Summary

Location: USA

Restaurant accounting goes beyond standard accounting by addressing the fast-paced, high-volume, and regulation-heavy nature of the food service industry. A robust accounting system helps restaurant operators control costs, improve profitability, and remain compliant in an ever-changing business environment.

Highlights

- Accounting uses bookkeeping records to help businesses make smarter financial decisions.

- Bookkeepers prepare records and financial statements for accountants to analyze.

- Restaurant accounting must deal with industry-specific nuances, such as high daily transaction volume, labor complexities, rapid inventory turnover, and tax law variances.

- Core restaurant accounting responsibilities include analyzing financial statements, generating insights, managing tax obligations, and ensuring regulatory compliance.

In the fast-paced and unpredictable restaurant industry, effective financial planning is essential. Reliable accounting systems are a restaurant’s best safeguard against rising costs, shrinking margins, and poor decision-making. By analyzing bookkeeping records, restaurant accounting empowers restaurant owners to better control costs, manage cash flow, and stay profitable amidst the constant operational and financial pressures of the industry.

What is accounting?

Accounting is the process of analyzing, interpreting, and reporting the financial data a business gathers through bookkeeping. Its main purpose is to help businesses craft sound financial strategies using available financial information. Many activities fall under the umbrella of accounting, including:

- Analyzing financial statements

- Providing financial insights

- Managing tax obligations

- Ensuring regulatory compliance

What is the difference between bookkeeping and accounting?

Bookkeepers and accountants work toward the same objective: ensuring the financial health and success of the business. However, they play different roles in the process. Bookkeeping focuses on recording, organizing, and maintaining financial records. Meanwhile, accounting uses these records to offer insights and advice.

If financial management were a restaurant, the bookkeeper would be the prep cook, and the accountant the head chef. The prep cook handles the foundational tasks: chopping ingredients, preparing sauces, and organizing workstations. In laying down the groundwork, the prep cook allows the head chef to focus on cooking, planning menus, and ultimately driving the restaurant’s success.

In the same way, bookkeepers organize and prepare raw financial data, eliminating the need for accountants to wade through tedious manual tasks. With accurate records already in place, accountants can focus entirely on strategy, financial analysis, and long-term planning.

What makes restaurant accounting different?

Restaurant accounting adjusts standard accounting practices to accommodate the unique complexities of the restaurant industry. It accounts for factors like high transaction volume, perishable inventory, variable labor structures, and industry-specific tax and compliance requirements.

Frequent financial analysis

Restaurants need to monitor their finances more frequently compared to other types of businesses, primarily because of high daily transaction volumes. The typical restaurant will see thousands of small transactions (including dine-in orders, takeout, and deliveries) daily. The sheer volume creates a greater risk of recording or reporting errors. Accountants need to monitor financial data regularly to spot errors and inefficiencies.

Sales can also fluctuate by day of the week. Restaurant operators can build a more accurate picture of sales trends by generating and analyzing financial reports weekly. In contrast, most businesses only review financial reports once a month.

Labor cost complexities

Restaurants typically employ a mix of hourly, salaried, tipped, and sometimes contract workers. Because each category comes with its own pay structure, tax requirements, and regulatory considerations, labor costing can get a little complex. For example, tipped employees may earn a lower base wage under tip credit laws, while salaried managers may be exempt from overtime rules.

Accountants must ensure that the restaurant processes payroll correctly for each worker type, reports and taxes tips correctly, and maintains compliance with federal, state, and local labor laws. They also analyze labor costs by role, shift, and department to identify inefficiencies and propose changes to scheduling or wage structures. With this level of analysis, restaurants can keep one of their most significant expenses under control.

Rapid inventory turnover

One of the most complex aspects of restaurant accounting is inventory management. Unlike in many other industries, restaurant inventory is perishable and loses value quickly due to spoilage. In addition, inventory turns over rapidly, as restaurants consume ingredients immediately to prepare menu items. This creates constant pressure to monitor and manage inventory closely.

Additionally, seasonality and spoilage cause the value of food and beverage items to fluctuate significantly from week to week. It’s the accountant’s responsibility to track these changes, monitoring inventory costs and profit margins per dish. Through regular monitoring, they can help identify when a menu item becomes less profitable and advise on whether to adjust pricing, portion sizes, or sourcing.

