Running a business in Washington means you’re part of a state that leads the way in terms of fair wages. With one of the highest minimum wages in the country, you have a real opportunity to support your workers and build a motivated, loyal team. Let’s go through everything you need to know so you can plan wisely and keep your business thriving.

What is the minimum wage in Washington?

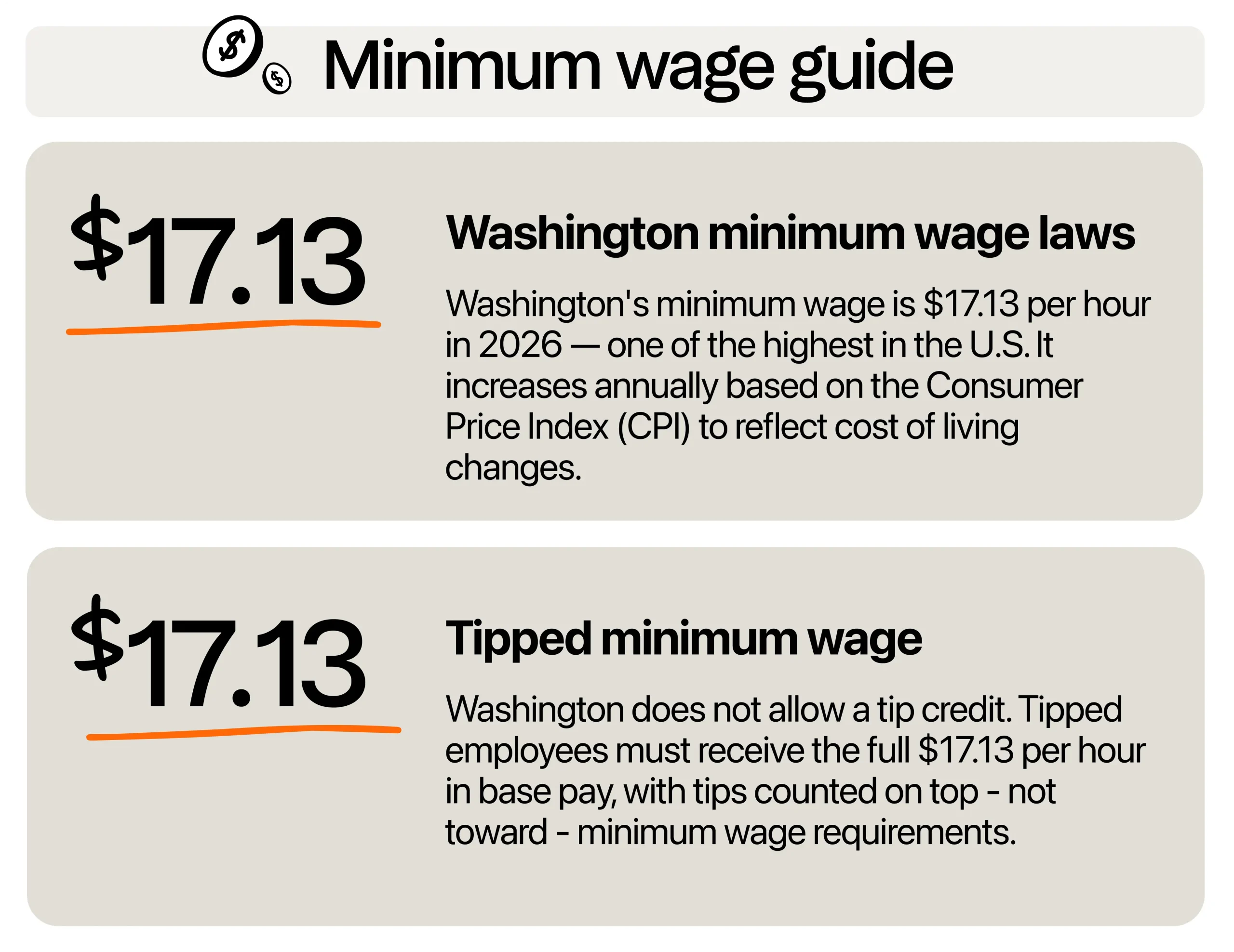

As of 2026, the minimum wage in Washington is $16.66 per hour. Every year, Washington uses the Consumer Price Index (CPI) to calculate how much the minimum wage should rise to keep up with the cost of living. This helps workers keep up with rising costs, and it gives you a predictable rhythm for planning ahead.

So, while we have a clear number for now, it’s smart to expect slight increases year after year. If you’re working on your budget or figuring out pricing for the year, set aside room for these changes so you’re not caught off guard when the new rates are announced.

How does this compare to the federal minimum wage?

