The Alaska minimum wage is set to rise by yearly increments ending in July 2027. While this is good news for employees, it can be scary for restaurant owners. Restaurants must carefully plan for these changes and optimize their operations to stay competitive.

What is the minimum wage in Alaska in 2025?

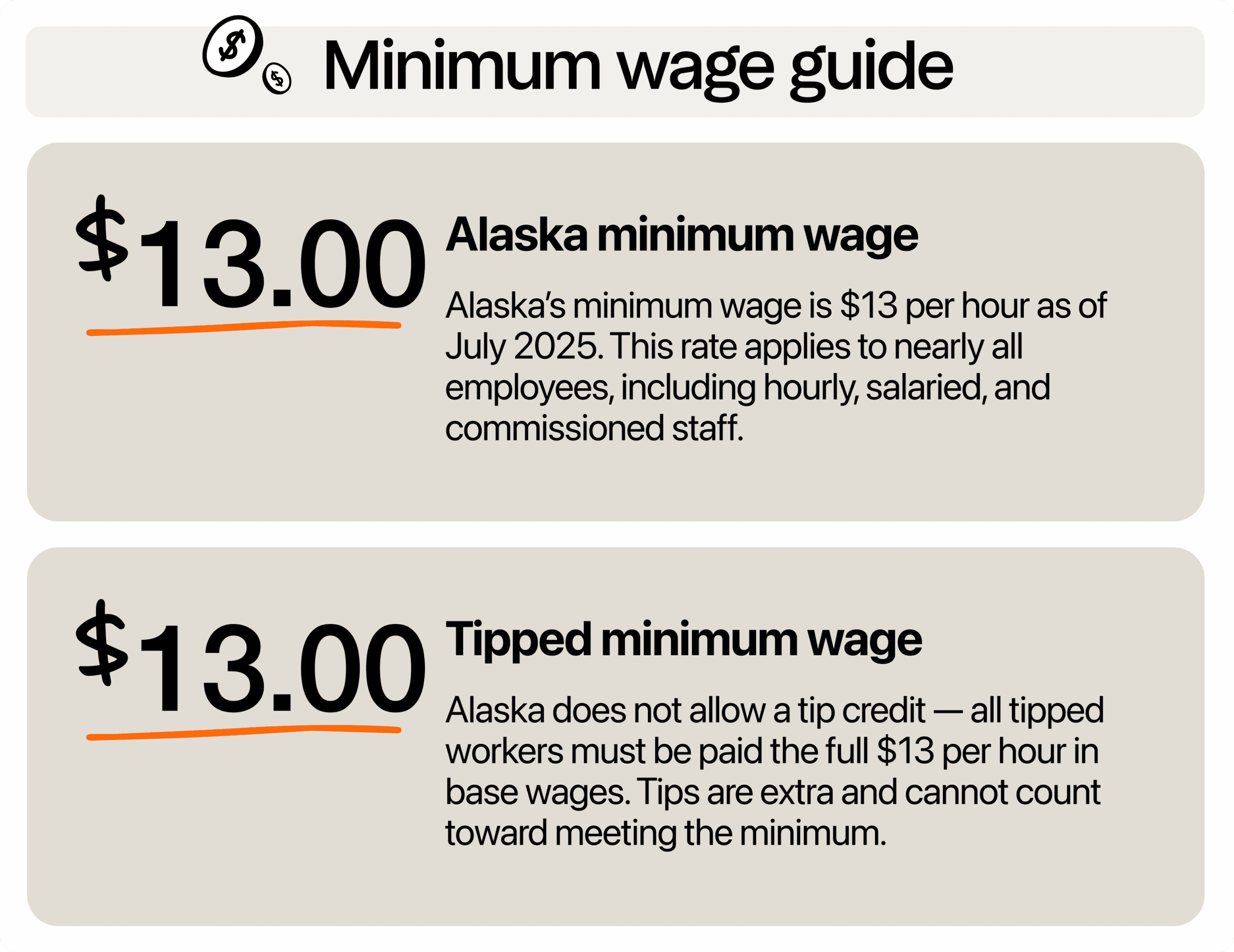

As of February 2026, the Alaska minimum wage is $13 per hour. This applies to almost all restaurant employees, whether they’re paid hourly, on salary, or by commission. The minimum wage is set to increase to $14.00 per hour starting July 1, 2026.

Unlike in many states, Alaska law doesn’t allow a tip credit, which means tipped and non-tipped workers must both be paid the full minimum wage. For restaurants, that means every FOH role, servers, bussers, runners, must earn at least $13 per hour before tips.

How does Alaska’s minimum wage compare to the federal minimum?

Alaska pays nearly twice as much the federal minimum wage of $7.25 per hour. That means restaurant owners are already working on a higher payroll baseline than other states. It’s good news for the local workforce but affects restaurant profit margins. As such, restaurant owners must carefully budget labor costs to maintain profits while compensating workers fairly.

Are there plans for a wage increase?

Under Alaska law, the state is set to raise the minimum wage in stages over the next few years. After sitting at $11.91 per hour in early 2025, the next increase kicked in at the start of July, raising the wage rate to $13 per hour.

It will go up again to $14 per hour in July 2026, and reach $15 per hour by July 2027. These increases come from Ballot Measure 1, which passed in November 2024 with support from a majority of voters.

Starting in 2028, the minimum wage won’t just sit still. It will go up automatically each year based on inflation, using the Anchorage Consumer Price Index (CPI-U). Even more important, the law includes a guarantee that Alaska’s wage will always stay at least $2 above the federal minimum wage, no matter how national laws change. That means if the federal wage ever rises to $12, Alaska’s would jump to at least $14.

For restaurant operators, these increases have ripple effects. One big example is how they impact the salary threshold for exempt workers or staff who don’t qualify for overtime.

