Montana minimum wage is set to increase each year to account for inflation. And while that’s great for workers, it also means higher payroll costs for restaurant owners. Instead of waiting to feel the squeeze, you must proactively plan your budget and understand wage laws to save money and stay profitable.

What is the minimum wage in Montana in 2026?

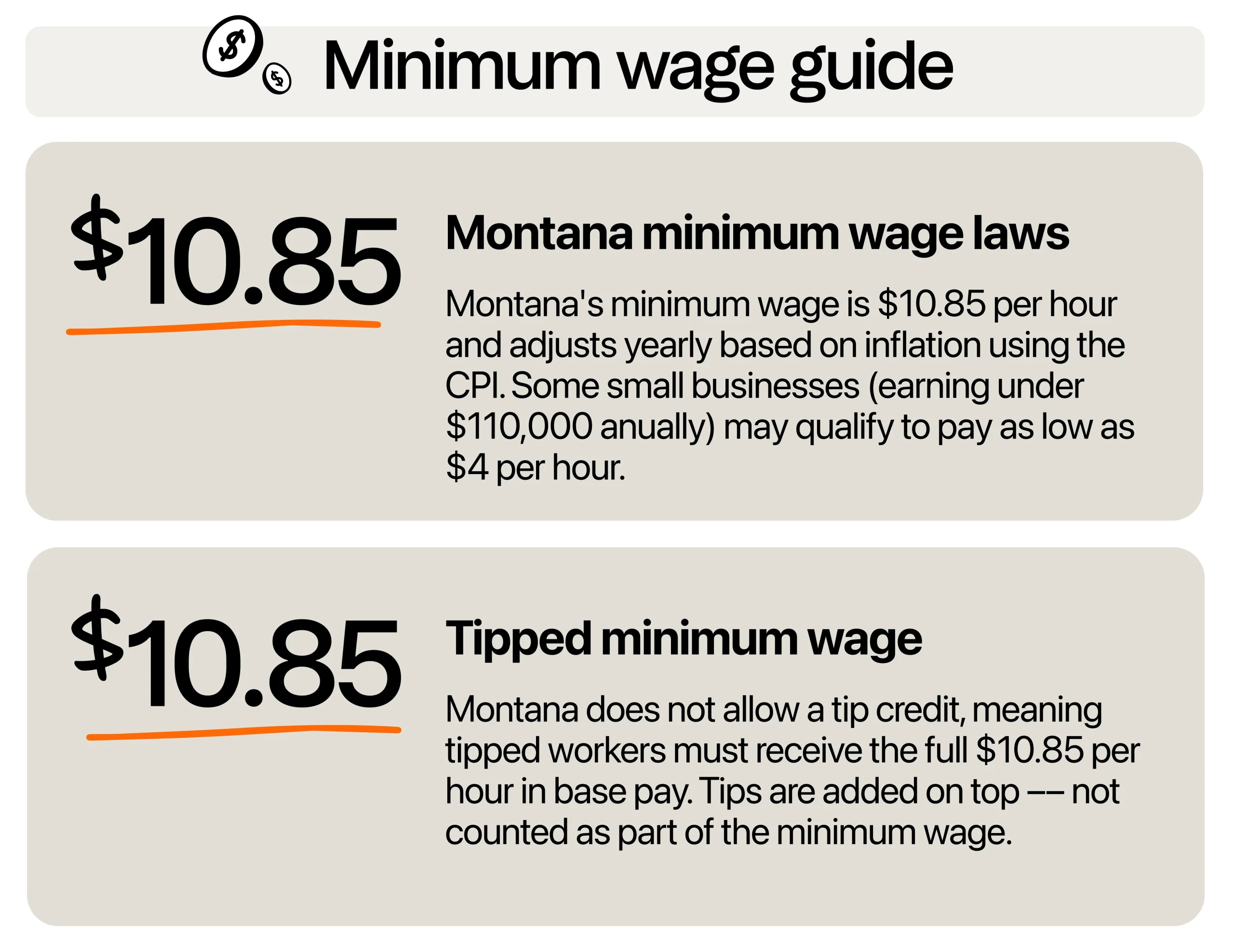

As of January 2026, Montana’s minimum wage stands at $10.85 per hour. Each year by September 30, the Department of Labor & Industry compares the Consumer Price Index for Urban Consumers (CPI-U) from two Augusts and rounds to the nearest nickel.

