More entrepreneurs are choosing Pennsylvania as the place to launch or grow their business. With small businesses accounting for 99.6% of all businesses in the state and employing nearly half of the private workforce, the environment is proving fertile for opportunity.

But even with the great potential, one area that deserves your full attention is wage compliance. While the state’s minimum wage law hasn’t changed in years, ignoring it or underestimating its broader impact can be risky.

What is the minimum wage in Pennsylvania

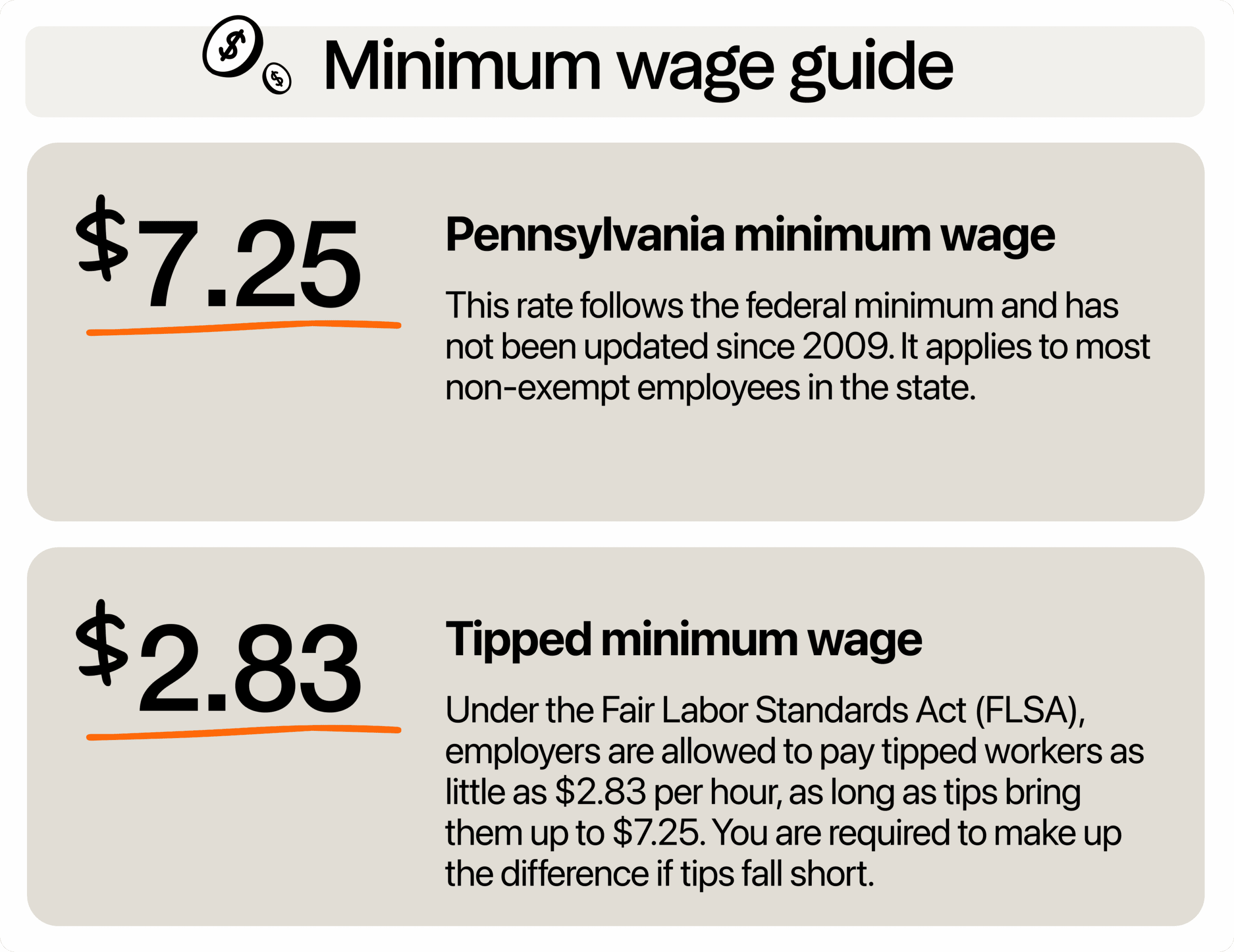

As of 2026, the minimum wage in Pennsylvania is $7.25 per hour. This rate follows the federal minimum and has not been updated since 2009. It applies to most non-exempt employees in the state. While some states have moved forward with increases, Pennsylvania remains one of the few that still adhere to the federal baseline.

For business owners, this means that you are legally allowed to pay workers the said rate per hour. But keep in mind, just because it’s legal doesn’t mean it’s competitive. Many employees today consider that rate outdated and insufficient for basic living expenses.

What about tipped employees?

If you own a restaurant, bar, or cafe, you’re likely using the tip credit system. Under the Fair Labor Standards Act (FLSA), employers are allowed to pay tipped workers as little as $2.83 per hour, as long as tips bring them up to $7.25. You are required to make up the difference if tips fall short.

Say a server only earns $3 in tips during a slow shift. You’re on the hook for the remaining $1.42 to meet the minimum wage requirement. Failing to track this accurately can lead to wage violations and potential legal trouble.

Also read: Pennsylvania tip laws for restaurants

You also must provide clear notice to your tipped employees that you are taking a tip credit. This needs to be documented, not just mentioned verbally.

Youth workers and training wages

Pennsylvania mirrors the federal rules here. Workers under 20 years old can be paid a training wage of $4.25 per hour for their first 90 consecutive calendar days of employment. After that period, you must bump them up to the full $7.25 minimum.

