Starting a business (like owning a bar or restaurant) in Georgia gives you access to one of the largest state economies in the South, with a booming logistics sector, low operating costs, and a supportive climate for small businesses. In 2023 alone, Georgia saw 277,598 new business applications, a 61.2% increase since 2019. That kind of momentum tells you you’re in a place where new ideas are welcome, and growth is within reach.

But with all that opportunity comes responsibility, especially when you’re building your team. One of the first things you’ll need to think about is labor cost. That means keeping a close eye on Georgia’s minimum wage, where it stands today, and what might change.

What is the minimum wage in Georgia in 2025?

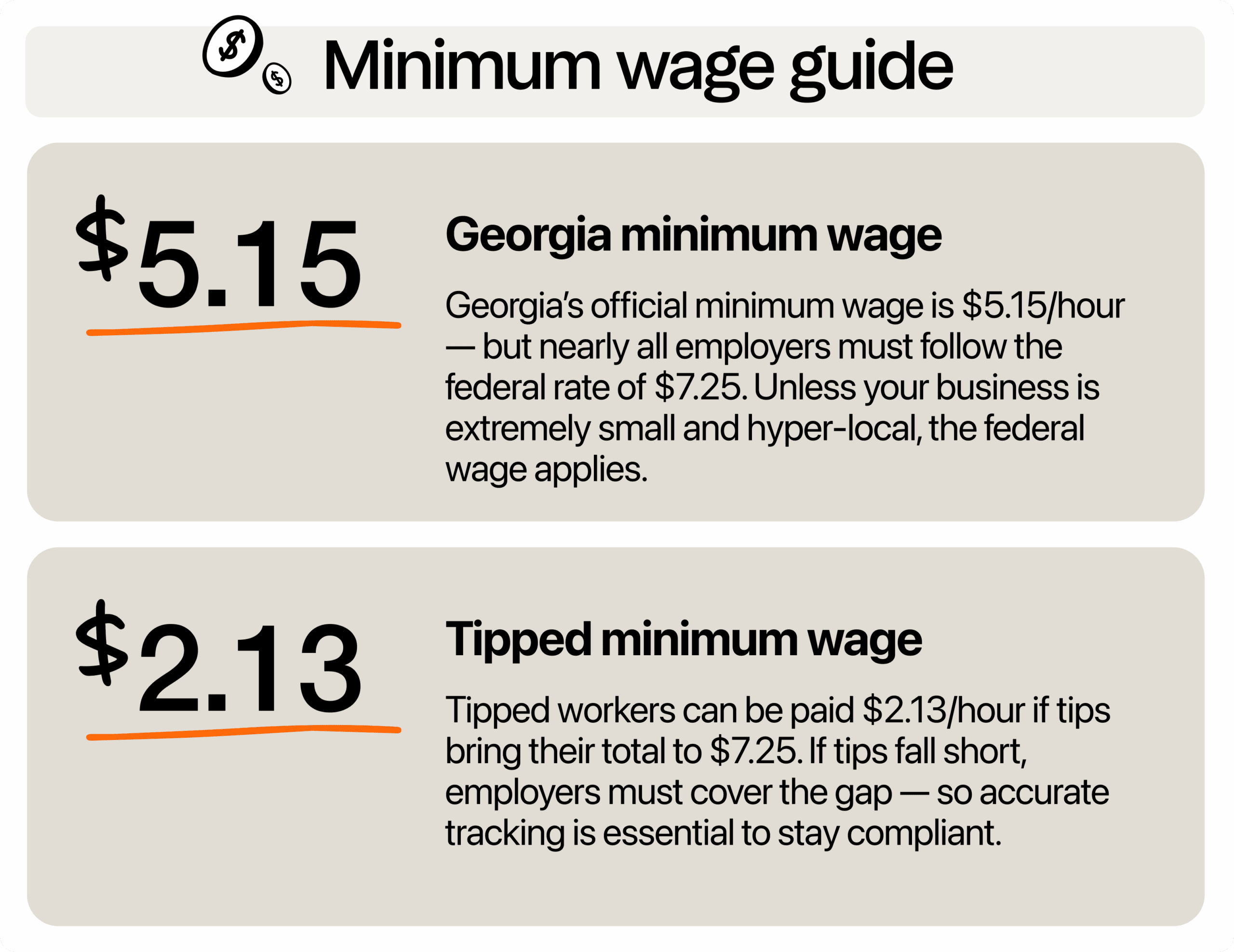

Let’s clarify what can be confusing for many business owners: Georgia’s minimum wage. Officially, the state minimum wage is set at $5.15 per hour, but almost every employer in Georgia must pay the federal minimum wage, which is $7.25 per hour.

You might wonder, why the gap? Georgia hasn’t updated its minimum wage law since 2001, so the $5.15 rate is still on the books. However, federal law takes precedence for nearly every employer, thanks to the Fair Labor Standards Act (FLSA). If your business makes $500,000 or more annually or if you’re involved in interstate commerce (which includes things like online orders or out-of-state suppliers), you’re covered under the FLSA.

So, unless you’re running a hyper-local operation with minimal sales and no out-of-state interactions, you’re required to pay $7.25 per hour. And even if you technically don’t fall under the FLSA, many small business owners still choose to follow the federal standard just to stay on the safe side and remain competitive in the job market.

When does the $5.15 minimum wage ever apply?

Georgia’s official minimum wage is $5.15 per hour, but before you start adjusting your payroll, here’s what you need to know: that rate rarely applies in practice. It only comes into play if your business is not covered by the federal Fair Labor Standards Act (FLSA), and that’s a very small slice of employers.

So, who does the $5.15 wage actually apply to? Technically, only businesses that meet all of the following criteria:

- You have five or fewer employees

- You don’t engage in interstate commerce (that includes online orders, out-of-state services, or working with out-of-state vendors)

- You earn less than $500,000 in annual revenue

