Running a business like a bar or restaurant in California places you at the center of a vibrant and diverse economy. As the largest economy in the U.S. with a gross state product of approximately $4.3 trillion in early 2025, California offers significant opportunities. Specifically, the restaurant industry alone employs over 1.6 million people, making it one of the most dynamic sectors for launching food or hospitality ventures.

As a business owner, you need to be knowledgeable about how minimum wage works in California and stay up to date on its ongoing changes. California’s minimum wage is among the highest in the nation, and it’s set to go up again.

What is the current minimum wage rate in California?

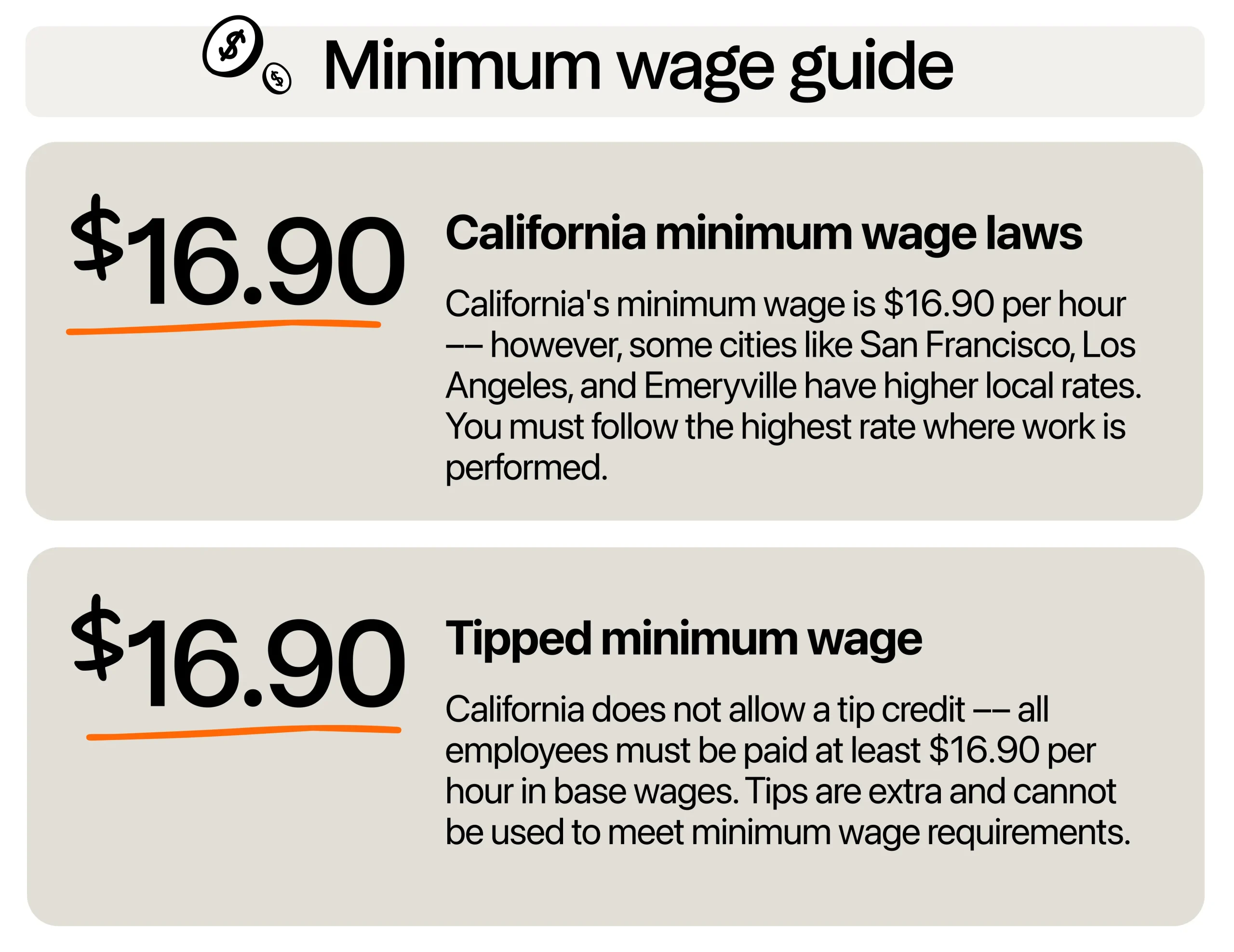

As of January 2026, the current minimum wage rate in California is $16.90 per hour for every employer, whether you have just a couple of staff members or a team that fills up an entire building.

