If you’re running a business in Kentucky or thinking about starting one soon, you’re likely asking: how much do I need to pay my employees? And how can I do it right without breaking the bank? Understanding minimum wage laws is more than just checking a compliance box. It helps you create a better workplace, plan smarter for your budget, and stay ahead in your industry.

What is the current minimum wage in Kentucky?

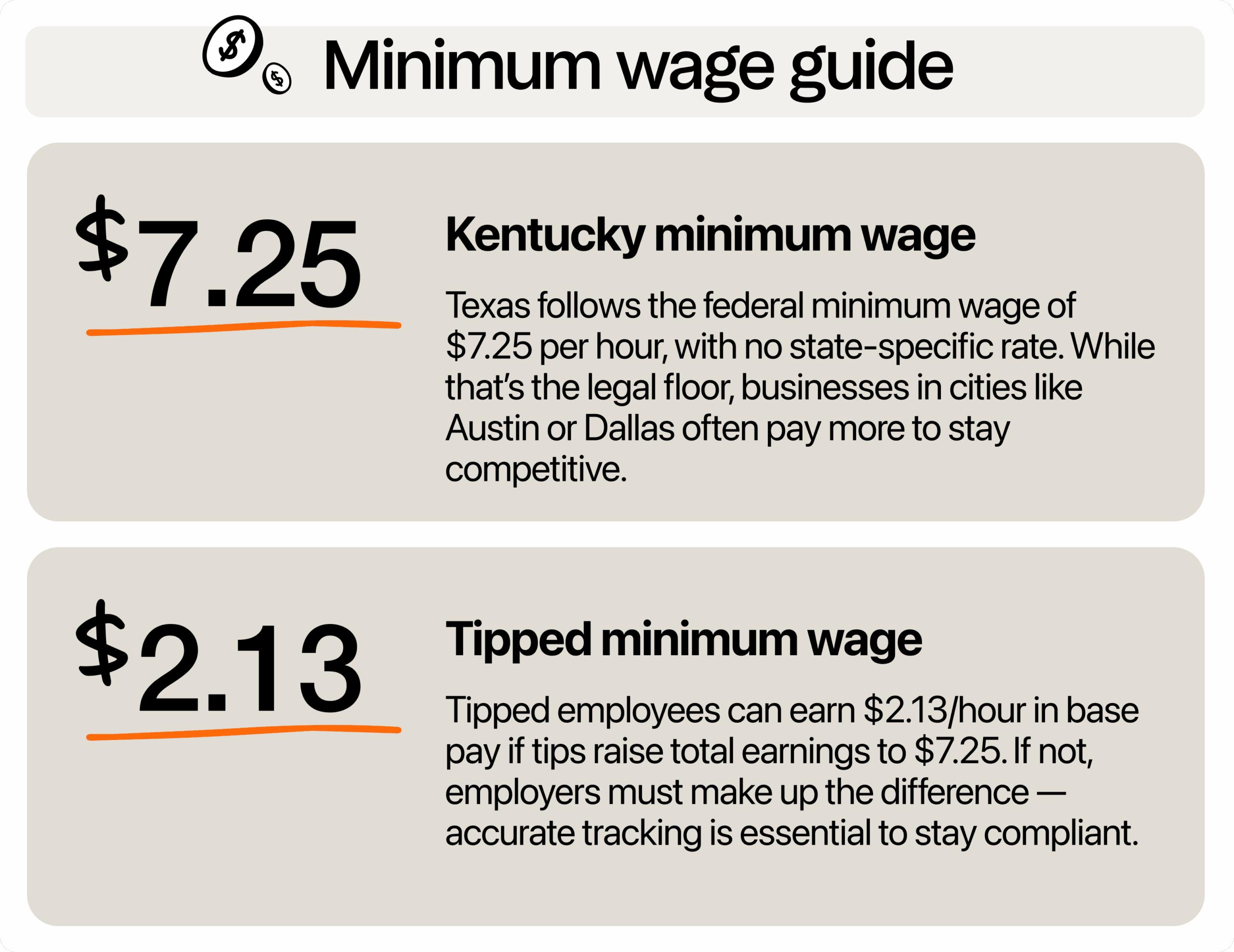

As of 2025, the minimum wage in Kentucky remains at $7.25 per hour, which matches the federal rate. This rate hasn’t changed since 2009, and it applies statewide. Unlike states like California or New York, which have set their own higher rates, Kentucky hasn’t passed legislation to increase the minimum wage beyond the federal level.

