New Jersey remains a leading state for new businesses and startups, with nearly 80% surviving their first year. You’ve got access to New York markets without the NYC overhead, a dense population that loves to eat out, and strong support for small business funding. But with all that opportunity comes one key challenge: labor costs. And it starts with understanding how New Jersey’s minimum wage works in 2025.

What is the minimum wage in New Jersey?

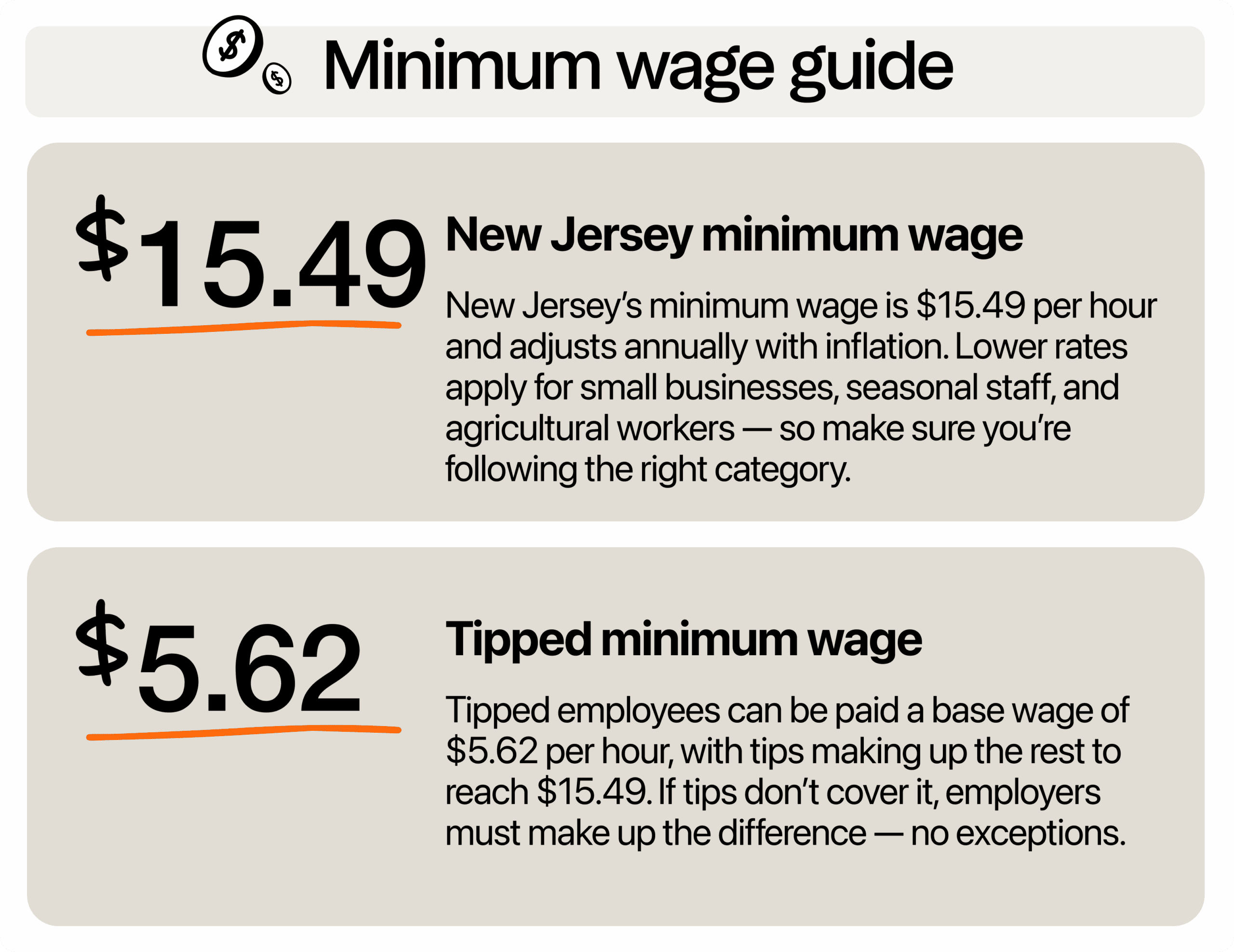

As of January 2025, the minimum wage in New Jersey is $15.49 per hour for most employees. This rate is indexed to inflation and is adjusted annually by the New Jersey Department of Labor.

There are separate wage rates for specific categories of workers:

- Tipped employees can be paid a cash wage of $5.62 per hour, with a maximum tip credit of $9.87. Employers must ensure that the combined cash wage and tips bring the employee’s total earnings to at least $15.49 per hour. If tips fall short, you are responsible for making up the difference.

- Seasonal and small employers, those with fewer than six employees, must pay at least $14.53 per hour in 2025.

- Agricultural workers must be paid at least $13.40 per hour this year.

It’s your responsibility to apply the correct rate depending on the classification of your workers.

What about youth workers and overtime?