If you check every one of those boxes, then Georgia’s lower state wage might technically apply, but even then, there’s a catch. Many small businesses still choose to follow the federal minimum wage of $7.25 to stay competitive and avoid legal gray areas.

There are also a few employee-based exceptions under Georgia law. The lower wage might apply to specific roles, including:

- Farm laborers, particularly those working on small or family-owned farms

- Domestic workers, like live-in housekeepers, caregivers, or nannies, employed directly by a household

- Employees at non-profit child-caring institutions, especially those receiving room and board as part of their compensation

- Certain student workers or interns, usually those enrolled in government-recognized training or vocational programs

But here’s the reality: even if you technically qualify to pay below the federal rate, it might not make long-term sense. Paying higher wages can help you attract better talent, reduce turnover, and create a healthier work environment. Especially in service-heavy industries like hospitality or retail, a small bump in pay can go a long way toward employee loyalty and productivity.

So, if you think you’re in an exception zone, contact or double-check with an employment law expert or labor consultant. And even then, consider the competitive advantage of paying more than the bare minimum.

What about tipped employees?

If you’re in the restaurant, hospitality, or bar industry, this one’s especially important. There is a separate minimum wage for tipped employees in Georgia. Tipped employees are those who regularly receive tips from customers as part of their earnings, such as servers, bartenders, or valets. The minimum cash wage you’re allowed to pay these workers is $2.13 per hour. But here’s the catch: they still need to make at least $7.25 per hour when you combine that wage with their tips.

This is known as the “tip credit” system. As the employer, you can take a credit of up to $5.12 per hour against the $7.25 minimum wage. So, if your employee earns at least $5.12 per hour in tips, you’re only responsible for paying $2.13. But if their tips come up short, even by a few cents, you’re legally required to make up the difference to meet the federal minimum.

This is called the “tipped employee minimum wage guarantee.” It protects your workers from earning below the minimum, and it’s your responsibility to track tips and wages closely to stay in compliance.

