Starting a business in Delaware, such as a restaurant or a bar, places you in a state known for favorable corporate laws, a strategic location on the East Coast, and a steadily growing local economy.

However, as a business owner, it’s essential to stay informed about labor costs, especially when it comes to Delaware’s minimum wage, so you can plan accordingly and remain compliant.

What’s Delaware’s minimum wage in 2025?

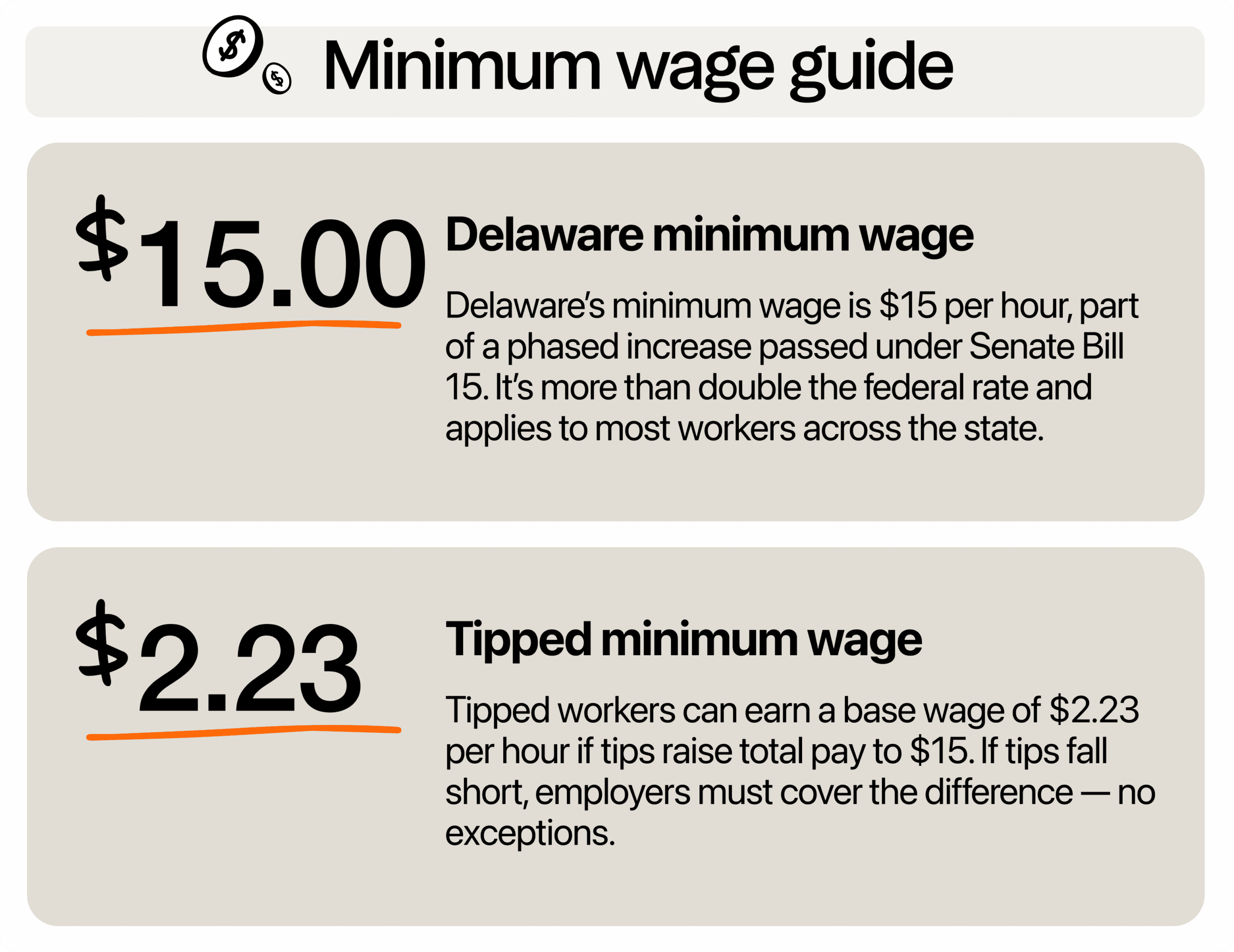

As of January 2025, Delaware’s minimum wage is $15 per hour. This increase is part of a phased plan initiated by Senate Bill 15, signed into law in 2021. Delaware’s proactive stance means wages are regularly updated to keep pace with living costs, making the state an attractive place for employees seeking fair pay.

