The Buckeye State sets its own pay floors, which is why it’s important for restaurant owners to know the minimum wage in Ohio. Knowing the rates helps you plan your labor budget and comply with wage law. You may even qualify to pay lower than the state-mandated rate if you meet certain small business criteria.

What is Ohio’s minimum wage in 2026?

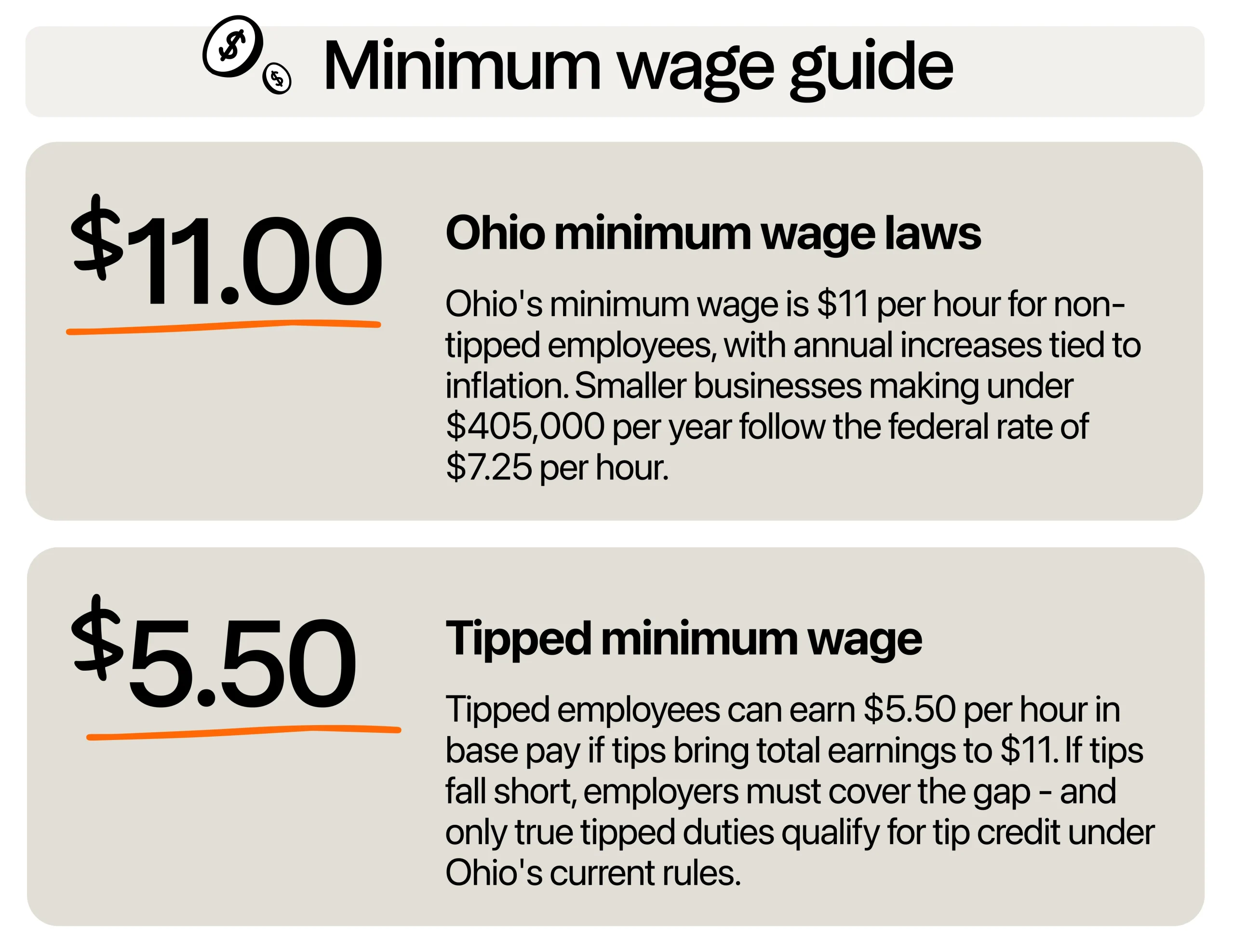

As of January 2026, the minimum wage in Ohio for non-tipped employees is $11 per hour. Tipped employees earn a base wage of $5.50 per hour, and their tips must bring total earnings up to at least $11.

For example, if a server in Ohio makes $7 in tips per hour, they reach $12.35, well above the state wage requirement. But if tips drop to $4 per hour, Ohio employers must add $1.50 to the employee’s wages to meet the minimum.

Businesses in Ohio with less than $405,000 in annual revenue follow the federal minimum of $7.25 per hour. Ohio law ensures these rates apply automatically each January.

