Small business owners still see Nebraska as a great place to start. The state offers low costs, manageable regulations, and a growing workforce. In fact, 99.1% of all businesses in Nebraska are small businesses, and they employ about half of its workforce, making Nebraska a hub for entrepreneurial activity concentrated in locally owned operations. Still, success starts with knowing the rules, especially wage rules. One of the key ones to stay updated on is the minimum wage.

What is the minimum wage in Nebraska?

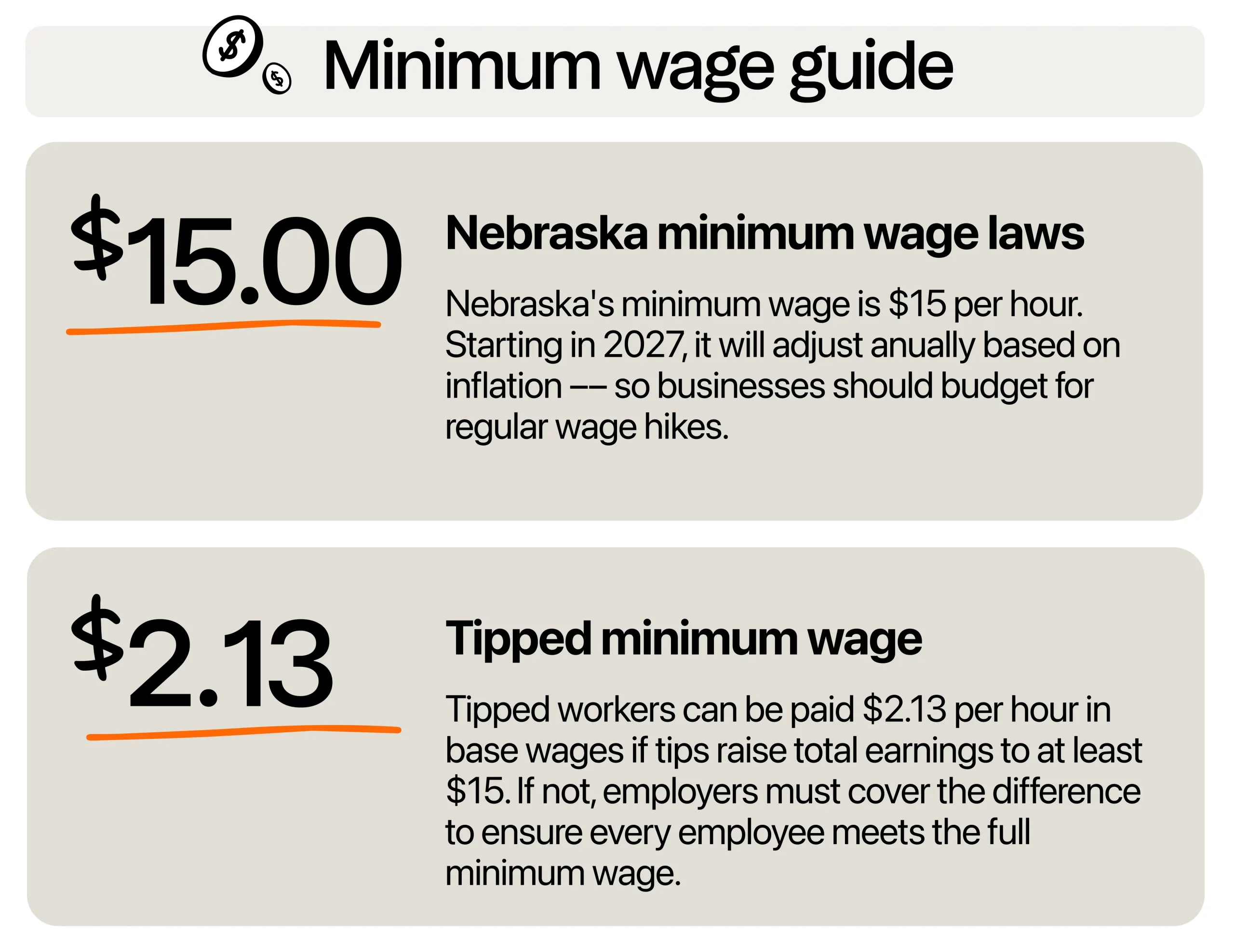

In January 2026, Nebraska raised its minimum wage to $15 per hour. This is part of a series of increases that voters approved under Initiative 433 in November 2022. The law set a schedule for annual increases, bumping the rate up every year until it hit $15 per hour by 2026. After that, it will adjust annually based on inflation using the Consumer Price Index (CPI).

