If you’re launching any business in New York, you’re stepping into a place that truly values fair pay, and you can see that in the wages. New York State has some of the highest minimum wages in the country, and while that might seem expensive at first, it also means you’re working in a strong economy where people have spending power and employees feel valued.

According to the 2024 Small Business Profile by the U.S. Small Business Administration Office of Advocacy, there are over 2.2 million small businesses employing more than 3.7 million people. That means you’re joining a huge community of entrepreneurs who see NY as full of opportunity and potential.

What is the minimum wage in New York?

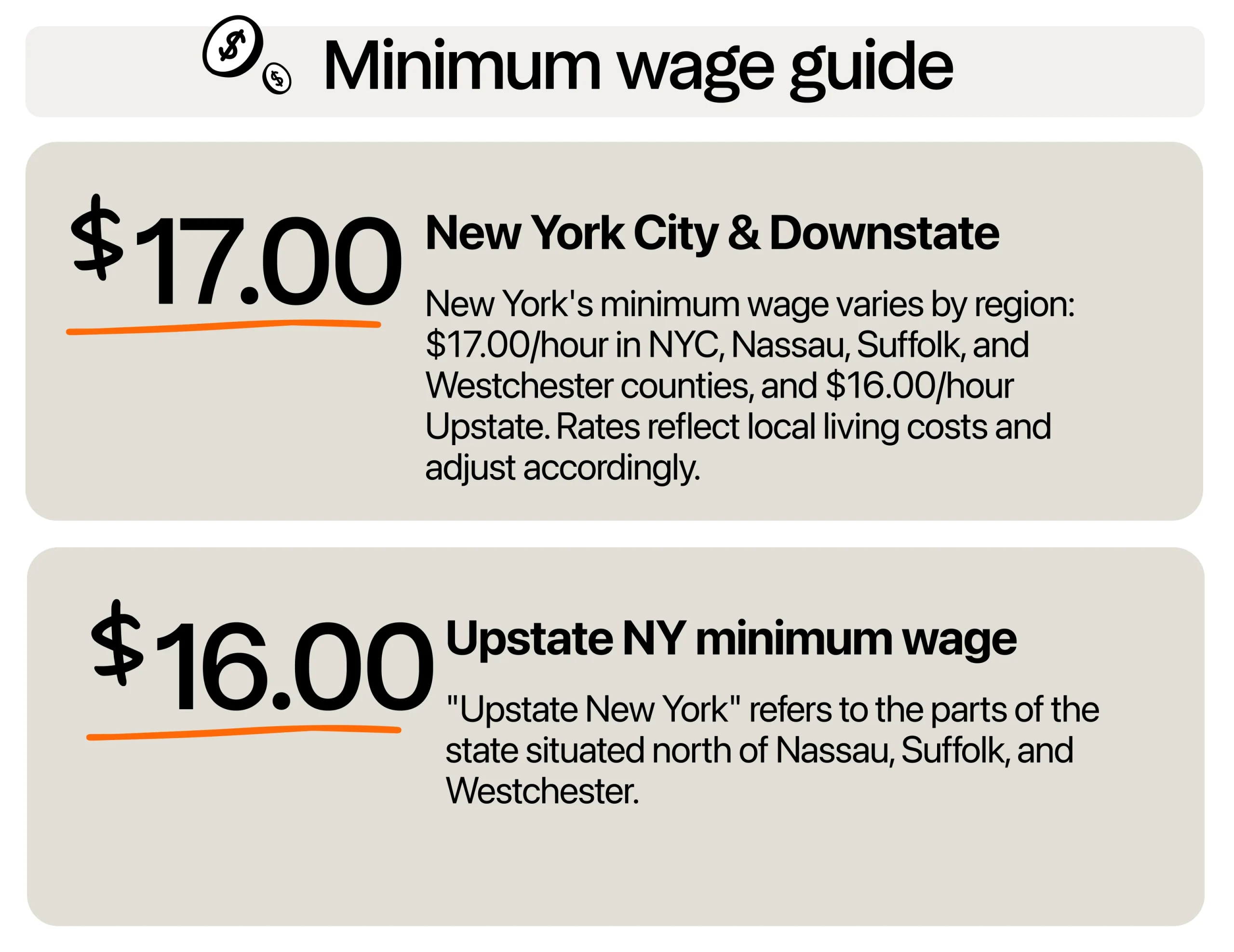

Before you start planning your payroll or setting prices, you need to know this first: New York’s minimum wage depends on location. It doesn’t have a uniform statewide minimum; it adjusts based on regional economic conditions and living standards.

