Oregon has one of the most unique and structured minimum wage systems in the U.S., and as a business owner, you can’t afford to treat this as just another compliance checkbox. Your wage strategy affects your payroll, your hiring success, and even your reputation in the local job market.

The good news is that Oregon’s tiered wage structure allows you to align your pay practices with your area’s actual cost of living. Here’s everything you need to know about it.

What are the 2025 wage rates in Oregon?

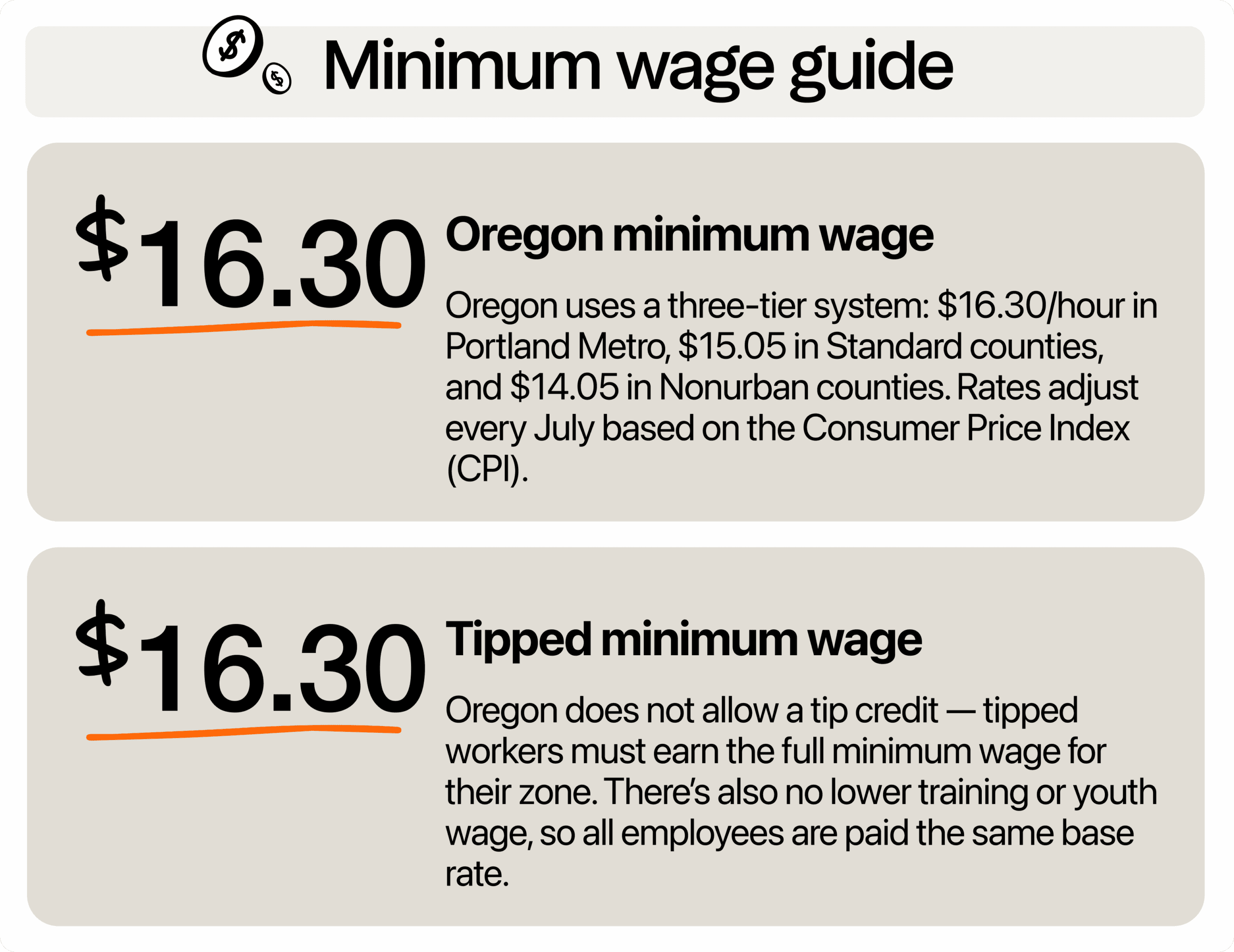

Unlike states that set a single flat rate, Oregon uses a three-tier system that adjusts the minimum wage based on geography:

- A standard minimum wage that applies to most counties.

- Portland Metro has a higher minimum wage, reflecting the elevated cost of living in the urban core.

- Nonurban Counties have a minimum that’s lower, acknowledging the lower cost of living in more rural areas.

As of July 2025, here are the updated hourly rates:

| Region | Minimum Wage (Effective July 2025) |

| Portland Metro | $16.30 |

| Standard (General) | $15.05 |

| Nonurban Counties | $14.05 |

These figures are not arbitrary. Oregon adjusts its minimum wage increases every July based on the Consumer Price Index (CPI), so the changes actually reflect the real cost of living and inflation.

Tipped workers and training wages

Oregon does not allow a tip credit, which means tipped employees must receive the full applicable minimum wage in their zone. If you own a diner and your servers make good tips, that’s great, but you still need to pay them the full $16.30 if you’re in the Portland Metro area.

Also, Oregon does not have a lower training wage or youth wage. If you’re hiring teens for the summer or onboarding new kitchen staff, you’re expected to pay them the same rate as your regular employees.