Here’s a comparison over the years:

| Year | Minimum Wage |

| 2025 | $13.50 per hour |

| 2026 | $15.00 per hour |

| 2027 onward | Adjusted annually for inflation (CPI) |

This means you’ll need to plan your payroll budget accordingly, especially if you employ workers at or near the minimum wage. This change will likely impact your entire pay structure if you run a restaurant, retail shop, or service-based business.

What about tipped employees?

Nebraska is a tip credit state that allows employers to take a tip credit. You can pay a lower base wage to employees who regularly receive tips, such as servers or bartenders, as long as their tips bring them up to the full minimum wage.

The tipped minimum wage in Nebraska is currently set at $2.13 per hour. If their tips don’t bring them up to $15/hour or the applicable full rate, then you are legally required to make up the difference.

Youth and training wages

Nebraska also allows a training wage. If you hire employees who are 20 years old or younger, you may pay them $13.50 per hour for their first 90 consecutive calendar days of employment.

This can be a good option if you’re hiring high school students, part-time interns, or entry-level workers. It gives you time to train them before bringing them up to the regular rate. But don’t forget, once those 90 days are up, you must bump them up to the full minimum wage.

Rules on overtime pay

Employers must pay overtime for any work over 40 hours in a Nebraska workweek for employees classified as “non-exempt.” Nebraska follows federal Fair Labor Standards Act (FLSA) rules. That means you must pay eligible employees at least 1.5 times their regular hourly rate for every hour beyond 40 in a week.

For example, if an employee earns the state minimum of $15 per hour, any overtime hours must be paid at $22.50 per hour. This applies to hourly workers in food service, retail, hospitality, and other similar industries.

If you are applying for a tip credit, keep in mind that overtime pay must still be calculated based on the full minimum wage, not the lower tipped wage. The overtime rate must be based on the Nebraska minimum of $15, even if you’re paying the employee $2.13 plus tips.

Exempt vs. non exempt

Most hourly workers fall under the non-exempt category and are entitled to overtime pay. But what if you plan to hire salaried team members? That’s where classification becomes important.

To legally classify an employee as exempt from overtime, all three of the following tests must be met:

- Salary Basis Test: The employee must receive a fixed, predetermined salary that does not fluctuate based on hours worked.

- Salary Level Test: The employee’s salary must be at least $684 per week, or $35,568 annually.

- Duties Test: The employee’s primary duties must fall under specific FLSA definitions for executive, administrative, or professional roles.

If even one of these conditions is not met, the employee is considered non-exempt and must receive overtime pay.

Are there any local ordinances to note?

Unlike some states with city-specific wage rates, Nebraska keeps things simple. The statewide minimum wage applies everywhere. Whether you’re opening shop in Lincoln, Norfolk, or Scottsbluff, you don’t have to worry about different local wage ordinances.

But that simplicity doesn’t mean you can coast. The minimum wage will increase according to the CPI after 2026, so you’ll need to keep your payroll system updated and communicate changes with your team in advance.

How Nebraska stacks up with nearby states

Nebraska’s $15 minimum wage puts it ahead of a few neighbors. Kansas and Iowa are still holding the line at $7.25, which means you’ll be paying quite a bit more if you’re setting up near the border. Missouri also clocks in at $15, and Colorado is leading with $15.16 statewide, and even more in cities like Denver.

If you’re opening a restaurant or any business in a town near state lines, keep in mind that your labor costs might be higher, but so could the quality of your workforce. Offering better pay can help you attract and keep reliable team members who might otherwise cross state lines for better wages.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Minimum wage vs. living wage in Nebraska

The legal minimum is one thing, but let’s talk about real-life numbers. According to the MIT Living Wage Calculator, a single adult in Nebraska needs about $20.99 an hour just to make ends meet. That jumps to $36.66 or more if they have a child.

So if you want to build a team that sticks with you, it’s worth thinking beyond the minimum. Many Nebraska business owners are already adjusting their pay scales to reduce turnover and improve morale. Starting off with strong compensation can make a big difference.

How businesses can make room for higher wages

If you are planning to open a business, let’s say a cafe, one question that might be running through your head is: where do I find the money to cover these rising wages?

It’s a fair concern. With Nebraska’s scheduled increases in the future, new business owners might wonder how to stay profitable while paying staff fairly. The good news is that it’s absolutely possible. You just need to plan for it.

Start with your numbers

Look at your cost structure early on. That means going beyond startup costs and thinking about monthly operating expenses like payroll, utilities, inventory, and rent. Your staffing budget should not be an afterthought. It should be one of your biggest line items, and it should be realistic.

If your budget is too tight, rework it. You can always trim initial menu offerings, reduce store hours in slower seasons, or wait to expand your team until you have built a steady customer base. That flexibility gives you breathing room to pay your core staff what they deserve.

