The Massachusetts minimum wage is one of the highest in the country, but it hasn’t gone up since 2023 and won’t be increasing anytime soon. Although it seems like good news for restaurant owners, there’s the challenge of attracting and retaining quality staff at this wage level, which isn’t even enough to cover the cost of living in the state.

What is the minimum wage in Massachusetts in 2026?

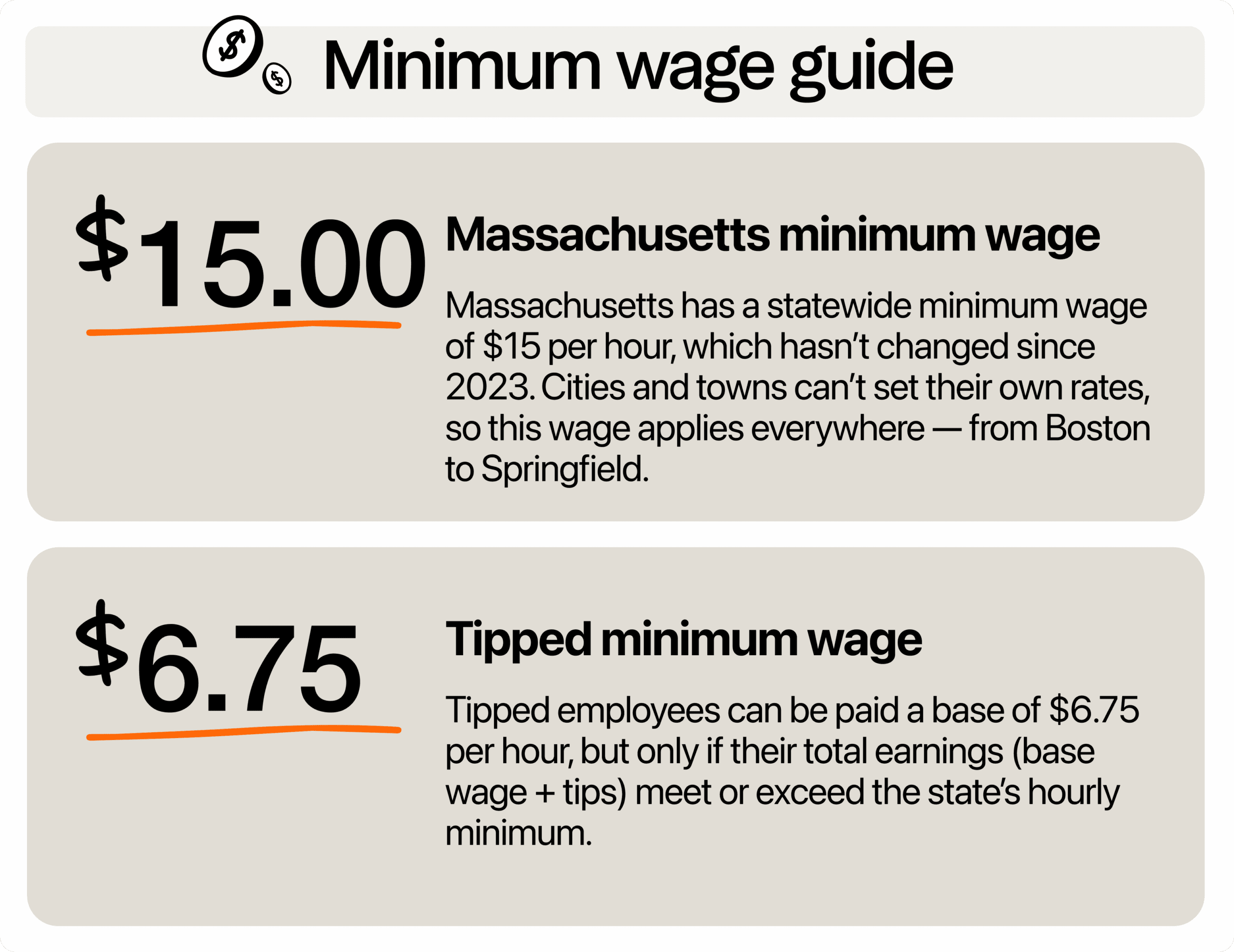

As of 2026, the minimum wage in Massachusetts is $15 per hour for most workers. This rate has stayed the same since January 2023, when the state finished a five-year plan to gradually raise the wage.

