Arizona’s minimum wage is higher than the federal rate, which means business owners, especially in the restaurant industry, need to stay up to date on state-specific labor laws. This is particularly true since you’ll have to juggle annual CPI-based wage increases under Prop 206. If you have restaurants in cities like Flagstaff and Tucson, you’ll also have to take note of the higher pay floors.

What is Arizona’s minimum wage in 2026?

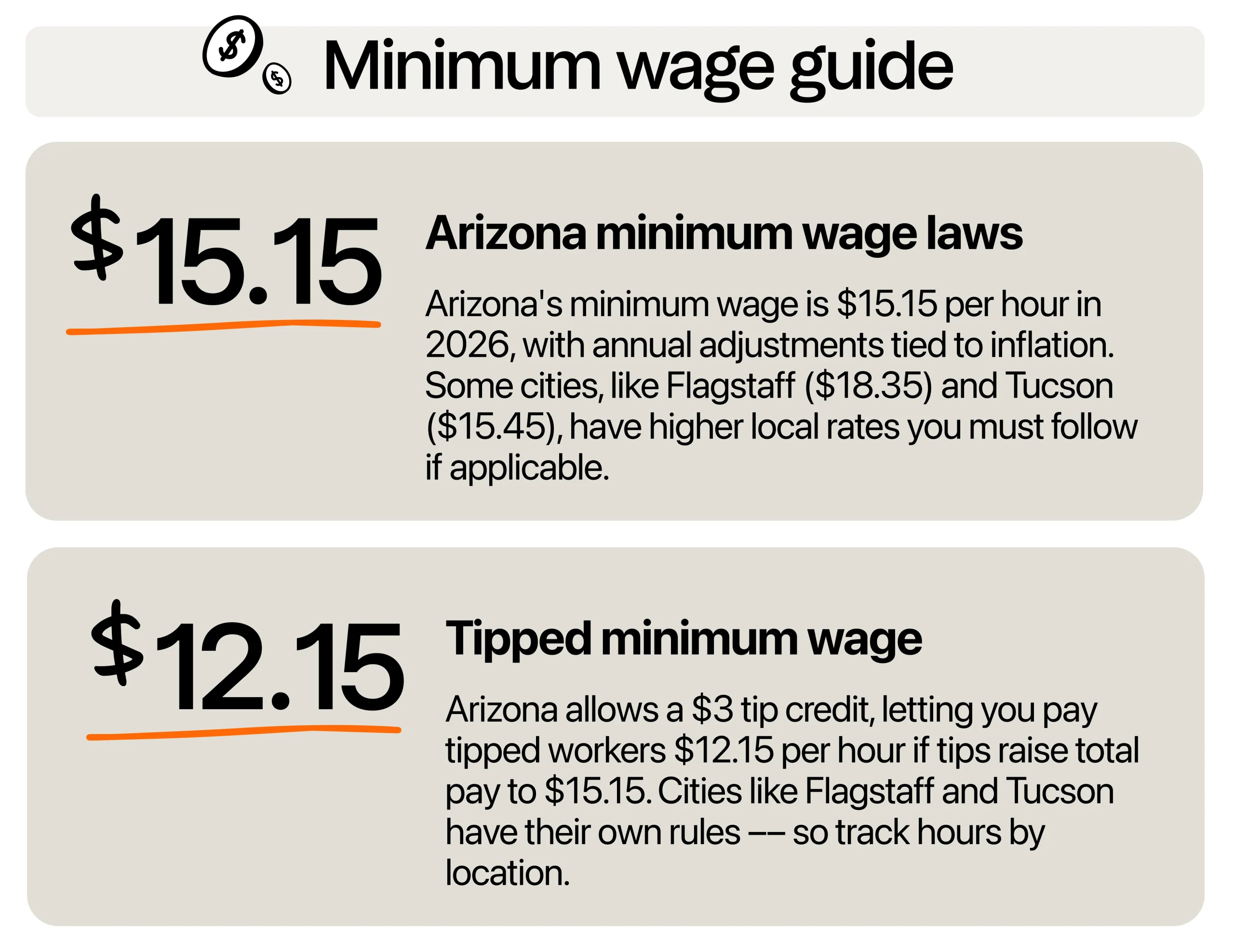

In 2026, the Arizona minimum wage rose to $15.15 per hour, up from $14.70 the previous year. State law ties this minimum wage to the cost of living, so wages keep pace with inflation and labor costs. It’s also more than double the federal rate at $7.25 per hour.

If you have servers, bartenders, or baristas, Arizona’s minimum wage rules allow a tip credit of up to $3 per hour. You pay a base cash wage of $12.15 per hour, and tips must fill the gap so total pay equals the full $15.15 per hour. Before you run payroll, double-check your system so it adds base pay and tips together each pay period; missing that step can land you in hot water.