Some employers try to game this by firing young workers before the 90 days are up to avoid the pay hike. Don’t go down that road. It’s unethical, and if it becomes a pattern, it can be seen as wage law evasion.

Overtime rules

Even if the minimum wage hasn’t moved, overtime rules are still in full force. In Pennsylvania, as with federal law, any hours worked beyond 40 in a workweek must be paid at 1.5 times the regular hourly rate. If your employee earns $7.25 per hour, their overtime pay should be $10.88 per hour.

Don’t forget that misclassifying employees as exempt when they’re not actually eligible can get you into trouble. Exempt employees must meet strict criteria around job duties and salary thresholds. If someone clocks in and out like an hourly worker and doesn’t have managerial responsibilities, odds are they aren’t exempt.

Does PA have local ordinances?

Pennsylvania does not allow local governments, such as counties or cities, to set their own minimum wage rates. The state law preempts local wage legislation, meaning all employers across the state must follow the same baseline: the federal minimum of $7.25 per hour.

This statewide uniformity might simplify compliance, but it also removes flexibility for local jurisdictions that want to raise wages based on cost of living or labor market conditions. If you’re doing business in Pennsylvania, you won’t have to navigate a patchwork of city-specific wage rules. But at the same time, you’re working within a flat statewide structure that hasn’t changed in more than a decade.

Why sticking to $7.25 puts your business at a disadvantage

Pennsylvania sits in the middle of a region where higher minimum wages have become the norm, not the exception. Neighboring states like New Jersey, Maryland, Delaware, and New York are offering minimum wages that are nearly double, or even more than double, Pennsylvania’s minimum wage rate.

Even states like Ohio and West Virginia, which are typically slower to increase wages, have surpassed Pennsylvania, offering $11 and $8.75, respectively. If you’re operating near the border, you’re not just competing with other Pennsylvania businesses. You’re also going head-to-head with employers who are paying far more for the same kind of work. That can make it difficult to attract and keep quality staff.

You don’t have to match other states overnight, but adjusting your rates into the $10 to $13 range can make a big difference. That extra few dollars per hour can be the deciding factor for job seekers who might otherwise look across state lines. Candidates pay attention to wages. They compare their options. And many are willing to travel farther if it means a better paycheck.

As a matter of fact, more and more Pennsylvania businesses are choosing to pay above the legal minimum wage even without a requirement to do so. A recent statement from State Senator Dan Laughlin notes that “most employers in Pennsylvania are already paying above minimum wage because they have to in order to attract workers.” Making the voluntary move toward higher pay isn’t just about doing the right thing; it has become a practical necessity in many industries.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Are there efforts to increase the minimum wage in PA?

Yes, Pennsylvania is actively debating proposals to raise its minimum wage in 2025 and beyond.

For example, Senate Bill 19, introduced in April 2025, would have raised the minimum wage to $15/hour statewide beginning in 2026, include cost-of-living indexing, and remove the preemption that prevents local minimum wage laws. However, it remains under legislative consideration and has not been enacted.

And last June 2025, the Pennsylvania House passed House Bill 1549, which proposes a tiered increase based on county size. Under this plan, Philadelphia would see its minimum wage rise to $15/hour starting January 2026. Seventeen other populous counties would reach $12/hr in 2026, $13 in 2027, and $15 in 2028. The remaining counties would grade up from $10/hr in 2026 to $12/hr by 2028.

Tipped employees would earn at least 60% of their county’s minimum wage. From 2029 onward, wages would automatically adjust annually according to inflation. But this also has not been enacted.

What this means for you as a business owner

You can continue to legally pay the current state minimum since no change has been signed into law. But several bills are now in play, and a change could happen, depending on how negotiations in the Senate progress.

Preparing early is wise. If you’re in a larger county, you may want to plan for a possible increase toward $12–$15/hour based on House Bill 1549 schedules. If the Senate Bill 19 moves forward, a state‑wide rise toward $15 could be on the horizon. Either way, it may be smart to implement phased wage increases or revised hiring benchmarks now to avoid a sudden cost shock later.

How to stay compliant with Pennsylvania wage laws

Pennsylvania’s minimum wage laws may look straightforward, but staying compliant requires more than just knowing the state minimum.

Use tip management software to avoid missteps

Pennsylvania is a tip credit state, so monitoring the tips is important. A tip management software simplifies this process. It tracks tips in real-time, calculates whether your employees are meeting the minimum threshold, and flags any shortfalls so you can correct them immediately. It also provides documentation you’ll need if a dispute or audit arises.

Use scheduling and time clocking software to maintain accurate records

Staying compliant with wage laws means keeping clear, accurate records of when employees are working and how much they’re earning. A time clocking software helps ensure that shift start and end times are logged, breaks are properly tracked, and any unauthorized overtime is flagged before it becomes an issue.

These systems often include automated alerts when staff approach 40 hours, restrictions to prevent early clock-ins, and digital logs that integrate with payroll software. This minimizes the risk of human error, ensures overtime is paid correctly, and gives you a clean digital record if you’re ever audited.

Post notices and keep documentation

Wage compliance also includes proper communication with your employees. The law requires you to display current federal and Pennsylvania labor law posters in a common area visible to all employees. This includes notices about minimum wage, overtime, and tip credits.

Smart wages shape stronger businesses

Pennsylvania’s wage laws may look straightforward on paper, but succeeding in this state takes more than legal compliance. It takes awareness, adaptability, and a willingness to meet the labor market where it is, not where it used to be. If your goal is to build a team that sticks around and customers who keep coming back, then paying fairly, scheduling wisely, and investing in your staff are moves worth making.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.