Did you know the Sunshine State was named the best state to start a business, boasting the second-highest startup rate per capita nationwide? With its booming entrepreneurial scene and growing working-age population, it’s no wonder more people are planting their business roots in Florida.

If you run a restaurant business, it’s important to stay on top of your labor costs. Understanding where the minimum wage stands, how it impacts your payroll, and how you can plan ahead will put you in a position of strength.

What is Florida’s current minimum wage?

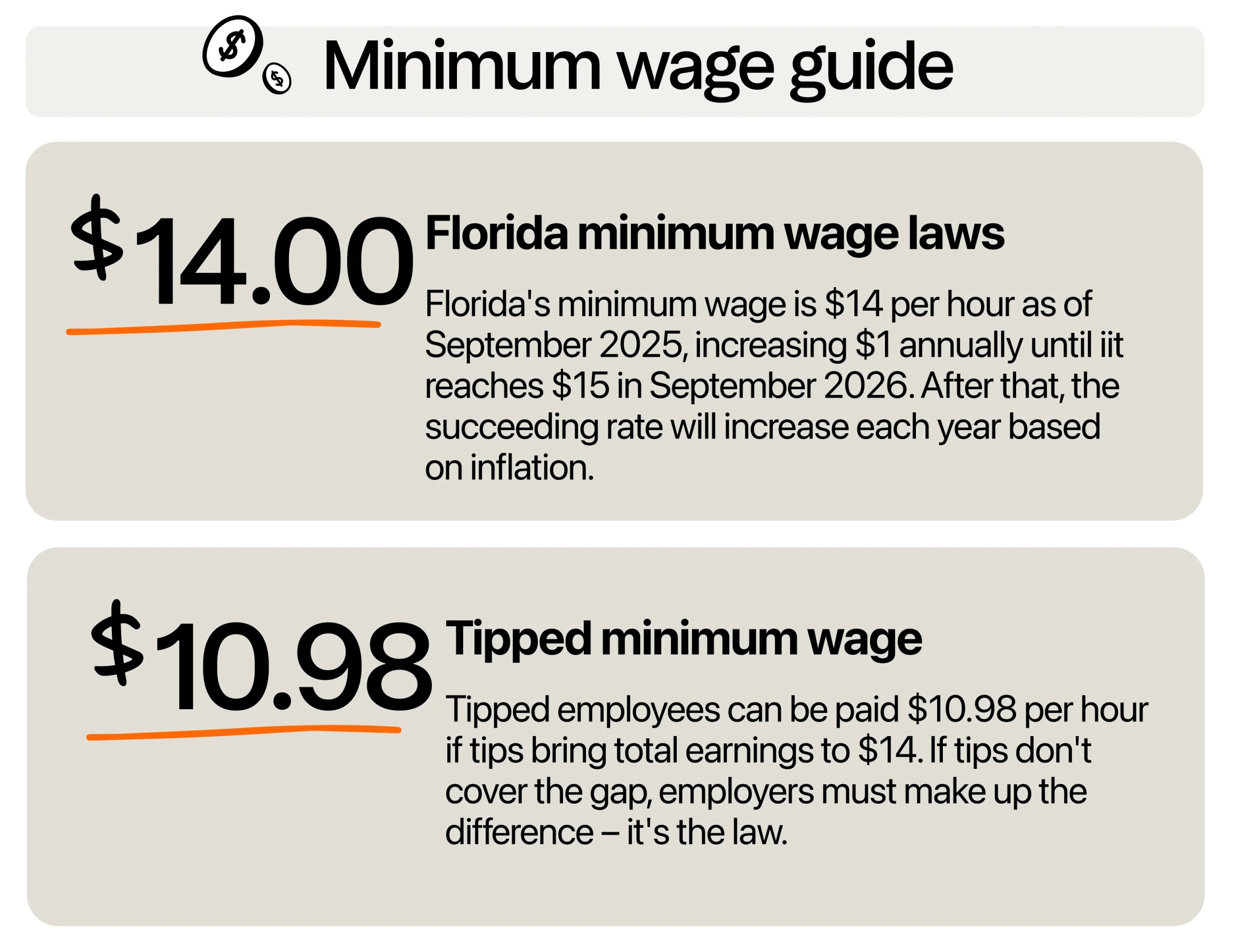

As of September 30th, 2025, the minimum wage in Florida is $14 per hour; however, that’s not the final number. Florida is on a step-by-step path set in motion when voters approved a wage hike in 2020. Each year, it goes up by $1 until it tops out at $15 per hour in September 2026.

This established timeline enables you to anticipate changes and focus on your business without unexpected last-minute surprises.

Wage for tipped employees

If you’ve got tipped employees on your team, such as servers, bartenders, valets, or spa attendants, your wage setup works a little differently. In Florida, you can opt to pay tipped employees at least $10.98 per hour (which will change to $11.98 in September 2026). Their tips should make up the difference to reach the full minimum wage of $14 per hour.

But remember, if tips fall short, it’s your responsibility to make up the difference.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Dates to remember regarding Florida’s minimum wage

When voters approved Amendment 2 with more than 60% support for an improvement in the state minimum back in 2020, it sent a strong, unified message: Floridians value fairness in the workplace and want to see wages keep pace with the real cost of living. It wasn’t just about bumping up paychecks, but it was about recognizing the role that everyday workers play in driving Florida’s economy.

