Paying your team correctly is about building trust and complying with the local government. For better or otherwise, Indiana still follows the federal standard, which affects how you can attract talent. If you run a restaurant in this part of the Midwest, you should be aware of the laws concerning Indiana’s minimum wage to stay competitive and protect your business.

What’s the minimum wage in Indiana in 2026?

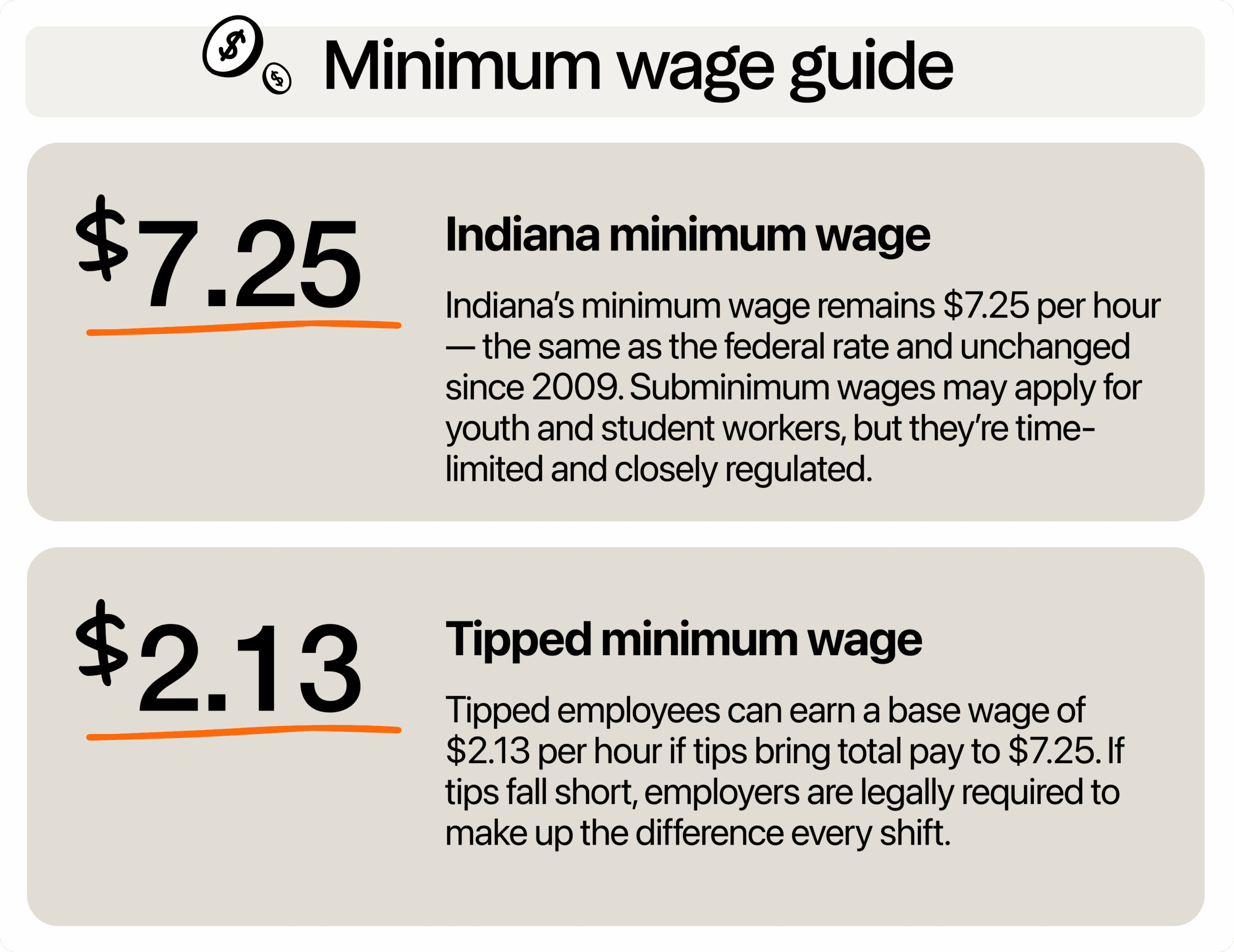

In 2026, Indiana’s minimum wage is still $7.25 per hour, which is the same as the federal minimum wage. This is a rate that hasn’t changed since 2009. For tipped wages, $2.13 per hour is the base. But it only works if their total earnings (wage + tips) reach the minimum.

If they don’t, business owners are legally required to cover the gap. So if your FOH team doesn’t get enough tips during a slow lunch shift, the law says you need to make up the difference.

Additionally, you can pay $4.25 per hour for the first 90 days to employees under 20. This is a short-term option and can’t be extended. After that period, they must earn the full state minimum. Just make sure to track start dates carefully.

High school or college students in work-study or part-time roles (under 20 hours per week) can be paid 85% of the minimum. That comes out to $6.16 per hour.