Additionally, some AZ cities even set higher local floors. For example, Flagstaff’s minimum wage is $18.35 per hour for all roles, and the tip credit was eliminated in 2026. Over in Tucson, local minimum wage is $15.45 per hour for every employee, with a $3 tip credit. If your restaurant spans city lines, you’ll need to tag shifts by location so each team member gets the correct wage rate.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Arizona minimum wage historical and legislative background

Arizona’s current minimum wage law began with Proposition 206, the Fair Wages and Healthy Families Act, passed by voters in November 2016. It set the minimum wage at $10 per hour starting January 2017, with scheduled increases through 2020. By January 2020, the rate reached $12 per hour, before Arizona switched it to an inflation-based model.

Since 2021, the Industrial Commission of Arizona has updated the state minimum every January to reflect changes in the Consumer Price Index. For example, a 2.5% CPI increase in 2024 raised the wage from $14.35 to $14.70 per hour in 2025 (rounded to the nearest $0.05).

In 2024, two high-profile ballot efforts sought to change Arizona’s wage law but did not succeed. Proposition 212 would have raised the rate to $18 per hour and phased out the tip credit by 2027. Unfortunately, its backers withdrew the measure in August 2024 after facing a legal challenge over petition signatures.

Later on, voters would also go on to reject Proposition 138. This would have allowed tipped workers to be paid 25% less than the posted hourly minimum wage if their tips plus wages equaled at least the standard rate.

Arizona’s minimum wage law continues to evolve from a set-dollar wage increase to a flexible, CPI-based model that adjusts at the start of each year. As these changes continue, restaurant owners must be prepared for the economic impact of rising wages on their labor budget.

The economic impact on Arizona restaurants

Labor costs often top 30% of food-service revenue, so rising wages hit your bottom line fast. According to the National Restaurant Association, labor and food costs each made up about 33 cents of every dollar in restaurant sales as of mid-2025, leaving around 5 cents for profit before tax.

With Arizona’s minimum wage climbing to $15.15 in 2026, employers need to revisit labor budgets now. To offset higher wage costs, many operators lift menu prices by 2% to 5%. Menu prices already rose 3.7% year-over-year as of last February 2025, which is the steepest increase in two years.

However, guests can be price-sensitive, so it’s important to strike the right balance. Simple value bundles, like pairing an entrée with a drink for $18 instead of selling each item separately, help you cover wage hikes without driving diners away.

Many restaurants (68%) are also cross-training staff to manage rising labor costs, according to our restaurant labor costs playbook. With this strategy, cooks can step in as servers during busy periods, cutting the need for extra hires. You can also mix more part-time roles with full-time positions, giving you the flexibility to add hours when you need them and dial back when business is slow.

What should employers in AZ do to stay compliant?

For one, you must post the official 2026 Arizona Minimum Wage Poster in a place where all employees can see it. Arizona’s Industrial Commission last updated the English and Spanish posters on September 29, 2025.

Print versions in the main languages of your team and pin them in your FOH and BOH areas. If you have locations in Flagstaff or Tucson, grab and display those cities’ posters too. Keeping these notices current shows regulators and your team that you take wage law seriously.

Additionally, remember that Arizona requires you to keep payroll and time-clock records for four years. Track each employee’s hours worked every day, their hourly pay rate, and any tips or tip-pool distributions.

Failing to keep these records can cost you. The Industrial Commission will fine you $250 for a first offense and $1,000 for each repeat violation. Using restaurant payroll software can simplify record-keeping by automatically tracking employee hours, wages, and shift details.

Take note of Arizona tip pooling laws as well. If you run a mandatory tip pool, limit participants to staff who regularly receive tips (servers, bussers, bartenders) and give each person a written notice of their share amount. Keep tip-pool agreements on file and review them every six months to avoid disputes.

How AZ restaurants can adapt to rising wages

Raising prices and cross-training can help your restaurant stay competitive, but there’s more you can do to protect your bottom line. First, check for menu optimization. Study your sales data and look for high-profit dishes you can promote. Based on this information, trim or rework items that sell slowly or cost too much to make.

For instance, you might slightly reduce portion sizes on low-margin plates or swap an expensive garnish for a cheaper local herb. Cutting waste in prep and storage also frees up cash. Look for ways to use every ingredient twice before it’s thrown away.

Your suppliers are another factor to consider. Talk to vendors regularly about volume discounts or bundled deals. If you buy produce and meat in larger batches, you can often negotiate lower per-unit costs.

Lastly, tighten your workflows. Take time to map out every task in your kitchen and dining area, then look for steps you can combine or eliminate.

A well-designed kitchen layout cuts walk time, while standard recipes and prep routines make handoffs smoother. With a clear efficient path from creating to serving a dish, you feed more guests in less time, and you need fewer labor hours to hit your sales goals.

Manage labor expenses proactively

Arizona’s minimum wage, along with other states, will likely keep rising with inflation. Now’s the time to proactively plan your restaurant’s financial strategy. Staying on top of your labor costs and compliance requirements will help you adapt smoothly to changing economic conditions.

Take control of rising labor costs with dedicated restaurant scheduling software. With 7shifts’ labor-forecasting tools, you can match your team’s hours to real-time sales projections. This way, you only staff up when you need to and avoid costly overtime.

Our shift-management features let you fill gaps instantly, swap shifts in seconds, and reward your crew for taking on extra hours. Now, you can keep your team motivated while maintaining an effective payroll budget.

Also read: Arizona tip laws for restaurants

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.