If you’re running a business in Alabama or thinking of starting one, you’re eyeing a good spot. Alabama is buzzing with entrepreneurial energy, and according to the US Chamber of Commerce, in 2023 alone, over 71,000 new business applications were filed in the state, reflecting a 0.5% increase from the previous year. This surge places Alabama among the top states for new business growth, signaling a vibrant and welcoming environment for startups.

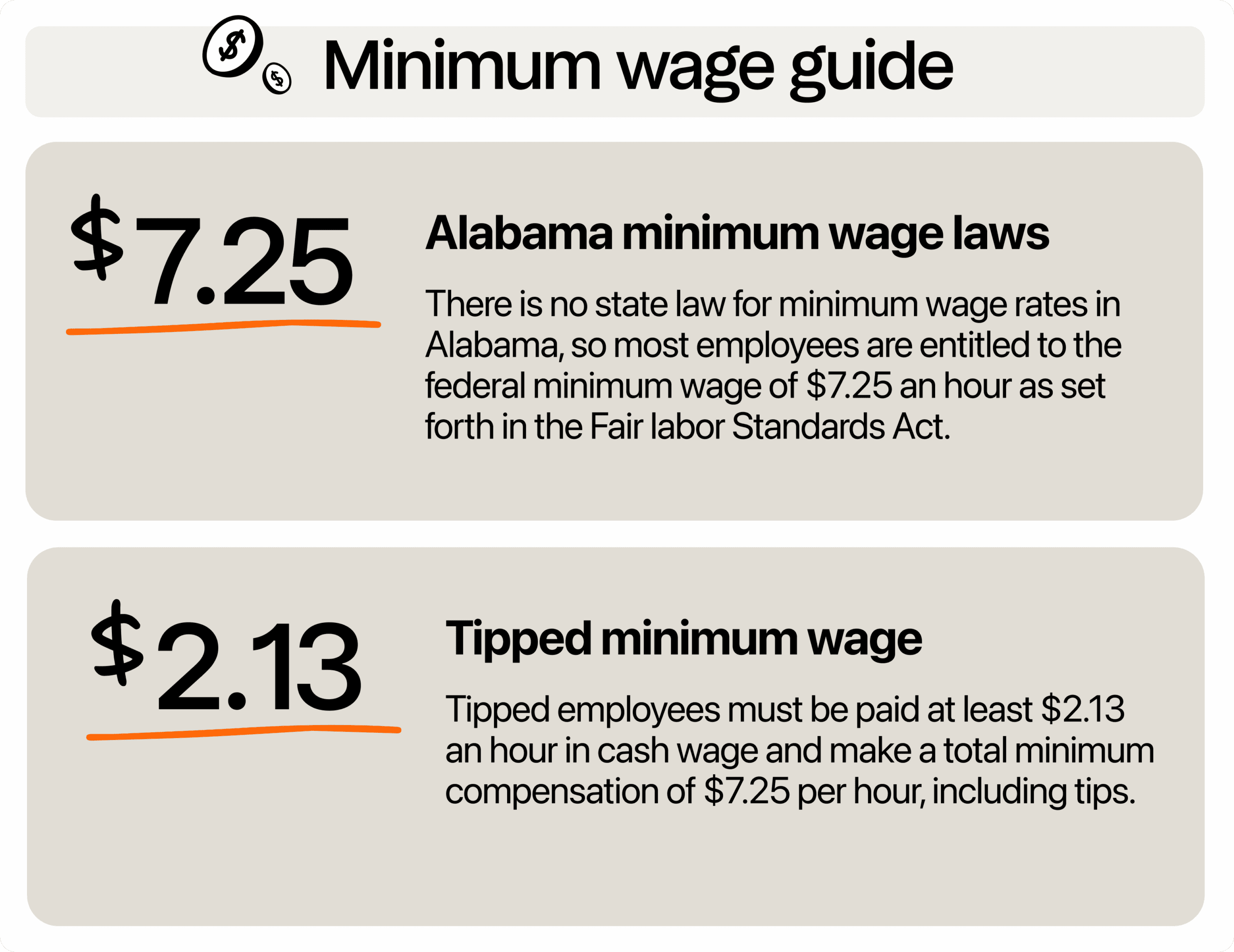

However, before you move forward, there’s one thing you need to factor into your plans: its minimum wage. Alabama doesn’t have its own minimum wage law. That means the federal rate of $7.25 per hour applies statewide, and it hasn’t changed for many years now. Sounds simple, right? But there’s more to consider if you want to stay competitive and compliant.