For tipped employees, like restaurant servers, bartenders, or salon workers, the base cash wage is $2.13 per hour. But here’s the important part: those tips must bring the employee’s total hourly rate up to at least $7.25. If they fall short, you’re responsible for making up the difference. So, it’s worth having a solid tracking system in place. Otherwise, you could face compliance issues down the line.

Can local governments raise the minimum wage?

Some business owners in Kentucky ask, “What if my city wants to raise wages locally?” It’s a fair question, especially if you’re based in an area with a higher cost of living or trying to attract more skilled workers. But the state has already set the ground rules on this.

In 2016, the Kentucky Supreme Court ruled that cities and counties are not allowed to enact their own minimum wage ordinances. This decision came after Louisville attempted to raise its minimum wage from the federal level to a more localized rate, arguing that local conditions demanded better pay. While the city passed the increase, the court struck it down, citing the state’s exclusive authority over wage laws.

What this means for you is simple: no matter where your business operates, whether it’s a bustling downtown in Lexington, a family-owned shop in Bowling Green, or a farm-based enterprise in a rural county, you’re bound by the same statewide minimum wage rate. On the one hand, this provides consistency across Kentucky. On the other hand, it limits flexibility for business owners and municipalities that might want to adjust pay scales based on their local economic realities.

While you can’t be forced to pay more than the state requires, you’re also free to go beyond it. Many Kentucky businesses choose to set their starting wages higher, especially in urban centers or competitive markets, to gain an edge in hiring. At the end of the day, wage consistency at the state level doesn’t mean you have to limit your business’s ability to stand out.

Voluntarily paying above minimum wage

Let’s be honest: $7.25 doesn’t stretch very far today. According to the MIT Living Wage Calculator, a single adult in Kentucky needs to earn at least $20.09 per hour to meet basic living expenses without public assistance. This stark difference underscores why many businesses across Kentucky are already paying well above the minimum wage, not because they’re required to, but because they have to compete for good workers.

Some Kentucky business owners find success advertising their above-average pay rates as a hiring advantage. It’s one of those decisions that looks like a cost at first, but often pays for itself in loyalty and productivity.

Let’s say you’re hiring for a cafe in Lexington or running a shop in Paducah. You’re competing not just with other small businesses but also with national chains that may offer $12 to $15 starting wages, signing bonuses, or benefits. This means you need to think beyond the legal minimum. Ask yourself: What’s the going rate in your area? What will help you keep good people once you hire them? Even a small bump in pay, let’s say from $7.25 to $9 or $10, can make your listing more attractive.

Higher wages can also reduce turnover, which saves you from the cost of constantly hiring and retraining staff. For example, Harvard Business Review reported that even a $1 increase in hourly wages can significantly boost retention rates in high-turnover sectors. Better pay also tends to boost employee morale, which often translates into better customer service, more consistent performance, and a more positive work environment.

When employees feel respected and fairly compensated, they’re more likely to stay, grow within your company, and contribute meaningfully to your success.

How can you prepare in case Kentucky minimum wage increases?

There has been an ongoing debate in Kentucky over raising the state minimum wage. Over the past few years, several proposals have been made to bump it to $15 per hour, but none have passed into law yet. Still, change could come fast if there’s a shift in the political climate or if neighboring states make significant wage moves.

This is where forward-thinking pays off. Start by reviewing your current payroll costs. If a minimum wage increase does eventually become law, you’ll want a clear picture of how your numbers shift at different wage levels: $10, $12, $15, and so on.

If you want help running those calculations, 7shifts offers free labor cost templates that are easy to use and tailored for restaurant and hospitality businesses. They can help you budget smarter and avoid surprises. Additionally, they can make it easier to break down your staffing expenses by the hour, week, or month. These templates are especially helpful if you’re operating a restaurant or retail store with variable shifts.

What should you do next?

Keep an eye on state legislation. While the rate is still $7.25, that could change depending on who’s in office and what proposals gain traction.

In the meantime, it’s worth evaluating whether paying more than the minimum could help you attract better talent or reduce turnover. Plenty of Kentucky businesses voluntarily pay $10 or more, especially in competitive industries like food service, healthcare, and retail.

