Building a great restaurant starts with building a great team. And for Wisconsin restaurant owners, that involves understanding how minimum wage laws impact your business. More than labor costs and restaurant payroll, knowing how much to pay your employees affects your ability to hire, keep, and motivate them.

Let’s take a look at the Wisconsin minimum wage for 2025, how it compares to nearby states, and whether it’s worth starting a restaurant in this Midwest state.

What is Wisconsin’s minimum wage in 2026?

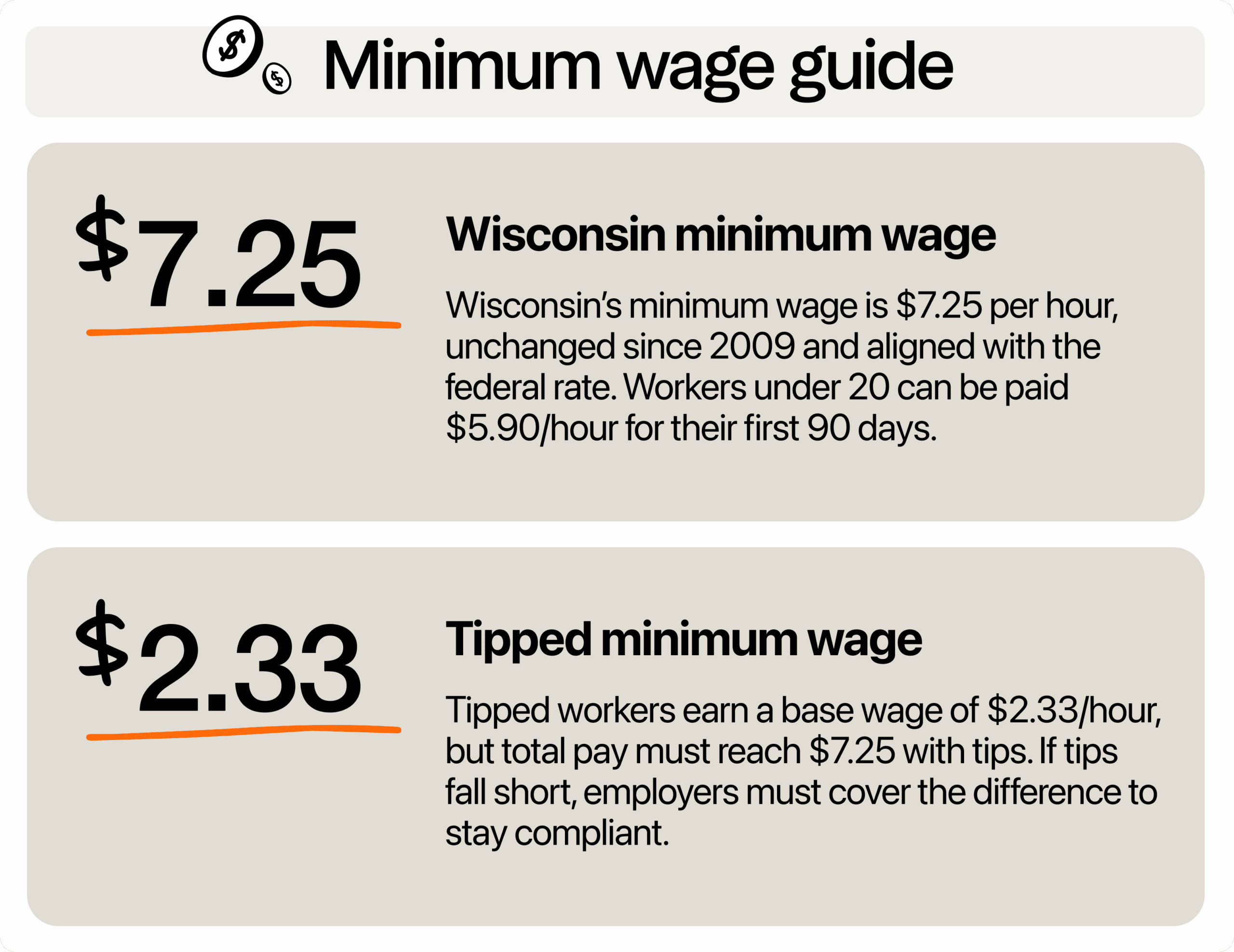

As of 2026, Wisconsin’s minimum wage is $7.25 per hour. This number hasn’t changed since 2009, and Wisconsin is one of the few states that still follows the federal minimum wage instead of setting a higher state minimum.