Rules on overtime pay

Oregon adheres to the federal Fair Labor Standards Act (FLSA) regarding overtime. If you’re managing a restaurant, bar, cafe, or bakery, extended shifts and rotating schedules are common. However, when an employee exceeds 40 hours in a workweek, Oregon law mandates paying them 1.5 times their regular rate for any additional hours.

Daily overtime doesn’t apply in most cases, so if your barista clocks 10 hours one day but only 38 hours for the week, you’re still within regular time. What matters is the total hours worked each workweek, not how many were packed into a single day.

Now, if your staff is truly exempt, meaning they fall under the administrative, executive, or professional exemptions, you’re not legally required to pay overtime. However, misclassifying someone as exempt when they don’t meet the federal or state criteria is a common and costly mistake. Always double-check their job duties and pay structure.

How to use the three-tier wage system to your advantage

The tiered wage structure in Oregon might look like a headache at first, but if you’re planning smartly, it can actually work in your favor. You can use this system to grow your business while keeping your labor costs in check.

Start lean in a non-urban area

If you’re just getting started or testing a new concept, launching in a non-urban county might be the smart way to play. With a lower minimum wage, you get a bit more breathing room on payroll. That means you can put more money into your food, your space, or your customer experience.

It’s also a good sandbox for perfecting your operations before expanding into higher-cost areas.

Use the wage map to plan your expansion

When choosing a second location or expanding a franchise, pull up the Oregon minimum wage zone map and plan accordingly. For example, opening in a Standard county gives you access to a more populous area without paying the premium labor rates found in the Portland Metro area. It offers a middle ground where you will find more foot traffic than in rural areas, but it will not be as expensive as the city.

When you’re ready to break into Portland Metro, you’ll already have a refined process and a solid customer base to support the higher labor expense. You can charge more confidently and deliver service that meets those higher expectations.

Staff flexibly across zones

If your business has mobile elements such as catering, food trucks, or deliveries, you can plan your scheduling around wage zones. Assign more hours to locations with lower minimums when it makes sense. Just make sure you’re tracking where the work happens and paying the right rate for each shift. This way, you stay compliant and efficient at the same time.

Build your brand where labor is more affordable

Some of the best businesses did not start in big cities. They grew in small towns, built a following, and expanded strategically. In fact, rural and nonmetro small businesses account for roughly 85% of all establishments and employ over half of local workers in those areas.

You can do the same. Focus on places where wages are lower but the community is strong and loyal. Build up your brand there. That buzz can follow you when you decide to scale.

How to stay compliant and still run a profitable business

If you’re feeling the pinch from high minimum wages, you’re not alone. But staying compliant doesn’t mean you have to run at a loss. It just means being more strategic with how you operate.

Automate your wage tracking

If your business operates in more than one county, you can’t afford to overlook this. Use payroll systems that support multi-location tracking. This ensures that you’re applying the right rate every time without the headache of manual calculations. Overpaying might not get you in legal trouble, but it will eat into your profits. Meanwhile, underpaying, even unintentionally, can open you up to fines and back pay claims.

Price smart, not cheap

Minimum wage is just one piece of your cost puzzle. Instead of trying to undercut the place next door, focus on building value. If your prices go up 25 cents but your service improves and your space is more welcoming, most customers will understand. Especially in areas like Portland, where customers expect to pay more but also demand better experiences.

Use scheduling tools to reduce excess labor hours

Avoid overstaffing during slow hours. A good scheduling software can help you forecast labor needs, assign shifts efficiently, and avoid unplanned overtime. Oregon’s minimum wage isn’t going down, so making smarter scheduling decisions is one of the best ways to keep your labor budget in check.

Stay alert to future changes

Minimum wage in Oregon is not static. Each July, new rates come out. Oregon employers should bookmark the Oregon Bureau of Labor and Industries (BOLI) website or sign up for updates. To check which wage zone your business is in, use their zip code tool or interactive map on the same page. Don’t rely on word of mouth or social media to find out about a wage increase.

Be a smart business owner and thrive

Oregon’s minimum wage rate and wage system are not meant to slow you down. It’s a framework you can actually lean into. By making smart decisions about where to launch, where to grow, and how to schedule, you are putting yourself in a better position to compete, comply, and succeed long-term.

Now, you might be wondering why the increase is in July and not January, like most changes. It comes down to timing. CPI data from the previous calendar year usually gets finalized early in the new year. By setting the effective date in July, the state gives itself time to review the data, finalize the numbers, and give you a fair heads-up.

For businesses, this mid-year bump can be a double-edged sword. On one hand, it gives you more time after the busy holiday season to adjust your budget. On the other hand, it means mid-year recalibrations in payroll and possibly pricing.

What about businesses operating in multiple zones?

If you own a food truck that moves from Portland to Salem or a delivery service covering both urban and non-urban areas, things can get complicated. Oregon wage law makes it clear that employees must be paid based on where the work is actually performed, not where your business is headquartered.

This means that if your employee works 20 hours in the Portland Metro area and 10 hours in a Standard county, each set of hours must be paid according to that location’s specific wage rates. The law requires you to break down their time by where the work happened and apply the proper minimum wage accordingly.

Labor laws follow the job site, not the mailing address of your business, so accuracy in location-based compensation is critical to staying compliant.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.