What is the state minimum wage in Alabama?

Alabama is one of only a handful of states that has chosen not to implement its own minimum wage. Since the federal minimum wage was established through the Fair Labor Standards Act (FLSA) in 1938, Alabama has consistently deferred to it without implementing a state-specific rate, and is officially listed as a “no state minimum” jurisdiction.

Today, the state follows the federal minimum wage, which is currently $7.25 per hour. This has been the federal rate since 2009, and unless there’s a change at the national level, that’s what applies across the board in Alabama.

Now, if you’re hiring tipped employees, like servers, bartenders, restaurant employees, or delivery drivers, you’re allowed to pay a base wage of $2.13 per hour as long as the tips they earn bring them up to the full $7.25 minimum. But you’re on the hook to make up the difference if tips fall short. It’s a good idea to keep close track of this to avoid issues with compliance or unhappy staff.

Are there any exceptions?

There are, but they don’t apply to most businesses. The Fair Labor Standards Act (FLSA) allows for some very specific exemptions, such as for student workers in certain programs, some apprenticeships, or people with disabilities under approved certificates.

Unless you’re running a very specialized operation or hiring under one of these certified exceptions, you’ll likely need to pay your hourly workers at least $7.25 per hour. And if your business is covered under the FLSA, you must also comply with its recordkeeping and overtime requirements.

Is $7.25/h enough to get by in Alabama?

Let’s be honest. $7.25 doesn’t stretch as far as it used to. Sure, it’s the legal minimum, but for most businesses trying to attract good people, it’s not the realistic minimum anymore. The cost of living has gone up. Rent, groceries, transportation, they all add up.

If you want to build a reliable team and reduce hiring headaches, paying above minimum wage isn’t just nice, but it’s smart. A single adult in Alabama needs over $16 an hour to cover basic needs without public assistance. That gap says a lot. You don’t need to double your payroll overnight, but even a small bump can make your jobs more appealing to quality workers.

Can cities like Birmingham set their own minimum wage?

They tried, but the state shut it down. Back in 2016, Birmingham became the first city in Alabama to pass a local ordinance to raise its minimum wage to $10.10 an hour, aiming to help low-wage workers keep up with rising costs. The ordinance was approved and set to take effect quickly. However, just before it could, the Alabama Legislature passed House Bill 174, known as the Alabama Uniform Minimum Wage and Right-to-Work Act. This law banned local governments from setting their own minimum wages, effectively nullifying Birmingham’s ordinance.

State lawmakers’ rationale was to ensure a uniform business environment across Alabama. However, critics argued that this move stripped local communities of the right to address economic challenges in their own way. Since then, cities and counties in Alabama have been prohibited from enacting their own wage laws.

Why you might consider paying above minimum wage in Alabama

You might be wondering, “Why should I pay more than $7.25 an hour if that’s all the law requires?” That’s a fair question, and here’s the thing: paying more isn’t just about doing the right thing—it’s often the smart move.

When your team feels valued through fair pay, they tend to give back in ways that matter. They show up on time, take ownership of their roles, and stick around longer. That’s a big deal, especially when you think about how much it costs to replace a worker. A report from the Center for American Progress estimated that replacing a low-wage worker can cost about 16% of their annual salary. That adds up quickly if you’re constantly rehiring.

Now picture this: you run a cafe and decide to pay $10 or even $12 an hour. At first, it might feel like a stretch, but you’re suddenly seeing fewer no-shows, better service, and more returning customers. That consistency builds your brand. And in a world where people love to share reviews online, happy staff often lead to happy customers.

You don’t need to overhaul your entire budget either. A small bump in menu prices, smarter scheduling, or cutting back on waste can help you cover the increase. Tools like 7shifts can help you make team management more efficient without sacrificing quality.

And let’s be real: there’s a national conversation about raising the federal minimum wage. If change comes, you won’t be scrambling to catch up. You’ll already be there.

What if the federal minimum wage increases soon?

There’s been a steady buzz about raising the federal minimum wage to $15 per hour. While nothing has been signed into law yet, it’s a conversation that keeps gaining traction, and it’s not something you want to ignore. If you’re running a business in Alabama, it’s smart to stay ahead of the curve. Because if the change happens, it will automatically apply across the state. You won’t have a grace period to catch up.

So, what can you do right now? Start thinking ahead. Review your current wage structure and identify how many of your employees are earning at or just above the minimum wage. Then ask yourself: What would it take to gradually increase those wages without putting pressure on your bottom line? Could you adjust your pricing slightly, simplify tasks, or schedule more efficiently?

