Opening a restaurant or bar in Louisiana is an exciting opportunity, especially with the state’s strong tourism scene. In 2023 alone, the state welcomed over 43 million visitors, many of whom are eager to eat, drink, and explore local experiences.

But before you start building your team or setting your menu prices, it’s important to get a clear picture of what labor costs are going to look like. That begins with understanding Louisiana’s minimum wage laws and what they mean for your business from day one.

What is the minimum wage in Louisiana?

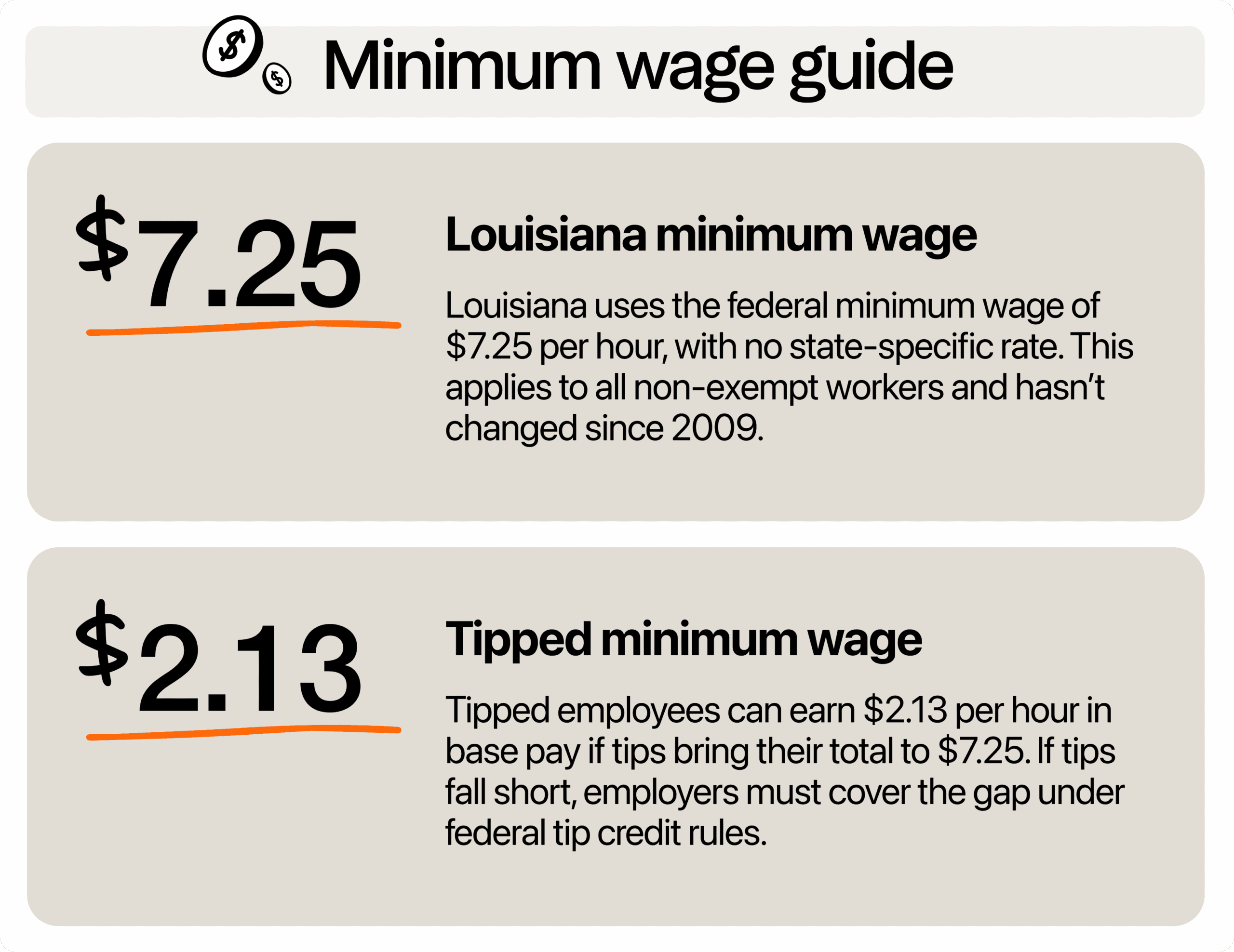

As of 2025, Louisiana follows the federal minimum wage of $7.25 per hour. The state has not passed its own minimum wage law, which means the federal rate applies by default. This rate hasn’t changed since 2009, and applies to all non-exempt workers across the state.

