If you’re running a business in Arkansas, whether that’s a family-owned café in Hot Springs, a landscaping service in Little Rock, or a startup out in Fayetteville, one thing is clear: your team matters. And one of the most direct ways to support your team is by paying them fairly and staying compliant with state wage laws. That means keeping a close eye on Arkansas’ minimum wage, where it stands today, and what might change.

What is the minimum wage in Arkansas?

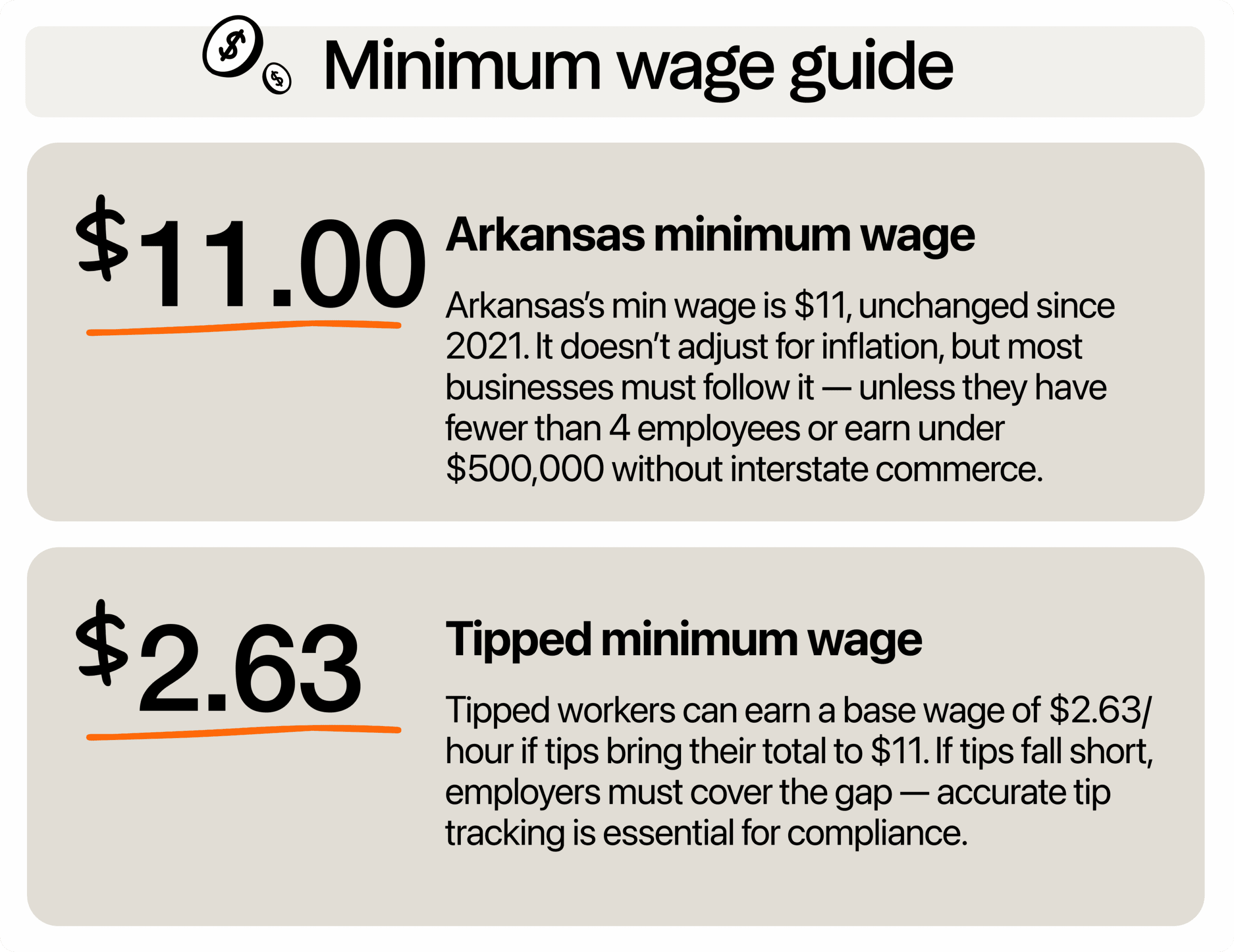

As of 2025, the minimum wage in Arkansas is $11 per hour. This rate has been in effect since January 1, 2021, after voters approved gradual increases through Issue 5 back in 2018. That ballot initiative raised the rate from $8.50 in 2018 to $11 by 2021.

Since reaching the $11 mark, there have been no additional increases, and unlike some other states, Arkansas does not currently adjust its minimum wage for inflation or cost of living. This means as of 2025, the rate still holds steady, giving business owners like you a clear, predictable baseline to work with when planning staffing and payroll.

If you’re new to employing staff or expanding your operations, you might wonder if this figure is going up soon. As of mid-2025, there are no confirmed increases or automatic adjustments tied to inflation. That means the $11/hour rate still stands, giving you a bit of stability as you plan ahead.

How does this compare to the federal minimum wage?

Here’s where things can get a little confusing. According to federal law, the national minimum wage is still $7.25 per hour, a rate that hasn’t changed since 2009. That’s why things can get confusing if you’re trying to juggle both federal and state guidelines.