This state minimum applies statewide. That means towns like Boston, Worcester, and Springfield can’t set their own minimum wage, even if local living costs are higher. This is different from some states where cities or counties can increase their minimum wage above the state minimum.

The federal minimum wage is much lower at $7.25 per hour, a rate that hasn’t changed since 2009. But under Massachusetts law, the state minimum must always be at least $0.50 higher than the federal level.

Right now, Massachusetts’ minimum wage is more than double the federal minimum. That gives workers in the state a stronger safety net, especially in a high-cost region like New England.

Specific wage rules restaurant owners should know

Aside from the minimum wage, Massachusetts restaurant owners should be aware of specific wage laws around tip credits, overtime, and wages for minors and apprentices. First, tipped employees can be paid a base of $6.75 per hour, but only if their total earnings (base wage + tips) meet or exceed the state’s hourly minimum.

You’re responsible for tracking tips closely. If a server only makes $6 per hour in tips on a slow shift, you must pay them an extra $2.25 per hour to bring them up to the state minimum.

For overtime, Massachusetts law follows the federal standard. If an employee works more than 40 hours in a week, you must pay them 1.5x their regular wage for those extra hours.

So if a line cook makes $15 per hour, they earn $22.50 per hour for overtime. This can sneak up during double shifts or busy weekends, so you should track hours closely.

The state also once required premium pay for Sundays and holidays, but these rules have largely been phased out. Most restaurants are no longer required to pay 1.5× on Sundays or holidays, though limited exceptions may apply (such as if Sunday hours put an employee over the 40-hour workweek).

Massachusetts does not allow a reduced youth or training wage. Employees under 20 must be paid the full minimum wage from their first day of work.

Students in co-op programs or vocational training may be paid limited student learner wages, but they must be state-approved. This is typically set at 85% of minimum wage, not a fixed dollar amount.

Stay restaurant compliant with 7shifts

7shifts makes restaurant compliance (including wage laws) easy with:

- Overtime alerts when employees approach daily or weekly thresholds

- Break compliance reminders to ensure meal and rest periods are provided

- Clopen prevention to protect employee well-being and avoid scheduling violations

- Multi-location wage tracking that automatically applies the correct local minimum wage

- Tip management tools built for specific tip credit rules

Save money and avoid penalties with proactive alerts that catch issues before they become violations. Start a free trial with us today!

Are there plans to increase from $15.00?

The minimum wage in The Bay State remains the same for the third year in a row. Although it’s higher than the federal minimum, it hasn’t been adjusted annually for inflation.

There have been efforts to raise the state minimum wage again. House Bill H1925 aimed to increase it to $20 per hour by 2027 and tie future raises to inflation. The bill didn’t move forward, but it laid the groundwork for similar proposals with built-in annual increases.

Right now, Senate Bill S1349 is still active in the legislature. It proposes boosting the minimum wage to $20 per hour by 2029, followed by annual adjustments based on the Consumer Price Index (CPI). If this bill passes, the minimum could automatically go up every year, something many low-wage workers have pushed for.

Voter support, however, hasn’t always lined up. In 2024, Massachusetts voters rejected Question 5, a ballot measure to raise the tipped minimum wage. The vote wasn’t close: over 64% voted against it. That shows many voters still have mixed views on increasing restaurant wages, especially when it affects tipping models and menu prices.

How does the state’s minimum wage compare to its neighbors?

Massachusetts’ minimum wage remains solid compared to nearby states, but it’s no longer leading the pack. In fact, some neighboring states have passed it and are continuing to adjust wages annually.

For instance, Connecticut’s minimum wage rose to $16.94 per hour in 2026. Even more importantly, the state ties future increases to the CPI, meaning wages are adjusted annually for inflation. That gives restaurant workers there a better shot at keeping up with rising costs.

Meanwhile, Rhode Island’s minimum wage was the same as Massachusetts’ last year, but the state increased it to $16 per hour in 2026. That gives business owners in border towns a real challenge. A dishwasher might choose to work a few miles down the road if it means making an extra dollar per hour.

On the northern side, though, New Hampshire’s minimum wage is stuck at $7.25 per hour, following the federal minimum. That means restaurants just over the border can keep labor costs low, but they may struggle to find and keep quality staff in such a competitive wage environment.

If you’re running a restaurant near the state line, minimum wage differences can seriously impact hiring, training, and turnover. Workers will go where the pay is better, especially for entry-level or tipped roles.

