If you’re thinking about launching a business in Texas, you’re looking at one of the most entrepreneur-friendly states in the U.S. With its low taxes, strong economy, and no state income tax, it’s easy to see why so many people are choosing to build their dreams here. In fact, according to business reports, Texas was considered the best state for business growth despite economic uncertainty.

But while Texas rolls out the red carpet for business owners, there are still some baseline rules you need to know, like how much you’re required to pay your employees. Since the state lacks a minimum wage law, the federal government’s regulations are typically followed.

How Texas’ minimum wage works in 2026

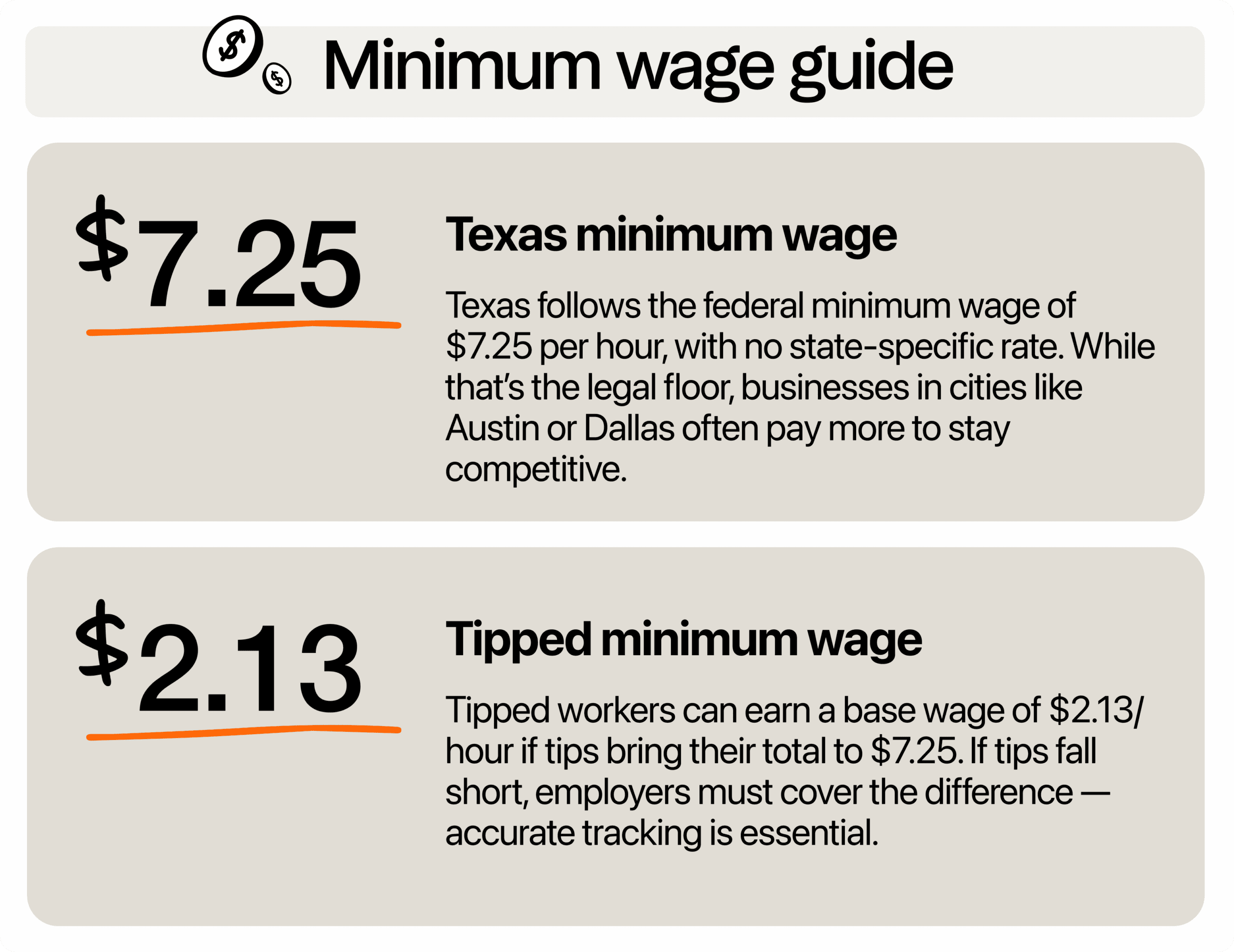

Since Texas mirrors the federal rate, you’re legally allowed to pay $7.25 an hour to most of your employees. That said, your business might need to pay more depending on your location or industry, especially if you want to attract top-notch talent.

If you’re in a city like Austin or Dallas, where living costs are a bit steeper, and job opportunities are plentiful, you’ll probably find that offering more than the minimum helps you build a stronger, more loyal team. Competitive pay isn’t just about staying compliant, but it’s about staying relevant and appealing as an employer.