Tax compliance complexity

Compared with other types of businesses, restaurants deal with more diverse tax obligations. Variances in sales and labor tax requirements complicate tax preparation and calculation. Below are some tax complexities restaurant operators face:

- Sales tax: Restaurant accountants must keep up with the various tax categories that apply to different menu items. Nearly all governments tax alcoholic beverages at higher rates than food products, while some jurisdictions tax dine-in meals differently from takeout or cold food. Additionally, restaurants with multiple locations must follow each area’s distinct tax laws.

- Labor tax: Employers are responsible for accurately withholding and reporting payroll taxes for each employee type, despite differences in wage structures and compensation methods.

- Tip reporting: Restaurant employers are required to report cash and non-cash tips worth $20 or more each month. They must withhold federal income tax, Social Security, and Medicare taxes on these reported tips and also match the employer share of FICA taxes. When tip pooling or tip sharing is in place, employers are responsible for accurately calculating and distributing tips, and for ensuring proper tax withholding and reporting on the redistributed amounts.

- Audit risk reduction: Since many restaurants work with cash and tips, their risk of IRS and state audits is much higher compared to other types of businesses. Restaurant accountants must keep the business audit-ready by generating all necessary documents (such as POS reports, bank reconciliations, and tip allocation documents) with accuracy and consideration for regulatory requirements.

Key components of restaurant accounting

Restaurant accounting encompasses a wide range of financial management activities. These translate bookkeeping records to provide strategic guidance and support profitability, compliance, and long-term success.

Analyzing financial statements

One of the key responsibilities of a restaurant accountant is to analyze the three primary financial statements, namely the balance sheet, the P&L (profit and loss) statement, and the cash flow statement. They compare these reports against historical data and industry benchmarks to gauge how well your business is performing.

- Balance sheets summarize the ending balances of all assets, liabilities, and equity accounts at a given point in time. In other words, it provides a snapshot of what your business owns and what it owes to lenders and investors. Accountants use balance sheets to evaluate whether you have a good ratio of debt to equity and investments.

- P&L statements summarize income, expenses, gains, and losses over a given period of time. Accountants look at the ratio of income to expenses to evaluate whether the business can generate enough money to sustain its operations, profit, and invest in growth. They also use historic P&L statement data to map out spending or revenue patterns they can use for forecasting.

- Cash flow statements track the movement of cash over a given period of time. Unlike the P&L statement, it exclusively tracks money that is immediately usable. Accountants use cash flow statements to assess whether a business is liquid enough to sustain its operations.

Providing financial insights

Restaurants use their industry expertise to extract valuable insights from your bookkeeping records. By crafting informed strategies, they empower your business to manage costs, improve profitability, and ensure long-term sustainability. Examples of insights accountants provide include:

- Forecasting: Using forecasting tools, accountants can estimate the financial impact of proposed business decisions. This allows you to explore potential strategies without committing actual funds.

- Budgeting: Accountants help you create spending plans. They identify the best way to allocate your funds to maximize revenue and maintain quality service.

- Cost control: Using your financial records, accountants map out spending patterns, then look for ways to reduce overspending, spoilage, and waste.

- Labor cost analysis: Accountants can break down labor costs by role, department, and shift. They use their findings to craft recommendations for wage structures and staffing strategies.

- Menu pricing: Restaurant accountants can break down sales and expenses by item to reveal profitability. With these insights, they’ll help you build a menu that highlights your most profitable dishes.

- Break-even analysis: By analyzing your fixed and variable expenses, restaurant accountants determine how much revenue you need to generate to operate sustainably. This helps them create clear sales targets.

- Cash flow management: Through cash flow statement analysis, accountants map out historic trends in cash flow. This helps them anticipate and prevent shortfalls, keeping operations running smoothly.

Managing tax obligations

Another major restaurant accounting responsibility is supporting businesses through its many tax obligations. Restaurant accountants stay on top of local and federal laws to help your business pay its due taxes while minimizing risk and avoiding penalties. A few significant tax responsibilities include:

- Preparing and filing business tax returns accurately and on time in accordance with local, state, and federal laws.

- Calculating and remitting payroll taxes, including Social Security, Medicare, and unemployment taxes.

