Kansas continues to draw attention as one of the best places to start and grow a business. With its central location, lower operating costs, and business-friendly climate, the Sunflower State attracted over $20 billion in private-sector investments between 2019 and 2024, including targeted grants and capital access for small businesses.

That kind of momentum is great news for entrepreneurs, but it also means you’ll need a solid plan to compete for talent and manage costs. If you’re planning to grow your team, it pays to understand how wages work in Kansas, and having a clear grasp of the wage laws helps you confidently build your payroll strategy.

What is the minimum wage in Kansas in 2026?

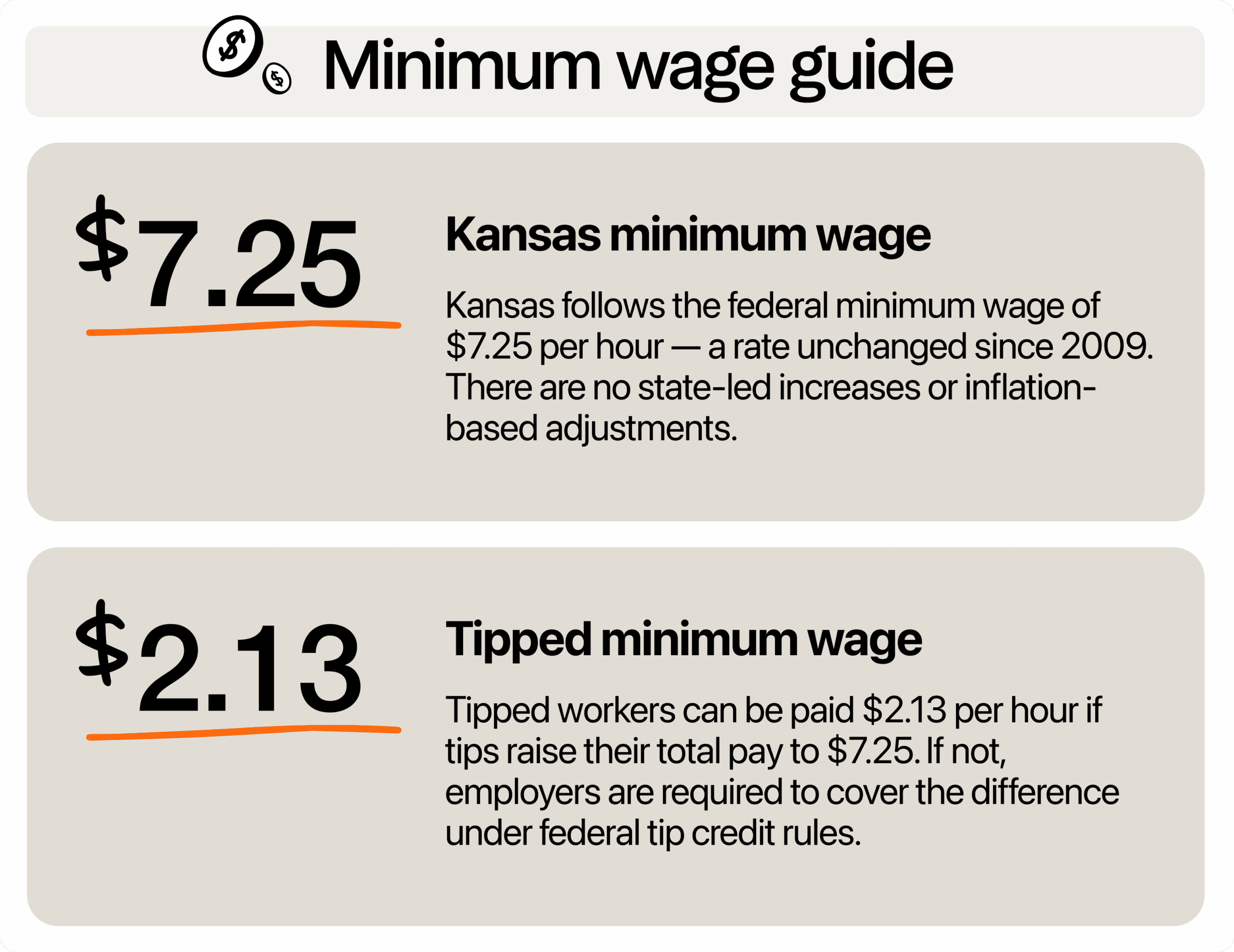

As of 2026, Kansas’ minimum wage remains at $7.25 per hour. This rate is set by the Fair Labor Standards Act (FLSA), which hasn’t changed since 2009. There are no automatic annual increases, no Consumer Price Index (CPI) based adjustments, and no legislative movement on the horizon to raise the rate.

For businesses in the service industry with tipped workers, Kansas allows you to take a tip credit, which means you can pay as little as $2.13 per hour in direct wages, as long as the employee’s tips bring them up to the $7.25 minimum. If they fall short, you’re required to make up the difference.

No local ordinances to worry about

Some states, like California, Washington, and Illinois, have cities or counties that impose their own minimum wage rules. Business owners in those areas often face different wage laws depending on where they operate. Kansas, on the other hand, keeps things simple. The statewide minimum of $7.25 applies everywhere, from larger cities like Wichita and Kansas City to small rural towns.

Youth and training wages

Kansas follows federal rules for youth workers. If you hire employees under 20 years old, you can pay them a training wage of $4.25 per hour for their first 90 days on the job. After that, they must be paid the standard $7.25.

Full-time students working in retail, agriculture, colleges, or universities can be paid not less than 85% of the minimum wage, which currently calculates to $6.16 per hour.

Student learners participating in vocational programs may be paid 75% of the state minimum wage, which is $5.44/hour, if the work aligns with their educational goals and a written agreement is in place between the employer, student, and academic institution.

Overtime and employee classification