Now, if you run a restaurant or bar and employ tipped workers, the rules are a little different. You can pay a base wage of $2.13 per hour, as long as their tips bring them up to at least $7.25 per hour. If their tips fall short, you’re responsible for making up the difference. It’s not optional, and it’s something you’ll want to stay on top of through careful payroll tracking.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Exceptions and special rules

The Fair Labor Standards Act (FLSA) recognizes that not all jobs and situations are the same, so there are a few exceptions where workers can be paid less than the standard $7.25 per hour in Texas. These exceptions are quite specific, and you’ll want to be sure you understand the details before applying any of them in your business.

- Student learners enrolled in vocational education programs may be eligible for a subminimum wage. This helps students gain experience while employers save on labor costs.

- Full-time students working part-time in certain industries, like retail, service, or at their own educational institutions, can be paid 85% of the federal minimum wage under specific conditions. It’s designed to encourage hiring students who are juggling school and work.

- Workers with disabilities may qualify for a lower wage if the employer obtains a special certificate from the U.S. Department of Labor. This provision exists to promote inclusive employment opportunities, though it comes with strict oversight.

- Tipped employees, such as servers or bartenders, have a different pay model. You can legally pay them a base wage of $2.13 per hour, provided their tips bring them up to at least $7.25 per hour. If tips fall short, you must make up the difference.

If you think your business might qualify to apply any of these wage rules, don’t just assume. Double-check with official sources such as the Department of Labor. Staying compliant keeps you protected and helps build trust with your team.

How does the state’s minimum wage compare?

Texas is on the lower end nationally. There are 30 states (plus D.C.) that have moved to increase their minimum wage above the federal rate. Many are even on track for $15+ per hour. But Texas has held steady at $7.25 for over a decade.

On the bright side, this keeps payroll costs lower, which can be a huge help for new businesses trying to manage startup expenses. But it also means you might have to compete a little harder to attract and retain workers, especially in high-demand industries.

Plenty of Texas employers already pay above the minimum, not because they have to, but because they know it helps reduce turnover, boost morale, and improve productivity. It’s not just about doing the right thing, but it’s good business.

Can the state raise its minimum wage?

Yes, Texas has the authority to raise its minimum wage, but it hasn’t exercised that option. The state continues to follow the federal minimum wage of $7.25 per hour, which has remained unchanged since 2009. While some local governments like Austin and Dallas have made efforts to increase wages, those changes only apply to city employees or public contractors. They do not affect private businesses, which must still comply with the federal minimum.

Still, the topic of raising wages continues to be debated. Worker advocacy groups, local coalitions, and nonprofit organizations regularly campaign for higher pay, arguing that $7.25 is no longer enough to support basic living expenses. According to the MIT Living Wage Calculator, a single adult in Texas without children needs to earn about $21.82 per hour just to cover basic needs as of 2025. That’s almost three times the current minimum wage.

Even without a statewide mandate, many Texas businesses are already offering more than the minimum. And it’s not only for goodwill. When you pay your staff better, you’re more likely to attract skilled workers, reduce turnover, and build a positive workplace culture. In competitive industries like food service and retail, sticking to the bare minimum might save money in the short term, but it can hurt your business in the long run.

So while the legal minimum hasn’t moved, the market often tells a different story. Choosing to pay more is a smart way to stay ahead and keep your business thriving.

Why do many Texas businesses pay more than the minimum wage

You might be wondering why some businesses go beyond the legal minimum when they’re not required to. After all, $7.25 is the standard rate, and that’s what Texas law follows. But here’s the thing: paying more than the minimum often isn’t just the right thing to do. It’s smart business.

Attracts stronger candidates

Offering competitive wages helps you attract stronger candidates. When job seekers compare opportunities, they aren’t just looking at job titles. They’re comparing pay. So when your business offers more than $7.25 per hour, you’re more likely to pull in candidates who are reliable, experienced, and ready to contribute right away. Better workers mean better service, fewer training headaches, and less time spent on hiring.

Reduces turnover

Higher pay can also reduce turnover. Constantly replacing employees eats up time and money. According to the Work Institute’s 2023 Retention Report, the cost of employee turnover is estimated at approximately 33% of an employee’s annual salary. That means if you’re regularly paying $7.25 per hour, but constantly rehiring, you’re not saving as much as you think. Paying $10 or $12 per hour instead might sound like more upfront, but it can be more sustainable in the long run.

Increases employee morale

When people feel like they’re being paid fairly, they tend to work harder and stay longer. They show up on time, engage with customers, and help keep operations running smoothly. That kind of consistency is tough to beat.

Also, in some industries, especially hospitality and retail, offering more than the minimum wage is necessary just to stay competitive. In cities like Austin, Houston, and Dallas, where the cost of living has gone up significantly, many employers voluntarily pay higher rates because it’s the only way to fill positions and stay operational. Additionally, the average living wage in Texas hovers well above the minimum, especially in urban areas.

