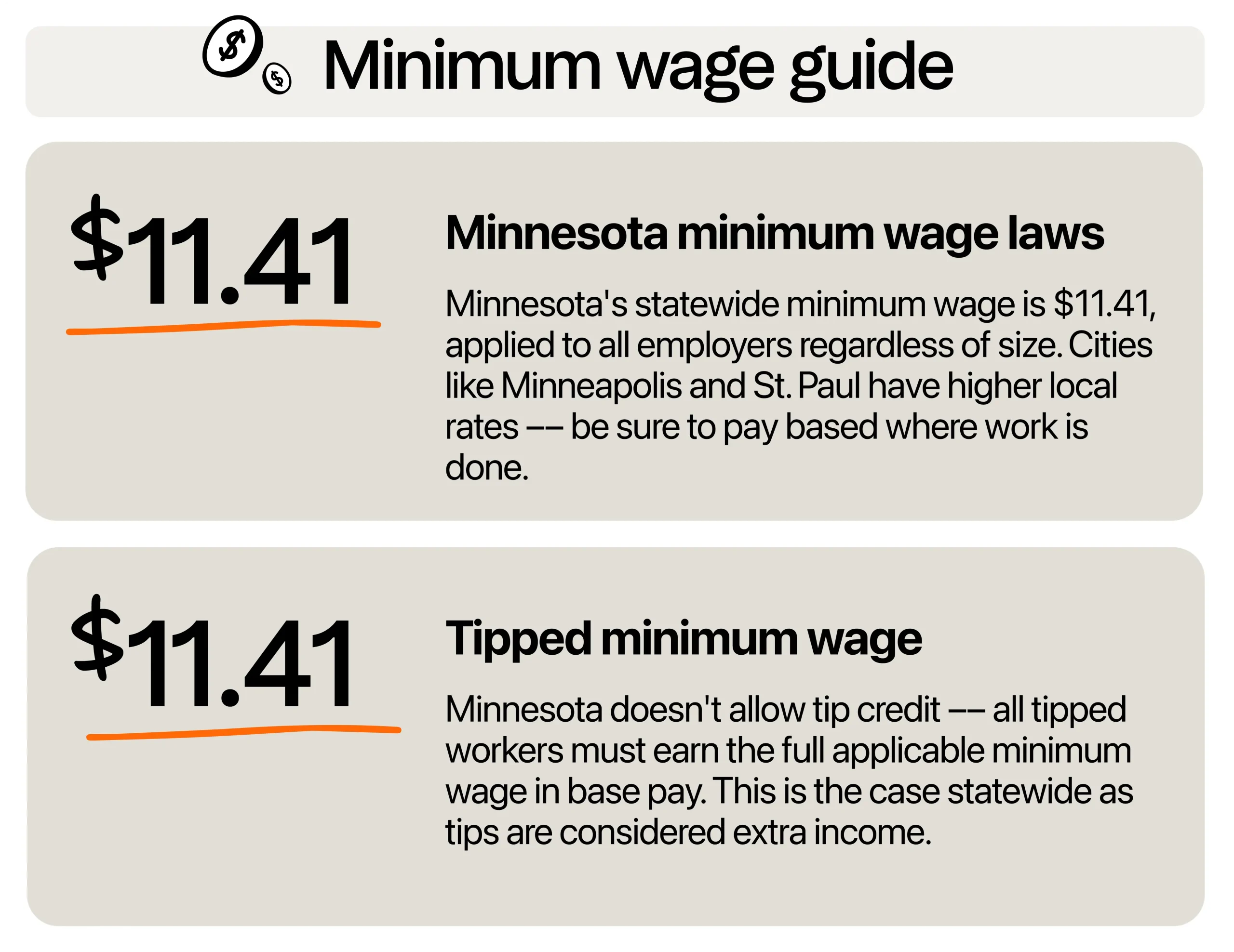

Before, Minnesota had two separate minimum wage rates depending on a business’s gross annual revenue. Large employers paid more than small employers under that structure. That changed starting January 2025. The state started using a single hourly minimum wage rate of $11.13 for all employers, regardless of size. Then, in January 2026, the minimum wage increased to $11.41 per hour.

This rate also applies to youth workers and J-1 visa holders working in hotels, motels, and lodging establishments.

Additionally, Minnesota doesn’t sit still on this rate. The state recalculates the rates every year, usually based on inflation metrics like the Consumer Price Index (CPI), which you can check on the U.S. Bureau of Labor Statistics website.

These rates are higher than the federal minimum wage of $7.25. So, even if you’re a small business, since you’re doing business in Minnesota, you must follow the state’s rules and not the federal baseline.

Local ordinances to remember

Some cities in the state have local wage ordinances, which differ quite a bit from the Minnesota minimum wage. Namely, if your business operates in Minneapolis or St. Paul, local ordinances apply.

As of 2026, the Minneapolis minimum rate is $16.37 per hour for all businesses, regardless of size. The city no longer separates rates by number of employees. Whether you’re a small operation or a large company, the same rate applies.

This change came after Minneapolis set a goal to standardize its wage structure by mid-2025. Now that the transition is complete, all employers must follow the wage rate. Moving forward, the city adjusts this rate annually based on inflation.