Kansas defers to federal law when it comes to overtime rules. Non-exempt employees must be paid 1.5 times their regular rate for any hours worked over 40 in a single workweek.

Salaried employees aren’t automatically exempt. To qualify for exempt status, a position must meet three criteria:

- Salary Basis Test: Paid a fixed salary

- Salary Level Test: At least $684 per week ($35,568 annually)

- Duties Test: The employee performs executive, administrative, or professional tasks

If your employees don’t meet all three, they must be paid overtime. Misclassification can lead to costly penalties and back pay claims, so it’s smart to review your team’s roles and compensation from time to time.

Is $7.25/hour enough to get by in Kansas?

This is the big question a lot of business owners and workers are asking. But let’s be real: $7.25 an hour isn’t much. It may be legal, but it’s hardly enough for someone to live on, especially with today’s prices.

According to the MIT Living Wage Calculator, a single adult with no children in Kansas needs to earn closer to $21.06 an hour just to cover basic needs like housing, food, healthcare, and transportation. If someone has dependents, that number goes up fast. That means $7.25 isn’t enough for most people to live independently without outside help or multiple jobs.

This matters to you as a restaurant manager or owner. Paying the bare minimum might keep you compliant, but it could cost you in other ways, like a high turnover rate, missed shifts, or low morale. When wages aren’t competitive, good workers move on quickly, often to other states or industries that pay more.

On the flip side, offering above minimum wage can make a real difference. It can help you attract more qualified people, keep them longer, and build a more reliable, motivated team. That kind of consistency saves you time and money on rehiring and retraining. Plus, customers notice when your staff is happy, and that can lead to better service and stronger loyalty.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

How Kansas compares to neighboring states

Kansas sticks with the federal minimum wage of $7.25 per hour, but its neighbors paint a very different picture. If your business operates near state borders or hires from nearby towns, it helps to know what you’re up against.

Colorado leads with a minimum wage of $15.16 per hour as of January 2026. If you’re hiring in areas like Goodland or Tribune, workers might consider commuting into Colorado for more than double the wage.