From a business standpoint, this setup can save on upfront payroll or labor costs, especially in high-tip environments. However, it also requires tight bookkeeping and honest reporting practices. Make sure you’re collecting accurate tip declarations and that employees understand how their pay is calculated. Missteps here can lead to wage disputes or labor audits, which can be expensive.

Many employers now use POS-integrated systems or tip management software like 7shifts that help automate tip tracking and ensure compliance. That way, you’re not left second-guessing your math at the end of the month. Keeping good records protects your business and gives your team transparency about how they’re paid.

And while it might be tempting to stick with $2.13, offering a slightly higher base wage for tipped workers can actually boost morale, improve customer service, and reduce turnover, especially when tips are inconsistent. In today’s market, a reliable paycheck matters more than ever.

What is the minimum wage for younger workers?

If you’re hiring teens or college students, you’ve probably seen just how eager they are to jump into their first jobs. Whether bussing tables, helping out during busy seasons, or handling deliveries, younger workers or restaurant employees can bring a ton of energy to your team. And the good news is you’re allowed to start them at a lower wage, BUT for a limited time.

Under federal law, you can pay employees under the age of 20 a training wage of $4.25 per hour during their first 90 consecutive calendar days on the job. This training wage is meant to give you some breathing room as you onboard someone who likely has little to no prior work experience.

Let’s say you’re hiring a high schooler for their first summer job or a student looking to pick up weekend hours. That 90-day window lets you train them, assess their strengths, and decide how they fit into your operation before you commit to full wage costs.

But keep this in mind: this is a short-term allowance, not a permanent pay level. After 90 consecutive calendar days, regardless of how many hours they’ve worked in that span, their pay must bump up to at least the federal minimum wage of $7.25 per hour. No exceptions. It’s a fixed timeline, so it’s smart to set a payroll reminder or track it in your scheduling software to avoid missing that deadline.

A best practice is to be upfront with your young hires about this timeline. Let them know when their pay will increase, and what benchmarks they can aim for along the way. That little bit of transparency goes a long way in building trust and getting them invested in their new role.

Some successful restaurant owners even choose to raise the pay earlier, especially if the employee catches on fast or starts showing leadership potential. That kind of incentive can do wonders for motivation, and it sends the message that hard work pays off.

Sure, the training wage helps with cost control when you’re just getting someone started. However, the real win is in nurturing reliable, motivated team members who might just stick around beyond their first 90 days.

Is it worth starting a business in Georgia?

While Georgia’s minimum wage laws may seem a little outdated at first glance, the state remains one of the most business-friendly environments in the country. For starters, Georgia boasts a low cost of living compared to coastal states, which means your operating costs, especially rent and utilities, tend to be more manageable, according to The Cost of Living Index published by the Council for Community and Economic Research (C2ER).

Taxes are another big plus. According to the Tax Foundation, Georgia offers a flat corporate income tax rate of 5.75%, which is lower than many other states. And if you’re just getting started, there are tons of local resources available through the Georgia Department of Economic Development, as well as regional Small Business Development Centers (SBDCs) that offer free advice, training, and support.

You’re also in good company. Major cities like Atlanta, Savannah, and Augusta are growing hubs for small businesses, restaurants, tech startups, and logistics companies. With access to a strong workforce, major transportation routes, and a growing population, Georgia gives you a solid foundation to launch and scale your business.

Of course, every business faces challenges, and compliance with labor laws is part of that. But if you stay informed, use the right tools, and focus on fair pay and strong operations, you’ll be in a great position to succeed.

As Governor Brian Kemp stated, “Georgia’s recognition as the number one state for Best Business Climate by Site Selection is a testament to our partnership approach to job creation and economic growth.”

What should employers in Georgia do to stay compliant?

Running a business means juggling a lot of moving parts, and staying compliant with wage laws is one you can’t afford to drop. But don’t worry. Keeping things above board doesn’t have to be complicated.

1. Know your classification. Start by figuring out whether your business is covered by the Fair Labor Standards Act (FLSA). If you’re not sure, it’s safer to assume you are. Being covered means you must follow federal wage laws, including the $7.25 minimum wage. If you’re not sure where you fall, a quick call to a labor consultant or HR professional can give you clarity.