Wages are more than just a legal checkbox. They can be a powerful tool for building loyalty and stability in your team. And in a tight labor market, offering a little more can give you a big edge.

Is it worth starting a business in Kentucky?

While Kentucky’s minimum wage hasn’t budged in years, the state still offers one of the most business-friendly environments in the region. One of the biggest advantages is its central location, within a day’s drive of over two-thirds of the U.S. population. That gives your business better access to major markets without the costs of being on the coast.

Food industry logistics and access are a big advantage. Kentucky’s central location makes it easier for restaurants, food processors, and distributors to source ingredients quickly and deliver products to nearby cities and states without long delays. If you’re in the food business, such as running a farm-to-table concept, a catering company, or a packaged goods brand, you’ll benefit from proximity to major agricultural suppliers and fast access to regional markets. This location advantage also cuts down on transportation costs and spoilage risks, which is especially valuable when dealing with perishable ingredients.

Operating costs are also lower than national averages. From rent to utilities, many business owners find they can stretch their budgets further in Kentucky. According to the U.S. Energy Information Administration, Kentucky consistently ranks among the lowest states for commercial electricity costs.

Taxes are also competitive. Kentucky’s corporate income tax rate sits at a flat 5%, as established for tax years beginning on or after January 1, 2018. Qualifying small businesses can access state programs like the Kentucky Small Business Tax Credit (KSBTC), which offers between $3,500 and $25,000 per year for small businesses that have hired and sustained at least one new job and purchased at least $5,000 in qualifying equipment or technology. Additionally, the Kentucky Business Investment (KBI) Program provides income tax credits and wage assessments to new and expanding businesses in various sectors, including manufacturing and technology.

And don’t forget about quality of life. With a cost of living approximately 11.4% below the national average, Kentucky offers an affordable lifestyle that can enhance employee satisfaction and retention. The state boasts abundant natural beauty, including scenic landscapes and outdoor recreational opportunities, making it an attractive place for employees to live and work.

What should employers in Kentucky do to stay compliant?

If you’re a business owner in Kentucky, staying compliant with wage laws is not just about avoiding fines, but it’s about creating an efficient, professional operation that earns the trust of your team and your customers. Here’s what you need to keep your business in good standing:

1. Track hours and tips accurately. Knowing your wage obligations and proper timekeeping are essential. Use reliable scheduling and payroll software built for cafes, restaurants, and the like to track employee hours, manage breaks, and record tip distribution. Inaccurate records can lead to wage disputes or penalties during audits. Digital records help you stay organized and make reporting easier.

2. Display labor law posters. Make sure your workplace includes up-to-date federal and Kentucky labor law posters in an area where employees can see them. These posters inform your team of their rights and your obligations, and failure to display them could lead to citations.

3. Classify employees correctly. Misclassifying workers as independent contractors or exempt employees when they shouldn’t be can trigger audits and backpay orders. If someone works scheduled hours under your direction and uses your tools, they’re likely an employee and not a contractor.

4. Keep detailed payroll records. Kentucky employers must keep records for at least one year. These should include employee names, addresses, occupations, hours worked, and wages paid. Keeping longer records for up to three years is a good practice, especially if you’re in an industry with frequent turnover.

5. Stay updated on changes. Minimum wage laws aren’t set in stone. Keep an eye on proposals and news from the Kentucky Labor Cabinet and the U.S. Department of Labor. Legislative changes can affect how much you pay, how often you pay, and what benefits you’re expected to provide.

6. Offer wage transparency and communication. Employees should always understand how their pay is calculated. Be open about hourly rates, overtime rules, and how tips are handled. A transparent system prevents confusion and helps build trust within your team.

Wages, wins, and what’s next

Abraham Lincoln once said, “Labor is the superior of capital, and deserves much the higher consideration.” If your team is the engine of your business, then investing in them, whether through fair pay, flexible scheduling, or better systems, isn’t just compliance. It’s smart business.

If you’re not sure where to start, take a weekend to audit your labor practices, revisit your budget, and run a few “what-if” scenarios. That small effort now could save you a lot of stress later.

And remember: you don’t have to do it alone. There are tools, templates, and communities out there built for business owners like you, ready to help when the laws change, your business grows, or your team expands.

Minimum wage resources

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.