Missouri has been one of the most competitive states in the country for business development, thanks to its favorable tax structure, central location, and lower-than-average cost of doing business. But before you dive in, you need to familiarize yourself with the state’s labor laws and structure, especially regarding wages. This will help you budget smarter, stay compliant, and build a stable workforce from day one.

What is the current Missouri minimum wage?

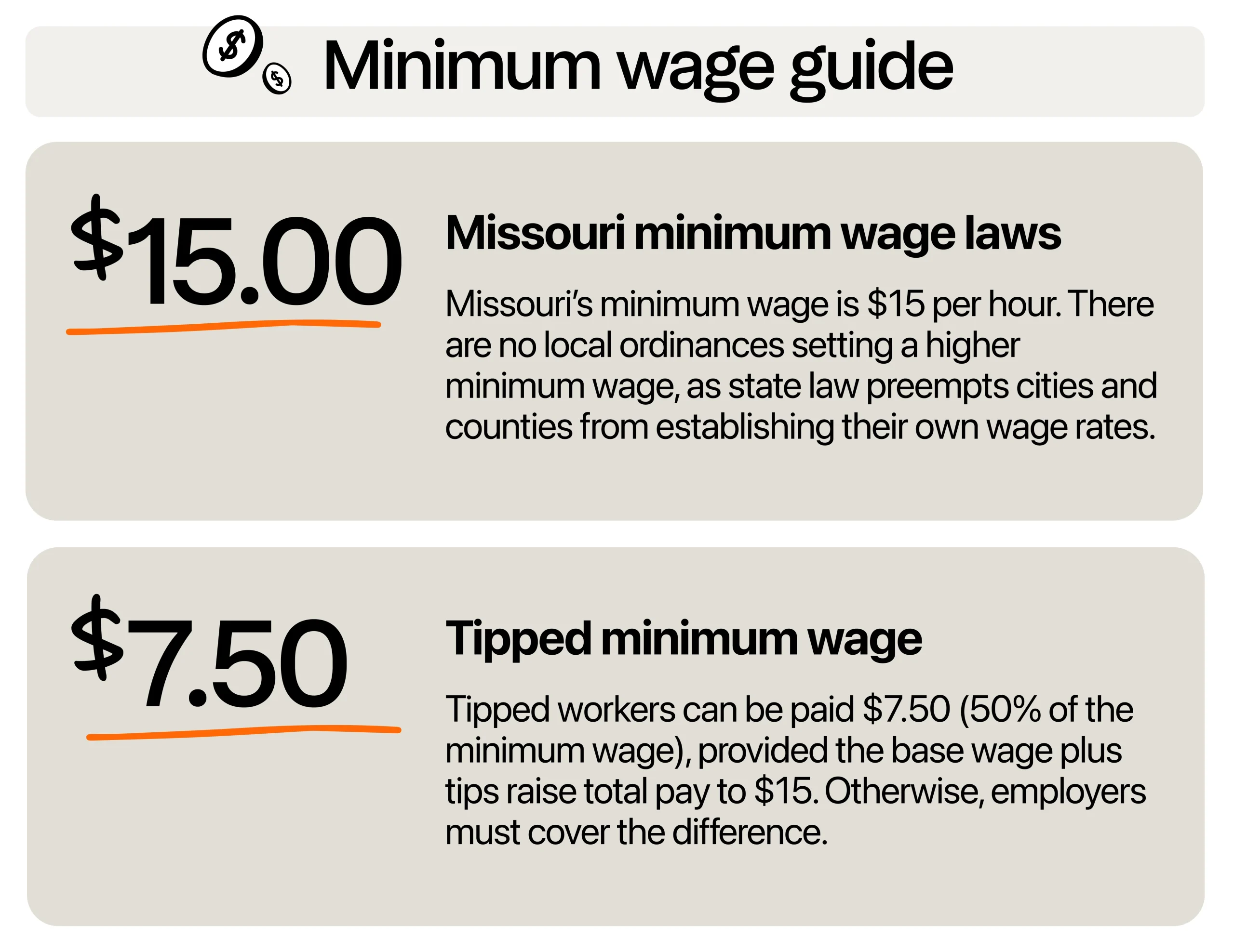

As of January 2026, the Missouri minimum wage is $15 per hour. That applies to most private sector jobs across the state. This increase is part of the voters-approved plan under Proposition B, which gradually raised the minimum wage each year from 2019 to 2023 and tied future increases to the Consumer Price Index (CPI). Then, a new measure (Proposition A, approved in 2024) and subsequent legislation (signed by Governor Kehoe in July 2025) accelerated the path to $15.00, removing the automatic CPI adjustments.