If inflation doesn’t rise, there’s no bump. Any change kicks in smoothly on January 1 of the following year, without any last-minute grabs by the legislature. This gives employers a heads-up to plan next year’s labor costs.

Another thing to remember is that, unlike many states, Montana’s wage law doesn’t allow a tip credit. As such, your FOH staff always gets at least $10.85 plus any tips.

There’s also a special exemption for businesses earning below $110,000 in annual sales and not under federal FLSA rules. These restaurants can legally pay employees just $4 per hour. Take note that this requires careful tracking of annual revenue. If your establishment crosses the threshold, you’ll need to transition to the full state minimum wage immediately to avoid penalties.

How does Montana’s minimum compare to the wage rates of neighboring states?

Montana’s minimum wage is well above the federal minimum of $7.25 but slightly behind its northern neighbor, South Dakota. SD’s rate is $11.85 per hour. This means a full-time employee in South Dakota now earns roughly $2,000 more per year than a Montana worker at minimum wage.

Meanwhile, Idaho, Wyoming, and North Dakota stick with the $7.25 federal minimum, offering less wage security for workers. The $3.60 wage gap makes Montana a more attractive place to work, especially for those in Williston, ND, Cody, WY, and Salmon, ID.

Nationally, Montana sits in the middle of the minimum wage spectrum. Some states, like California and Washington, boast rates well above $15, while others hover near the federal baseline.

The Treasure State’s approach of tying wage increases to inflation provides a balanced method that protects workers without overly burdening small businesses. This strategy guarantees gradual, predictable adjustments that help both employers and employees plan for economic changes.

Are there laws being made to increase the minimum wage?

Aside from the annual CPI-based adjustment, there have been efforts to increase employee pay. In early 2025, the Montana Legislature considered House Bill 484, which aimed to boost the state’s minimum wage from the current $10.55 to $12.06 per hour. This could have meant an extra $1.51 per hour in labor costs per minimum-wage team member, which is around $3,140 more per full-time employee yearly.

But HB 484 didn’t move forward. It was introduced in February 2025, discussed in committee, and then tabled and officially died in May. While some lawmakers argued the bump was overdue, the measure lost steam as concerns about inflation and additional expenses mounted.

Although the proposal didn’t push through, it did reignite conversation on the current wage and the possibility of an increase. Advocates argue that, even with inflation indexing, the rate of $10.55 (in 2025) didn’t keep pace with the rising cost of housing, food, and childcare.

On the other hand, the National Federation of Independent Business (NFIB) voiced its opposition. After all, the increase would put immense financial pressure on small businesses already grappling with thin margins.

Nonetheless, restaurant owners must be ready for continued proposals or even ballot initiatives in the future. Since 2006, Montana’s inflation-indexed wage system has helped avoid sudden spikes. But groups pushing for faster gains are gaining momentum.

How to stay ahead of inflation-indexed wage increases

CPI-based increases are one of the financial challenges that restaurant owners in Montana must be ready for. While it’s expected, the rise in labor costs can still put pressure on margins, especially when paired with higher food prices and slower seasons. The key is to plan ahead and build a strategy that helps you keep up with these changes without hurting your team or your bottom line.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Budget annually for expected increases

First, make sure to build wage increases into your yearly budget, even before they’re announced. The state usually shares the new rate by September 30, and it takes effect on January 1. That gives you at least three months to update your numbers.

Let’s say your staff includes five full-time employees at the $10.85 per hour rate. If the wage goes up by 30 cents, like it did from 2025 to 2026, you’re looking at an extra $3,120 per year in base wages alone. If you’re not planning for that now, it can eat into your profits later.

To help you forecast, take a look at past increases. Montana’s wage has gone up by 20 to 35 cents per year over the past five years. Then, use a 3-5% bump as a rough forecast, based on inflation trends. Add that to your restaurant budget for Q1 next year.

Being proactive protects your margins and helps you avoid scrambling when the rate changes. It also shows your team that you’re organized and serious about fair pay.

