Starting a business in Virginia puts you in a strong position. The state continues to offer plenty of promise with its solid economy, growing communities, and active tourism sector. In fact, Virginia’s restaurant industry alone is expected to bring in about $6.4 billion this year. That’s a clear sign that opening a bar, café, or restaurant, or finding a job in these industries, could be a smart move this year. This strong business environment is directly connected to Virginia’s minimum wage policies, which are designed to support workers while giving businesses a predictable framework for planning.

What is Virginia’s minimum wage?

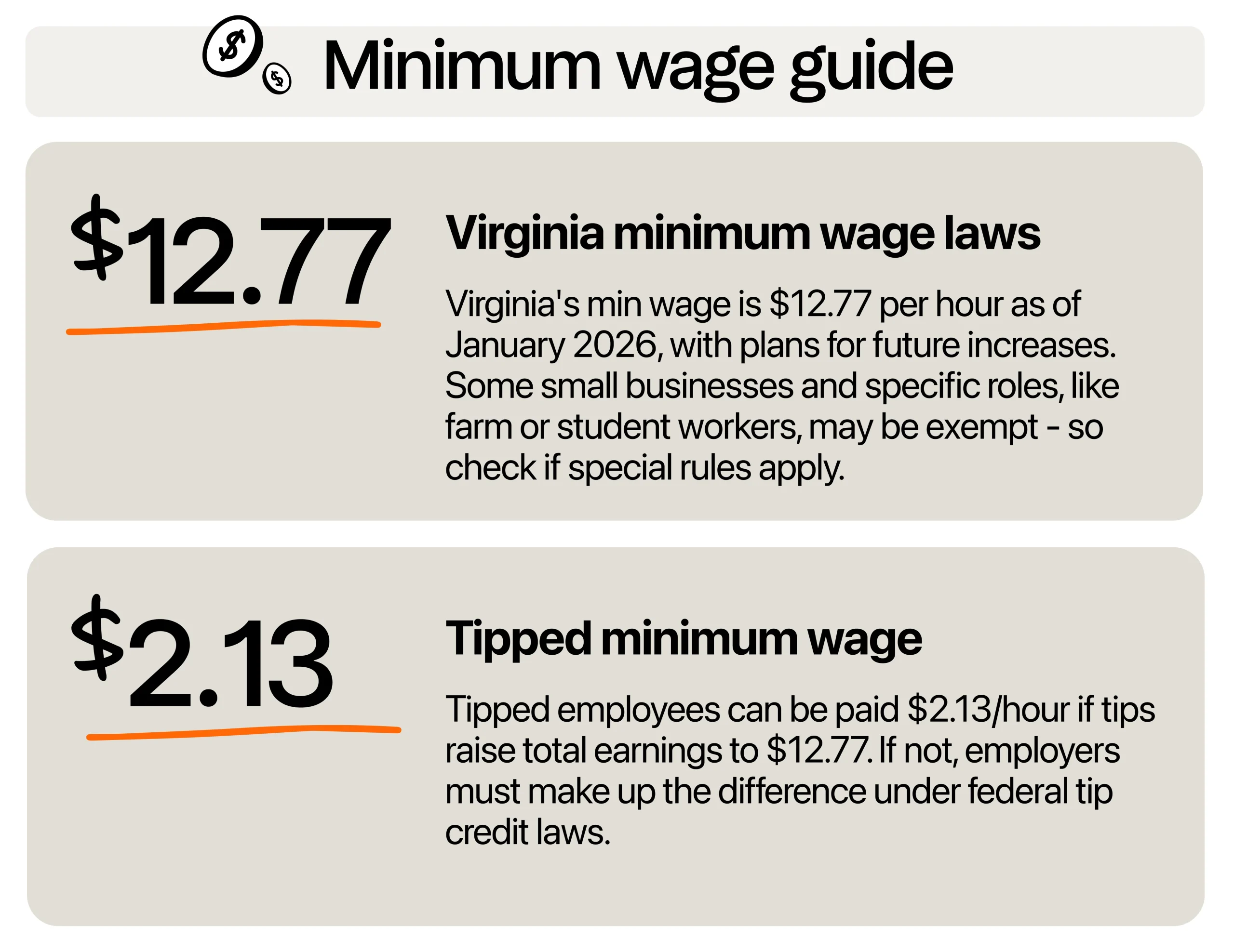

As of January 2026, the Virginia minimum wage stands at $12.77 per hour. This figure is part of a plan to gradually raise wages to help workers better manage the cost of living. If you’re a business owner, this gives you a solid reference point for setting wages, planning your budget, and staying competitive in hiring. Offering fair pay can help you attract dependable employees and keep them on your team.