2. Stay up to date. Wage laws don’t stand still. Georgia has made multiple efforts to raise the minimum wage, and while nothing has passed yet, there is momentum. Don’t wait for legislation to hit your desk. Keep an eye on proposed changes and plan accordingly. Subscribing to Georgia Department of Labor updates or setting Google Alerts can keep you in the loop without adding to your to-do list.

3. Track everything. Recordkeeping isn’t just for accountants—it’s your first line of defense during an audit. Use digital tools to track employee hours, tip declarations, overtime, and breaks. Systems like 7shifts can help you simplify this process and reduce the risk of human error. These platforms also let you run quick reports, so you can spot payroll issues before they become legal ones.

4. Post required notices. You’re legally required to post certain wage-related information in a place where all employees can see it. This includes both state and federal labor law posters. The good news is that these are free to download from government websites. Print them out, hang them in a break room or near the time clock, and you’re covered. Skipping this step can lead to fines, so don’t let this easy win fall through the cracks.

5. Pay above the minimum if you can. Legally, you might be allowed to pay $7.25 an hour. But practically? That might not cut it anymore. Employees are looking for workplaces where they feel valued, and wages are part of that equation. Even a small increase above the minimum can help you attract better candidates, reduce turnover, and boost workplace morale. Think of it as an investment in your team and your long-term success.

Staying compliant doesn’t mean burying yourself in red tape. It’s about building smart habits into how you run your business day to day.

Are there upcoming changes to Georgia’s minimum wage?

Currently, there are no confirmed changes to Georgia’s minimum wage, but if you’re a business owner, you’ll want to keep this on your radar. In early 2025, Senator Kenya Wicks introduced Senate Bill 273, proposing to raise Georgia’s minimum wage to $22 per hour. Although the bill hasn’t passed, it reflects a broader conversation about fair wages and the cost of living.

Local governments are also taking action. For instance, Forest Park increased its minimum wage to $23.46 per hour for full-time city employees, aiming to attract and retain talent. This move underscores the importance of competitive wages in today’s job market.

Now, just because things are quiet doesn’t mean they’ll stay that way. While none of the bills for increasing the minimum wage have passed, the conversation is heating up, and public pressure continues to grow.

You’ve probably seen headlines about wage increases in nearby states. That kind of movement can spark momentum here in Georgia, too. Even without an official change, many businesses are already paying more than the minimum to stay competitive, especially in industries like food service, hospitality, and retail, where finding reliable staff has become more challenging.

So, how do you stay ahead of the curve? Think of this as an opportunity to future-proof your business. If the minimum wage goes up in a year, or even six months, you don’t want to be scrambling. Start planning now so any change feels like a minor adjustment, not a major disruption.

- Forecast the impact: Run the numbers to see how a jump to $12, $15, or higher would affect your payroll. Even a modest increase can add up fast, so get a sense of how your budget would shift.

- Review your pricing: If a wage hike is on the horizon, you may need to update your menu prices, service fees, or product costs to stay profitable.

- Communicate with your team: Be open about potential wage changes. Transparency builds trust and shows your team you’re staying proactive, not reactive.

Planning for a possible wage hike now is like buying insurance. You hope you won’t need it soon, but you’ll be glad you’re ready if things change. A little prep today can save you a lot of scrambling tomorrow.

Georgia’s wage floor isn’t a ceiling

Whether you run a small cafe or a growing retail shop, staying on top of Georgia’s wage laws helps you protect your business and keep your team happy. Sure, Georgia’s minimum wage might look like a bargain on paper, but smart business owners like you know that real success comes from building a team that’s motivated, loyal, and proud to show up. Competitive pay, thoughtful benefits, and a positive work environment for restaurant employees aren’t just nice to have. They’re what set you apart.

So, while the law may say one thing, your leadership can say something better. Choose to raise the bar, and your business will rise with it.

Minimum wage resources

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.