Software Solution

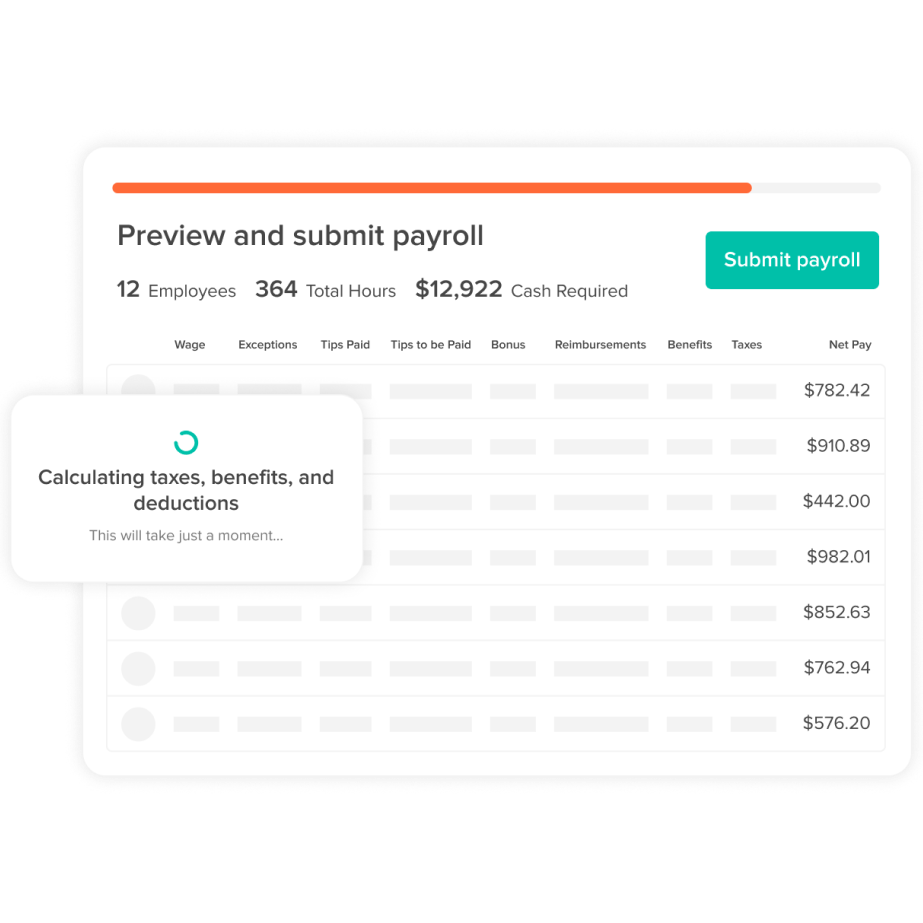

Restaurant Payroll Software

Learn more

Excel templates made for restaurants. Download all the tools you need to help you save time, money, and streamline your operations.

Restaurant Schedule Template

Get the best restaurant excel-file schedule template to help create your staff work schedules.

Timecard Calculator Template

Add up staff timecards in seconds - saving you time and money.

Tip Pooling Calculator Template

Simply fill in the employee hours and the tip amounts and the spreadsheet calculates the payout for you.

Restaurant Employee Training Manual Template

Set your staff off on the right foot with the editable manual.