As of 2026, the state minimum wage rates are as follows:

- New York City and Downstate (Nassau, Suffolk, Westchester counties): $17.00 per hour

- Upstate New York: $16.00 per hour

Now, when people refer to “New York City and Downstate,” they aren’t just talking about the five boroughs that make up NYC proper. They also include the surrounding counties, namely Nassau, Suffolk, and Westchester, which are geographically adjacent and socioeconomically aligned with the city. These areas, often considered part of the metropolitan orbit, share many characteristics: they’re densely populated, have elevated housing costs, experience higher prices in transportation and food, and generally reflect a faster-paced, more commercially active lifestyle.

In short, the cost of living in these regions is considerably higher when compared to other areas in the state.

On the other hand, “Upstate New York” refers to the parts of the state situated north of these counties. These regions tend to exhibit a different rhythm altogether. They are often less urbanized and more spread out in terms of population distribution, and their lifestyles tend to reflect a slower, less hectic pace. Housing, transportation, and other daily necessities typically cost less than their Downstate counterparts, so the set minimum wage is higher compared to Downstate NY.

What are the tipped wages in NY?

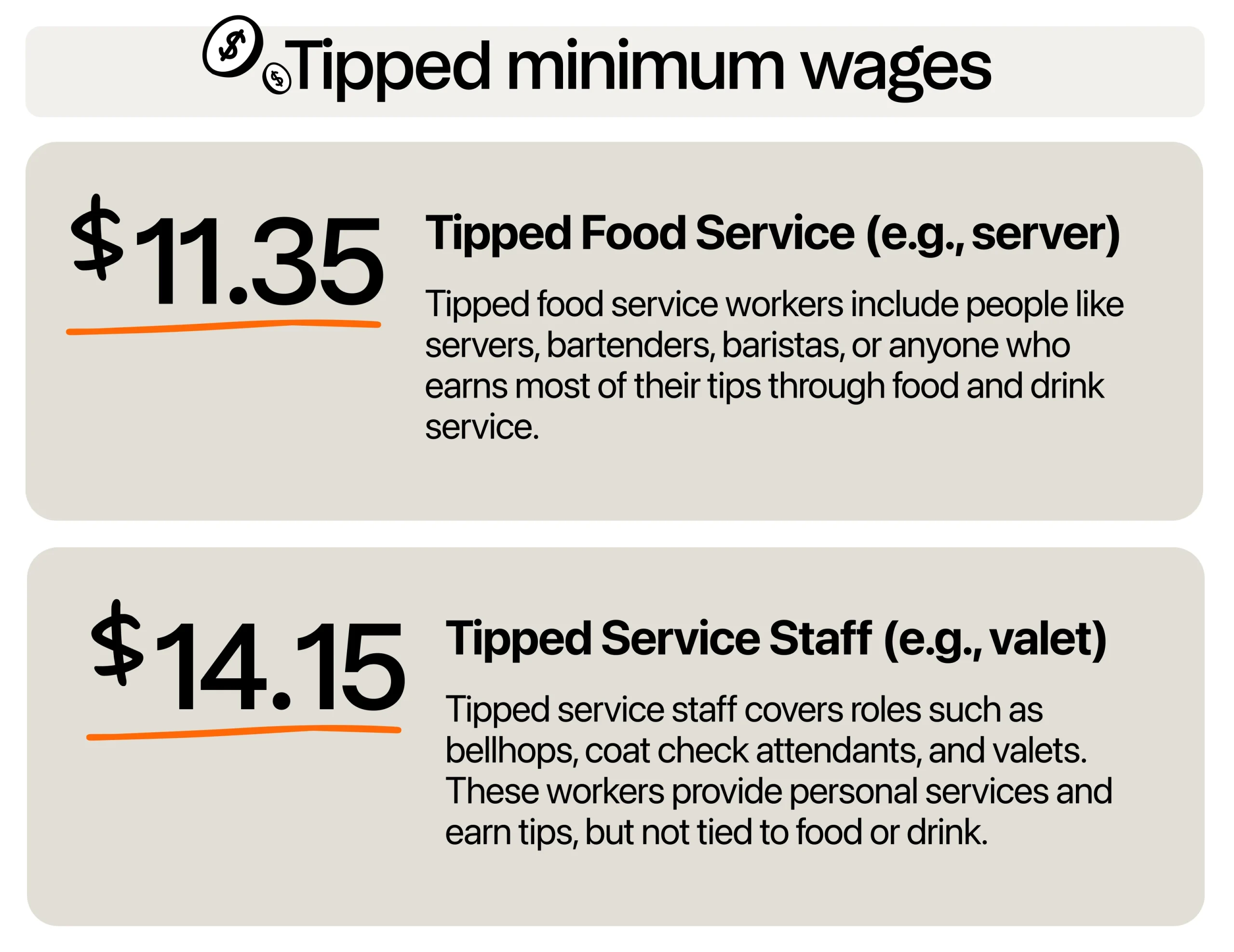

In New York, tipped wages exist because the law recognizes tipping as an expected part of compensation for certain service jobs. Certain jobs, like servers, bartenders, and valets, have a long tradition of tipping as part of their income. The state has tip laws that allow a tip credit system, so you can pay a lower cash wage as long as the worker’s tips bring them up to at least the full minimum wage.

In New York, tipped workers fall into two main categories. Tipped food service workers include people like servers, bartenders, baristas, or anyone who earns most of their tips through food and drink service.

On the other hand, tipped service staff covers roles such as bellhops, coat check attendants, and valets. These workers provide personal services and earn tips, but not tied to food or drink.

| Role / Region | NYC / Downstate Cash Wage | Upstate Cash Wage | Tip Credit NYC / Downstate | Tip Credit Upstate |

| Tipped Food Service (e.g., server) | $11.35 | $10.70 | $5.65 | $5.30 |

| Tipped Service Staff (e.g., valet) | $14.15 | $13.30 | $2.85 | $2.70 |