How are minimum wages set in Ohio?

It all started in 1938 with the Fair Labor Standards Act, which created a national federal minimum wage. In 1971, Ohio took control and set its state minimum at $1.60 per hour, higher than the federal standard. Then, in 2006, voters passed a state constitutional amendment tying future increases to the Consumer Price Index for urban workers (CPI-W).

Each January 1, the Ohio Department of Commerce checks inflation data and adjusts the Ohio minimum wage automatically. As a result, non-tipped wages increased by approximately 26% from 2018 to 2024, and then by an additional 2.4% in 2025, while the tipped base wage rose by about 29%.

This system gives operators one fixed date (January 1) to update payroll settings. This clear, automatic process helps operators plan labor costs and protect workers’ rights under state and federal labor standards.

It’s a predictable framework that differs from the federal-only approach by neighboring states, as seen in the Kentucky minimum wage. Don’t forget to apply overtime pay at 1.5 times the hourly wage for hours over 40.

How to determine applicable rates

Since the wage increase is automatic, you can plan labor costs every new year proactively. Use the gross-receipts test to see which minimum wage rate applies. If your restaurant’s annual sales are $405,000 or less, you follow the federal minimum of $7.25 per hour for all staff, including tipped roles. On the other hand, if your restaurant’s annual sales exceed $405,000, you must follow Ohio’s state minimum wage of $11.00 per hour for non-tipped workers and $5.50 for tipped employees.

Take note that workers aged 14 and 15 also earn the federal minimum of $7.25 until they turn 16. That means all your hourly wage employees under 16 must be paid at least $7.25, regardless of your sales.

To avoid mistakes, track birthdays and set reminders to bump up wages automatically at year-end. You can also use restaurant payroll software that calculates wage adjustments based on age and current minimum wage rates.

Who counts as a “tipped employee”?

Anyone who earns more than $30 in tips in a typical month in Ohio is officially tipped. That means servers, bartenders, and bussers who clear more than $30 in tips must be tracked under the tipped wage rules.

Tipped workers have a lower base hourly rate, but their total pay (base rate + tips) must hit at least the full state minimum of $11.00. If a team member’s tips plus that $5.50 base don’t reach $11.00 in a shift, you as the employer must make up the difference.

Ohio’s approach to the tip credit, like many states, mirrors the FLSA. Historically, there was an informal “80/20 rule” guidance, and a more formal one that took effect federally in December 2021.

This rule limited the amount of time (20% of a workweek, or 30 consecutive minutes) a tipped employee could spend on “directly supporting” non-tipped duties, like rolling silverware, refilling ice bins, or cleaning tables, while still being paid the tipped minimum wage.

However, the federal Department of Labor formally withdrew this 80/20 rule in December 2024, reverting to its prior “Dual Jobs Rule.” This means that the strict time limits on “side work” are no longer explicitly in effect under federal law, and by extension, generally for Ohio as well.

Under the current Dual Jobs Rule, the key distinction is whether the employee is performing duties that are part of their tipped occupation or duties for a completely separate, non-tipped occupation.

Let’s say a tipped worker performs “related duties” that support their tip-producing work, such as preparing for service, cleaning tables during service, or rolling silverware. An employer can generally still claim the tip credit for that time since these tasks are considered integral to the tipped role.

However, an employee performing duties that aren’t part of their tipped occupation, like a server suddenly spending hours doing maintenance work or deep cleaning bathrooms, which a janitor typically handles. Then, the employer cannot claim a tip credit for those hours, and the employee must be paid the full state minimum wage for that time.

The rule makes sure employers don’t take a tip credit for work that’s not part of a tipped employee’s main role. At the same time, it provides more flexibility for common “side duties” that are part of the overall service provided by a tipped employee.

How to calculate overtime for tipped workers

Calculate overtime at 1.5 × the full state minimum wage ($11.00 × 1.5 = $16.50) and then subtract the tip credit. For example, if a server works 45 hours, their five overtime hours are paid at $16.50, and then you may apply the applicable portion of the tip credit to those hours.

On top of that, Ohio sets strict restaurant tip pooling laws. Only staff who customarily receive tips, like servers and bartenders, can share in the pool. Kitchen cooks and managers must be excluded. You must also keep detailed tip records, including total tips, hours worked, and credits claimed, for at least three years.

Readying yourself for wage changes

Now that you know how much Ohio’s minimum wage is, you can avoid payroll surprises and fines. Make sure to plan for next year’s budget around November or December so that you can smoothly transition between wage rates.

Use restaurant scheduling software to forecast labor and make sure every shift stays within your budget. Start your free trial today.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.