This is a great time to evaluate your payroll, benefits, and staffing setup. Maybe it’s time to rethink roles or invest in cross-training so your team can do more without increasing headcount. Some businesses are already paying above the federal minimum simply because it’s necessary to compete. You might find that raising your wages voluntarily, even before it becomes law, can help you attract better talent and reduce turnover.

If the federal minimum wage does jump to $15, being prepared could save you a lot of last-minute stress. You’ll already be in a better place financially and operationally. And if it doesn’t change? You’re still giving your business a competitive edge by offering fair, motivating wages.

Wage laws may shift, but a thoughtful employer stays ready. Consider this your early invitation to lead, not only to comply.

What should employers in Alabama do to stay compliant?

Staying compliant with wage laws in Alabama doesn’t have to be a burden. In fact, it can be one of the smartest moves you make for your business. When you treat your team fairly and keep everything above board, you build trust, loyalty, and a smoother-running operation. Here’s how to stay on track:

1. Know the federal minimum wage inside and out

Since Alabama doesn’t have its own minimum wage, the federal minimum of $7.25 per hour is your baseline. But don’t stop at memorizing that number. Apply it consistently across your payroll. Every hourly, non-exempt employee must earn at least that amount for every hour worked. If you have tipped employees, remember they must still make up that $7.25 total between tips and base wage. If their tips fall short, it’s your job to make up the difference.

2. Document everything accurately and consistently

You’ve probably heard this before, but solid recordkeeping is your safety net. Keep track of hours worked, breaks taken, tips earned, and overtime logged. Whether you use time-tracking software or good old-fashioned paper timesheets, what matters is that the data is reliable and easy to access. If a worker has a question or an auditor shows up, you’ll be glad you kept everything organized.

3. Keep an eye on federal updates

Wage laws don’t change often, but when they do, you need to be ready. There’s been growing talk about raising the federal minimum wage to $15 per hour, and if that happens, Alabama businesses will need to comply immediately. Sign up for email updates from the U.S. Department of Labor or follow reliable small business news sources. A little awareness today can save a major headache tomorrow.

4. Understand overtime rules and apply them fairly

Here’s the deal: if your employee works more than 40 hours in a single workweek, they’re owed time-and-a-half for the extra time. That means if they make $10/hour normally, they should earn $15/hour for any time over 40 hours. Alabama follows federal law on this, and it’s one of the most common areas where small businesses slip up. Be proactive. Plan your schedules carefully and make sure your payroll system flags overtime automatically.

5. Avoid misclassification mistakes

Not every worker is created equal in the eyes of the law. You need to know the difference between an independent contractor and an employee, and between exempt and non-exempt workers. Misclassifying someone, especially if it looks like you’re avoiding taxes or skipping overtime, can lead to hefty fines and legal trouble. If you’re unsure, it’s worth checking the Department of Labor’s guidelines or even asking a legal professional to take a look.

6. Display the right posters in your workplace

Yes, posters matter. You’re legally required to display federal labor law posters where your team can easily see them, such as break rooms, entryways, or near the punch clock. These posters let your employees know their rights, which keeps everyone informed and reduces misunderstandings. You can get the posters for free from the Department of Labor website.

7. Train your team and foster open communication

Labor law compliance isn’t just about policies, but it’s about people. Make sure your managers and anyone who handles payroll or scheduling are on the same page. A little training goes a long way. Also, create a culture where employees feel safe bringing up concerns. If someone thinks something’s off, encourage them to speak up. You’ll catch small issues before they turn into big ones.

8. Use tech tools to simplify compliance

Running a business is already a juggling act. Tools built for cafes and restaurants among others can help you forecast labor costs, automate scheduling, and stay on top of wage rules. Payroll platforms can handle tax filings, calculate overtime, and issue pay stubs, all with minimal effort on your end. Treat this as your digital assistant, which saves time and helps you sleep more easily.

Big wins start with good wages

Running a business isn’t easy, but treating your team well can make all the difference. Alabama may not require more than $7.25, but you’re not just meeting a requirement. You’re setting the tone for your workplace. You have the chance to stand out, support your staff, and build a stronger business.

In the long run, investing in people always pays off. So go ahead and be the kind of boss people want to work for, and let smart tools like 7shifts help you do it. From scheduling and labor tracking to team communication, 7shifts makes it easier to focus on what matters most: your people.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.