If you hire youth workers under 18, New Jersey permits a training wage of 85% of the minimum wage for the first 120 hours of employment. That’s $13.17/hour for standard hires and $12.35/hour for small business or seasonal hires, during their initial training phase only.

Meanwhile, overtime kicks in after 40 hours/week, and must be paid at 1.5× the regular state minimum. For example, a line cook earning $15.49/hour would earn $23.24/hour for overtime hours. Restaurants with double shifts or late-night turnovers should use time-tracking tools to stay compliant.

Are there any local ordinances and city-specific rules to be aware of?

You won’t have to worry about different minimum wage rates across New Jersey cities. The base minimum is the same whether you’re in Newark, Trenton, or a boardwalk town along the coast.

However, while the minimum wage itself stays uniform, some cities have local labor ordinances and rights that go beyond the state’s general rules.

Take Newark and Jersey City, for example. These cities have their own earned sick leave policies that apply even to small restaurants. That means you need to track sick time carefully and make sure your employees know how to request it. If you’re used to winging it with verbal requests or informal time-off logs, it’s time to tighten up.

You might also run into local rules about scheduling. While New Jersey doesn’t mandate predictive scheduling at the state level, some cities are nudging toward stronger scheduling protections. If you’re calling in staff at the last minute to handle a rush, you’ll want to check whether that’s allowed or if you owe extra pay for short notice.

If you’re growing or opening a second location, take a moment to research that city’s ordinances. It’s a small step that can save you from major fines and keep your team running efficiently. Your best move is to sign up for email updates from your city’s labor office, connect with local restaurant associations, and use automated tools that help track changes and flag compliance issues.

What to expect and when wage updates are announced

Every fall, the New Jersey Department of Labor makes things official. By September 30, they announce the new minimum wage rates for the upcoming year, giving you a solid three-month head start to prepare your budget, update your payroll system, and rework your pricing if needed.

Most of the time, the yearly wage rate increases to somewhere between 3% and 5%, based on inflation data from the previous August. It’s not a wild guess, but it’s a reliable ballpark that helps you forecast better when planning your next year’s budget. So if you’re forecasting labor costs for the next year, use that range as a guide and start planning in early fall.

If you don’t want to keep checking manually, you can sign up for wage and labor law updates emailed to you by subscribing to the NJDOL legal notices page.

How New Jersey compares to nearby states

Neighboring states like New York and Pennsylvania show just how competitive this wage environment can be. In New York City, the state rate is $16.50 per hour. In upstate New York, it’s $15.50 minimum hourly. Meanwhile, Pennsylvania still uses the federal rate of $7.25, which gives New Jersey restaurants near the state border a hiring advantage but only if you’re offering more than the legal floor.

Keep in mind that job seekers know what their options are. If you’re offering $14.53 while a chain restaurant in Jersey City starts at $17 with benefits, it’s understandable why some applicants might lean toward the higher-paying option.

How to stay compliant without cutting corners

Wage enforcement in New Jersey is no joke. Missed overtime, mishandled tip credits, or poor recordkeeping can result in serious penalties. But here’s the good news: with the right tools in place, staying compliant doesn’t have to feel overwhelming.

Track tip credits accurately with the right tool

New Jersey is a tip credit state with specific tip laws, which means you can count tips toward meeting the minimum wage, but only if those tips bring your employee’s total pay up to the required rate. If not, you’re responsible for making up the difference.

A tip management software helps you track tips per shift, distribute pooled tips fairly, and ensure everyone reaches the required minimum. This also gives your staff clear, real-time access to their earnings.

Use scheduling tools to comply with local labor ordinances

Even though the Jersey state has one wage rate, NJ has cities with local labor rules, so managing shifts manually can lead to missed requirements. A scheduling software can help you set up guardrails around maximum shift hours, required breaks, and advanced notice periods. These tools also make it easier for an employer to prevent understaffing during peak hours or overstaffing when things are slow.

Automate your payroll to get wages and overtime right

Payroll mistakes are one of the fastest ways to land in legal hot water. Whether it’s failing to apply overtime correctly or miscalculating wages after a shift swap, small errors add up fast. A good payroll software lets you automate overtime calculations, properly apply tip credits, and run reports that make audits less stressful.

Strengthen team communication to support compliance

Good communication isn’t just about running operations efficiently, but it’s also part of staying compliant. When wage updates, schedule changes, or policy shifts aren’t communicated clearly, you risk misunderstandings that can lead to complaints or violations.

An employee engagement platform that handles announcements, shift updates, group chats, and even shout-outs can help you maintain transparency and keep your team in the loop. It builds trust, cuts down on errors, and makes it easier for you to document that key information was shared when needed.

Make your business thrive

New Jersey isn’t the cheapest state to run a food business, but it’s one where smart, prepared owners can still win. When you treat the minimum wage in NJ as part of your growth plan, not just a legal obligation, you create a workplace where people want to stay. The true advantage in food service is having a reliable team that understands their roles, cares for your guests, and gives guests reasons to keep returning. When that happens, your business doesn’t just stay afloat, it thrives.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.