Running a food business such as a cafe, bakery, or food truck in Maryland puts you in one of the best states for new businesses. In fact, the state boasts a median household income of over $101,652 in 2023, one of the highest in the country, which gives your business access to a customer base with real spending power.

Alongside that opportunity, you need to understand how the state’s minimum wage laws work as they will affect your payroll budget, employee morale, and your ability to stay competitive. And because Maryland has scheduled wage increases, it’s something you need to keep track of.

What is the minimum wage in Maryland?

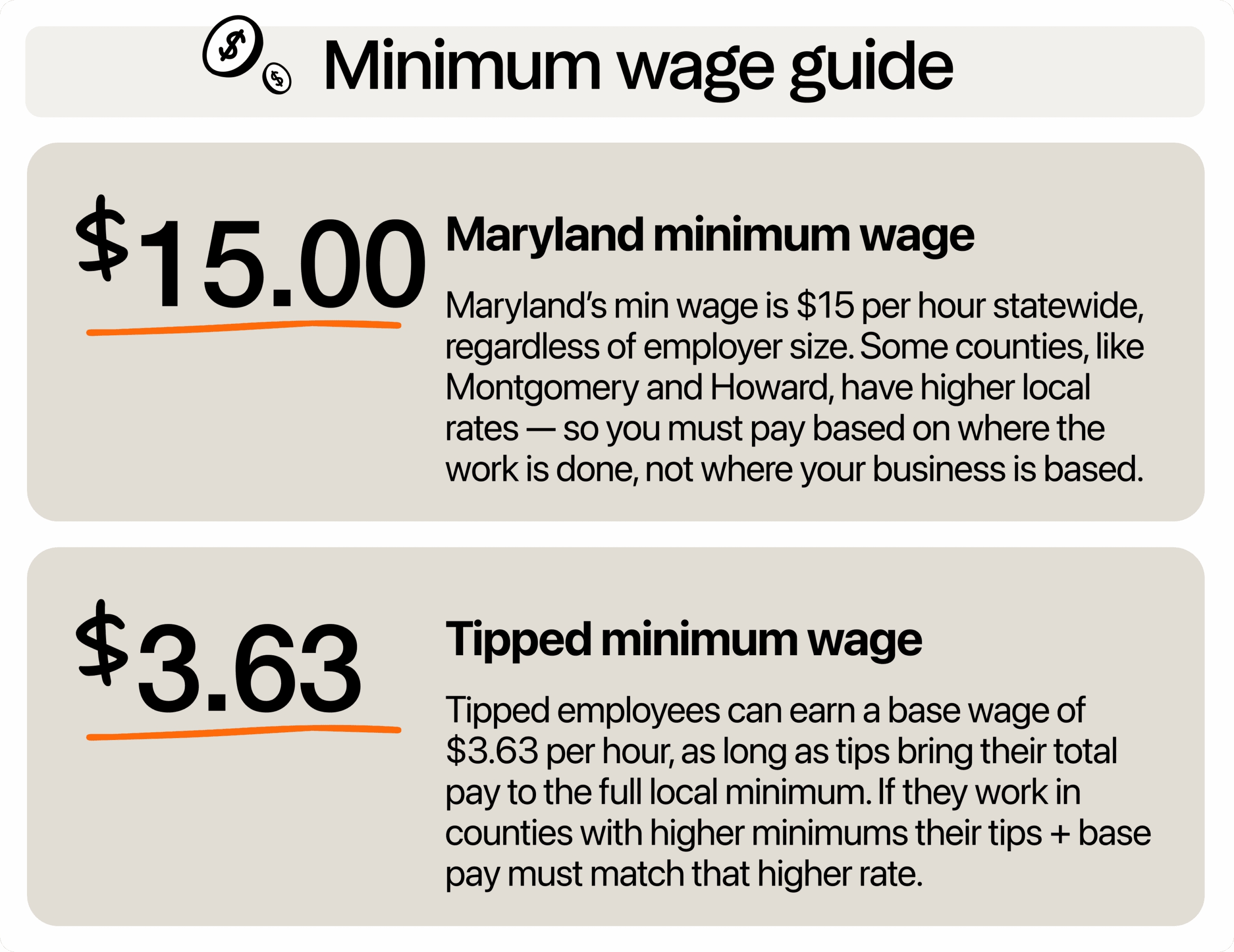

As of January 2025, the Maryland minimum wage is $15 per hour statewide, applying to all employers regardless of size. This marks the final stage of the state’s gradual wage increase plan, originally passed in 2019 and accelerated by the Fair Wage Act of 2023.