As a business owner or employer, note these important dates:

| Effective Date | Non-Tipped Minimum Wage | Tipped Base Wage |

| Sept 30, 2025 | $14/hour | $10.98/hour |

| Sept 30, 2026 | $15/hour | $11.98/hour |

| Starting 2027 | Adjusted annually for inflation (CPI) | Same applies to tipped wages |

After hitting the ceiling rate of $15 per hour by 2026, the succeeding rate will increase each year based on inflation. That means you won’t get a fixed dollar amount anymore, but an annual adjustment tied to the Consumer Price Index, and you’ll need to keep an eye on the yearly updates and factor those changes into your payroll planning. You can do this by subscribing to their email newsletter and updates.

Does Florida allow a training wage or a lower rate for young workers?

Unlike some states or even federal guidelines, Florida doesn’t offer a lower starter wage or temporary training rate for employees under 20. If you’re hiring high school students for the summer rush or college kids looking for weekend shifts, the pay expectations are clear. They’re entitled to earn the state minimum wage.

However, federal law (the Fair Labor Standards Act) includes a youth minimum wage provision that allows employers to pay employees under age 20 a reduced rate of no less than $4.25 per hour only for the first 90 consecutive calendar days of employment (and this does apply in Florida). Once that period ends, the worker must receive at least the applicable state minimum wage.

That transparency makes it easier to set performance goals and helps avoid misunderstandings down the line. Plus, paying all workers equally from day one creates a more inclusive, team-oriented workplace where everyone feels like they’re on equal footing.

How to make the state’s minimum wage work for your business

Rising wages don’t have to mean rising stress. Each increase gives you a chance to review how your business runs. You can look at how much you’re paying your team, decide if your staffing and scheduling still make sense, and adjust your prices or staffing if needed. Use it as a chance to get ahead as you grow your business.

Take a good look at your payroll setup

Start by reviewing what you’re already doing. Are your current wage rates in line with Florida’s latest minimum? Have you factored in the next increase for this coming September? These scheduled bumps are a good reason to check in on your payroll process and make sure everything’s up to date.

Now’s also a great time to think about whether your current systems are helping or slowing you down. If you’re already using payroll or workforce software, check that it’s set to update automatically each year. That simple step can save you from last-minute scrambles and keep everything on track. If you’re still tracking things manually or jumping between tools, this could be a good opportunity to level up.

Post the wage notice

It might seem like a small thing, but making sure the current minimum wage notice is posted somewhere visible does a couple of helpful things. First, it keeps you legally compliant. Second, and perhaps more importantly, it conveys a subtle yet clear message to your employees that you are attentive to wage compliance and to the current regulations.

You can grab the current poster right from the Florida Department of Commerce’s website. It takes just a few minutes to print and post it in your break room or common area. Then you’re set.

Use the wage schedule to plan ahead

The state’s scheduled minimum wage increase provides a clear path forward, and you should treat it like a roadmap. Instead of making sudden changes, you can spread out price increases over the next few months or adjust your shift scheduling or staffing in advance. You can also use this time to line up employee evaluations or wage adjustments to match the timing of the state changes. This keeps everything in sync and makes your budgeting easier.

Rethink your staffing and scheduling plan

With higher wages on the horizon, now is a great time to step back and look at your staffing, scheduling practices, and how you’re running things. Do you have the right number of people working the right shifts? Are you using your team’s time in a way that makes sense for your business goals? Are there any patterns you could plan around better, like slow days or peak hours?

You don’t have to make huge changes. Even small tweaks, like adjusting schedules or cross-training your team, can help you stay efficient and balanced as your payroll costs shift. It’s about working smarter, not harder.

Think of wages as part of your growth strategy

Don’t look at higher wages as a setback. Your team plays a big role in how well your business runs. When your team feels respected and well-paid, they show up with better energy and focus. It also means less turnover, less time training new hires, and a stronger team that takes care of your customers.

Stay compliant with Florida laws using 7shifts

Wage laws may be complex, but 7shifts makes restaurant compliance easy with:

- Overtime alerts when employees approach daily or weekly thresholds

- Break compliance reminders to ensure meal and rest periods are provided

- Clopen prevention to protect employee well-being and avoid scheduling violations

- Multi-location wage tracking that automatically applies the correct local minimum wage

- Tip management tools built for specific tip credit rules

Save money and avoid penalties with proactive alerts that catch issues before they become violations. Start a free trial with us today!

Is Florida still a good place to grow a business?

Florida’s minimum wage will rise in 2026 and beyond, but that doesn’t mean it’s a bad time to grow your business. The state still offers a strong economy, steady population growth, and a good environment for business owners who want to build something solid.

For starters, the state doesn’t have a personal income tax, which normally includes taxes on wages, salaries, commissions, bonuses, and other personal income. This means your employees keep more of what they earn, and you don’t have to raise wages just to stay competitive. That alone can be a huge draw when you’re trying to recruit and retain great people.

Then there’s Florida’s consistent influx of new residents and visitors. The state sees steady population growth, driven by both retirees and working-age adults looking for better quality of life and job opportunities. That’s more potential customers for your business, and more talent to choose from when you’re ready to expand your team.

Plus, the state also benefits from strong tourism, reliable infrastructure, and policies that make it easier to run a business. Cities like Miami, Tampa, and Orlando continue to grow, attracting small businesses and new investments. Smaller towns like Ocala, Lakeland, and Gainesville are also seeing that growth as more people move in and spend locally.

Growing a business starts with fair pay

The minimum wage in Florida is going up, and while that means higher payroll, it can also bring real value to your business. Fair pay helps workers feel respected and motivated, which can lead to better performance, less turnover, and a solid team that helps your business grow.

Even though the law sets the floor, you don’t have to stop there. Offering a bit more, whether in pay, perks, or a supportive work environment, can make a big difference in how your team performs and sticks around. When your workers feel valued, your customers notice, and your business grows stronger.

Other restaurant compliance resources for Florida:

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.