Trim menu size and standardize recipes

One smart way to manage rising labor costs is to do some menu engineering to make it leaner and more efficient. A smaller, focused menu is faster to prep, easier to train for, and cheaper to run.

Look at your lowest-selling items. Use your POS data to find dishes that haven’t moved in the last 60 days. Cut those first. Every dish you remove means fewer ingredients to order and less time spent on prep, especially during peak hours. Then, find high-margin items and highlight them on your menu.

Next, standardize your recipes. That means locking down exact portions, ingredients, and cooking steps for each dish. You’ll cut back on errors and train new staff faster. For example, be specific about how many pickles your signature burger uses. Five pickles over “a few,” lets you save money over hundreds of orders.

Review cash flow monthly and forecast for labor cost scenarios

To stay ahead of rising wages, you need to keep a close eye on your cash flow. Don’t wait until the end of the quarter or year. Review your cash flow every month so you can catch trends early and adjust quickly.

Compare your weekly labor costs to your weekly sales. If labor is climbing above 30% to 35% of sales, that’s a sign to adjust. Look for patterns. Are certain shifts overstaffed? Are sales dropping, but schedules staying the same?

Then, run labor cost scenarios. For example, what happens if the minimum wage jumps from $10.55 to $11.00 next year? Multiply the difference by total hours worked. If you schedule 1,200 hours per month, that’s an extra $540 per month, or $6,480 per year. Can your current margins absorb that?

Planning for a few “what ifs” now gives you time to respond later, before the numbers hit your bank account. It also helps you make confident decisions about pricing and staffing. The more you forecast, the fewer surprises you’ll face when wages change.

Reevaluate staffing models

Take a look at your current staffing practices. Are you scheduling too many people during slow times? Are some shifts doubled up when they don’t need to be?

Match sales to your staff schedule. If lunch shifts are slower than expected, try using split shifts, where a team member works lunch, clocks out, then returns for the dinner rush. It can cut down paid downtime while still covering peak hours.

Take note, though, that split shifts can be challenging for employees who need consistent work hours. Communicate clearly about split shift expectations, and consider offering additional perks or slightly higher hourly rates to compensate for the inconvenience. Some employees appreciate the flexibility, while others might find it disruptive.

Also, watch for unnecessary double-ups. This is when two people are scheduled for the same task, like hosting or prepping, but the volume doesn’t call for it. Reducing even one unneeded shift per day could save over $2,000 per month, depending on your labor rate and hours.

Use restaurant scheduling software that gives you real-time labor vs. sales tracking. That way, you can build shifts around demand with accurate data. Small changes in your staffing model can make a big difference in your bottom line, especially with wages set to rise again in a few months.

Add service charges and explain support for staff wages

If you’re hesitant to increase menu prices, consider turning to service charges to help cover labor costs. It’s a fixed fee, usually 3% to 20%, added to the bill that goes toward fair pay for your team.

If you go this route, the most important step is clear communication. Add a short note to your menu or receipts explaining the purpose. You can say, “A 5% service charge helps support fair wages for our kitchen and service staff.” Most customers appreciate knowing their extra dollars directly support workers.

Make sure your team is trained to explain it, too. And remember, tips are still separate. Guests can still tip servers, and service charges can be used to support BOH wages, which tips usually don’t cover.

This strategy helps spread wage costs across all guests, especially helpful during high inflation or slow seasons. Even a 5% charge on a $50 ticket adds up to $2.50 per table, which can make a big difference over time.

From a tax perspective, most of Montana doesn’t charge a statewide sales tax, so your service charge usually won’t be taxed. But there’s an important exception: if your restaurant is in a resort community like Big Sky or Whitefish, you could be subject to a local resort tax of up to 3% on the service charge.

Plan ahead and protect your margins

Montana’s inflation-based wage increases don’t have to be a threat to your bottom line. You just have to put effort into planning and having the right strategies to keep labor costs in check. Small changes to your menu and pricing strategy can make a huge difference in your profitability.

Stay on top of labor costs with restaurant payroll software that pulls in real-time hours and tips. With the right tools, you can plan ahead and protect your margins as wages rise.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.