Nebraska is close behind at $15, which took effect in January 2026. That’s also more than twice what Kansas businesses are required to pay, which could make hiring near towns like Marysville or Belleville more competitive.

And Missouri currently also pays $15 per hour. For businesses near Kansas City or Fort Scott, this can put you in a tough spot if potential hires decide to cross state lines for better hourly pay.

Like Kansas, Oklahoma follows the federal minimum of $7.25 per hour. That somewhat levels the playing field for businesses near towns such as Coffeyville.

The difference in wages between Kansas and its neighbors can make it harder to hire workers near state borders. If your business is close to another state, offering a bit more than the Kansas minimum wage can help you compete and convince workers to stay local.

Are there plans for the minimum wage to go up?

There’s been ongoing talk at the federal level about raising the minimum wage, but nothing has officially changed just yet. In July 2023, lawmakers introduced the Raise the Wage Act of 2023. This bill aimed to gradually raise the federal minimum wage to $17 per hour by 2028, replacing an earlier version that proposed $15 by 2025. Neither version has passed, so it’s unclear whether this push will move forward.

All of this shows momentum in parts of the country, but as of the moment, there’s no current news on its federal rate increase, especially in Kansas.

Offer strong wages in your restaurant without overcommitting

Running a restaurant in Kansas means you already know how important it is to keep good staff. However, with tight margins and a federal minimum wage of $7.25 per hour, raising pay too much and too fast can feel risky. The good news is you don’t have to go all the way up, say $15, to stay competitive.

Start by aiming just a little higher. Offering $8 to $10 per hour can make your job postings more attractive, especially when paired with a few thoughtful perks. Think flexible shifts, family meal discounts, or even a tip-sharing model that rewards teamwork. These small extras can set you apart from the place down the street that sticks to the minimum.

If you rely on tipped workers, you’re probably already using the tip credit option. Still, make sure their total take-home pay consistently hits or exceeds the required $7.25. When your team knows you’re fair, word spreads fast. That’s good for hiring and your reputation.

Also, consider checking in with your current staff, too. Ask what would make their job better. Sometimes it’s not just about the hourly wage. It could be about more consistent scheduling or getting paid weekly instead of bi-weekly.

Where to find room in your budget for higher wages

Offering better wages doesn’t always mean hiking up your menu prices. With the right strategies, you can free up room in your budget without turning customers away.

Adjust your food costs to make room for better pay

Start by reviewing your food costs. Are there items that regularly go to waste or require pricey ingredients for just one dish? That’s a good sign that it’s time to simplify. Look for ways to use overlapping ingredients across different meals so you cut down on waste and make prep work easier for your team.

For example, if you’re buying arugula just for one salad that barely sells, swap it out for something that already appears in other dishes. Less spoilage, fewer restock trips, and smoother prep shifts mean you’re saving time and money.

Even your portion sizes can tell you where your money’s going. Use POS reports and staff feedback to track what customers consistently leave behind. If fries, side salads, or bread baskets are coming back untouched, try offering smaller portions or making them optional.

Additionally, your POS and sales data can help you spot patterns in employee behavior, like who’s regularly upselling and who tends to comp items. Linking these behaviors gives you a clearer view of what’s costing you on the plate and on the floor. From there, it’s easier to have focused coaching conversations. Maybe it’s time to train staff on smarter upselling or adjusting portions with intention.

Lastly, label your stock clearly by using a first-in, first-out system, and stay on top of what’s actually moving. These small tweaks help you cut costs without cutting quality, and that extra room in the budget can go directly to better pay.

Drop what’s not selling

Start by doing and checking your reports. Identify which items don’t sell well or get the most complaints. These are costing you money without bringing value. Taking low-performing products or services off your list can free up time and reduce costs. You’ll also make life easier for your team, who won’t have to prep or explain things customers don’t really want.