In comparison, Maryland’s rate is more than double the federal minimum wage of $7.25 per hour, which still applies in many states. If you’re doing business in Maryland, the state rate always applies because it is higher.

Do local jurisdictions in Maryland have higher minimum rates?

Yes, some do. While Maryland’s statewide minimum wage rate is your baseline, two counties, Montgomery and Howard, have set their own rates that go above it. If your business is based in either county or you plan to expand there, you’ll need to pay those higher local rates.

| County | Employer Size | Minimum Wage |

| Montgomery County | 51 or more employees | $17.65/hour |

| 11–50 employees | $16/hour | |

| 10 or fewer employees | $15.50/hour | |

| Howard County | 15 or more employees | $16/hour |

| Fewer than 15 employees | $15/hour |

If you’ve got one location in Baltimore and another in Silver Spring, or if your food truck crosses into Ellicott City, your payroll system needs to reflect those differences. Even a small mistake, like paying the state rate in a county with a higher threshold, can cost you back pay and penalties.

What if your business operates in multiple counties?

Let’s say you own a small catering business. Your staff might prep food at your main kitchen in Baltimore City, but then head out to serve clients in places like Howard or Montgomery County. In Maryland, what matters most for minimum wage compliance is not where your business is headquartered, but where the actual work takes place. Labor laws follow the location of the job, not where your business is located.

So if your staff spends part of their workweek in a higher-wage county, they need to be paid that county’s rate for the hours they work there. You may need to split shifts on your timecards and do a bit of extra payroll math. This is where using payroll software that tracks hours by job site can be a game changer.

What about tipped workers?

If you employ servers, bartenders, or anyone who earns tips, Maryland allows a tip credit. This means you can pay a lower base wage as long as tips bring the employee’s total earnings up to the required minimum.

For 2025, the minimum tipped wage in Maryland is $3.63 per hour. If an employee’s tips don’t bring their total earnings up to at least $15 per hour or the higher local minimum if they’re working in a county like Montgomery or Howard, you’re responsible for covering the gap to make sure their pay meets the legal threshold. This rule applies statewide, including in counties with higher local minimums.

So, if you’re paying staff in Montgomery County, make sure their combined tips and base wage meet that county’s minimum based on your business size.

Are there training or youth wages in Maryland?

The short answer is no. Maryland does not allow a lower training wage or a separate youth wage. Regardless of age or experience, everyone you hire must be paid the full $15 minimum wage. So if you’re hiring seasonal staff, high schoolers, or interns, they must start at the standard rate.

This can affect your summer hiring plans or short-term scheduling needs. If you’re used to paying a lower rate for temporary help, it’s worth reviewing your budget and staffing strategy now that the $15 base applies to all.

Overtime pay rules in Maryland

Maryland follows the federal Fair Labor Standards Act (FLSA) when it comes to overtime. That means non-exempt employees must be paid 1.5x their regular rate when they work more than 40 hours in a workweek.

For example, let’s say you have a barista earning the state minimum of $15 per hour. If they work 45 hours in one week, they must be paid time-and-a-half for the five overtime hours, so $22.50 per hour for those. Their total pay for the week would reflect 40 hours at $15 and 5 hours at $22.50. This applies whether you are in Baltimore City, Montgomery County, or any other part of the state.

Can the state minimum wage change again soon?

Maryland reached its current $15/hour statewide rate after a series of scheduled increases. While there’s no active legislation to raise it further right now, that could always change. To stay ahead, keep tabs on the Maryland Department of Labor’s Wage Alert page.

However, if your business is in Montgomery County or Howard County, you should expect the local minimum wage to increase again soon. Both counties have future minimum wage increases already scheduled through 2026. Starting in 2027, their rates will be tied to inflation, meaning automatic adjustments will kick in each year based on cost-of-living data.

If you operate in Montgomery County, you can follow updates through the Office of Human Rights. For businesses in Howard County, check their official site for local updates and announcements.

