West Virginia has been drawing the attention of entrepreneurs for its affordable cost of living, strategic location, and supportive climate for small businesses. In fact, recent data from the U.S. Small Business Administration shows that small businesses make up over 98% of all businesses in the state, with many reporting stable or growing revenues. This success makes the Mountain State an appealing place to set up shop.

At the same time, business owners here work within a minimum wage system that is straightforward but set at a relatively low rate compared to many other states. This simplicity can make payroll planning easier, yet it also creates challenges when competing for workers who may be drawn to higher pay elsewhere.

What is the current minimum wage in West Virginia?

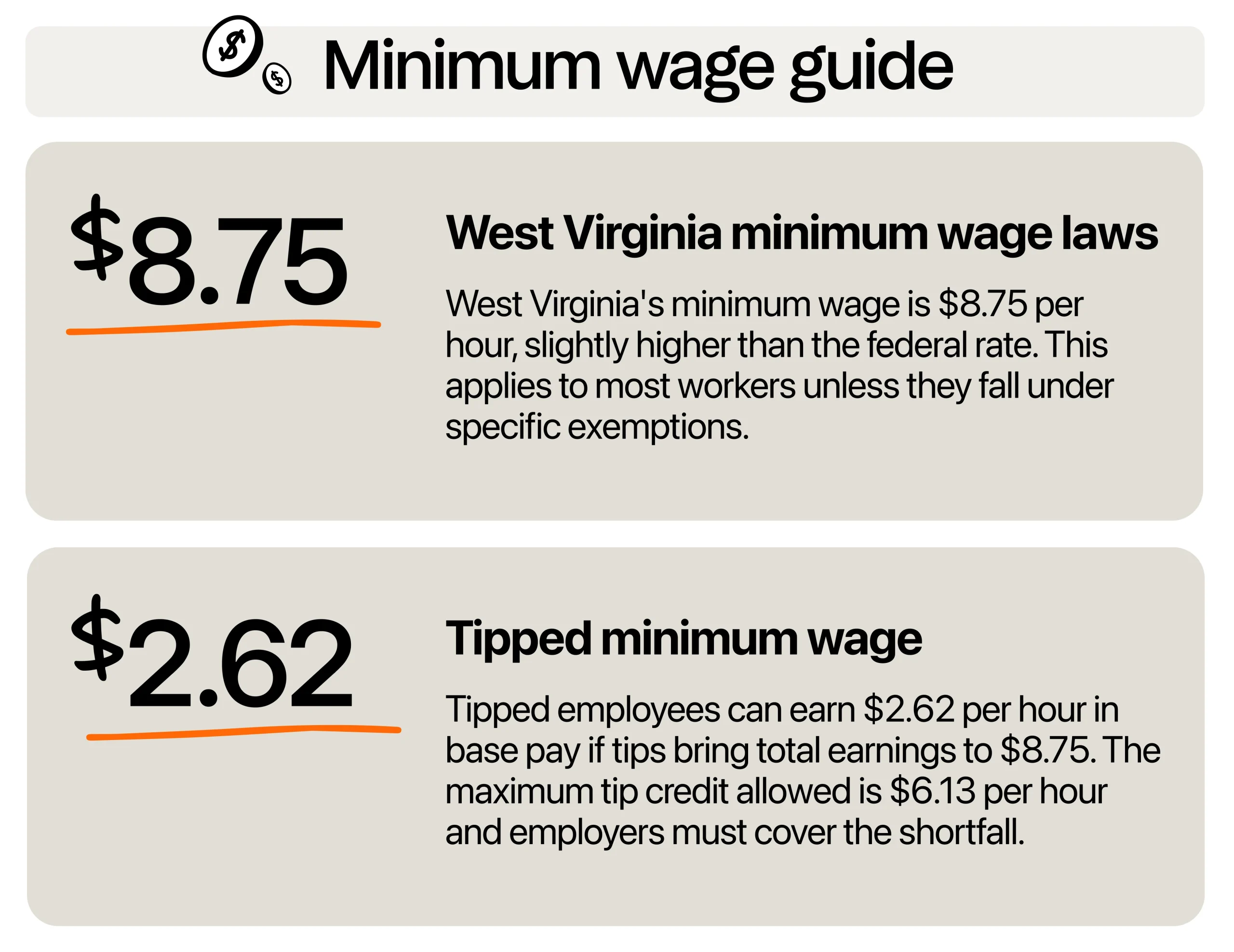

As of 2026, the West Virginia minimum wage for most workers is $8.75 per hour. This is the legal baseline, and it applies unless an employee qualifies for a separate category, such as tipped work or a youth training rate.

It’s slightly higher than the federal rate ($7.25/hour), which has not been changed for many years.