If you’re worried about costs, tools like 7shifts help make it easier to find balance. These platforms let you track labor expenses, forecast payroll needs, and fine-tune scheduling so you can offer better pay without breaking the bank.

Raising wages may feel like a big decision, but for many Texas business owners, it turns out to be a good one. It helps build a stronger team, keeps customers happy, and saves you from the costly cycle of constant hiring. Paying more than the minimum might just give your business the edge it needs.

How to stay compliant with the laws on minimum wages

Running a business in Texas means staying on top of both state and federal wage requirements. While the rules aren’t overly complicated, ignoring them can lead to fines, audits, or worse, legal trouble that slows your momentum. The good news is that staying compliant doesn’t have to be difficult if you know what to watch for.

Post the required wage notice

Start with the basics. You need to post the current federal minimum wage notice in a visible area where employees can easily see it. Break rooms, time clock areas, and employee entrances are all good spots. You can download a free, printable version from the U.S. Department of Labor website.

Keep accurate records

Accurate recordkeeping is the next important thing to do, and it’s not something to brush off. You’re expected to keep payroll records that show hours worked and wages paid, and you should hang on to those documents for at least three years. This includes timesheets, tip reports, and any overtime calculations. If you’re ever audited or an employee files a complaint, these records are your protection.

Monitor tipped employee earnings

If you employ tipped workers, make sure you’re checking that their total earnings, including tips, meet or exceed $7.25 per hour. You’re allowed to pay a lower base wage of $2.13, but only if tips make up the difference. If they don’t, it’s your responsibility to add the missing amount.

To make this process easier, you can use tools like 7shifts’ tip management software, which helps track and distribute tips accurately while keeping everything compliant and transparent. Running regular checks and keeping clear records goes a long way in preventing issues later on.

Avoid worker misclassification

Now, when it comes to interns, contractors, and other nontraditional roles, misclassifying workers is a common mistake, and one that can cost you. Independent contractors must meet strict criteria to stay outside of employee classification. If they act like employees, like working scheduled shifts, following your instructions, or relying solely on your company for income, they might legally count as employees and must be paid accordingly.

Know the rules for interns

The same goes for interns. Unless you’re following Department of Labor guidelines for unpaid internships, which are usually tied to educational programs, most interns should be paid at least minimum wage. The safest approach is to review each position carefully and ask your legal advisor or HR platform to weigh in.

Double-check youth and student wage rules

Lastly, don’t forget to double-check wage compliance for youth workers or students. Texas and federal law allow for some exceptions, like the $4.25 training wage for workers under 20 during their first 90 days, but those exceptions have time limits and conditions.

For easier compliance, consider using digital tools built for full-service restaurants, cafes, or others that can handle scheduling, payroll, and wage tracking in one place. These tools can help small businesses stay organized, avoid errors, and prevent underpayment issues.

Is there a possible increase in the minimum wage in Texas?

As of now, there’s no major push at the state level to raise the minimum wage. However, things can change, and cities like Austin and Houston are always exploring new ways to support their workers.

Local initiatives are making strides to improve wages for workers. For instance, Harris County has approved a significant wage increase for county employees and contractors. Starting May 2025, county employees will earn a minimum of $20 per hour, and from July, contractors will receive at least $21.65 per hour. This move aims to address rising living costs and promote economic and racial justice.

In Houston, hospitality workers are advocating for a $23 minimum wage, citing the city’s booming tourism industry and the need for wages that reflect the cost of living. City Council members have expressed support for these efforts, recognizing the essential role these workers play in the local economy.

These local actions demonstrate a growing recognition of the need for higher wages, even in the absence of state-level changes. As a business owner, staying informed about these developments can help you make competitive and fair compensation decisions.

Stay compliant with Texas laws using 7shifts

Wage laws may be complex, but 7shifts makes restaurant compliance easy with:

- Overtime alerts when employees approach daily or weekly thresholds

- Break compliance reminders to ensure meal and rest periods are provided

- Clopen prevention to protect employee well-being and avoid scheduling violations

- Multi-location wage tracking that automatically applies the correct local minimum wage

- Tip management tools built for specific tip credit rules

Save money and avoid penalties with proactive alerts that catch issues before they become violations. Start a free trial with us today!

Texas-sized opportunity starts with fair pay

The minimum wage may be the legal floor, but it doesn’t have to be your limit. Offering more than the bare minimum can lead to bigger returns. Higher pay attracts better people, builds loyalty, and positions your brand as one that values its team. And with 7shifts helping you simplify your workforce management and forecasting, paying more doesn’t have to mean stretching your budget thin. With features such as labor cost tracking, demand-based scheduling, tip management, and integrated payroll insights, 7shifts makes it easier to stay on top of both staffing and budgeting.

Remember, when you invest in your people, they invest right back into your business.

Other Texas restaurant resources:

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.