If you have tipped employees, you can pay them as little as $7.50 per hour, but only if their tips bring them up to at least $15/hour. If not, you’re legally required to make up the difference.

Are there any local wage ordinances?

The short answer is no. Missouri law prohibits cities and counties from setting their own minimum wage rates. In 2017, the state passed a law that nullified local increases, including St. Louis’s previous attempt to raise its citywide wage. That means whether you’re in Kansas City, Springfield, Columbia, or a rural town, the statewide rate of $15 applies.

Youth workers and training wages

Missouri does not offer a reduced youth or training wage like some other states either. You can’t pay a lower rate to employees under 20 or new hires within their first 90 days. Everyone, regardless of age or experience level, is entitled to the same $15/hour, unless they are tipped employees under federal rules.

That said, you can still structure incentives and raise tiers based on performance or longevity, as long as you don’t dip below the legal minimum.

Overtime pay

Missouri follows federal overtime rules. You must pay employees 1.5x their regular rate of pay for any hours worked over 40 in a single workweek. There are no state-specific daily overtime rules, so the 40-hour weekly threshold is your main benchmark.

For example, if you have a warehouse worker earning $15 an hour and they work 45 hours in a week, they must be paid $22.50 per hour for the five hours of overtime. That’s $75 extra on that week’s paycheck. Multiply that across several employees, and you can see how those overtime hours add up quickly.

Be aware that certain employees may be exempt from overtime under the Fair Labor Standards Act (FLSA), such as salaried executive, administrative, or professional roles, but those exemptions depend on both the employee’s job duties and how much they’re paid. Just giving someone a title like “manager” isn’t enough.

Exempt vs. non-exempt employees

Not every type of employee is entitled to overtime pay. The key difference comes down to how an employee is paid and what kind of work they do. Be careful not to misclassify someone as exempt when they should be non-exempt, as it can lead to serious wage violations and financial penalties.

To be classified as exempt, an employee typically must meet all three of the following criteria:

- They are paid on a salary basis

- They earn at least the minimum salary threshold set by the FLSA

- They perform exempt job duties, generally executive, administrative, or professional work.

Missing even one of these conditions usually means the employee should be classified as non-exempt and therefore eligible for overtime pay. Non-exempt employees are usually paid hourly and are entitled to overtime pay when they work more than 40 hours in a week.

Will there be wage increases in the future?

On July 10, 2025, Governor Mike Kehoe signed House Bill 567. While this law kept the voter-approved jump to $15.00 per hour for 2026, it explicitly eliminated the annual cost-of-living adjustments that were supposed to start in 2027.

Unless the state legislature passes a new law or voters pass a new constitutional amendment, the minimum wage is now locked at $15.00 for the foreseeable future.

How Missouri’s wage compares to surrounding states

If you’re planning to start a business, let’s say a bakery, Missouri gives you somewhat of a practical advantage. The current minimum wage of $15/hour is equal to that of Illinois, but still competitive enough to attract good talent, especially compared to Kansas or Arkansas.

Even better, Missouri keeps things simple. You don’t have to worry about different rates by city or sudden changes. This kind of stability gives you room to focus on your operations, grow your team, and reinvest in your business without worrying that payroll will get out of control.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Common wage-related pitfalls and how to avoid them

Having a solid team is important in every business, but staying compliant with wage laws is just as critical. Getting your wage practices right from the start helps protect your business and supports a workplace your employees can rely on.

Untracked overtime

One of the most common mistakes new or growing business owners make is letting overtime hours sneak up on them. Employees may stay late or clock in early, and without a reliable way to monitor that time, you could end up paying more than expected, or worse, underpaying them and risking a wage violation.

To stay ahead, set up a reliable time clocking software that flags when employees are nearing overtime. Combine it with scheduling software that uses your sales and staffing data, so you’re assigning shifts that match real demand. These systems help you plan smarter and avoid unnecessary labor costs.

Tip credits without tip tracking

Missouri is a tip credit state, so keeping track of tips is not just helpful but essential to staying compliant with wage laws. But here’s where a lot of new businesses run into trouble: they don’t track tips accurately.

If you can’t prove that employees made enough in tips to close the gap between the tipped wage and the Missouri minimum, you are legally required to pay the difference out of pocket.