If you’re wondering how this compares to the federal minimum wage, it’s significantly higher. The federal rate remains at $7.25 per hour, where it’s been stuck since 2009. Delaware is among many states that believed this was insufficient and enacted laws to provide workers with improved baseline pay. And in Delaware, when state law sets a higher rate than the federal one, you must follow the higher one.

Tipped employees and tip credit rule

If you run a business in food service, hospitality, or any other sector that includes tipped roles, the rules are a little different but not more complicated. Delaware uses a tip credit system. This means you can pay a lower direct wage to tipped workers, assuming their tips make up the difference to meet the $15/hour threshold.

Right now, the minimum direct cash wage for tipped employees in Delaware is $2.23 per hour. If their tips don’t bring them up to $15/hour, you are responsible for making up the gap. That’s not optional, and failing to do so can result in back pay obligations and penalties.

Minimum wage for younger employees or trainees

Some states allow reduced wages for student workers, minors, or trainees. Delaware does not. If you’re hiring a 16-year-old part-timer or onboarding a trainee for a full-time role, you must pay the full state minimum wage. That’s $15/hour across the board. So, be sure your onboarding and budgeting processes reflect that.

Local pay ordinances

As of January 2025, Delaware does not allow municipalities to set local minimum wages higher than the state minimum. So, whether you’re operating in New Castle County, Kent County, Sussex County, or within city limits, the state minimum wage $15/hour applies uniformly.

You don’t need to juggle varying pay scales across different jurisdictions within Delaware. You can confidently apply the same wage structure across all locations. Also, the state hasn’t introduced special “living wage” mandates or sector-specific ordinances at the city or county level. This simplifies payroll and compliance with no need to track extra local requirements.

Delaware rules on overtime pay

In Delaware, overtime pay follows the federal rule. If a non-exempt employee works more than 40 hours in a week, you must pay them 1.5 times their regular rate for the extra hours. If you pay someone $15 per hour, overtime must be paid at $22.50. This rule applies across all industries.

For tipped employees, the same overtime rule still applies. But here’s where it gets tricky—their time-and-a-half pay is based on the full minimum wage rate of $15, not the lower tipped wage. So even if you only pay a server $2.23 per hour in cash wages, their overtime pay must still be based on the full $15. That means $22.50 per hour for overtime, minus whatever they earn in tips. You still have to make up the difference if their total pay falls short.

Delaware doesn’t have any extra state-specific overtime rules, which makes it easier to manage.

Exempt vs. non-exempt

Not every employee follows the same pay rules. Some qualify for overtime, others don’t. Delaware follows federal standards to determine who is exempt and non-exempt under the Fair Labor Standards Act (FLSA)

Non-exempt employees must be paid at least minimum wage and receive overtime for hours worked over 40 in a week. This includes most hourly workers, tipped staff, and part-time employees.

Exempt employees, on the other hand, don’t qualify for overtime. To consider someone exempt, you need to check three things:

- Duties test: They need to do executive, administrative, or professional work.

- Salary basis test: They must be paid a set salary, not by the hour.

- Salary level test: Their weekly salary has to be at least $684, or $35,568 a year.

If an employee doesn’t meet all three, they’re non-exempt. But be warned: misclassifying employees can lead to penalties, audits, and back pay claims.

Potential changes in the future

As of now, Delaware law does not include any automatic annual increases tied to inflation or the Consumer Price Index. So, the $15/hour rate is likely to stay in place until the state legislature votes on any further changes. That gives you a bit of stability when it comes to forecasting labor costs.

However, it’s still worth keeping an eye on state legislation. If lawmakers decide to revisit the wage floor in the future, it could mean new hikes and adjustments for your business. To stay up-to-date on Delaware’s minimum wage changes, keep tabs on the Delaware Department of Labor’s Wage & Hour Unit. They publish official updates and guidance, including announcements of any future increases, exemptions, or policy shifts.

Why Delaware’s consistent wage laws work in your favor

Delaware brought in over 298,165 new businesses in 2023 alone, which says a lot about how appealing this state is for starting entrepreneurs and established companies.

One big reason? You don’t have to deal with a patchwork of local wage laws since local governments aren’t allowed to set their own minimum wage rates. That means the $15 per hour statewide minimum applies everywhere. Whether you’re in Wilmington or Rehoboth Beach, the same rule holds.

If you’ve looked at states like California or Washington, you’ve probably seen how tricky it gets. Businesses there often face different minimum wages just by crossing into the next town. That kind of setup makes it harder to plan payroll and manage hiring across locations.