Tipped employees

Tipped employees come with their own set of rules under wage law. By federal minimum guidelines, they’re the ones who regularly earn more than $30 a month in tips.

As mentioned, you can pay them a tip credit of $2.13 per hour as long as the tips help them reach $7.25 per hour. The max credit you can claim is $5.12 per hour.

Let’s say a server earns $2.13 per hour but only makes $3 in tips that hour. Their total wage would be $5.13, which is $2.12 below the legal minimum. You need to pay that difference, which applies to every shift, not just by paycheck.

Overtime, payroll, and break rules

Wages in Indiana get trickier with overtime. If your tipped workers go over 40 hours in a week, overtime must be based on the full minimum wage, not their tipped rate. That means $7.25 × 1.5 = $10.88 per hour. Overtime pay kicks in once your team puts in more than 40 hours in a week.

When it comes to payroll timing, Indiana employment law requires you to pay at least twice per month. You’ve got to issue paychecks no later than 10 days after the end of the pay period. The state can hold you accountable for late wages, legal fees, and court costs if you miss the deadline.

If an employee quits or is let go, their final paycheck must be ready on the next regular payday. If they make a written demand for their wage, and they leave without giving notice, you have 10 days to pay them.

As for breaks, Indiana keeps it simple, but not always in a good way. There’s no legal requirement to give meals or rest breaks to adults. However, minors working six or more hours must get at least 30 minutes of break time. So if you’ve got high schoolers on a split shift or working long weekends, make sure your managers schedule those breaks. It’s a legal must.

Use restaurant time clock software to log hours, track breaks, and keep overtime in check. It should have its own payroll feature or integrate with your current tool, so you don’t have to worry about missing a deadline or miscalculating employee wages.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

How does Indiana’s minimum wage law compare to neighboring states?

You must be aware of the minimum wage because you’re competing for talent with restaurants in your area as well as ones across state lines. It’s even more challenging because Indiana has the lowest in the Midwest.

Illinois has the highest at $15 per hour, while Michigan ($13.73 per hour) and Ohio ($11 per hour) also offer rates higher than the federal mandate. Kentucky is the only other state that follows the federal minimum.

That puts Indiana restaurant owners in a tight spot. You’re legally within bounds at $7.25, but if your dishwasher can drive 20 minutes and make a few more bucks an hour in Ohio or Michigan, what’s stopping them?

This also affects tipped workers. Illinois, for example, raised its tipped minimum wage to $9 per hour. That’s more than four times Indiana’s $2.13 per hour tipped base. If you’re trying to build a strong FOH team while paying federal minimum wages, you’re playing with one hand tied behind your back.

Sticking to the state’s minimum wage might help your payroll costs short-term, but it could make hiring harder and turnover higher, especially in border towns or college areas. Offering slightly higher employee wages, bonuses, or more flexible schedules can help level the playing field.

Are there plans to increase wages for Indiana workers?

There have been clear legislative attempts for wage increases in Indiana. However, these efforts have consistently failed to gain traction and pass in the state legislature.

Senate Bill 106

Back in 2021, Indiana lawmakers looked at a major update to the minimum wage, and for restaurant operators, it could’ve changed the game. Senate Bill 106 proposed a jump from $7.25 to $10 per hour after June 2022, an increase to $13 per hour after June 2023, and hit $15 per hour after June 2024.

By 2025, the state minimum wage would then rise every year, tied to inflation through the Consumer Price Index (CPI). If it had passed, this would’ve brought Indiana wage rates in line with neighboring states like Illinois and Michigan.

House Bill 1345

House Bill 1345 was introduced in 2021 as another effort to raise the minimum wage in the Hoosier State. Like Senate Bill 106, it aimed to gradually increase the base pay for workers across the state. While the changes weren’t as steep, this bill still offered a path toward stronger wage protections and inflation-based growth.

The bill proposed to raise the state minimum wage from $7.25 to $8.20 per hour after June 2022. Then, after December 2022, it would increase again to $9.15 per hour.

The rate would increase for a set percentage after the end of each year until 2025, where the wage would rise annually with inflation through the CPI. But like Senate Bill 106, House Bill 1345 didn’t pass.

Senate Bill 366

The most recent effort to raise the minimum wage in Indiana was in 2023, with Senate Bill 366. It proposed increasing the rate from $7.25 to $13 per hour for any work week starting on or after July 2023.

But this bill didn’t stop there. It also tried to repeal an Indiana law that blocks cities from setting their own minimum wages. Right now, even if places like Indianapolis want to raise the rate to keep up with rising costs, they can’t. State rules prevent them from going above the federal minimum. SB 366 would’ve changed that, letting local leaders respond to their city’s needs.

SB 366 didn’t pass. In fact, it didn’t even get a hearing during the 2023 session. But just because the bill stalled doesn’t mean the pressure is gone. With neighboring states like Ohio and Michigan raising wages and tying them to inflation, the push for updates in Indiana may not be slowing down.

