If you’re running a restaurant, café, or bar in North Dakota, your payroll planning has likely remained fairly straightforward over the years. That’s because, much like Iowa and Louisiana, North Dakota uses the federal minimum wage as its baseline. But while simplicity might feel like a plus at first, it also brings hidden challenges in hiring, compliance, and retention, especially in an economy where neighboring states are stepping up their wage standards.

What is the minimum wage in North Dakota in 2025?

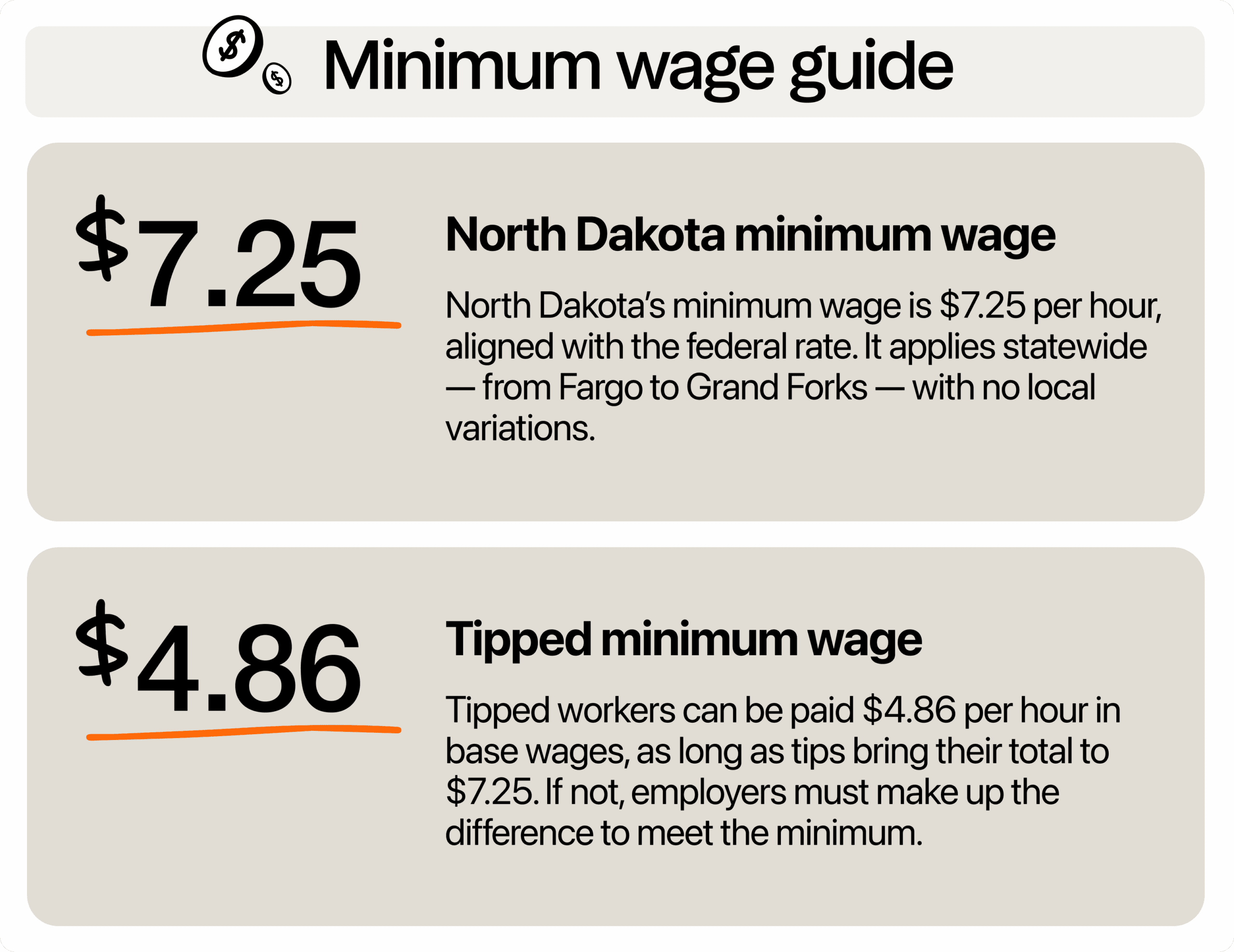

North Dakota’s minimum wage as of 2026 is $7.25 per hour, the same as the federal minimum. This applies across all industries unless your employees fall into a special category, like tipped workers or student learners.

There are no local city ordinances setting higher wage floors than the state minimum, so the rate is uniform across Bismarck, Fargo, Grand Forks, and everywhere else in the state. That simplicity can be a relief for businesses operating in multiple counties or cities.

What about tipped wages?