If you have tipped workers like servers or bartenders, Louisiana follows the federal tip credit rule under the Fair Labor Standards Act (FLSA). That means you can pay as little as $2.13 per hour in direct wages, as long as the employee’s tips bring them up to at least $7.25/hour. If tips fall short, you’re responsible for covering the difference.

Federal law also requires you to pay overtime. Any employee working more than 40 hours in a single workweek must receive 1.5 times their regular rate of pay for every extra hour worked. That includes your kitchen staff, dishwashers, and anyone else not classified as exempt.

Youth workers and training wages

Under federal law, which Louisiana adopts by default, you can pay a “training wage” of $4.25 per hour for the first 90 days of employment, but only to workers under the age of 20. After that period, their wage must jump to at least $7.25. This can help if you bring on seasonal high school workers or new staff during a busy period.

Just remember that this window is limited, and it only applies under very specific conditions. Don’t try to stretch it or rehire someone just to restart the clock. That’s a red flag under federal rules and can get you into trouble.

Are there local minimum wage laws in Louisiana?

Unlike states where cities can set higher wages, like Colorado or California, Louisiana has no local minimum wage ordinances. Even major cities like Baton Rouge follow the federal rate. That simplifies compliance, but it also means you’re not insulated from workforce trends.

There is one exception worth noting. New Orleans has set a higher minimum wage, but only for a specific group: employees of city contractors, subcontractors, and those receiving city financial assistance, who must be paid at least $16.01 an hour under the city’s Living Wage Ordinance. This local rate, however, does not apply to all workers in the city. Most private-sector jobs remain subject to the federal minimum.

Many national employers voluntarily offer $15 an hour or more to attract workers, even in states with low legal minimums. So while the Pelican State keeps it simple, your real competition isn’t the law. It’s the marketplace.

Why $7.25 an hour isn’t enough in Louisiana in 2025

You’re not likely to attract or keep solid employees at $7.25 an hour. Most workers know they can earn more just by crossing into another state or applying at a big-name chain offering higher starting pay. That puts business owners like you in a tough spot, one where it’s not the law pushing you to pay more, it’s the market.

And it’s more than just about competition, it’s about survival. According to the MIT Living Wage Calculator, a single adult with no children in Louisiana needs to earn at least $20.51 an hour to cover the basics (rent, groceries, healthcare, and transportation). That number only rises for those with children. So while $7.25 is the legal minimum, it’s far from what most people need to live independently without help or multiple jobs.

At this point, the question isn’t just “What can I legally pay?” It’s “What do I need to pay to build a stable team?” Often, that means starting at $9, $10, or even $12 an hour. Yes, it’s a bigger upfront cost, but it pays off through lower turnover, better morale, and stronger performance from people who feel like they matter.

How to stay competitive when the minimum wage isn’t enough

Paying the minimum wage floor in Louisiana may be legally acceptable, but it’s rarely enough to stay competitive in the hiring market. With rising living costs, higher-paying competitors, and workforce shortages, many small business owners are looking for practical ways to offer more without breaking their budgets.

Start with a wage audit

Take a close look at your competitors, especially those who are hiring successfully. What are they offering in terms of pay and perks? Are they advertising flexible shifts, free meals, signing bonuses, or guaranteed raises after 90 days? If so, that’s the baseline you’re competing against, even if your business model is different.

A simple chart with competitors’ starting rates and benefits can help you identify where you’re falling short and what low-cost improvements you can make to close the gap.

Get smart with benefits, even the small ones

You may not be able to offer full-blown healthcare plans or 401(k)s, but small perks add up. Flexible schedules, employee meals, tip pooling, or gas stipends for weekend shifts all have value. Workers often prioritize consistency and predictability just as much as they do dollar amounts.

If you’re in a tourist-heavy area like New Orleans or Lafayette, try seasonal bonuses tied to sales goals. That way, you’re rewarding high performance while keeping base pay manageable.

Build a culture that sells itself

Retention isn’t always about pay, but it’s also about how people feel at work. Employees who feel respected, safe, and supported are more likely to stay, even if your base wage is slightly lower than a competitor’s.

Make sure your managers aren’t just good at scheduling but also willing to listen to staff concerns. Clear workplace rules and consistent scheduling practices can make a big difference in keeping employees long-term. In a restaurant, this could look like posting work schedules at the same time every week so team members can plan their lives. It could also include setting clear expectations around how shift swaps or time-off requests are handled. When employees know what to expect, they feel more secure in their jobs.

It also helps to have a feedback system in place. This might be quick check-ins between staff and supervisors or anonymous suggestion forms that allow employees to share their thoughts. These simple systems show employees that their input is welcome.

