If you’re looking to open a food business, like a restaurant or a cafe, in somewhere that supports growth, South Dakota makes a strong case. According to the Small Business Profile from the U.S. Small Business Administration Office of Advocacy, between March 2023 and March 2024, over 3,800 new businesses opened here, while tourism alone pumped in more than $5 billion last year. That kind of spending power means more people eating out, more orders, and more opportunity for you to grow. That brings us to something you’ll want to plan for from the start: South Dakota’s minimum wage.

Getting familiar with the basics now means fewer surprises later, especially in a state like South Dakota, where the rules are straightforward but still require your attention.

What is South Dakota’s state minimum wage in 2026?

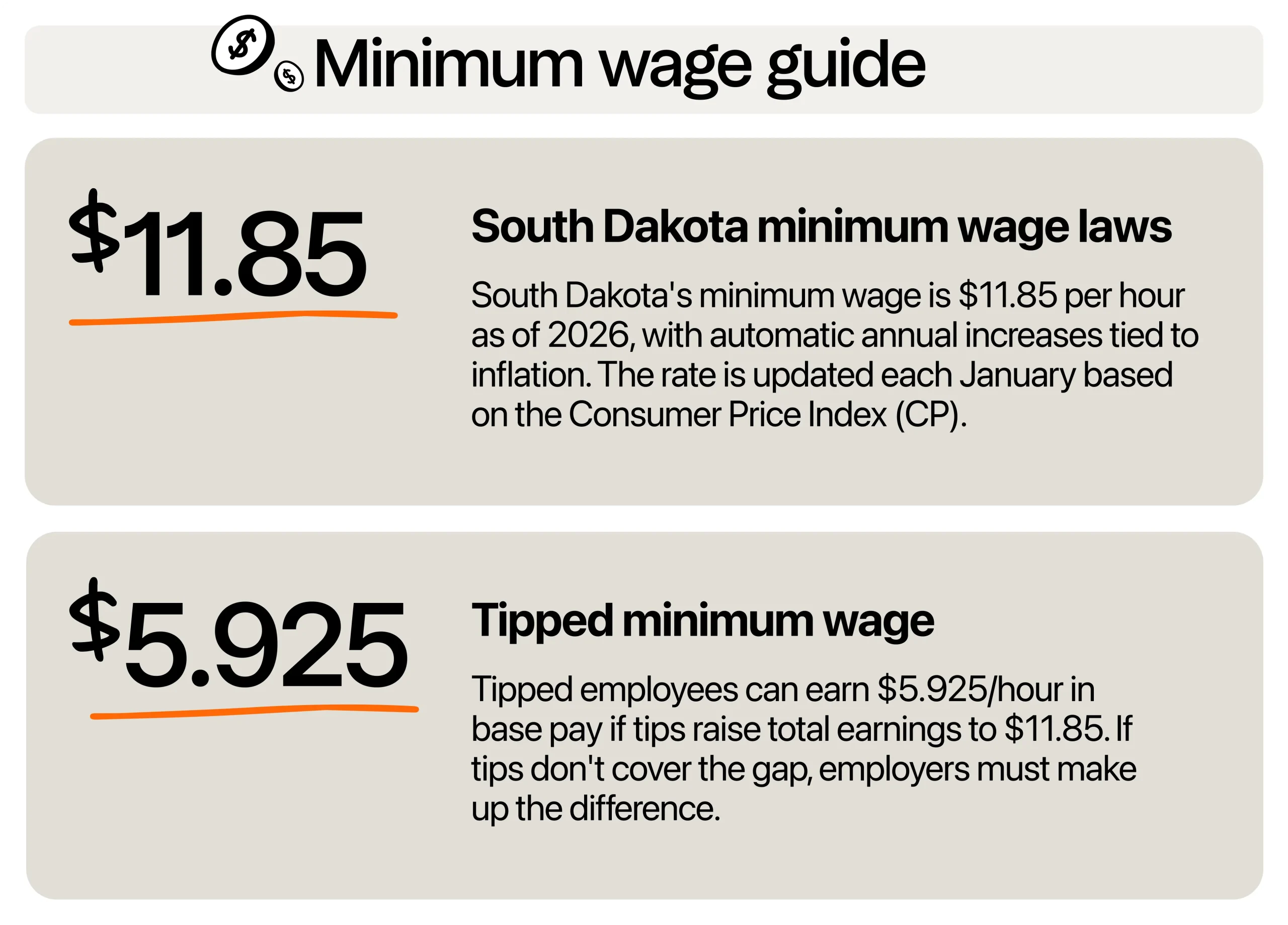

As of January 2026, the South Dakota minimum wage is $11.85 per hour—up from $11.50 in 2025. South Dakota adjusts its minimum wage every year based on the cost of living, using the Consumer Price Index (CPI) as the benchmark. So, while there is no legislative back-and-forth to worry about, you do need to keep an eye on the annual adjustments.

For tipped workers, the minimum wage is set at $5.925 per hour in 2026. You can apply a tip credit, but only if your employee earns enough in tips to bring their total hourly compensation to at least $11.85. If their tips fall short, you’re required to make up the difference.

Are there special rates for youth or training wages?

South Dakota follows the federal “opportunity wage” rule, which allows for a lower youth wage in certain situations. If you’re hiring workers under the age of 20, you can pay them $4.25 per hour for the first 90 consecutive calendar days of their employment. This gives you room to train new employees without blowing your budget.

But after those 90 days, they must be bumped up to at least the state minimum.

There’s no special training wage beyond that, so any interns, part-time help, or seasonal employees must be paid according to the standard wage laws unless they fall under a very narrow set of exemptions.

What about overtime pay?

South Dakota follows the federal rules under the Fair Labor Standards Act (FLSA). That means you need to know whether your employees are classified as exempt or non-exempt. Non-exempt workers like your servers, cooks, and dish staff have the right to be paid 1.5 times their hourly rate for every hour worked beyond 40 in a workweek. For example, if your cook earns $11.85 and works 45 hours, those 5 extra hours must be paid at $17.775 each.