Setting up tip management software helps you stay compliant by tracking tips by shift, summarizing each employee’s total tips, and creating clear records in case of a wage audit. With this kind of system in place, you know your team is being paid correctly, and you’re meeting your obligations as an employer.

Payroll mistakes

A lot of wage-related problems start with payroll. If it’s not set up correctly, you could underpay staff, miscalculate overtime, or miss tip credit requirements without realizing it. These errors not only open you up to fines, but they can also break your team’s trust.

To stay on track, look into a payroll system that does more than cut checks. It should connect with your scheduling and time-tracking tools, calculate pay according to Missouri’s tip credit rules, and stay updated with both state and federal labor law. The right system catches problems early, keeps accurate records, and gives you peace of mind.

How your restaurant can stay competitive

Missouri’s minimum wage continues to rise yearly, but that doesn’t mean your business has to fall behind. It’s possible to stay competitive and continue to grow while meeting wage requirements.

Be intentional with your menu and inventory

Food waste can quietly eat into your margins. If you’re constantly tossing out expired ingredients or low-selling items, it’s time to review your menu. Focus on dishes that use overlapping ingredients to simplify inventory and reduce spoilage. Choose high-margin items that are quick to prepare and consistently popular. This frees up extra dollars that you can put toward fair wages.

Use your schedule like a strategy tool

Your schedule should reflect your sales trends. Look at your busiest and slowest times of the week, then align staffing levels accordingly. There’s no need to keep two hosts on a slow Tuesday afternoon.

Likewise, make sure you’re fully staffed during peak hours to avoid burnout. Smart scheduling saves money and keeps service consistent.

Train for flexibility

The more your employees can do, the more flexible your team becomes. A server who can help prep in the kitchen, or a barista who can also manage the register, gives you room to work with smaller teams without compromising quality. This also keeps your operation running smoothly during call-outs or unexpected surges.

Consider a service charge system

Many Missouri restaurants now apply a 15% to 20% service charge in place of traditional tipping. If done transparently, this approach provides consistent earnings for your team and reduces income gaps between shifts. Make sure customers understand where the fee goes and how it supports your staff.

Non-cash incentives can go a long way

You don’t always need to offer more money to create a workplace people want to stay in. Set schedules, flexible shift swapping, paid breaks, and even something as simple as recognizing birthdays can make a difference. Offering earned wage access, where employees can withdraw part of their paycheck early, can also reduce stress and turnover.

Tap into community resources

Local workforce boards and regional development programs may offer grants, training reimbursement, or free courses for employees. For example, you can explore opportunities through the Missouri Job Center or the Missouri Department of Economic Development. These resources can ease onboarding costs and help you upskill your team without cutting into your labor budget.

How to stay compliant with local labor law

There’s more to wage compliance than just tracking time, calculating tips, or setting up your payroll system. If you want to protect your business and maintain your team’s trust, it helps to approach compliance from multiple angles.

Post and communicate pay information clearly

In Missouri, you’re required to display the latest wage order where your team can easily see it, like the breakroom, by the time clock, or wherever your staff gathers before a shift. This simple step keeps everyone on the same page about pay rates and helps avoid confusion down the line.

It’s also a good idea to hand every new hire a written notice that outlines their pay rate, pay schedule, and how tips are handled if it applies. When you communicate clearly from day one, you build trust and show your team that you’re running a fair, organized shop. That kind of openness goes a long way in keeping your business strong and your staff confident in your leadership.

Provide clear and accurate wage statements

It’s not just about how much you pay, but it’s also about how clearly you show it. Make sure your pay stubs or digital wage statements include all required details, like total hours worked, hourly rate, total earnings, tip credits, and any deductions. Transparency helps prevent misunderstandings and builds trust with your staff.

Keep employee classifications up to date

One area that trips up many business owners is misclassifying employees. For example, if you treat a worker as salaried, exempt from overtime pay, but their actual duties do not meet the exemption criteria, you could be liable for back pay and penalties. Review each role in your team at least once a year, especially after promotions or changes in responsibility.

Follow updates from Missouri labor authorities

Missouri wage laws are not static. Sign up for email alerts or check in with the Missouri Department of Labor regularly so you don’t miss upcoming rate changes, rule updates, or compliance deadlines. Staying informed means you’re never caught off guard.

Grow your business

With a strong economy, steady minimum wage and wage law, and no local rate differences to worry about, Missouri gives you the kind of business climate many states can’t match. Sure, you still have to stay sharp on compliance and plan for annual increases, but you don’t have to do it alone or guess your way through it.

Also read: Missouri tip laws for restaurants

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.