You’ve probably heard that the U.S. federal rate is $7.25 per hour and that number hasn’t changed since 2009. But here’s the thing: when state and federal minimum wages don’t match up, you must follow the higher rate. In Washington, that means paying at least $17.13 per hour, even if the federal number is lower. It’s a simple rule but an important one, especially if you’re new to running payroll or if you’re expanding your team.

Who is covered by the Washington minimum wage?

While the Washington minimum wage sets the baseline for hourly workers, not all employees are covered. Knowing the difference between exempt and non-exempt employees helps to understand who’s covered.

Non-exempt employees

Most workers in Washington are considered non-exempt. This means they’re protected by both state and federal wage laws. Non-exempt employees must be paid at least the minimum wage for every hour they work. They are also entitled to overtime pay, which means time and a half if they work more than 40 hours in a week. This includes hourly workers, many part-time employees, and some salaried workers who do not meet specific exemption requirements.

Tipped employees

In Washington, you must pay tipped employees, whether they are servers, bartenders, baristas, or hairdressers, the full state minimum wage of $17.13 per hour before tips are factored in.

Unlike some states, Washington does not allow for a tip credit or tip allowance. This means you cannot count tips as part of the minimum wage. Tips belong entirely to your employees and must not be used to make up any portion of their base wage. This protects workers and gives them a dependable income regardless of how busy a shift might be or how generous customers are.

Agricultural workers

In Washington, agricultural workers must be paid the same minimum wage as other workers. There is no lower rate for farmworkers, whether they work in fields, orchards, or packing houses.

In addition, agricultural workers are entitled to overtime pay under Washington law. It’s important to keep accurate records of hours worked to avoid wage claims or penalties. This reflects the state’s focus on fair treatment for all types of labor.

Exempt employee

Exempt employees are not entitled to minimum wage or overtime protections. In Washington, to classify someone as exempt, their job must meet certain criteria. Typically, they need to perform specific types of duties, such as executive, administrative, or professional work, and earn at least a minimum salary threshold that’s set by the state.

They must also meet three tests: the salary basis test (they must be paid a fixed salary), the salary level test (they must earn at least the required minimum salary), and the duties test (their job duties must qualify under the law).

For 2025, the salary level test requires a minimum annual salary of $80,168.40 for employees of small employers (50 or fewer workers) and large employers (more than 50 workers).

Examples of exempt employees include managers, department heads, accountants, software engineers, and teachers.

Here’s a simple table comparing the two:

| Classification | Entitled to Minimum Wage? | Entitled to Overtime Pay? | Salary Requirements (2025) | Key Roles |

| Non-Exempt | Yes | Yes | None | Retail workers, clerical staff |

| Exempt (Small Employers: 1-50 employees) | No | No | $80,168.40/year ($1,541.70/week) | Managers, professionals, executives |

| Exempt (Large Employers: 51+ employees) | No | No | $80,168.40/year ($1,541.70/week) | Managers, professionals, executives |

Special rates for minors

If you hire workers who are 14 or 15 years old, you’re allowed to pay them 85% of the standard minimum wage in Washington. That’s roughly $14.56 per hour. This can be a great way to offer entry-level opportunities for young workers while keeping your labor costs manageable.

That said, Washington’s child labor laws come into play here, too. These minors have restrictions on the number of hours they can work, especially during the school year. For example, they can work no more than 3 hours on a school day or 16 hours during a school week. They also cannot work during school hours and have limits on the types of work they can perform.

Plus, you’ll need to obtain a minor work permit if you want to hire underaged workers in the state.

Local ordinances might set higher rates

In Washington, it’s not just the state wage law you need to consider. Some cities set higher local minimum wages, and these rates can change from year to year, just like the state’s rate does.

For example, Seattle’s minimum wage is higher than the state rate and can vary based on employer size and whether you provide health benefits. Large employers or those who don’t pay toward employee medical coverage may need to pay significantly more, which can impact your overall labor budget.

SeaTac is another city with its own minimum wage rules, especially for hospitality and transportation workers.

Spokane and Tacoma have also discussed local wage measures over the years, so staying informed about proposals or changes can save you from compliance headaches down the line.

It’s always a good idea to check the latest local requirements for your specific location.

Overtime rules

Washington follows federal overtime guidelines, but with its higher minimum wage, overtime pay can increase quickly. Overtime kicks in once an employee works more than 40 hours in a workweek, and that can include time spent on training, meetings, or mandatory events. You’ll need to pay 1.5x their regular rate for each hour beyond that. So, if your employee makes $17.13 per hour, their overtime rate would be $25.70 per hour.