St. Paul, on the other hand, is phasing in increases based on business size. Here are the wages for 2026:

| Business Size | Minimum Wage |

| Macro Businesses (101+ employees) | $16.37/hour |

| Small Businesses (6 to 100 employees) | $15/hour ($16.37 starting July 1, 2026) |

| Micro Businesses (5 or fewer employees) | $13.25/hour ($14.25 starting July 1, 2026) |

The structure may seem layered, but the city provides clear guidance and annual updates.

If you run multiple locations or have a remote team working from various counties or cities, always pay attention to where the work is being performed. Do not rely solely on where your HQ is located.

What if your business operates in multiple cities or counties?

Let’s say you own a small catering company based in Ramsey County. Your kitchen crew preps meals at your facility, but your event staff often travels to Minneapolis, St. Paul, or nearby suburbs to serve clients. In Minnesota, what matters most for minimum wage compliance is where the actual work takes place, not where your business is headquartered.

If your team works part of the week in a city with a higher local wage ordinance, like Minneapolis, they must be paid that city’s rate for the hours worked there. If they prep for four hours in Ramsey County but serve an event in Minneapolis for six, you need to split that shift and apply the correct wage to each location.

Do tipped employees follow the same rates?

Unlike some states, Minnesota does not allow tip credit. That means even if your servers, bartenders, or staff make a significant amount in tips, you’re still required to pay them the full state minimum wage for each hour worked. Tips go on top of that.

This often surprises newcomers, but it’s non-negotiable in Minnesota. Let’s say you run a pizza place in Minneapolis and your servers earn $150 in tips on a Saturday shift. You still need to pay them $16.37 for every hour they work, tips aside.

This is a big difference from states like Iowa, where tipped workers can be paid as low as $4.35 per hour with tip credit support.

Are there training wages and youth wages?

The state allows a 90-day training wage of $9.31 per hour for employees who are under 20 years old. This applies only to their first 90 consecutive days of employment and is meant to support onboarding and initial training.

It’s important to note that this training wage is strictly time-limited. On the 91st day, you must raise their pay to the full $11.41 minimum, regardless of skill level or role. It’s a small break for employers bringing on younger, less experienced team members, but it’s not a long-term wage solution.

Overtime information in Minnesota

Minnesota state law requires overtime pay after 48 hours in a single workweek. However, if your business is covered by the Fair Labor Standards Act (FLSA), which includes most businesses involved in interstate commerce or grossing over $500,000 annually, you must follow federal rules and pay overtime after 40 hours instead.

This is a common compliance issue. Even if you’re following state law to the letter, missing the stricter federal rule could still land you in trouble. Make sure your payroll system reflects both standards so you’re always in line with the one that applies.

Will there be wage increases in the future?

Yes. Minnesota’s state minimum wage is adjusted every January based on inflation, so you can expect it to change each year. Minneapolis and St. Paul have also moved beyond their earlier phase-in periods. Minneapolis already applies a uniform minimum wage, while in St. Paul, most businesses are now on a set path of inflation-based increases. Only the smallest employers are still catching up, but even their scheduled hikes are nearly complete.

All three jurisdictions, Minnesota, Minneapolis, and St. Paul, now rely on annual inflation-based adjustments rather than tiered timelines. As a business owner, you should plan for modest yearly increases in payroll.

Here’s the positive side: adjusting wages early can improve staff retention, attract better talent, and reduce turnover. All of that can save you money over time.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

How to adapt your operations to rising wages

Raising wages is rarely easy, especially if your margins are tight. But in Minnesota, where minimum wage rates increase annually and vary by location, preparing in advance is more than just smart; it’s necessary. The good news? There are ways to make it work without sacrificing your bottom line.

Leverage geographic wage differences

If your business operates in more than one city or county, pay attention to where the work happens. Minnesota cities like Minneapolis and St. Paul have higher minimum wage rates, while other areas follow the lower state minimum. You might find opportunities to assign certain tasks, like prep work, inventory, or admin, to staff in lower-wage locations when possible.

It won’t work for everything, but smart scheduling and task planning could give you a little extra flexibility in managing overall payroll costs.

Align staffing with peak hours

Many businesses can reduce unnecessary costs just by adjusting shift coverage. Look closely at your sales trends, service data, or customer flow patterns to understand when your real peak hours happen. Often, staffing habits are based on assumptions rather than actual numbers. Use time tracking or POS data to confirm when your team is busiest, and place your strongest staff members during those times. On the other hand, identify consistent slow periods where fewer employees are needed.

Even cutting 2–3 low-traffic hours per week per employee can add up to hundreds or even thousands in savings over the course of a year. This doesn’t mean reducing headcount; it means redistributing hours more intentionally. Over time, it can make your labor costs more efficient without compromising customer service.

Cross-train your team

The more versatile your staff is, the easier it becomes to run smoother shifts, especially in busy environments like restaurants, bakeries, cafes, or bars. When team members are trained to handle more than one role, such as moving between the register, food prep, dishwashing, or restocking, you don’t need as many people scheduled at once. This gives you more flexibility without sacrificing service.

