Vermont continues to show promise for small business growth. According to the data from the U.S. Chamber of Commerce, Vermont had 7,516 new business applications in 2023 alone. That data signals confidence in the local economy and a supportive environment for entrepreneurs. With its emphasis on community-first values and sustainable living, Vermont offers a solid foundation for food businesses looking to start or expand.

Part of running a business in the Green Mountain State means staying current on labor laws, especially minimum wage rules that directly affect your bottom line.

What is the current minimum wage in Vermont?

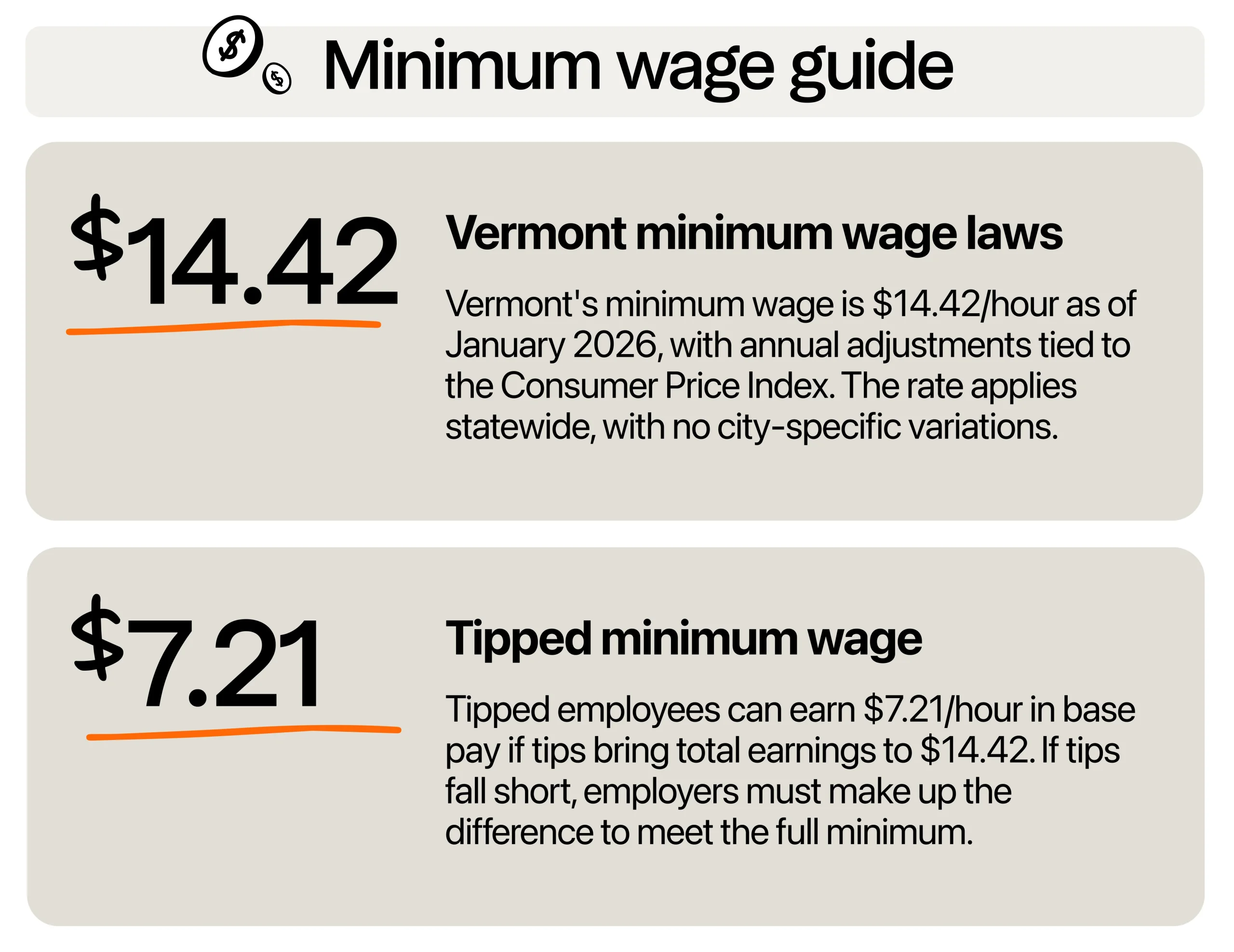

As of January 2026, the minimum wage in Vermont is $14.42 per hour. This applies to most non-exempt, non-tipped workers across the state. This rate is tied to the Consumer Price Index (CPI) and gets updated each year to reflect the cost of living. The previous rate was $14.01, which was in effect throughout 2025 before this increase.

Compared to the federal rate of $7.25, the Vermont wage rate is significantly higher. That means if your business is based in the state, the state minimum applies no matter what. You cannot legally pay below $14.42, even if federal rules allow for a lower rate.

You don’t have to worry about different wage rates in different cities either. Vermont uses a single statewide minimum wage, so whether you’re doing business in Brattleboro, Barre, or Bennington, the current rate is $14.42 per hour.

What about tipped workers?

Vermont allows a tip credit, which means you can pay tipped employees a base wage of $7.21 per hour, provided their total earnings (base wage plus tips) reach at least $14.42 per hour. If tips fall short, you must cover the difference. This applies to employees who regularly receive more than $120 per month in tips, such as servers and bartenders.

Can you pay younger workers less?

Vermont doesn’t offer a lower wage for younger or less experienced workers. Whether you’re hiring a student for the summer or bringing on someone new to the workforce, you’ll need to pay at least the full minimum wage or the applicable tipped rate. It’s a straightforward rule that helps maintain fairness across your team and simplifies your payroll planning.

What are the overtime pay rules?

Vermont follows federal overtime rules under the Fair Labor Standards Act (FLSA). That means non-exempt employees must be paid time and a half when they work more than 40 hours in a single workweek. So, if a cook earns the minimum wage of $14.42 per hour, their overtime rate would be $21.63 for each hour over 40 hours in a week.