For restaurant owners, it’s also important to understand the rules around tipped employees. In Wisconsin, the tipped wage is $2.33 per hour. Workers like servers, bartenders, and bussers must receive enough in tips to bring their total wage to at least $7.25 an hour.

If their tips don’t cover the gap, employers are legally required to make up the difference to meet the basic minimum wage under federal and state law.

For example, if a server at your restaurant earns $2.33 per hour plus $3.00 in tips, their total hourly pay would be $5.33. Since this is below $7.25, you’d need to add $1.92 per hour to meet the required minimum wage.

Young workers under the age of 20 also have a different wage rate. For their first 90 days of employment, you can pay them the opportunity wage of $5.90 per hour. After 90 days, or if they turn 20 during that time, you must raise their wages to the full $7.25.

Are there any current efforts to change the minimum salary for Wisconsin?

Governor Tony Evers has made several attempts to raise Wisconsin’s wage floor. His 2023 state budget proposal included a plan to increase the minimum wage gradually, hoping to reach $10.25 per hour by 2026.

In his 2025-2027 budget proposal, there was no mention of a specific wage. Creating a task force to study and recommend wage adjustments was proposed, though. But by the end of 2025, minimum wages had not increased. This poses a problem since a single adult with no kids should ideally earn $20.96 per hour and work full-time to be able to live comfortably.

How does Wisconsin compare to neighboring states?

If you’re hiring in Wisconsin, you’re competing not just with local businesses but also with those in neighboring areas. Knowing the different minimum wage rates per state, especially those around Wisconsin, can help you plan your pay strategy and keep your best employees.

| State | Minimum wage (2025) | Tipped wage |

| Wisconsin | $7.25 | $2.33 |

| Illinois | $15.00 | $9.00 |

| Minnesota | $11.41 | (No tip credit) |

| Michigan | $13.73 | $5.49 |

| Iowa | $7.25 | $4.35 |

States like Illinois, Minnesota, and Michigan have significantly higher minimum wages, which could potentially draw workers away from Wisconsin businesses.

Tipped employees also face lower tipped wage rates compared to their peers in neighboring states. For example, servers in Illinois earn a tipped wage of $9.00, way higher than Wisconsin’s $2.33.

With 65% of restaurant managers and owners saying the current labor market is “very tight,” competition for good employees is fierce.

If nearby states offer higher pay, it becomes harder for Wisconsin restaurants to compete. This is especially true in border cities like Kenosha, La Crosse, and Hudson, where a quick drive across state lines can mean a significant wage boost for a worker.

It’s already happening with servers, bartenders, and other tipped workers. Many are crossing state lines for better-paying jobs in Minnesota and Illinois.

Speaking to Wisconsin Public Radio, Laura Dresser of the High Road Strategy Center notes that for tipped jobs especially, the difference is “enough to make workers put their labor elsewhere.”

Beyond tipped workers, even in non-tipped, entry-level service roles, Wisconsin is losing ground. While many employers have voluntarily raised starting pay to $13, $14, or even $16 per hour to compete, neighboring states are setting the floor much higher, giving businesses across the border an edge in attracting talent.

That’s why, even without a state-mandated increase, Wisconsin restaurant owners must stay competitive on their own. Offering just the legal minimum might save money today, but it can cost you in turnover, staff shortages, and poor service.

Strategies to stay competitive

One of the simplest but most powerful strategies is to offer wages above the state minimum. Even raising your starting pay by $1 to $2 an hour can make a huge difference. It shows potential employees that you value their work and are willing to invest in your team.

For instance, Milwaukee’s decision to raise its local minimum wage to $12.00 per hour for businesses with more than 50 employees (and $11.00 for those with fewer) has helped the city remain competitive in attracting and retaining restaurant workers. This local ordinance has made restaurant jobs in Milwaukee more appealing compared to other parts of Wisconsin.

As a result, the city now holds a significant share of the state’s restaurant workforce, about 77% of Wisconsin’s 282,600 total restaurant and foodservice jobs. It shows how higher local wages can support job growth and stability in the industry.

Additionally, having a clear, fair tip pooling system can make a big difference in team morale. Restaurant tip pooling laws in Wisconsin allow tip pooling among servers, bartenders, and bussers, but it must be voluntary and transparent.

By creating a system where tips are shared fairly among staff, you encourage teamwork. No one feels left out, and it helps balance slow nights when tips might not be evenly spread. A solid tip pooling strategy can support your team financially, especially when minimum wages are low.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

How can employers stay compliant with Wisconsin wage laws?