In Alaska, salaried exempt employees must be paid at least twice the minimum wage based on a 40-hour workweek. That means by 2027, the minimum salary for exempt status will be $62,400 per year (2 × $15 × 40 hours × 52 weeks).

For instance, the average restaurant general manager salary is around $61,467 per year or $29.55 per hour. That puts many GMs just below the upcoming exempt threshold. If you’re paying salaried team members near that range, you may need to raise their pay or reclassify them as non-exempt, which would require tracking hours and paying overtime.

What is the paid sick leave mandate and what does it mean for restaurants?

Along with the minimum wage increase, Alaska’s Ballot Measure 1 included a second major provision: mandatory paid sick leave for employees. If your restaurant has fewer than 15 employees, you must allow each worker to earn and use up to 40 hours of paid sick leave per year. For those with 15 or more team members, the cap is 56 hours per year.

Sick leave is earned at a rate of 1 hour for every 30 hours worked, starting from day one of employment. Moreover, there’s no waiting period. Employees can use paid sick time as soon as they’ve accrued it.

Unused hours must also roll over from year to year, although you can cap how much they can use annually based on your team size. If your staff doesn’t use all their time, you’re not required to cash it out. But if you choose to offer that, your team must agree to it in writing.

The state hasn’t released an official notice template yet, so you’ll need to create your own. This written notice must go to all current employees by July 31, 2025, and to all new hires moving forward. It should explain how much sick leave they’re entitled to, how they can use it, and that you won’t punish them for doing so.

Many restaurant owners already use general PTO policies (like vacation or personal time). So, as long as your current time-off policy meets the sick leave law’s standard with the same hours, same allowed uses, and same protections, you don’t need to add a new sick leave policy.

Even if you’re still waiting for final regulations from the Alaska Department of Labor and Workforce Development, it’s best to act now. Updating your policy, training managers, and making sure your systems track hours correctly will keep you compliant and protect your team.

How do Alaska wages compare to nearby areas?

Alaska’s closest neighbors, Yukon Territory and British Columbia, more or less offer the same rates. In the Yukon Territory, the minimum wage rose to $17.94 CAD per hour in April 2025, which is about $13.10 USD per hour. On the other hand, British Columbia raised its minimum to $17.85 CAD per hour in June 2025, which is roughly $13.03 USD per hour.

Both are nearly identical to Alaska’s hourly rate. This means local restaurant owners don’t have to worry about workers crossing borders for higher compensation, although universal healthcare offered by the Canadian government is very tempting. You should offer more than just the state minimum rates to stay competitive, such as reliable scheduling and benefits packages that show how you value your team’s well-being.

How to manage labor costs with the Alaska state minimum

Paying workers fairly shows you value your team, but it does take a toll on restaurant profitability. Fortunately, you don’t have to pick one over the other. There are ways you can balance labor costs and maintain a positive workplace culture.

Review your current pay structure

Start by making a full list of all your employee data, like their job titles, whether they’re hourly or salaried, and what they currently earn. This step helps you spot any gaps in pay that may fall below Alaska’s current minimum.

If you have salaried employees, double-check whether they qualify as exempt under Alaska’s wage laws. By 2027, salaried exempt workers must be paid at least $62,400 per year, which equals 2x the $15 per hour rate over a 40-hour workweek.

So, if you have a kitchen manager or general manager earning under that threshold, you may need to either raise their pay or reclassify them as non-exempt, and start tracking their overtime hours.

Leverage tools for time tracking and payroll

When labor costs rise, tracking hours and managing payroll accurately becomes even more important. Restaurant time clock software can help you monitor attendance, so you’re not paying for time they didn’t work. You can also set up alerts for early punch-ins or missed breaks, which could lead to unplanned overtime or meal break violations.

It’s also important to keep records to protect your business. If an employee files a complaint or if your restaurant gets audited, having digital time logs and wage reports can save you from backpay claims or fines. Alaska wage law requires you to follow strict record keeping rules, especially as regulations expand with new sick leave and exempt status requirements.

You should automate restaurant payroll as well to reduce errors and stay on top of rising employer costs. Higher wages mean you’ll be spending more on taxes, workers’ comp, and benefits. Payroll platforms can break reports down by department or role, helping you see where each labor dollar goes and where you might save by adjusting shifts or simplifying roles.

Cross-train staff

Cross-training makes your team more efficient. When FOH staff learn BOH basics, and vice versa, you build a more flexible workforce that can step in when someone calls out or an unexpected demand hits.

Train your hosts on to‑go packaging during slow dining shifts. When pickup volume rises, that host can jump in, freeing up your delivery runner or bartender to focus on service. You avoid paying extra for a part-time hand just to handle spikes.

Adjust your menu and workflow

Reworking your menu can help you manage labor costs before passing it onto customers and risk losing their trust. Find high-margin items that are also easy to prepare and highlight them in your menu. Think dishes that share ingredients or cooking steps, like grilled chicken tacos or sheet-pan veggies. These let you serve more patrons without adding kitchen staff or time pressure.

Another game-changing move is batch prep or off-peak production. Tasks like chopping veggies, marinating proteins, or assembling sauces can be done during slower hours or even off-site prep days. That reduces rush-time stress and lets small teams focus on plating and serving during peak hours.

Brace yourself for wage increases

While the increase in Alaska’s minimum wage demonstrates a value for worker protections, it also raises the stakes for restaurant owners trying to stay profitable. But with the right tools and strategy, you don’t have to lose sleep over these changes. Leverage technology and find ways to optimize your workflow for a win-win scenario.

Use restaurant scheduling software to make sure every shift stays within budget and compliant with wage laws. Tools like 7shifts automate break tracking and manage team availability to avoid last-minute reshuffles that eat into your bottom line.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.