Exempt employees, usually salaried managers or administrative staff, don’t qualify for overtime, but they must meet specific salary and job duty tests. Keep in mind that misclassifying someone as exempt when they’re not could land you in trouble with back pay or penalties, so it’s worth double-checking if you’re unsure.

Are there local wage ordinances?

One of the advantages of doing business in South Dakota is consistency. Unlike states that allow cities or counties to set their own minimum wage, South Dakota keeps it simple. No matter where your business is, Sioux Falls, Rapid City, Brookings, Aberdeen, or any smaller town, you’re working with the same baseline wage: $11.85 per hour for non-tipped workers and $5.925 for tipped workers. There are no local ordinances that override the state minimum wage.

This uniformity helps you cut down on compliance headaches. You won’t have to track multiple rates, adjust payroll per location, or stay on top of city council decisions that could change wages overnight. This brings peace of mind and lower administrative costs for businesses with multiple locations or plans to expand within the state.

How does South Dakota compare to its neighbors?

When you evaluate South Dakota’s minimum wage of $11.50 per hour in the context of nearby states, it becomes clear that the state is positioned to offer both cost stability and competitive recruitment power. North Dakota, for instance, remains at the federal rate of $7.25. While that may appeal to those looking to keep labor costs low, it can be a disadvantage when trying to draw and retain quality workers, especially in regions close to the border where better-paying jobs in South Dakota may lure talent away.

Minnesota, on the other hand, has a 2026 minimum wage of $11.41 for all employers, with no distinction between business sizes. While this rate is close to South Dakota’s, Minnesota carries stricter labor compliance requirements that can slow down operations or increase administrative workload. South Dakota offers nearly the same pay with a more streamlined regulatory environment.

Iowa, like North Dakota, still follows the federal minimum of $7.25. Again, that may look like a cost-saving opportunity, but consider whether you’ll be able to hire and keep workers long-term when nearby South Dakota businesses are offering significantly more per hour.

Now, Nebraska is a different story. With its 2026 minimum wage sitting at $15.00, it’s clearly committed to moving wages upward. If you’re opening a business there, you’ll need to prepare for higher payroll costs from day one. But in return, you may also find a stronger talent pool and customers with more disposable income, something that could support higher pricing and a broader service offering.