What are the tipped worker rules?

If you operate a business where tipping is customary, such as a restaurant, bar, or coffee shop, the rules for tipped workers are especially important. West Virginia is a tip credit state, which means you can count a portion of an employee’s tips toward meeting the state’s minimum wage requirement.

What does this mean? It means you can have a base wage for tipped employees as low as $2.62 per hour. However, their total earnings, including tips, must equal at least $8.75.

The maximum tip credit you can apply is $6.13 per hour.

If an employee’s tips don’t make up the difference, you must cover the shortfall. For example, if a server works a slow shift and only makes $4 in tips per hour, you are required to add $2.13 to meet the $8.75 total.

Are there training wages or youth rates?

The state allows a training wage of $6.40 per hour, but it comes with strict conditions. This rate applies only to employees under 22 years old and only for the first 90 days of employment. After this period, they must be paid at least the regular minimum wage of $8.75 per hour, unless they’re already earning more.

The training wage essentially functions as the youth rate, meaning workers under 22 can be paid $9 per hour during their first 90 days before transitioning to at least $8.75 per hour. For example, if you hire a 20-year-old for a part-time position in your cafe, you can pay them the training wage while they learn the job during those initial 90 days, and then move them to the standard minimum wage.

This rule can be particularly useful for seasonal businesses, such as summer resorts, ice cream stands, or even for food truck businesses, where many employees are under 22 and work only for a short period.

Are there local ordinances or local rates?

Unlike some states where cities or counties can set their own higher minimum wage, West Virginia does not currently have local ordinances that establish different minimum wage rates from the state standard. This means that whether you operate in Charleston, Morgantown, or a rural county, the same state minimum wage rules apply.

For you as a business owner, this provides consistency across locations. If you expand to multiple locations in the state, you can maintain a single wage structure without worrying about city-specific pay laws.

How does overtime pay work in West Virginia?

The state requires overtime pay at 1.5x the regular hourly rate for any hours worked over 40 in a single workweek. This applies to employers with six or more employees and is generally for non-exempt employees under the federal Fair Labor Standards Act (FLSA) and West Virginia labor laws.

Non-exempt employees are entitled to overtime pay, while exempt employees, such as certain salaried managers, administrative staff, or professionals meeting specific duties and salary thresholds, are not. For example, if you pay your non-exempt kitchen staff or servers $10 per hour, their overtime rate would be $15 per hour. In the food industry, non-exempt roles typically include cooks, dishwashers, servers, and bartenders. Certain salaried managers who meet specific duty and pay requirements may be exempt.

Restaurants, cafes, and bars often have fluctuating schedules, especially during peak dining hours, weekends, or events, which can quickly push staff beyond 40 hours.

Are there efforts to increase wages in the state?

West Virginia’s efforts for an increased rate have been made, but there have been objections. Under House Bill 2481, the state has committed to a step-by-step increase in the state’s minimum wage, with the goal of reaching $15 per hour by the end of 2028. It was introduced and referred to the committee, but died there without further action. So, while the intent was there, nothing has been officially passed yet.

Is West Virginia’s 2026 minimum rate enough nowadays?

The current minimum hourly falls short of what many consider a living wage. According to the MIT Living Wage Calculator, a single adult with no children in the state may need $19.43 per hour to cover basic needs like housing, food, transportation, and healthcare. If you have employees supporting families, that gap grows even wider.

As a business owner, this is where you need to think about more than compliance. Paying only the legal minimum may help keep immediate payroll costs low, but it can also mean higher turnover, more time spent training new staff, and challenges attracting skilled workers. Many businesses in West Virginia bridge the gap by offering competitive starting wages above the minimum, introducing performance bonuses, providing flexible scheduling, or offering non-cash perks such as meals, transportation stipends, or professional development opportunities.

You don’t have to match the living wage overnight, but finding ways to move closer to it can improve employee satisfaction and loyalty. In the long run, that stability can save you money and strengthen your business’s reputation as a good workplace.

How does the state compare to neighboring states?

In surrounding states, West Virginia’s state minimum wage is higher than the federal minimum wage of $7.25, which still applies in Kentucky and Pennsylvania. However, it’s lower than the Virginia minimum of $12.77, Maryland’s statewide rate of $15 per hour, and Ohio’s 2026 rate of $11 per hour for non-tipped employees. West Virginia lands right in the lower-middle of this mix, higher than some neighbors but far behind those offering more competitive pay.

If you operate near a state border, that gap can sway where potential employees choose to work. For example, someone living near the Maryland line may be tempted by the $15 rate just across the border.

As a business owner, this is a reality check: if surrounding states are offering more, you may need to rethink your wage strategy to keep your best people from crossing over.