If tips fall short, businesses step in to cover the gap so your team always takes home fair pay. It’s a setup that helps you manage payroll wisely while creating jobs that attract people who take pride in providing great service. When you understand how this works, you can build a workplace that feels fair for everyone and fits your business goals.

Rules on NY youth, trainee, and apprentice wages

Beyond tipped workers, you might also be wondering how New York handles pay for younger employees, trainees, and apprentices.

Minors

If you’re hiring someone under 18 in New York, you’ll be paying them the same minimum wage rate as an adult doing the same job. Unlike some states, like Georgia, that offer a special youth wage or allow a lower rate for minors during a training period, New York keeps it simple and fair.

Trainees

In some states, you might see lower training wages as a way to ease new employees into their roles. But in New York, trainees are entitled to the standard minimum wage right from the start. Whether you’re bringing on someone fresh to the industry or transitioning an existing employee to a new position, their pay should meet the minimum required for your region.

Apprentices

Apprenticeships in New York work a little differently. The only time you might see a different rate is through specific government-funded apprenticeship programs. For example, the state’s Manufacturers Intermediary Apprenticeship Program (MIAP) offers a skilled pipeline in trades like manufacturing. Apprentices start at a percentage of a fully qualified worker’s wage and gradually earn more as they gain experience. These programs may have special pay structures, but they’re not the norm.

If you’re hiring for roles in retail, hospitality, or similar sectors, expect to pay the standard minimum wage. This is one of the ways New York ensures fairness and consistency across industries, unlike other states that may offer wider exceptions for apprentices.

What about overtime rates?

In addition to base pay, it’s important for employers to understand how overtime is handled, especially if your team regularly works long hours. New York has overtime laws designed to protect workers from excessive hours without fair compensation.

Most employees are eligible for overtime pay when they work more than 40 hours per week. This rule applies throughout all regions, whether you’re in New York City, Long Island, Westchester, or Upstate.