Tracking hours accurately is essential, and many employers find that digital timekeeping systems or scheduling software make this process easier. Staying on top of scheduling and keeping a close eye on hours worked can help you manage costs, avoid surprises in payroll, and keep employees satisfied with fair compensation.

Could Washington raise wages again?

The short answer is yes; Washington’s minimum wage is almost certain to rise again. That’s because the state doesn’t set it and forget it. Washington ties its minimum wage to inflation, which means every year, the state reviews the cost of living and adjusts the wage to help workers keep up. These adjustments are based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). So, if the cost of everyday essentials like food, housing, and transportation goes up, you can count on the minimum wage following suit.

Now, we don’t know exactly what the new minimum wage will be yet. That figure will come out after state officials review the inflation data for the year. What you can do is stay prepared. The Washington State Department of Labor & Industries typically announces the new minimum wage each fall, giving you a few months to review your payroll, make budget adjustments, and plan any necessary pricing updates. This timing helps you avoid last-minute scrambles or surprises when January rolls around.

It’s a good idea to sign up for wage alerts directly from the Department of Labor and Industries. That way, you’ll get the news straight from the source as soon as the wage increases or the new rate is announced.

Is it wise to set up a business in Washington?

Now, with Washington holding the highest state minimum wage in the U.S. and potentially going higher in the next few years, is it still smart to open or grow your business here? The strong answer is yes.

As of 2024, there are 672,472 small businesses in the state, making up 99.5 percent of all Washington businesses. They employ about 1.4 million people, or 48.4% of the state’s workforce, according to the U.S. Small Business Administration’s Office of Advocacy. That shows strong support for small businesses, and many owners still see real opportunity despite the higher wages. The state’s strong economy, educated workforce, and customer base that values fair employment create an environment where well-run businesses can thrive.

Yes, the minimum wage is higher than in many other states, but that comes with some upsides. Paying a fair wage can help you attract skilled, motivated employees and reduce turnover. When your team feels valued, they’re more likely to stick around and provide excellent service, which can boost your reputation and bottom line.

You’ll also find that customers in Washington generally expect and support businesses that treat workers well. This can help you build goodwill and loyal customer relationships.

The key is to think strategically. Review your pricing, services, and operations to make sure your business can comfortably handle higher wage costs. Many business owners find success by focusing on delivering exceptional value, creating unique customer experiences, and running lean, efficient operations. If you stay proactive and flexible, Washington can still be a rewarding place to grow your business.

How can you stay compliant?

If you’re opening a restaurant or planning a business in Washington, staying compliant with wage laws and employment rules is necessary. Not only does it help you avoid fines and legal trouble, but it also builds trust with your employees and creates a positive work environment.

Review payroll practices

Take a close look at how you’re handling payroll. Double-check that your pay rates match up with current state and local minimum wage requirements, as well as salary thresholds.

Don’t forget to review timekeeping systems, overtime calculations, and how you classify your employees. This includes making sure that exempt employees meet all three tests (salary basis, salary level, and duties) or switching them to non-exempt status if they don’t. When you communicate these changes clearly, your team will appreciate the transparency.

It might also be worth exploring payroll software or working with a payroll service to automate some of this work. Regular internal audits of your payroll practices can also help you catch and correct mistakes early.

Understand local regulations

Washington has several cities with minimum wage rates that are higher than the state’s base rate. If you operate in places like Seattle, SeaTac, or Tacoma, make sure your pay rates match their specific rules.

Also look at related requirements, like secure scheduling laws or paid sick leave rules that may apply in those cities. Staying up to date with these local regulations not only keeps you compliant, it helps show your team and your customers that you’re committed to fair and lawful practices.

Consider subscribing to city or county business updates to be updated with the latest information, so you never miss important changes. And don’t forget to check in on these rules regularly since local laws can change faster than state laws.

Plan for budget adjustments

Higher wages will affect your budget, but they don’t have to throw you off track. Use this as a chance to review your pricing, staffing, and overall financial plan. You might decide it’s time to adjust your prices, look for new ways to bring in revenue, or renegotiate vendor contracts.

Some business owners find that investing in cross-training employees helps them stay flexible with staffing while keeping costs steady. Others focus on improving efficiency through technology or process improvements.

Stay flexible and proactive so you can protect your bottom line while continuing to offer great service and support to your team.

Build a business where people want to work

Running a business in Washington means more than just meeting wage requirements. It’s about building a place where people want to show up, contribute, and grow with you. When you commit to fair pay and a supportive environment, you’re creating a business that attracts talent, earns loyalty, and delivers great service.

That’s how businesses succeed in the Evergreen State. When your team wins, your customers win, and so do you.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.