How to be competitive vs. neighboring states

We get it. You might feel the pressure to keep your wages competitive without stretching your budget too far. If nearby states are offering more, it’s natural for workers, especially those close to the border, to be tempted by better pay just a short drive away. The key is to make your workplace attractive enough that employees choose to stay with you, even when other options are available.

Offer competitive pay where you can

You may not be able to match Maryland’s $15.00 or Virginia’s $12.77, but consider aiming for a range of $9.50 to $11 if your budget allows. This still places you above the state minimum while showing your team that you value them. Even a modest increase in this range can boost loyalty, reduce turnover, and make your business more attractive to job seekers.

Employees notice when you invest in them, and competitive pay often pays you back through better performance and retention.

Create a benefits package that works for your team

If large wage increases are not possible, consider adding perks that matter to your employees. Free or discounted meals, help with transportation, flexible shifts, or partial healthcare contributions can make your business stand out without dramatically increasing payroll costs.

Focus on growth opportunities

Workers are more likely to stay if they see a future with your business. Offer skill training, cross-training between roles, and a clear path for promotion. In restaurants, for example, a dishwasher could learn prep work, then line cooking, and eventually move into a supervisory role.

Build a strong workplace culture

People don’t just work for a paycheck. They work in an environment where they feel respected and part of a team. Recognize good work, communicate openly, and create a place where employees enjoy coming in every day. A positive culture can outweigh a slightly lower wage.

Reduce turnover by listening

Make it easy for employees to share feedback through regular check-ins, anonymous suggestion boxes, or team meetings, and show that you take their input seriously by making adjustments where possible.

When workers see their opinions lead to real changes, it builds trust and reinforces that they’re valued. Employees who feel heard are more engaged, more productive, and far less likely to leave, which directly benefits your business by reducing turnover costs and strengthening team stability.

Trim costs in smart ways

If you need to free up funds to offer better pay, look at your menu or product lineup. Cutting down on underperforming or least popular items can reduce waste and lower costs. This can allow you to reallocate savings toward employee wages or benefits without sacrificing overall quality or service.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Common labor compliance mistakes and how to avoid them

West Virginia labor laws may seem straightforward since they apply consistently across the state, but that does not mean you can be complacent. You still need to pay close attention to the rules that protect your employees and safeguard your business from costly penalties.

Classify your employees correctly

Misclassifying employees is one of the most expensive mistakes an employer can make. If you label a worker as an independent contractor when they should be an employee, or classify a non-exempt worker as exempt to avoid paying overtime, you risk massive fines, back pay, and potential lawsuits. The financial hit could wipe out your profits for months.

Take the time to study classification rules, consult with an HR expert if needed, and make sure your payroll software reflects the correct status for every single person on your team.

Track work hours with precision

Inaccurate timekeeping is a silent profit killer. Relying on paper timesheets or verbal reports opens the door to underpayments, overpayments, and disputes. In an audit, “I didn’t know” will not protect you.

A timeclocking software gives you an exact, real-time record of when employees start, finish, and take breaks. These records are your best defense if an employee challenges their pay or if you face a labor inspection.

Manage tips the right way

In the food and service industry, tip handling is one of the biggest compliance traps. Failing to track tips correctly or misunderstanding tip credit rules can leave your staff earning less than the legal minimum. That is a direct violation of the law and a fast way to lose employee trust.

A tip management software records tips accurately, applies the correct tip credit, and gives you a clear audit trail. This protects both your employees’ income and your business from penalties.

Maintain complete payroll records and accurate overtime calculations

Payroll records are your proof of compliance. If they’re incomplete or inaccurate, you have no defense. Overtime mistakes are common and costly, such as forgetting to include bonuses or commissions in overtime pay calculations.

Digital payroll systems store records securely, calculate overtime correctly, and ensure every eligible dollar is paid. This builds trust with your staff and keeps you clear of labor disputes.

Post required labor law notices

It’s not enough to follow the rules. You must also make sure your employees are aware of their rights by posting the proper labor law notices in an accessible location.

In West Virginia, businesses are required to display state and federal labor law posters that outline minimum wage rates, tip credit rules, break requirements, and other worker protections. Failing to post these notices can result in fines and give employees grounds for complaints. You can obtain the official West Virginia labor law posters directly from the West Virginia Division of Labor’s website.

Competitive pay drives business growth

Even though West Virginia’s wage laws might seem straightforward, the top business owners understand that compliance is just the starting point. The legal minimum sets the baseline, not the limit, for what you can offer your team. Going beyond it’s not an unnecessary expense but an investment in your business’s future.

After all, offering competitive pay helps attract stronger talent, which boosts your team’s stability and enhances your standing in West Virginia’s business community.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.