So, how does overtime pay work? You need to pay 1.5 times the employee’s regular hourly rate, also known as time-and-a-half. For example, if your worker earns $17.00 an hour, every overtime hour earns them $25.50. It’s a good idea to plan your scheduling carefully, especially during busy seasons, to keep labor costs predictable and fair.

Overtime pay covers not just extra hours in a day but hours worked beyond 40 in a workweek. It’s based on the total weekly hours, not daily totals, unless a union contract or special agreement says otherwise. This means keeping accurate records of hours worked each day is important.

There are some exemptions when it comes to overtime pay. Certain executive, administrative, and professional employees might not qualify for overtime if they meet specific conditions under both state and federal law. For example, if you have a salaried manager who supervises other employees, has hiring or firing authority, and earns above a set weekly amount, they could be exempt. The same goes for jobs that involve specialized knowledge, like certain accountants or engineers.

It’s important to go beyond job titles and look closely at what your employees actually do. Make it a habit to review job duties and classifications so you don’t misclassify someone by mistake. This keeps your payroll accurate, helps you avoid penalties, and shows your team that you’re committed to compliance.

What’s coming next for New York’s rate in 2026?

As you plan for your business’s future, it’s wise to keep an eye on upcoming changes to wage laws that could affect your bottom line. Looking ahead, New York’s updated minimum is set to increase in stages beyond 2026. Future increases will be tied to the Consumer Price Index for Urban Wage Earners (CPI-W) in the Northeast. This is designed to help wages keep up with the cost of living. It also gives both employers and employees a clearer picture of what’s ahead, so you can plan with more confidence.

For you as a business owner, this means you can review your pricing, staffing, and budgeting strategies early and avoid surprises down the line. It’s a chance to stay ahead and keep your operations running efficiently.

There is also growing discussion about further proposals, such as raising the wage floor in some areas to $20 or more. These proposals could significantly impact sectors like retail, hospitality, and food service.

Lawmakers continue to debate changes to the tip credit system, which could affect hospitality businesses and their payroll models. Some proposals aim to phase out the tip credit altogether, ensuring tipped workers receive the full minimum wage before tips. This could reshape how restaurants and similar businesses handle pay and pricing.

What should employers in NY do to stay compliant?

With evolving wage laws and potential new proposals on the horizon, staying compliant is more important than ever for New York employers. Protecting your business from costly penalties and legal issues, especially related to labor laws, while keeping your team happy and motivated, is achievable with a few simple practices and steady attention.

Post required wage notices

Start by posting the most up-to-date minimum wage notice where all employees can easily see it. This is required by law and reflects your commitment. You can go further by including this information in onboarding packets for new hires. You can also highlight it during training sessions and post digital copies on internal platforms your team uses daily.

When you keep minimum wage information visible and easy to access, you help prevent misunderstandings and create a culture of trust that benefits everyone.

Watch for updates from the Department of Labor

Minimum wage rates can change, sometimes with short notice. Staying updated helps you avoid last-minute scrambles. Make it part of your routine to check official announcements from the New York State Department of Labor or subscribe to their newsletters. You can also set alerts in your calendar or task management tools so you never miss an update.

Keep accurate records

Good recordkeeping does more than meet legal requirements. It helps your business stay strong. Detailed records of hours worked, pay rates, overtime, tips, and bonuses give you clarity when making decisions or answering employee questions. They are also a lifesaver during audits or inspections.

Many businesses use digital timekeeping tools, cloud payroll software, or integrated platforms to reduce errors and save time. Don’t forget to keep copies of agreements about pay, hours, and job roles so you have a clear reference if anything is questioned later.

New York success starts with strong wages

As a business owner, you know that running a company is about more than just juggling numbers; it’s about making smart choices that lift your team, strengthen your operations, and support your community. The wage structure of New York gives you the flexibility to do just that. By adjusting wages to match local living costs, you help your employees stay ahead on their expenses while keeping your business resilient.

Whether you’re running a busy spot in NYC or managing an upstate storefront, this plan gives you room to plan for growth and focus your resources where they matter most. Tools like 7shifts make it easier to put those plans into action, giving you real-time labor insights, smarter scheduling options, and a clearer view of your costs so you can stay ahead of the competition.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.