- Ensuring proper collection and reporting of sales tax, which can vary by location, item type, and service format (e.g., dine-in vs. takeout).

- Managing tip tax compliance by overseeing accurate reporting, withholding, and remittance of FICA taxes on employee-reported tips.

- Advising on tax deductions and credits relevant to restaurants, such as depreciation on equipment, food donations, or the Work Opportunity Tax Credit (WOTC).

Ensuring regulatory compliance

Accountants have in-depth knowledge of local and federal regulations—such as labor, tip, tax laws, and licensing requirements. They ensure your restaurant stays compliant whenever you make business decisions and execute financial management tasks.

Here are a few examples of how restaurant accountants help with compliance:

- Tax compliance: Restaurant accountants are responsible for preparing and filing accurate tax returns in compliance with local, state, and federal regulations. They ensure all income and expenses receive proper tax treatment and that payroll taxes are correctly withheld, reported, and paid.

- Tip reporting: Accountants ensure that employee tips are properly documented and reported using the appropriate IRS forms. They also oversee the correct calculation, withholding, and payment of payroll taxes on reported tips.

- Financial reporting: To keep your documents audit-ready and aligned with GAAP and IFRS standards, restaurant accountants regularly review your balance sheets, P&L statements, and cash flow statements.

- Licensing and permits: Restaurant accountants have a strong understanding of local and federal licensing requirements. They track renewal schedules to help keep all licenses and permits current, reducing the risk of fines, penalties, or forced closures.

Restaurant accounting best practices

While restaurant accounting offers valuable benefits, inefficient processes can prevent you from realizing its full potential. Following best practices helps you maximize efficiency, minimize risk, and unlock deeper financial insights.

Hire an accountant

While bookkeeping is a job many restaurant operators can perform themselves, restaurant accounting requires specialized knowledge. The financial management needs of restaurants (such as perishable inventory management, labor cost analysis, tax compliance, and tip reporting) tend to be complex, and addressing them requires significant time investment.

Since you want to focus your time and energy on running your business, it’s best to outsource demanding accounting tasks to experts. Restaurant accountants understand the unique financial challenges of the industry and can provide the support needed to navigate them effectively.

Use accounting software

While it’s possible to do restaurant accounting manually, the higher your transaction volume, the harder this will be. Using accounting software for both accounting and bookkeeping tasks will save time and reduce the risk of manual data entry. It also provides automated support for many processes, such as the following:

- Tax preparation: Many accounting software programs offer tax preparation features that automatically gather and organize data for accurate tax filing. They will also use your data and local rules to calculate sales tax, payroll tax, income tax, and VAT owed.

- Budgeting and forecasting: Accounting software comes with machine learning tools that analyze your financial data to generate informed budgets and forecasts. They also use data visualization tools to transform the information into easy-to-digest charts and graphs.

- Regulatory compliance: The financial statements accounting software automatically complies with GAAP, IFRS, and local standards.

- Payroll compliance: Accounting software will automatically apply local labor laws for minimum wage, overtime, deductions, and benefits.

Monitor key metrics regularly

The restaurant industry is fast-paced. Operators deal with high daily transaction volume, regular price fluctuations, seasonal demand, and thin, sensitive profit margins. To address the constant flux of changes, restaurant operators and their accountants should monitor key financial metrics regularly. Regular financial monitoring helps restaurants spot problems before they snowball, control cash flow, and optimize profit margins.

Examples of useful restaurant metrics include:

- Cost of goods sold (COGS) by category (e.g., food, beverage, alcohol)

- Labor costs and labor cost percentage relative to revenue

- Prime cost (food + labor costs) as a percentage of total sales

- Gross profit margin

- Net profit margin

- Ideal menu price

- Daily and weekly sales trends

- Table turnover rate

- Average customer headcount

- Average revenue per guest

Maximize the benefits of restaurant accounting with 7shifts

Robust restaurant accounting systems play a crucial role in the success of a restaurant. Accountants use your bookkeeping records to assess your overall financial health, which allows them to recommend strategies for cost control, revenue generation, budget optimization, and more. They also help you remain compliant with laws, tax rules, and other restaurant requirements.