Minimum wage vs. average wage vs. living wage

While the minimum wage in Indiana is $7.25 per hour, restaurant owners must also be aware of the average wage and living wage in the state. This way, you can develop competitive offers that can attract and retain top talent.

The average server salary is around $31,200 per year, which is around $15 per hour for full-time work. Take note, though, that this varies widely depending on location and restaurant type.

Then there’s the living wage, which is what a person needs to earn to cover basic living costs without public assistance. The MIT Living Wage Calculator estimates the living wage for a single adult with no children is $20.81 per hour. That number jumps even higher if the person has kids.

So, what does all this mean for restaurant operators? It means that even though you’re allowed to pay $7.25 per hour, many workers simply can’t afford to stay in those jobs long-term. If you’re trying to cut turnover or hire great people in a tough market, it may be worth bumping employee wages above the minimum rate, even if the law doesn’t require it yet.

How restaurants can stay compliant

What seems like small payroll mistakes, like underpaying tipped workers and missing overtime payouts, can lead to huge legal problems. Make sure to stay compliant to avoid hefty fines and legal fees.

Audit your wages

The first step to staying compliant with Indiana minimum wage laws is to run a full wage audit. This means checking that every employee on your team, servers, cooks, dishwashers, and managers, is being paid correctly for their role, their hours, and their tips.

Check the base pay and make sure no one is earning below that unless they’re properly classified as tipped workers. If you’re using the tipped wage, you must guarantee that each worker still earns at least the minimum after tips. If not, you’re required by law to pay the difference.

Next, review your overtime rates. Any non-exempt employee who works over 40 hours in a week must be paid 1.5x their regular rate. Again, for tipped workers, the overtime rate must be based on $7.25 per hour, not the tipped base. That means the minimum overtime rate for tipped staff is $10.88 per hour.

Small mistakes, like forgetting to adjust rates after promotions or misclassifying tipped roles, can lead to big fines. In 2024, the U.S. Department of Labor recovered over $273 million in back wages from employers who violated wage laws.

Double-check classification

Make sure your team is correctly classified as well to stay compliant. Mislabeling employees, especially when it comes to exempt and non-exempt roles, can lead to unpaid wages, fines, and legal trouble.

Non-exempt workers must be paid at least minimum wage and overtime when they work more than 40 hours in a week. Most hourly restaurant employees fall into this group. Exempt employees, on the other hand, are usually salaried and don’t get overtime, but they must meet strict requirements under federal employment law.

To be classified as exempt, a worker must be paid on a salary basis (not hourly) and earn at least $684 per week (as of 2024). They must also perform executive, administrative, or professional duties, not just general tasks or shift work.

So, your general manager might be exempt. But a lead line cook or bartender, even if they help with some paperwork, probably isn’t. If you treat a non-exempt worker as exempt and skip overtime pay, you could be violating wage laws, even if it’s by mistake.

Update your employee handbook and onboarding

Additionally, keep your employee handbook and onboarding process up to date. Clear, written policies help protect your business and keep your team on the same page from day one.

It should spell out key wage policies, including how much you’re offering, overtime rules, and how tips are tracked, pooled, or distributed if you run a tip pool. Tip pooling laws in Indiana allow employers to implement mandatory tip pools.

If you update pay rates, add new roles, or adjust tip procedures, those changes should be reflected right away in your handbook and onboarding documents. That way, everyone from new hosts to veteran servers understands what they’re earning and why.

Putting a lot of thought into your onboarding is the first impression your team gets of how your restaurant operates. Use that time to explain pay schedules, break rules, overtime procedures, and how to flag any errors in their check. This builds trust, and can help you avoid legal risks later.

Train managers

If your managers are in charge of schedules, approving timesheets, or handing out paychecks, they need to understand wage and payroll laws. As mentioned, pay should be at least twice a month, with paychecks issued on or before 10 business days after the end of the pay period.

If managers aren’t aware of these laws, they might cause delays in pay without realizing it’s a violation. That could trigger fines, legal action, or even government audits.

Train your managers on:

- How often payroll is processed and when checks are due

- How overtime is calculated

- What to do when a worker leaves the job

- Tip credit rules and how to apply them correctly

Pay right and keep your best staff

Even though the minimum wage in Indiana hasn’t changed in over a decade, restaurant owners can’t afford to stand still. With neighboring states raising pay and inflation pushing up living costs, you need a plan to stay competitive. Paying the legal minimum might check the compliance box, but offering just a little more can help you hold onto great staff and cut down on constant hiring and training.

Stay on top of payroll and manage labor costs with restaurant scheduling software that lets you assign shifts, track hours, and set break reminders. Make compliance one less thing to worry about as you run your business.

Also read: Indiana tip laws for restaurants

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.