Cross-training also helps you avoid scrambling when someone calls in sick or when business unexpectedly picks up. It empowers your team to step in where needed, keeps things running efficiently, and boosts morale by giving staff more confidence and variety in their workday.

Review product or service pricing

If your pricing hasn’t changed in a while, review your margins. A modest price increase, just 25 to 50 cents on high-demand products or services, can offset wage increases without hurting customer retention.

For example, if you run a coffee shop, you could raise the price of a latte by 30 cents, but also start serving it in a more premium cup or include latte art to justify the bump. If you’re managing a bakery, you could slightly increase the price of your best-selling pastries and upgrade the packaging or display to make it feel more premium.

Pair price increases with improved presentation or added value, so customers feel they’re getting their money’s worth.

Review your menu and identify low performers

One way to offset higher wages is by trimming the items that cost more to make than they bring in. Review your sales reports regularly to see which menu items or services aren’t selling well. Ask your staff what gets returned or left unfinished most often.

For instance, if you notice your signature flatbread sandwich isn’t moving compared to simpler menu items like grilled cheese or BLTs, it may be worth cutting or modifying the recipe. These insights can help you identify what to cut, scale back, or rework. Removing or adjusting just one underperforming item could help streamline operations, reduce waste, and free up margin for higher payroll costs.

Build wage adjustments into your budget cycle

Plan for wages like you do for your rent or vendor contracts. Add a modest annual bump into your budget, even before it’s mandated. That way, you’re not scrambling when the rate changes. This also builds trust and predictability with your team.

For example, you might budget for a 3% wage increase each year, or tie raises to performance reviews every six months. Some restaurant and café owners gradually raise hourly wages by 50 cents every quarter until reaching a target rate. Others offset wage increases by rotating in limited-time high-margin menu items that boost revenue during seasonal peaks.

Staying compliant with the right tools

Doing everything manually to stay compliant may have worked in the past, but nowadays, it leaves too much room for error and eats up time you could be spending on growth. Business owners like you need to think smarter and adopt tools that help you work faster and stay compliant.

Track hours accurately

If your team works in different locations, like Minneapolis one day and another part of the state the next, then tracking hours accurately is critical. Time clocking software lets your staff punch in from approved devices or locations. That means no more guesswork or scribbled time logs. It helps you see who worked where and for how long. This really matters when local wage rates come into play.

It also cuts down on buddy punching, missed breaks, and those “oops, I forgot to clock out” moments.

Automate wage calculations

Payroll in Minnesota comes with rules. Your team should be paid correctly based on the hours they work, the locations they work in, and the legal requirements set by the state. Payroll software handles all the math for you. It applies overtime, calculates taxes, and keeps records tidy in case you ever need to show them. If you’ve ever had to fix a paycheck mistake by hand, you already know how much stress this can save.

Optimize labor coverage

You know how tricky schedules can get, especially when you’re trying to avoid burnout, control overtime, and keep your team happy. Scheduling software helps you map out shifts in a way that makes sense. For your business and your payroll. It can flag double shifts, help avoid costly overtime, and make sure you’re not short-staffed during a rush. Whether you’re running a bar in St. Paul or a café in Rochester. Better scheduling means smoother shifts and fewer headaches.

Check out government websites for site-specific compliance

Suppose you’re opening multiple locations in the North Star state. In that case, it’s smart to confirm exactly where your property falls, especially since Minneapolis and St. Paul have their own minimum wage rules separate from other cities and suburbs.

Before signing a lease or setting up shop, take a moment to check government websites for the official property map. This will help you verify if your address is officially within city limits. That way, you’ll know which wage laws apply and can avoid confusion or payroll errors down the line. It’s a quick information check that can give you clarity before you make big decisions.

Is it still smart to start a business in Minnesota?

Even with high minimum wages and layered local ordinances, Minnesota remains a promising place to start a business, especially if you plan ahead. According to recent studies, small businesses make up over 99% of firms in the state and employ nearly 46% of the workforce. And while the wage rules may seem complex, they’re clear and consistent, which helps you budget more confidently when you understand them.

Minnesota also boasts a strong survival rate for new businesses, slightly better than the national average, based on a report from the Minnesota Department of Labor and Industry. So, if you’re thinking long-term, this is a place where small ventures can grow and stick around. And with a high per capita income and strong consumer spending power, your business has a real chance to thrive.

Of course, the costs of compliance are real. But with the right systems and support, they don’t have to be overwhelming. Grants, workforce training programs, and business resources are widely available through organizations like DEED. These can help balance out the challenges and put your business in a strong starting position.

Making your business thrive in the North Star state

Minnesota’s multiple wage rates across the state may feel like an extra layer of stress. But it does not have to be a problem. It can be an opportunity to build a stronger team. When you pay fair wages and stay on top of your obligations, you make your business more competitive and create a healthier work environment.

If you’re worried about keeping everything straight, automate it. 7shifts can do the calculations while you focus on what you do best: running your business.

If you’re paying your people fairly, accurately, and on time, you’re already ahead of the curve.

Also read: Tip laws in Minnesota for restaurants

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.