Restaurants, bars, and cafes run on the dedication of tipped employees such as servers, bartenders, bussers, and hosts. You can legally pay them a base wage of $4.86 per hour, so long as their total pay (wages + tips) reaches the $7.25 minimum. If it falls short, you must cover the gap.

Let’s say a server works 40 hours and earns $75 in tips. That’s only $1.88/hour from tips. Add $4.86/hour in base pay, and they’re still short of the $7.25/hour minimum. That means you’re responsible for paying the missing 51 cents per hour.

If you’re implementing tip pooling, you’ll need to understand local tip pooling laws. North Dakota allows tip pooling, but only among employees who regularly receive tips. That includes servers, bussers, and bartenders, but not back-of-house roles like dishwashers or line cooks, unless everyone in the pool is earning at least $7.25/hour before tips.

Are there any special wages for youth and students?

North Dakota follows federal rules when it comes to special wage categories. You’re allowed to pay workers under the age of 20 a training wage of $4.25 per hour, but only during their first 90 calendar days of employment. This introductory wage allows you to hire and train new workers with less pressure on your labor costs early on.

There’s also a wage option for full-time students and vocational learners, as long as they meet federal licensing requirements. In those cases, you can pay them 85% of the standard minimum wage. That comes out to $6.16 per hour. This rate is often used for part-time student positions in restaurants and cafes, particularly when balancing school hours with a flexible work schedule.

Overtime pay

North Dakota follows the Fair Labor Standards Act (FLSA), which means you also need to pay 1.5x the regular wage for all hours worked beyond 40 in a week. Most hourly workers are considered non-exempt. On the other hand, exempt employees, typically salaried supervisors, administrative roles, or executives, are not entitled to overtime, provided they meet specific duties and salary thresholds.

Misclassifying an employee can lead to fines and back pay, so it’s worth checking the FLSA’s exemption guidelines if you’re unsure. Additionally, North Dakota doesn’t impose daily overtime or double-time requirements, so the federal 40-hour rule is your benchmark.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Are there scheduled increases?

There’s no automatic cost-of-living adjustment to the North Dakota minimum wage. It remains tied to the federal rate unless state lawmakers vote to change it. In recent years, there have been proposals to increase it to $9.25/hour, followed by yearly $0.25 increases. So far, those haven’t passed. But that doesn’t mean they won’t.

You don’t want to be caught off guard. Smart business owners forecast future labor costs based on potential legislation. Planning ahead, even if it’s speculative, helps you adjust pricing, hiring, and operations gradually instead of making sudden and costly changes.

Why staying at minimum wage might be hurting your business

On paper, paying $7.25 per hour might help you keep labor costs predictable. But in practice, it can make it tough to compete, both within North Dakota and across nearby state lines.

The current cost of living in North Dakota is significantly higher than $7.25. According to the MIT Living Wage Calculator, a single adult needs around $19.78 an hour just to cover essentials like housing, transportation, and food. That’s more than double the federal minimum. Meanwhile, national chains and larger employers within the state are already offering $12 to $15 an hour to attract talent. If your wages fall too far behind, you risk losing good workers to competitors who simply pay more.

Now, look outside the state. Minnesota’s minimum wage is $11.41, while Montana’s is $10.85. If your business is near the border, this matters. A restaurant in Wahpeton might lose cooks and servers to a job just across the Red River, where the starting pay is higher.

The goal isn’t to match those numbers exactly, but your pay structure has to be competitive enough to keep people interested. That might mean rethinking your compensation package, not just base wage but also things like flexible scheduling, training, and growth opportunities. In a tight labor market, small advantages make a big difference.

How restaurants can budget for a competitive wage

Offering just $7.25 an hour may not cut it anymore, especially if competitors across state lines or down the street are paying more. If you’re losing solid candidates or struggling to keep your best people, your pay scale might be the problem. The good news? You don’t have to slash profits to offer a more competitive wage.

Audit your menu or product line

Start by applying menu engineering principles. Look closely at what you sell and how well each item performs. Are there dishes that consistently underperform, take longer to prepare, or rely on ingredients you rarely use elsewhere?

For example, if your diner offers a weekly special that needs a unique sauce or seasonal produce used in no other recipe, that item might be quietly draining your profit margin. Removing just one or two of those low-impact items could free up hundreds of dollars a month that can be redirected to payroll.

Recalibrate portions and upgrade the upsell

If customers often leave food uneaten, consider scaling back portions or offering more flexible serving sizes. A “half order” or “light” version option not only reduces food costs but may even appeal to health-conscious customers.

On the flip side, train your team to upsell smartly. Add-on items like a side of bacon, premium condiments, or featured desserts can boost ticket sizes without significantly increasing overhead. The extra margin from these small upgrades can offset the cost of offering higher base wages.