If you’re not sure whether someone is exempt or non-exempt, it usually comes down to their job duties and salary. Most hourly food service workers are non-exempt and entitled to overtime. Getting this wrong can lead to costly back pay claims.

How does Vermont’s minimum wage compare to neighboring states?

If you’re running a business in Vermont, especially near the state border, you’re not just competing with local shops. You’re also up against businesses in nearby states. That makes it worth looking at how your wage rates compare.

Vermont’s minimum wage is $14.42 for 2026. That’s a big step up from New Hampshire, where the minimum is still at $7.25. Massachusetts is at $15, and in parts of New York like New York City and Long Island, businesses are required to pay as much as $17.00. Other areas in New York are at $16.00.

So, where does that leave you? Right in the middle of the pack with room to maneuver. Your payroll costs are lower than those in major New York cities, but you’re still offering better base wages than employers just over the border in New Hampshire. That balance gives you a chance to attract good workers without overextending your labor budget.

Plus, Vermont keeps things simple. You’re working with one statewide rate, not juggling a patchwork of city-specific ordinances like you would in parts of New York. That means fewer headaches for you and a more straightforward payroll system for your business.

How can your restaurant afford higher wages?

It can if you run smarter, not necessarily leaner. There are ways that don’t require cutting hours or overworking your staff. It just takes a closer look at how you operate and where your money goes.

Start with total value, not just the hourly rate

Wages are only one part of what employees care about. If you can’t offer $16 per hour, can you offer predictable hours? Staff meals? Tips that actually push total pay higher than the base? Paid time off after 6 months? Those extras can help close the gap, and they signal to employees that you’re invested in them, not just their output.

Use menu engineering and pricing strategy to your advantage

Before you start trimming labor hours, take a look at your pricing. Are your low-margin items pulling their weight? If you run a restaurant, this is a good time to apply menu engineering. This strategy helps you categorize each menu item based on profitability and popularity, then position your best performers where customers are most likely to choose them.