Try automatic gratuity

Instead of leaving wages entirely in the hands of traditional tipping, consider adding a clear service charge to each check. Whether it’s a flat fee or a percentage, this creates more predictable income for your staff. It helps level out earnings between slow and busy shifts and gives your team more financial stability. Just be sure to communicate the charge clearly on menus, receipts, and even verbally if needed, so guests know exactly where their money is going.

Match your schedule to real customer traffic

Don’t overstaff just because “that’s how it’s always been.” Use past sales data or scheduling tools to see when your busy hours really are. If you’re consistently slow mid-afternoon, don’t schedule three people when one can handle it. And if your lunch rush is always slammed, make sure you’re covered with your strongest people. Better scheduling helps you save money and keep your team from burning out.

Cross-train your team

Cross-training gives you flexibility. When your team can handle more than one task, like taking orders, restocking, and cleaning, you don’t need as many people on shift. It’s easier to fill in when someone’s out, and you’ll get more done with fewer people. Employees like learning new things, too, and it helps them grow with your business.

Ask your staff where you’re wasting time and money

Your team knows your business’s pain points. They see what’s slowing things down or getting tossed in the trash. Ask them for ideas. You might be surprised at how practical their suggestions are, like ways to prep faster, stock smarter, or save materials. Offer a small reward for the best ideas to encourage input.

Reward your top performers

Lastly, if increasing pay across the board isn’t possible right now, think about offering perks that don’t cost much but still carry value. These could be things like flexible scheduling, preferred shift selection, an extra break, or even letting someone clock out early once in a while.

Small gestures of appreciation, like recognizing someone’s hard work in front of the team, giving out “employee of the week” titles, or offering free staff meals on certain days, can boost morale without adding pressure to your budget. When your team feels appreciated and supported, they tend to stick around longer, and that stability saves you time and money in the long run.

How businesses can stay compliant

The Kansas wage keeps things simple with one state wage rate. There’s no confusion, no city-by-city rules to keep track of, and no excuse to fall out of compliance. However, even if you think your system is working fine, as employers, you still have to take time to double-check everything and see if you’re compliant.

Use a payroll system that tracks hours and calculates overtime properly

Manual time tracking leaves room for errors, and mistakes in payroll can lead to headaches for both you and your staff. A reliable payroll system keeps everything accurate and on schedule. It’ll help you avoid violations, handle overtime automatically, and even generate reports that save time during tax season.

Invest in tip tracking if you have tipped employees

For businesses that include a team of servers, bartenders, or delivery staff, tip compliance matters. An automated tip management system not only ensures your employees get every cent they’ve earned, but it also protects you from underpayment claims. With automated tools, you can keep digital records, track tip pooling, and easily prove your compliance if ever audited.

Review your staff classifications regularly

Not every salaried role is automatically exempt from overtime. Double-check that anyone classified as exempt really meets the legal standards. Things like job duties, pay thresholds, and weekly salary limits matter. Misclassifying staff can lead to costly fines, and you can avoid this problem by reviewing roles at least once a year.

Keep an eye on federal labor updates

Even if Kansas hasn’t changed its wage laws in years, the federal government still might. If the federal minimum wage increases, it will apply across the board. Staying updated helps you prepare early instead of scrambling later. You don’t need to obsess over the news, but checking in on Department of Labor updates a few times a year is a smart habit.

Winning in Kansas starts with good pay

Kansas’ minimum wage might be basic, but that doesn’t mean your approach to wages has to be. You’ve got the flexibility to decide how you want to structure pay in a way that fits your business goals. And with no complex local laws to worry about, you can focus on what really matters: growing your business and creating a workplace where people want to stay.

To make that happen, you need more than just a pay strategy. You need the right tools to manage it. That’s where 7shifts comes in. Our software can help you stay compliant by tracking hours accurately, so you avoid wage violations. You’ll also get performance insights that help you reward strong employees and coach others, building a more reliable team.

Also read: Kansas tip laws for restaurants

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.