But in Delaware, you only need to think about one rate. That predictability gives you a leg up when it comes to budgeting, forecasting, and staying compliant. This is especially helpful if you operate in more than one city or county.

Even better, there’s no scheduled wage increase beyond 2025. That kind of stability lets you plan ahead with confidence. You won’t need to scramble to adjust wages or redo your numbers every few months.

Managing a business that works with the local wage rate

Paying the Delaware minimum of $15 an hour might seem like a lot at first, but it doesn’t have to break your business. With the right strategies, you can handle wage increases and still stay profitable.

1. Adjust your schedule smartly

Take a look at your team’s hours. Are there slow parts of the day where you can trim back without hurting service? Can a few team members cover more ground with a little cross-training? Small changes to your schedule can save real money without cutting staff.

2. Focus on employee retention

Hiring is expensive. If you can hold on to good workers, you’ll save on training costs and reduce disruptions. Delaware’s fair pay helps, but so does recognizing effort, creating a positive work culture, and offering consistent schedules. Workers are more likely to stick around when they feel respected and supported.

3. Use tools that save time

You don’t have to do everything by hand. Use scheduling software, time-tracking apps, or a solid POS system to simplify the day-to-day stuff. The more you automate, the more time you are free to focus on what matters.

4. Revisit your pricing

If your costs have gone up, it might be time for your prices to follow. Even small increases on high-volume items can make a difference. Be honest with your customers. Most understand that paying fair wages means better service and happier staff.

5. Watch for wastes

Take stock of what’s going unused, overstocked, or wasted. If it’s food, materials, or time, small leaks in your process can add up fast. A little tightening here and there can make wage costs easier to manage.

How to stay compliant

Delaware keeps things simple: there is one state minimum wage, no city-level variations, and no scheduled automatic increases, so there’s really no reason to be non-compliant.

Still, even simple rules require clear follow-through. So how do you make sure your business stays on the right side of the law?

Keep accurate records and use updated payroll systems

Keeping solid records isn’t just helpful, but it also protects your business. Make sure you’re tracking employee hours clearly, including start and end times, rest breaks, and overtime. The more detailed your records, the easier it is to stay compliant and avoid payroll issues down the line. A reliable payroll system can help you automate this process and ensure your calculations reflect Delaware’s minimum wage law.

Use a tip management software if you have tipped workers

Since Delaware is a tip credit state, you’re allowed to pay a lower cash wage to employees who earn tips as long as their total earnings meet or exceed the $15/hour threshold. To make that work legally and efficiently, you need a dedicated tip management software. This can help you track tip distribution, document tip pooling arrangements, and create detailed reports that show compliance with both state and federal wage laws. If you’re still logging tips manually or splitting them informally, it’s time to switch.

Having a reliable system in place takes the guesswork out of the process and protects both your team and your business.

Post the required notices

It’s easy to overlook breakroom posters, but Delaware requires you to post up-to-date minimum wage information somewhere your employees can clearly see it every day.

If you haven’t refreshed your posters since last year, now’s the time. Posters must reflect the current $15/hour minimum wage, and using outdated versions could lead to a compliance violation during an inspection. You can download the latest version directly from the Delaware Department of Labor. Keep extras on hand in case one gets damaged or removed. Posting them in places like breakrooms, employee entrances, or near time clocks makes it easy for your team to stay informed.

Fix mistakes immediately

Mistakes happen. Maybe a payroll error shorted someone’s check or miscalculated their overtime. Sometimes, a missed break or incorrect tip adjustment can slip through, especially during busy pay periods. What matters most is how quickly and responsibly you respond to those errors.

Fix the issue as soon as it’s discovered, whether through internal audits, employee feedback, or an outside inquiry. Document the correction clearly and note what went wrong, what actions you took to fix it, and how you plan to prevent it from happening again. Then, inform the employee promptly and professionally.

Showing that you’re acting in good faith goes a long way if a complaint is ever filed or if the Department of Labor reviews your business. A fast, honest correction can help you avoid penalties and reinforce your company’s commitment to fair practices.

Make the most of Delaware’s wage structure

Delaware’s minimum wage rules may be fixed for now, but your business isn’t. What often goes unnoticed is the leadership behind the figures. This is your opportunity to shape the kind of business you’re creating, not just through compensation, but through how you treat your employees, adapt to change, and foster a workplace worth staying in. While the Delaware wage framework provides a stable baseline, it’s the culture, trust, and consistency that truly establish long-term success. Use this to run a business that is both compliant and resilient.

Remember, businesses that make the right choices not only retain excellent employees but also attract loyal customers.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.