Rethink your raise strategy

Instead of an automatic annual wage increase, which can pile on costs quickly, consider performance-based or tenure-linked raises. For instance:

- $9.50 starting wage

- $10 after 30 days with no attendance issues

- $11 after 90 days if they meet performance metrics

This gives new hires something to work toward and gives you a chance to measure fit before committing to a higher pay rate.

Keep your message clear when hiring

Let people know what kind of workplace they’re walking into. If you’re not offering a top hourly wage, be transparent about what you are offering. “We start at $9.50/hr, but we offer set schedules, paid lunches, and $11/hr after 90 days” is more attractive than a vague listing with just a low hourly rate.

If you promote from within, say it. If you offer bonuses, spell that out. Clear communication brings in people who value more than just the base wage.

How to make room for higher wages

Louisiana is known for its resilience, hospitality, and unique flair, which help businesses thrive even during lean times. But when you’re thinking about raising wages, especially in an industry like food service or retail, your biggest question might be: Where exactly do I find the money?

Start with your inventory

Look at your menu or product offerings. Are there items that don’t sell well, spoil quickly, or require expensive ingredients that aren’t used anywhere else? Let’s say your bar offers a specialty cocktail with an ingredient you only use once a week; that’s a red flag. Consider simplifying your menu. Removing one or two of those items can free up dollars that could go toward payroll instead.

Rethink portion sizes or upsell strategy

A small tweak in how you serve can lead to better margins. Are customers consistently leaving food on their plates? Your portions might be too generous. Offer “light” versions at a slight discount or make side dishes optional instead of automatic. Less waste means more savings.

At the same time, upselling can balance things out. Train your team to offer add-ons that boost ticket size, like adding a side salad, premium topping, or featured dessert. These upgrades don’t cost much to provide but can add significantly to your bottom line.

Trim inefficiencies in scheduling

Louisiana businesses often face seasonal swings, especially with tourism. That’s where smart scheduling becomes your best friend. Use your POS data and sales trends to predict slow vs. high-traffic times. Having five servers on when three would eat up your labor budget fast. Also, under-staffing when it’s busy can lead to burnout and missed sales.

Even a few hours shaved off per week, when done right, can make room for better hourly pay without increasing your total labor spend.

Tap into local partnerships and programs

Louisiana has programs to help small businesses grow, sometimes with tax credits or hiring incentives. Depending on your parish, you might find workforce grants, training subsidies, or small business relief programs. It’s worth calling your local Chamber of Commerce or economic development office to ask. You can start by checking out the Louisiana Economic Development (LED) website.

You can also benefit from partnering with local schools or job training programs. These relationships can give you access to eager workers and even bring in subsidies that offset training costs. For example, the Louisiana Workforce Commission provides several workforce development resources.

Staying compliant in Louisiana

Running a bar or a restaurant in Louisiana gives you one big advantage when it comes to compliance: there’s only one statewide minimum wage to follow. But that simplicity doesn’t mean you’re off the hook. In food service, where schedules fluctuate and tips are part of the pay, the risk of falling out of compliance is high if you’re not paying attention.

Get serious about tip tracking

Servers and bartenders rely on tips, and you rely on making sure they’re paid correctly. If you take a tip credit, it’s your responsibility to prove that their tips bring them up to at least $7.25/hour. Use reliable tip management software that records tips by shift, covers pooled tips, and gives you the reports you need in case of an audit from the Department of Labor.

Review your staff classifications regularly

In Louisiana’s restaurant industry, it’s easy to assume a salaried kitchen manager or shift lead is exempt from overtime, but that’s not always the case. Under federal rules, exempt status depends on more than just being on salary. The role must meet strict criteria involving job duties and a weekly pay threshold. If someone doesn’t qualify and still works over 40 hours a week, you could be liable for back pay and penalties.

Review your classifications at least once a year, especially after promotions or job duty changes, to comply with the labor law fully.

Stay alert for changes

Louisiana might not change its state wage laws often, but if the federal minimum wage increases, it applies here automatically without delay. To avoid being caught off guard, check the U.S. Department of Labor’s website at least once a quarter. Better yet, sign up for email updates so you can get notifications the moment something changes.

Your bottom line benefits from fair pay

While it might be tempting to view Louisiana’s minimum wage as a simple box to check off, wages are directly tied to employee satisfaction, retention, and ultimately, customer experience. Sure, you’re following the law by paying the minimum. But what are you risking by staying at the bottom?

In a state where wage laws are relatively simple, you have room to be strategic. Take advantage of that. Think beyond compliance and start thinking about how your pay practices support your bigger business goals. That mindset can put you ahead of competitors who are stuck at the minimum.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.