Get smarter with your schedule

In North Dakota, businesses can fluctuate with the seasons, especially if you’re near college towns or serve the tourist crowd in the warmer months. Smart scheduling is key. Rely on your POS or time clocking system to forecast busy vs. slow hours. Don’t schedule five people when three can handle it. But also don’t short-staff and risk burnout or bad reviews.

Even saving three to five labor hours per week can add up to hundreds over the course of a month. That cushion could be between paying $7.25/hour and $9/hour for your core staff.

Tap into local economic resources

If you’re trying to offer better wages but feel squeezed by a tight budget, there’s good news: North Dakota actually has your back. There are programs designed to help business owners like you train, grow, and hire, without footing the full bill.

For starters, check out the Workforce Innovation and Opportunity Act (WIOA). This program can reimburse you for up to 50% of an employee’s wages during their training period. That means you can bring in new talent, train them up, and still protect your payroll.

Another great tool is the New Jobs Training Program. If you’re creating at least five new full-time roles, you may be able to reclaim a portion of your state income tax withholdings to reinvest directly into those hires.

You should also check out the Department of Commerce’s grant programs, which include support for technical training, regional workforce development, and paid internships.

If you’re not sure where to begin, the North Dakota Small Business Development Centers (ND SBDC) offer free business advising and can walk you through what’s available.

Lastly, don’t overlook partnerships with local schools and workforce programs. These connections not only give you access to enthusiastic trainees, but sometimes even come with funding to offset onboarding or coaching costs.

What you can do to stay compliant

Even if you’re not in a position to raise wages right away, compliance can’t take a back seat. From how you track tips to how you build schedules, using the right tools and processes can help you follow wage laws while running a lean operation.

Make payroll compliance your baseline

Don’t take the simplicity of North Dakota’s wage law for granted. Keep accurate time records for all hourly employees. Use automated payroll software that tracks regular hours, tips, and overtime pay. This is especially critical in restaurants or bars where shift schedules and tip income can vary wildly from week to week.

You should also keep records of each employee’s hourly rate, hours worked, tips received, and any deductions for at least three years. This protects you during audits and ensures you stay on the right side of the law.

Use tip management tools for transparency

Since North Dakota allows tip credits, you need a reliable way to track and prove that your tipped employees are earning the equivalent of $7.25 per hour or more. A dedicated tip management software will help you log each shift’s tips, verify that servers meet wage thresholds, and generate reports you can show during inspections. These tools reduce compliance risks and help you maintain team trust by making sure no one is short on their earnings.

Build smarter schedules with data

Compliance doesn’t stop at just paying the right hourly rate. It extends to how you manage your employees’ time. Inconsistent scheduling can easily lead to unintentional overtime violations or missed break requirements. With the help of scheduling software, you can avoid overstaffing, burnout, and compliance gaps by aligning shifts with actual demand and ensuring fair labor practices.

These tools also allow employees to set their availability, request time off, or swap shifts. They help prevent payroll mistakes and support a workplace where time records are accurate, documented, and audit-ready.

Post required labor notices where staff can see them

You’re legally required to display updated federal and state labor law posters in a place your employees frequent, like a break room or by the time clock. These include details on wage rights, workplace safety, and anti-discrimination laws. You can download free versions from the North Dakota Department of Labor or download federal labor posters in PDF form from the U.S. Department of Labor’s poster page.

Keep good records and back them up

North Dakota employers are required to keep wage and hour records for at least three years. That includes timecards, pay stubs, schedules, and tip declarations. Make sure those records are stored securely, preferably both digitally and in printed form. If a labor dispute ever comes up, your best defense is solid documentation.

Is North Dakota still a smart place to start a business?

The short answer is definitely yes. It’s not just the low taxes, the minimum wage or the ease of registration. It’s the fact that this state continues to show up in national rankings as one of the best places to build something from the ground up.

In 2024, Forbes ranked North Dakota the #1 state to start a business—and for good reason. ND’s startup costs are low, survival rates are high, and the process of launching is straightforward. Nearly 77% of businesses in the state survive their first year, which is higher than the national average.

When it comes to the consumers’ spending power, the per capita personal income in the state was approximately $70,966 in 2024, ranking fifth to seventh highest among all states, and just slightly below the U.S. average of around $72,400.

In other words, North Dakota gives you room to grow. When your customers have spending power and the local economy supports small business success, you’re in a great position to offer better wages, attract strong talent, and build something sustainable.

Growth happens when you plan smart

North Dakota may follow the federal minimum, but that doesn’t mean you’re limited. With steady laws, low startup costs, and customers who can afford to spend, you’re in a strong position to do more than meet the baseline. Offering better pay isn’t just good for your team, but it’s good for business.

You’re building in a state that values small business success. Take advantage of it.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.