It’s important to note that some exceptions still apply. Small businesses with fewer than four employees, certain farm jobs, and some part-time student positions may follow different rules. When you are unsure, it is wise to check with the Virginia Department of Labor and Industry to be sure you are on the right track with the Virginia laws.

Who does this apply to?

The minimum wage applies to most employees in Virginia, including your hourly team members, kitchen staff, and front-of-house workers. It covers nearly all industries where hourly or non-exempt employees work.

However, there are some exceptions and unique rules you should know about. Small businesses with fewer than four employees are generally exempt. Certain farm workers, domestic workers employed in private homes, and students working part-time in bona fide educational programs also fall under different rules.

Seasonal and temporary workers may have special conditions depending on the type of work they do and the time of year. For example, minors are subject to child labor laws that limit their working hours and prevent them from performing certain tasks.

If you are unsure how the law applies to your team, it is always a smart idea to check with the Virginia Department of Labor and Industry or consult with a local employment attorney. Taking time to understand these details helps you avoid mistakes, protect your business, and stay compliant with state regulations.

How to stay compliant with Virginia’s minimum wage changes

Keeping up with Virginia’s minimum wage changes doesn’t have to be stressful. In fact, with the right habits, you can stay compliant, support your team, and keep your business running.

Post required wage notices

Make sure you have the current federal and Virginia minimum wage notices posted in a spot where employees can see them easily. Break rooms, timeclock areas, or employee entrances work well. You can download free, printable versions from official websites. This simple step helps you stay in line with the Virginia law and keeps everyone informed.

Keep a close eye on tipped wages

If you have tipped workers, it’s smart to check payroll reports regularly. Tipped minimum wage is technically $2.13 per hour, but you need to make sure they’re earning at least $12.77 per hour, including tips. If they don’t hit that mark, you’ll need to make up the difference. Staying on top of this keeps you compliant and shows your employees that you care about fairness.

To make this process easier, you could look into using 7shifts tip management software. It helps you track tip pools, automate calculations, and provide clear, transparent payouts so you and your team can feel confident everything’s handled properly.

Avoid worker misclassification

Be cautious about classifying workers as independent contractors or interns. If they follow your schedules, use your tools, or depend mainly on your business for income, they may need to be classified as employees and paid accordingly.

Remember, Virginia applies both state and federal standards when determining proper classification, and mistakes can lead to fines or legal issues. Take the time to review each role carefully and document why someone is classified a certain way.

When in doubt, consult an HR expert or legal advisor. You can also look into using digital HR tools that help track worker status and provide guidance on compliance, giving you extra peace of mind.

Keep improving your business plan

With Virginia’s minimum wage increasing, it’s smart to review your business plan, especially in pricing, operations, and scheduling. Small adjustments now can help your business stay competitive and strong. You could also take this opportunity to evaluate your staffing needs and explore ways to boost efficiency without sacrificing service quality.

Consider whether new technology, cross-training employees, or updating vendor contracts could help balance rising labor costs. Planning now puts you in a better position to adapt and thrive as changes roll out.

What is next for Virginia’s minimum wage in 2026?

Virginia’s minimum wage in 2026 is $12.77 per hour. The minimum wage may increase based on inflation and cost-of-living adjustments.

As a business owner, when you pay your team fairly, you’re setting yourself up for success. People are more likely to stick around, give great service, and take pride in their work. In the long run, those benefits can help balance out higher payroll costs.

Turn wage hikes into wins

Virginia’s minimum wage changes are designed to help workers and strengthen communities. As a business owner, you might feel the pressure of rising labor costs, but you can turn this into a positive. This is a great time to examine your pricing, refine your product or service offerings, and find smarter, more efficient ways to run your business.

If you need help, many restaurant managers find that tools like 7shifts’ payroll software, scheduling apps, or tip management software can make these transitions easier.

If you’re running a business in Virginia, especially in people-focused industries like food service, think about going beyond the minimum wage, offering benefits that matter, and creating a workplace where people feel appreciated. The team you build will be worth the investment.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.