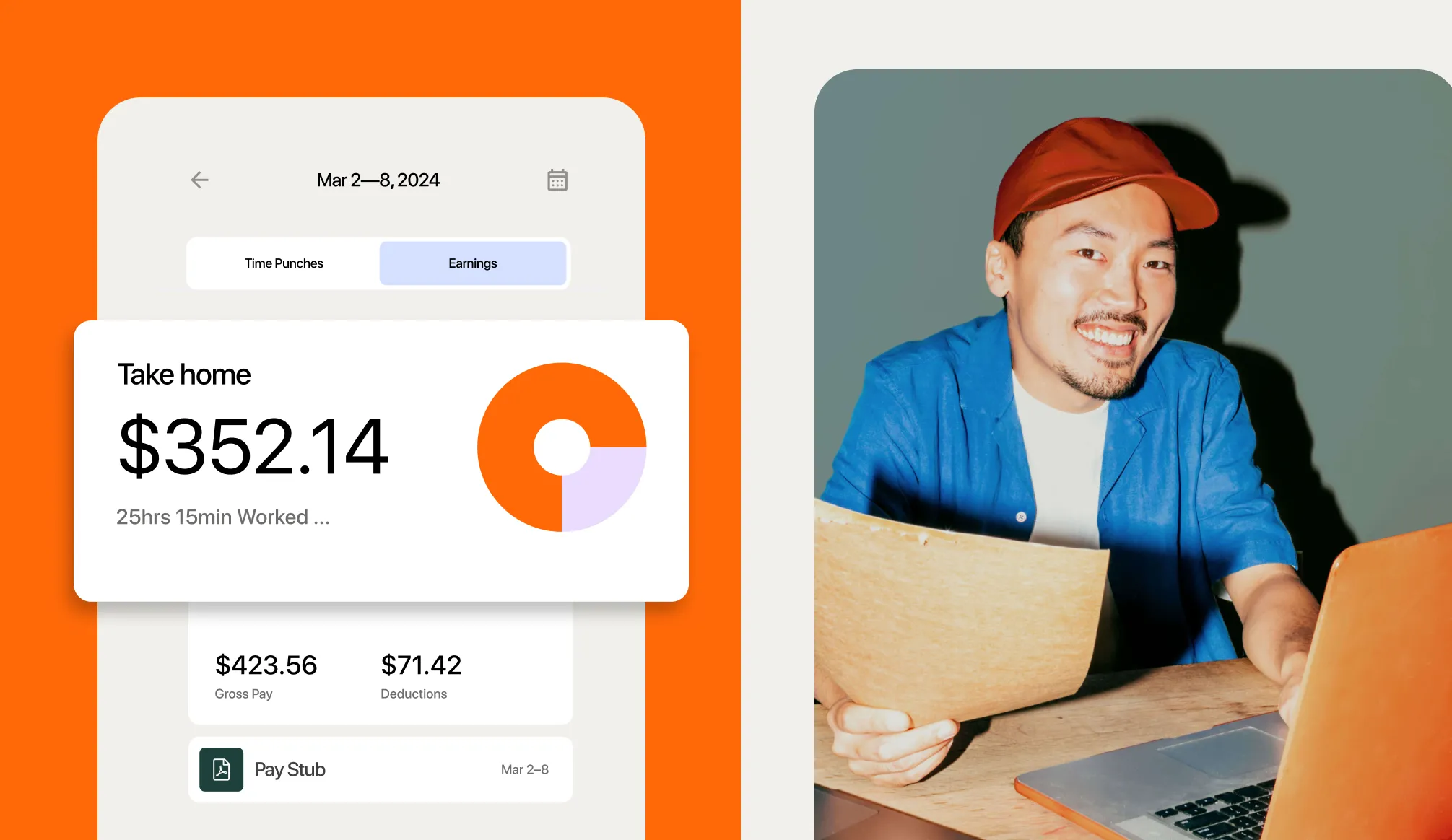

7shifts helps you establish a solid bookkeeping foundation for accounting processes. It automates many important financial management tasks, such as payroll processing, tip management, and time-clocking. With our QuickBooks integration, you can easily transfer data like timesheet hours, payroll details, and sales reports to your journals, ledgers, and statements, improving accuracy and efficiency.

Jessica Ho, Content Marketing Specialist

Jessica Ho

Content Marketing Specialist

Hi, I'm Jessica, Content Marketing Specialist at 7shifts! I'm writing about all things related to the restaurant industry.