It’s a good idea to bookmark these pages or subscribe to alerts, so you’re not caught off guard by new rules. Local counties can make changes independently, so checking in every few months is better than once a year.

How to manage high minimum wage and county differences in Maryland

If you’re just starting out, seeing minimum wages climb over fifteen or even seventeen dollars an hour in some counties might feel discouraging. It’s a lot to take in, especially when you’re juggling permits, finding a location, managing inventory, and building your team from scratch. But these challenges are manageable if you stay strategic about how you build your business from day one.

Focus on pricing from the beginning

Minimum wage is part of your cost structure, just like rent and ingredients. So from day one, bake those rates into your pricing. Look at what similar businesses in your area charge. See where you can raise prices modestly without scaring away customers. People often accept paying a little more if your service is fast, your team is friendly, and your product is consistent.

Instead of trying to win on price alone, aim to win on value. Better customer experience, smoother service, and small touches can justify a few extra cents per item. Over time, this helps you stay profitable even in counties with higher wage requirements.

Work smarter with your schedule

Rather than hiring a large team right away, build shifts around demand. If your peak hours are lunchtime and weekends, schedule your core crew accordingly. You also need to keep track of where each employee is working and what wage applies in that location.

7shifts can make this easier. Our automated tools, built for restaurants, cafes, and coffee shops let you assign pay rates by job site and automatically apply the correct wage based on location. You can also view your team’s schedule, hours, and projected labor costs in one place. That way, you can stay compliant with local wage laws without having to build reports or run manual calculations.

Use the rules to your advantage

Higher minimum wages may feel intimidating, but they often point to areas where people have more disposable income. That means you can potentially earn more per transaction if you position your business right. For example, if your shop is in a county with a higher wage floor like Montgomery, you can use that to justify premium pricing. People in those areas may be used to paying more, and if your food, service, or ambiance feels worth it, they’ll come back.

You can also use employee headcount brackets to your advantage. If your business stays under the ten-employee limit in Montgomery County, you qualify for a lower wage rate of $15.50 instead of $17.65. That can help keep your labor costs manageable while you test your business model and get your footing. You are following the rules while staying strategic.

Pay attention to the counties’ requirements and rates, and plan your operations accordingly. If you deliver, prep, or sell in multiple counties, time tracking by location helps you comply without overpaying. This way, you’re turning legal obligations into informed choices that support your long-term success.

How to be compliant with wage laws

With different counties in Maryland setting their own minimum wage rates, keeping up with the rules can feel frustrating, especially when you’re already handling hiring, training, and day-to-day operations. But compliance isn’t just about avoiding penalties. You protect your business from costly audits, employee complaints, and back pay claims.

Use payroll systems that adjust easily

Make sure your payroll software allows for automatic updates when minimum wages go up. The right tools will alert you when laws change and make it easy to switch hourly rates without manual entry. That kind of automation pays for itself by reducing errors, saving time, and helping you stay ahead of compliance issues.

Set up location-based time tracking

In Maryland, where the work happens matters. If your business has one location in Baltimore and another in Silver Spring, or if your staff travel to different job sites, you need a system that tracks where and when your team works. A good time clocking software that lets you assign locations to each shift will make sure you’re applying the correct wage every time. If you’re using 7shifts, this feature can be set up and automated easily.

Make use of a tip management system

Monitoring tips are often overlooked, especially in busy restaurants or bars, but they are one of the biggest compliance issues the Department of Labor monitors.

Using tip management software allows you to record tips by shift and associate them with each employee. This ensures a dependable paper trail that can be useful during an audit. Additionally, it helps you identify underpayment early, enabling correction before legal concerns arise. If tips are insufficient, you are obligated to compensate for the difference.

Review your team’s classification

Do your managers or administrative staff actually meet the exemption requirements under the FLSA? It’s worth reviewing their job descriptions and pay structure. Misclassifying a non-exempt employee as exempt could lead to back pay and penalties if caught in an audit.

Thrive in Maryland with the right systems in place

With different minimum wage rates across Maryland’s counties, keeping everything straight can be a challenge when you’re focused on daily operations.

The good news is, you do not have to juggle it all manually. 7shifts can help you automate wage tracking, manage staff schedules, and stay on top of labor costs across locations. If you’re running one food truck or several cafes across county lines, the right system makes it easier to stay compliant without losing focus on your team or customers.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.