Rethink your offerings

Instead of launching with a 40-item menu, focus on 10 to 15 dishes that are affordable to produce, easy to prep, and popular with customers. Apply good menu engineering by grouping dishes into categories based on their popularity and profitability. This helps you highlight best-sellers, adjust pricing on low performers, and decide which items to remove or promote. Think about ingredient overlap so you are not stocking different items that go bad quickly. This reduces food waste and keeps your costs lower without sacrificing quality.

Train smarter, not harder

Hiring fewer well-trained people is better than hiring more employees who feel lost. When your staff knows how to multitask, like a cashier who can also restock shelves or a line cook who can prep ahead during downtimes, you can keep your team lean and efficient.

Better yet, investing in strong onboarding and regular check-ins builds loyalty. Loyal employees mean less turnover. That saves you money because replacing an hourly worker can cost over $5,000 when you factor in recruitment, onboarding, and productivity loss.

Build in value-driven pricing

You do not have to offer rock-bottom prices to attract customers. People will pay a few dollars more when they know they are supporting a local business that treats its team fairly. Include a line on your menu or website that explains how your pricing helps cover livable wages. This kind of transparency can win you respect and repeat business.

Service charges can also help. For example, restaurants can add a 15-20% service fee that goes toward team compensation. Just make sure you explain it clearly to customers and staff alike.

Lean on Nebraska’s advantages

One benefit of doing business in Nebraska is that, aside from rising wages, it remains an affordable state overall. Commercial real estate, cost of living, and utilities are lower than in many coastal or metro areas. That frees up some room in your budget to be used where it counts, such as payroll.

You also do not have to worry about juggling different wage laws from city to city. Nebraska has one consistent statewide minimum wage, which simplifies your payroll setup. You do not need multiple pay structures across locations.

How businesses can stay compliant

A few years ago, staying compliant with wage laws was as simple as keeping a printed schedule, jotting down hours on a clipboard, and double-checking tip reports at the end of the week. That might have worked when wage rates were flat and teams were smaller. But with Nebraska’s minimum wage at $15 and federal labor rules demanding more detailed tracking, those old methods just don’t hold up anymore.

Use automated payroll systems to properly classify and pay staff

In the past, you might have tracked employee hours on a notepad and calculated pay by hand. This could work when wage rates were fixed and your team was small. But today, Nebraska’s rising minimum wage and federal labor rules make proper pay classification a non-negotiable. Misclassifying an employee or missing an overtime calculation could lead to serious trouble.

This is where an automated payroll system becomes essential. It helps ensure accurate classification between exempt and non-exempt workers, calculates pay based on actual hours worked, and flags overtime as it happens. It also keeps a clean, reportable record to back you up if your payroll practices are ever challenged.

Track tips accurately to stay compliant with Nebraska’s tip credit rules

Tipped workers might have once reported tips at the end of the shift on a slip of paper or with a verbal note. But in a tip credit state like Nebraska, that’s no longer enough. You’re required to ensure tipped employees actually earn the full minimum wage when tips are counted.

A tip management software does the math for you. It tracks tips by shift, compares the total against your state’s minimum wage, and alerts you if the employee’s pay falls short. It also keeps digital records that make audits easier and stress-free.

Protect your payroll with time clocking software that catches overtime early

Letting employees write down their clock-in times or verbally tell you their hours worked might have been the norm. But that method makes it easy to miss overtime, round incorrectly, or lose proof of hours during a dispute.

Using a time clocking software tracks punch-in and punch-out times to the minute. It alerts you when someone approaches 40 hours and ensures every worked hour, including overtime, is properly recorded and paid. It also gives you accurate reports that hold up in case of a wage law complaint.

Use scheduling software to document shifts and prevent compliance gaps

In the past, posting shifts on a whiteboard or handing out paper schedules may have worked fine until someone missed a shift, swapped without notice, or claimed they never saw their schedule. Undocumented shift history becomes a major liability when labor disputes or audits arise.

Modern scheduling software like 7shifts helps you stay compliant by keeping detailed logs of assigned shifts, employee acknowledgments, and real-time changes. These records serve as proof that employees were scheduled properly and fairly. It also helps you avoid accidental overscheduling or back-to-back shifts that might violate break or rest period guidelines.

Make your business thrive with a strong team

Nebraska’s minimum wage might feel like a stretch, especially if margins are tight. But it can also push your business to become more efficient and offer more value to the people you employ. Staff who feel fairly paid are more likely to stay, work hard, and represent your brand well.

So while you stay on top of the new numbers, also think big-picture. Pay is part of your company culture. And in Nebraska, businesses that adapt well will be the ones that thrive.

Also read: Nebraska tip laws for restaurants

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.