Unlike in past years, there has been no split based on business size. Now, every business, large or small, needs to pay at least $16.90 per hour to every employee. This makes the rule simple and fair for everyone, but it also means you need to pay extra attention to the details that come with operating in California.

What about local wage rates?

One of the challenges for California business owners is that cities and counties often have their own minimum wage standards. These rates are usually higher than the state’s base wage ordinance.

Many local governments in California update their wage standards to match the cost of living, and it’s very common for your local rate to be higher than the state’s. In January 2026, the minimum wage for non-hotel workers in West Hollywood increased to $20.25. And in July 2025, cities like San Francisco and Berkeley raised their minimum wage to $19.18 per hour, Los Angeles increased its minimum to $17.87 per hour, and Emeryville now sits at $19.90 per hour. These city-level wage rates are expected to change again in July 2026, based on the Consumer Price Index (CPI).

If you operate in more than one city or county, you may need to manage several wage rates for different locations. Make it a habit to check for both state and local updates at the start of the year and in the middle of the year.

Why does California’s wage keep rising?

With so many local variations, you might wonder why California’s minimum wage keeps changing in the first place. This is due to labor standards and state laws that are designed to protect workers from falling behind as the cost of living increases.

State law (SB 3) set a schedule for steady annual increases until the minimum wage reached $15 per hour, and now it requires the state to review inflation and the Consumer Price Index each year. If the cost of living goes up, California’s minimum wage can be adjusted again to make sure workers can still afford basics like rent, food, and healthcare. This review happens every year, so you’ll see regular announcements about whether the minimum wage is going up again next January.

Lawmakers say this approach is meant to keep workers from being squeezed out of housing, food, and other necessities. As a business owner, it means you can expect minimum wage to keep rising when inflation spikes or the economy heats up. For example, in 2025 and 2026, both the state minimum wage and many local city rates increased as the state responded to higher prices across California. The law requires the state to publish its decision each year by August, so you’ll have time to prepare for any changes that take effect the following January.

Even though the frequent increases mean a little more work to keep up with payroll and planning, staying informed and adjusting early gives you an edge. Businesses that get ahead of wage changes usually keep their teams happy and avoid surprises.

What’s the rule for tipped employees in California?

In addition to understanding base pay, it’s important to know how California treats employees who earn tips. If you have ever worked in food service or hospitality in other states, you probably know that most states let employers use a tip credit, which allows them to pay tipped workers a lower hourly wage as long as tips make up the difference.

In California, that is not the case. Here, the law is straightforward: all employees, including servers, bartenders, bussers, and any other worker who regularly receives tips, must earn at least the full minimum wage directly from their employer, no matter how much they make in tips. This applies whether you run a busy restaurant, a small café, or a high-end bar in the city.

What does this mean for you as a business owner? If you’re coming from another state, it might be surprising at first that you cannot pay your tipped staff a lower base wage. You have to make sure that every employee gets paid at least the California minimum wage for every hour they work, and this is completely separate from any tips they receive.

Tips are considered a bonus on top of their hourly wage. No matter how many tips your team earns in a shift, you can’t count them toward your payroll requirements or use them to offset what you owe as an employer. This approach can actually make things easier for both you and your staff. You don’t need to calculate complicated tip credits, and your payroll process stays straightforward.

If you’re looking to make tip management even easier, there are payroll and workforce management tools designed for California’s requirements. For example, 7shifts offers tip pooling and tip management software that takes the stress out of distributing tips and helps keep your payroll accurate. With platforms like this, you can track tips, share reports, and automate compliance so you don’t have to worry about manual errors or confusion.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Overtime laws in CA

Overtime rules in California are among the most generous in the country, and knowing the specifics can really help you manage your business effectively. You need to pay overtime when an employee works more than eight hours in a single day or exceeds 40 hours in a week. Daily overtime is paid at one and a half times the employee’s regular rate, and if someone works more than 12 hours in a day, double time applies for those extra hours.

Additionally, when an employee works seven consecutive days in one work week, they must receive time-and-a-half for the first eight hours on that seventh day and double time for any hours beyond that.