Staying compliant with Wisconsin wage laws protects your restaurant from fines and penalties. It’s easier to correct small errors early than deal with a Department of Labor audit or employee complaint later.

Make sure your records are up to date

First, it’s important to maintain accurate records. Employers must track all hours worked, wages paid, and tips earned for every employee. Take note that Wisconsin law requires keeping these records for at least three years. These records should be clear and detailed, including start and end times, overtime hours, and any break periods.

Posting labor law notices is also required. Every restaurant must display up-to-date posters in a visible area, like break rooms or near time clocks. This includes Wisconsin’s minimum wage and federal Fair Labor Standards Act (FLSA) notices.

Pay employees on time

Another important step is to pay your employees promptly. By law, you’re required to pay for services at least once a month, but many restaurants choose weekly or biweekly schedules. Establish a reliable payroll schedule and stick to it.

Using dedicated restaurant payroll software can automate this process, making it easier to avoid costly mistakes. Late payments can lead to complaints or investigations from the Department of Workforce Development.

Classify workers as employees

You also want to classify workers correctly, tagging them as W-2 workers, not independent contractors, including servers, cooks, hosts, and bartenders. Misclassifying employees as independent contractors to avoid taxes or benefits is illegal and can lead to heavy fines from both the IRS and the Department of Labor.

A good rule of thumb: if you control how, when, and where a person works, they are likely an employee, not a contractor. Restaurants should be especially cautious when hiring seasonal or temporary staff.

Create pay stubs

Finally, provide detailed pay stubs. In Wisconsin, employers must offer stubs showing the number of hours worked, the wage rate, total tips received (if any), gross wages, and deductions.

For non-exempt employees, overtime pay kicks in after 40 hours in a workweek, and it must be at least 1.5 times the regular hourly rate. Wisconsin also has specific rules for youth workers under 18, including limits on working hours during school weeks and requirements for work permits.

If you employ minors, double-check that you are complying with child labor laws; violations can lead to serious penalties.

Is it still worth starting a business in Wisconsin?

Wisconsin is one of the most business-friendly places in the Midwest due to favorable rental prices, utilities, and taxes. In fact, the low minimum wage and operational costs give potential restaurant owners enough room to strategically plan their startup costs.

For restaurant owners, lower rent and utility costs mean you can spend more of your budget on staffing, inventory, and marketing. These are things that really help grow your business.

Plus, Wisconsin’s flat 7.9% corporate income tax rate is one of the lowest in the region, making it easier to keep more of what you earn.

Beyond the financial advantages, Wisconsin offers:

- A skilled workforce: Many restaurant employees are trained through programs at Madison College and Milwaukee Area Technical College, preparing them for front- and back-of-house roles.

- A growing food scene: Beyond Milwaukee and Madison, towns like Green Bay, Eau Claire, and La Crosse are seeing more farm-to-table restaurants, food trucks, and craft breweries, giving new restaurants more ways to reach loyal, local customers.

- Simplified labor laws: Wisconsin’s minimum wage and tipped wage laws align with federal standards, making compliance simpler for restaurant owners compared to states with more complex rules.

Of course, there are challenges. The state did get an F rating in Thumbtack’s recent annual Small Business Friendliness Survey. Some business owners reported concerns about regulations, licensing complexity, and workforce shortages.

Another challenge is seasonal fluctuations in foot traffic. Restaurants must be prepared for slower business during winter when people avoid going out.

Nonetheless, even with some hurdles, starting a restaurant in Wisconsin can still be a smart move. The state’s lower startup costs, strong food culture, and skilled workforce can help you achieve success.

Midwest buffet franchise Pizza Ranch is a great example of how a restaurant can grow and thrive in Wisconsin’s business environment. It started in Iowa and has since expanded to three locations: Waupun, Fond Du Lac, and Oshkosh.

Focus on building strong community ties and offering consistent quality. Restaurants that support local farms, participate in community events, or simply get to know their regulars often see long-term success.

Invest in your restaurant’s most valuable assets

While Wisconsin’s costs give you room to budget, competition for skilled employees remains tough, especially with neighboring states that mandate higher wages. Offering better pay, creating a positive work environment, and investing in your staff can help your restaurant stand out.

Manage labor costs efficiently with restaurant scheduling software. With 7shifts, you can create schedules easily, track time accurately, and pool tips automatically, helping you stay compliant with labor laws.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.