For example, items that are both high in sales and high in profit margin should be front and center. At the same time, you can de-emphasize or reprice dishes that cost more to make but do not bring in much return.

Highlight offerings that are both in demand and profitable. If some services sell well but bring in very little, consider bundling or adjusting the price. Even a small increase of fifty cents to one dollar can add up when applied consistently across high-volume items.

Be intentional with scheduling

If you are still scheduling the same way you did a year ago, it may be time for a reset. Are you consistently overstaffed during slow hours? Are people clocked in when there is nothing to do? These are the kinds of gaps that quietly eat into your profits.

One of the best ways to solve this is by using a reliable scheduling software. You can compare sales data against labor hours, forecast peak times, and assign shifts more efficiently. Good software lets you spot patterns that are easy to miss on paper and makes sure you are staffing based on real demand, not habit.

Cross-train with purpose

When everyone knows how to do a little more, you need fewer hands to keep the ship steady. Cross-training is not about piling work on your staff. It is about flexibility. When one person can handle both front-end and back-end tasks during a lull, you stay covered without calling in extra help. This gives you breathing room when someone calls out or business slows down.

Get clear on where the money goes

Sometimes, the issue is not the wage increase. It is that you do not have a clear picture of your labor spend. Sit down and break it down. Where are your payroll dollars going? Are certain shifts or roles less efficient than others? A basic weekly labor cost report can highlight areas where a small change could save you hundreds over the course of a month.

How to stay labor compliant in VT

Balancing your team management, inventory, and customer satisfaction can make compliance feel overwhelming. However, adhering to the wage law doesn’t have to be complicated, especially if you start with a few smart steps.

Keep a close eye on tips

Since Vermont is a tip credit state, you are allowed to pay tipped workers a base wage of $7.21 per hour. Their tips must bring them up to at least $14.42 per hour. It is your responsibility to prove that this happens every pay period. If tips fall short, you are required to make up the difference.

To stay on track, do not rely on handwritten notes or memory. Use tip management tools that match hours worked with tip earnings. This helps you meet legal requirements and builds trust with your team because they know you are keeping things fair and transparent.

Plan for the yearly increase

Vermont ties its minimum wage to inflation, so you can expect slight increases each January. The exact rate is usually announced in the fall. To stay ahead, set a calendar reminder to check for the new rate every October. This allows you to adjust your pricing, scheduling, or staffing plans early rather than scrambling at the last minute.

Display the right labor law posters

Vermont law requires you to post updated wage and labor law notices where your team can easily see them. This is not just a formality. It is part of your legal obligation. You can download the latest posters from the Vermont Department of Labor’s website for free. Posting outdated information or missing notices could lead to penalties, so check once a year to make sure you are covered.

Keep payroll records organized

You are required to keep accurate payroll records, including hours worked, wages paid, and tips received. These records should be stored for at least three years. Digital payroll software can help you maintain clean, searchable records that save time and reduce errors.

Respond quickly to employee concerns

Sometimes, employees may raise questions about their pay. Whether it is a concern about missed tips or incorrect hours, take it seriously and investigate quickly. Addressing problems early can help you avoid formal complaints or audits later on.

Make compliance part of your routine

Think of compliance as just another system in your business, like your ordering or cleaning schedule. When you treat it as a regular habit rather than a reaction to problems, it becomes easier to manage. The goal is not just to avoid fines. It is to build a strong workplace where your team knows they are treated fairly and legally.

Your business’s success starts with good pay

Vermont’s higher minimum wage reflects a higher cost of living, a higher standard of service, and higher employee expectations. Customers in Vermont value businesses that treat staff well. When your team feels supported, they perform better, stay longer, and represent your brand well. All of that leads to better customer experiences, more repeat business, and stronger word of mouth.

So, take the state wage not as a challenge, but as the starting line. Price your menu smartly, train your crew well, and use systems that help you track compliance with less hassle. If you do that, you are not just keeping up. You are building something worth sticking around for.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.