Can employees live comfortably on the Massachusetts minimum?

Massachusetts is known for its high cost of living, particularly when it comes to housing. According to the MIT Living Wage Calculator, a single adult in Massachusetts needs to earn at least $28.88 per hour to cover basic needs like housing, food, transportation, and healthcare.

For families, the gap between the minimum wage and a living wage becomes even wider. For example, a household with one adult and one child in Massachusetts might need an hourly wage of over $55.15 to cover their basic expenses.

What does this mean for you? While the Massachusetts law sets the minimum wage, many employees may find it difficult to make ends meet. This can lead to higher employee turnover and challenges in attracting skilled staff, not to mention having a less motivated workforce.

As an employer, being aware of these economic realities can help you consider ways to support your employees, whether through competitive wages above the minimum, benefits, or flexible scheduling.

Aside from fostering a fair workplace, compensating your team properly also helps your bottom line. When employees can’t afford to stay, they leave. Employee turnover is expensive once you factor in lost productivity, recruitment, and training. On average, it costs $1,056 to replace each FOH staff member, $1,491 for BOH, and $2,611 for managers.

Moreover, the value of $15 has dropped. Due to inflation, $15 today buys less than it did in 2018, when the state started raising wages from $11. This means you’ll need around $19.35 to buy the same amount of goods and services as seven years ago.

Consider paying above minimum wage when you can, or offer perks like consistent hours, shift flexibility, and faster tip payouts. Doing so can help you keep strong team members and reduce churn.

How to manage higher labor costs without cutting corners

As much as you want to pay your employee way higher than the minimum rate, margins can be tight. Luckily, there are ways to reduce restaurant expenses without alienating your team and hurting the diner experience.

Trim the menu

A smaller menu means fewer ingredients to stock, less waste, and faster prep. Start by looking at what’s not selling. If a dish rarely gets ordered or has a high spoil rate, it’s costing you more than it’s worth. Cutting it frees up time for your kitchen team and helps speed up service, especially during the rush.

With fewer items, you can also train staff faster and reduce mistakes. If everyone knows the core menu inside and out, service becomes smoother. And from a labor standpoint, shorter cook times mean fewer hours spent on prep and fewer people needed on slower shifts.

Use ingredients across dishes

Cross-utilizing ingredients cuts down on inventory and also simplifies training. For example, you can use roasted chicken in a sandwich, a salad, and a pasta dish. This way, your team preps one protein for three menu items instead of three separate proteins. It reduces food waste and makes ordering easier.

This approach also lessens the chance of spoilage and unexpected costs. If an item doesn’t sell well in one dish, it’s still moving through others. Plus, your kitchen crew can focus on nailing a few ingredients, rather than managing a long list of one-off items.

Consider service charges

Instead of relying only on tips, some restaurants are moving to a service charge model. This lets you redistribute pay more evenly across FOH and BOH. For example, adding an 18% service fee can help you raise base pay for your team, especially BOH staff who often don’t get tipped at all.

Be clear with customers about why you’re making the change. A simple explanation on the menu or receipt can help avoid confusion. It also builds trust when guests know their money is supporting a better wage for your team. This setup can also help you reduce the gap between slow and busy nights, giving staff more predictable earnings.

Raise menu prices strategically

Sometimes, you really need to raise prices to keep up with restaurant costs. Check your food and labor costs for each dish. For instance, if a plate costs you $5 to make (including prep time), aim to price it so you’re covering that and hitting your profit margin. Even a $0.50 increase per dish can add up fast over a week’s worth of orders.

Just like with service charges, be transparent when making changes. Many diners understand that costs have gone up. A small note on your menu or social media can go a long way.

You can say something along the lines of “We’ve updated our pricing to support fair wages for our team”. Plus, instead of bumping prices across the board, focus on your top sellers or high-cost items first.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Making things work in Massachusetts

The minimum wage in Massachusetts may seem fair on paper, but it’s nowhere near enough in a state with high cost of living. For restaurant operators, staying compliant is just the starting point. The real challenge is building a pay structure that attracts talent and keeps turnover low, while making sure to protect your bottom line.

Leverage restaurant scheduling software to reduce labor waste. 7shifts helps you schedule smarter and track hours more accurately. This way, you can cut down on idle time and better match labor to sales, creating more room in your budget to offer competitive wages.

Other compliance resources for Massachusetts:

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.