These rules are strictly enforced, and any minimum wage increase will directly affect how much overtime you owe. That means it’s important to always use the current base wage when calculating overtime payments. Make sure you track your employees’ hours accurately, and consider using reliable scheduling or payroll software, so you always have clean records. This proactive approach will save you from payroll errors, disputes, and unexpected costs later on.

Rules on California youth workers, trainees, and special wage rates

Beyond overtime, different rules apply if you’re hiring minors or trainees, as there are strict requirements to keep in mind.

All minors, no matter if they are 14, 15, 16, or 17, must be paid at least the current California minimum wage, which is the same as for adults in most situations. There are no special youth wage rates under California law, so even high school students in their first job are entitled to the same minimum hourly wage as everyone else.

Local city rates also apply, so if you operate in San Francisco, Los Angeles, or any city with a higher minimum wage, that rate applies to minors, too. While federal law allows for a lower “youth minimum wage” for the first 90 days of employment, California does not. Always use the highest applicable rate for your location and double-check your city or your specific county minimum rate.

For trainees with no previous experience in a similar job (and where permitted under state and local law), you’re allowed to pay them 85% of the minimum wage for their first 160 hours on the job. After that, they must be paid the full minimum wage.

For apprentices, the requirements are different. Apprentices in California must be enrolled in a state-approved apprenticeship program, and their wage rates are set by the program, not the general minimum wage law. Apprenticeship pay schedules are usually based on a percentage of the journey-level rate for the trade, and these rates increase as the apprentice advances through the program.

How to stay compliant with California’s laws on minimum wages

With so many different rules depending on your city or industry, it can feel like a lot to manage. The good news is that once you know where to look and what steps to take, keeping up with all these requirements becomes a normal part of running your business.

Know your local minimum wage (city by city)

California’s state minimum wage is only a starting point. Many cities and counties across the state set their own minimum wage rates, and these are often higher than the statewide requirement. Local minimums can change at different times throughout the year, so it’s easy to fall behind if you’re not paying close attention. You can’t assume one pay rate will work for every business location.

Make it a habit to check your city or county government website regularly for updates. January and July are the most common times for wage rate changes in California.

Watch for special industry rules

California cities love to create their own rules for specific industries. If you have a hotel in Los Angeles or Santa Monica, or run a fast-food restaurant in any city with a new ordinance, your minimum wage requirements could be much higher than the state or even the city base.

For example, Los Angeles hotel workers are set to see rates jump to $25 per hour in mid-2026, and some fast-food franchises already pay at least $20 per hour. Healthcare workers in large systems have their own wage laws as well. Always check for special wage ordinances by industry, since these can be easy to miss and costly if ignored.

Post the right wage notices (not just state posters)

California requires you to display up-to-date minimum wage notices for both the state and your city or county. The poster in your breakroom should always show the current rates for your exact business location. If you have more than one branch, every site must have the correct local notice posted.

Check city government websites (like sfgov.org for San Francisco or lacity.org for LA) for printable versions. Update these notices every time the law changes, which is often in July for city wages and January for statewide changes.

Respond quickly to city and state audits

California cities take wage enforcement seriously. If you receive a notice from a local agency, gather all your payroll and timekeeping records for the specific location and timeframe in question. Respond promptly and cooperate with the agency. Most cities will give you a chance to correct honest mistakes, but ignoring an audit or wage claim can result in fines.

If you’re not sure what to do, call your city’s wage enforcement office or a local HR consultant who knows your area’s requirements.

Stay compliant with California laws using 7shifts

California’s wage laws may be complex, but 7shifts makes restaurant compliance easy with:

- Overtime alerts when employees approach daily or weekly thresholds

- Break compliance reminders to ensure meal and rest periods are provided

- Clopen prevention to protect employee well-being and avoid scheduling violations

- Multi-location wage tracking that automatically applies the correct local minimum wage

- Tip management tools built for California’s no-tip-credit rules

Save money and avoid penalties with proactive alerts that catch issues before they become violations. Start a free trial with us today!

Keep your payroll sharp and your business stress-free

Change is often a part of the California business scene, but it doesn’t have to be stressful. If you make wage planning part of your regular business routine, you turn what could be a headache into just another day at the office. Staying proactive, talking openly with your team, and using the right tools all help you ride out wage changes. Keep your eyes on the numbers and your ears open for updates, and you will always be a step ahead.

Other California compliance resources:

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.