So, where does South Dakota fall in this mix? Right in the middle. It’s not the cheapest state to operate in, nor the most expensive, but it offers a predictable wage structure with fewer bureaucratic hurdles. If you’re trying to attract a strong workforce without being buried in compliance paperwork or overpaying for entry-level roles, South Dakota may be exactly the environment your business needs. For many, it’s the sweet spot.

How businesses can stay competitive with wages without breaking the bank

South Dakota’s minimum wage may be predictable, but that doesn’t mean competition for talent is easy. Finding great people who will stick around, without your labor costs eating into your profits. But how do you stay cost-effective while still being attractive to workers?

Use a pay structure

You don’t have to raise wages across the board to be competitive. Instead, be smart with how you offer increases. Maybe new hires start at $11.85, but if they show up on time for 30 days, they’re bumped to $12. That creates a clear path without immediately inflating payroll.

You can also tie raises to responsibilities like closing duties or food safety training.

Make the schedule part of the benefit

A reliable, flexible schedule is something many workers value just as much as pay. If you can offer consistent hours or let staff pick shifts in advance, that’s a win. You can also reduce burnout by avoiding short-notice changes, which keeps morale up and turnover down.

A scheduling software can help you get there. With it, you can post shifts ahead of time, let employees swap or pick up shifts easily, and cut down on last-minute adjustments that cost you time and money.

Be smart with your menu

If you want to keep wages competitive without raising your labor budget too high, start by looking at your menu. Menu engineering helps you focus on items that are profitable, fast to prepare, and less likely to result in waste.

Cut back on slow-moving or high-cost dishes and double down on meals that bring in margin. The money you save here can be redirected to payroll. That way, you can afford to offer better pay or perks while still keeping your costs in check.

Highlight total compensation.

Remind your team (and your applicants) that minimum wage is just one part of the package. Do you offer free meals, shift drinks, or early clock-out bonuses? Even small perks add up. If you can’t offer health insurance, maybe you can provide paid birthday leave or split tips evenly. Whatever it is, make sure people know.

Don’t wait to address problems

If a worker comes to you frustrated about hours or pay, listen and adjust where possible. You don’t need to overhaul your business. You just need to show that you care. Word travels fast in the restaurant world, and how you treat your people is part of your brand.

Staying labor compliant in South Dakota

In South Dakota, where the minimum wage changes every year, staying compliant with the wage law is more than just good practice. It protects you from penalties, lawsuits, and surprises in payroll.

Track tips and wages the smart way

South Dakota is a tip credit state, which means tip tracking is not optional. To avoid costly mistakes or gaps in pay, use a digital tip tracking system that logs earnings per shift. It saves you time and protects you if there’s ever a wage complaint or audit. You can’t just guess or assume. Having clear records proves you’re doing it right, and your team will appreciate the transparency.

Use timeclock and scheduling tools that actually work

If you have part-timers, shift swaps, or rotating staff, then time-tracking by hand or text message isn’t going to cut it. A good time clock software lets you assign shifts, log hours, and monitor break times all in one place.

This becomes even more important if you’re hiring minors. Federal rules limit how many hours they can work, and if they go over, you’re on the hook. Automating your scheduling helps you avoid accidental violations.

Plan for the January bump

South Dakota’s minimum wage is adjusted annually with increases every January based on the cost of living. Even if the increase is just 30 or 40 cents, that adds up over time, especially if you have five, ten, or twenty employees on payroll.

Build the projected increase into your budget now. If you start planning ahead in Q4, you won’t feel blindsided when the new year hits. It also helps you update menus, service pricing, or staffing levels in advance instead of scrambling.

You can stay updated on wage changes and other information by checking the South Dakota Department of Labor website each fall. They typically announce the new rate for the coming year by October. Bookmark the page, set a reminder, or sign up for email alerts if they offer it. The earlier you know, the better prepared you’ll be to adjust your business plans.

A capable team leads to a successful business.

Paying minimum wage in South Dakota is not just about meeting a legal threshold. It’s about laying the foundation for a strong team and a thriving business.

Remember, your workforce is your backbone. Pay them fairly, follow the rules, and you’ll likely find that South Dakota is a place where your business doesn’t just survive but grows.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.