But here’s the key takeaway for you: when state and federal minimum wages don’t match, you must pay the higher rate. In Arkansas, that means the $11/hour state minimum wage is what applies to most workers. So while you might still hear about the $7.25 figure on the news or in articles, don’t use it as your guide. This distinction is especially important if you’re new to managing payroll or expanding your team.

Which employees does the Arkansas minimum wage apply to?

You might assume the $11 minimum wage applies across the board, but the law makes room for a few exceptions. While most hourly workers in Arkansas are entitled to this rate, there are certain categories of employees for whom different rules come into play. If you’re managing a team or considering your first hire, it’s important to know who qualifies and who might fall under a different wage structure.

Tipped employees

If you run a restaurant, café, or any business where tipping is part of the job, you’re allowed to pay a lower base wage, known as the cash wage of $2.63 per hour. That number isn’t random, as it’s set by Arkansas law and is designed to work alongside customer tips.

But here’s the catch: if their total pay falls short, it’s your responsibility to cover the difference. This setup offers some flexibility in managing payroll, especially in industries where daily earnings can vary. Just keep in mind, it also puts the responsibility on you to track tips accurately.

One helpful option is using 7shifts’ tip management software, which can simplify tracking, reporting, and compliance so you’re not left guessing or juggling spreadsheets.

Small businesses with fewer than four employees

Small businesses with fewer than four employees in Arkansas are not legally required to follow the state minimum wage of $11 per hour. That means if your business has just three or fewer employees at any given time, you’re technically exempt from paying the state minimum.

Still, this doesn’t mean you’re off the hook entirely since you still have to comply with the federal minimum wage, which currently stands at $7.25 per hour.

Be cautious, however: if you’re close to the threshold or hiring seasonally, your headcount could fluctuate and trigger new requirements. Also, even if you’re not legally required to pay the state rate, offering competitive wages can still give you a leg up in hiring and employee retention.

Small businesses earning under $500,000

If your annual gross revenue is under $500,000 and you don’t engage in interstate commerce (like shipping products out of state or ordering from out-of-state suppliers), you may be allowed to follow the federal minimum wage of $7.25/hour.

That said, very few businesses fall into this category nowadays, especially with the growth of online sales and out-of-state services.

Student learners and trainees

If you’re offering internships, training programs, or student jobs, you may be able to pay below the standard rate temporarily under what’s called a subminimum wage program. These programs are legal, but they come with strict rules and documentation requirements. It’s a good option if you’re investing in young talent and offering real training value, but make sure you’re doing it by the book.

Certain nonprofits and seasonal camps

In very specific cases, like nonprofit-run camps or religious retreats, there may be additional exemptions. But these are the exception, not the rule. If you think your organization might qualify, it’s best to reach out directly to the Arkansas Division of Labor or consult a payroll advisor who understands the ins and outs of wage law.

In short, while the $11/hour rate is the standard, you do have some flexibility in unique situations.

Why this matters for your business

Even if you’re just a few dollars off, wage violations can lead to significant consequences. In Arkansas, employers who willfully or repeatedly violate minimum wage or overtime pay requirements may face civil penalties of up to $1,000 for each violation. Beyond financial penalties, such violations can damage your business’s reputation and employee trust.

Fair compensation isn’t just a legal obligation; it’s a strategic advantage. Offering competitive wages helps attract and retain quality staff. According to data from Oxfam, nearly one-third of Arkansas workers, approximately more than 450,000 individuals, earn less than $17 an hour. If your competitors provide higher wages, better benefits, or more flexible schedules, you risk losing valuable employees to them.

Balancing wage costs with overall business health requires proactive planning. Monitor your cash flow, improve staff schedules, and make the most of the tools that enhance efficiency. Investing in fair pay practices not only ensures compliance but also fosters a motivated and loyal workforce, ultimately contributing to your business’s long-term success.

Tips for managing labor costs effectively

If you’re feeling the pressure of rising payroll expenses, you’re not alone. Labor is one of the biggest costs in any business, but there are ways to manage it smartly without sacrificing quality or morale. This isn’t about cutting hours or pushing your team too hard, but it’s about creating a plan that keeps things running smoothly and efficiently.

Start by reviewing your scheduling strategy. Are you staffing too heavily during slow periods? Are you scrambling during peak hours? These mismatches can drive up labor costs without giving you the return you expect. By aligning staff schedules with actual demand, you can make the most of every hour worked.

This is where modern tools come in handy. Platforms built for full-service restaurants like 7shifts can be a game-changer for small and medium businesses. It allows you to build smarter schedules, set labor cost targets, and flag potential overtime before it becomes a problem. It even helps you understand staffing trends based on things like time of day, weather, or historical sales.

You can also use it to improve communication within your team. When everyone knows their schedule ahead of time and can easily swap shifts or request changes, it reduces stress and helps keep morale high. That kind of transparency and flexibility builds a positive work environment, and that leads to better service, better retention, and fewer surprises on payday. With the right tools and a proactive mindset, you can keep your budget on track while supporting the people who keep your business moving forward.

If you’re not sure where to start, 7shifts offers free Excel templates to help you calculate labor costs and identify areas where you might be overspending or underutilizing your team. It’s a simple step that can give you clearer insights and more confidence in your staffing decisions.

Adjusting your pricing if needed

If labor costs are eating into your margins, you’re definitely not alone. Business owners across Arkansas are facing the same balancing act on how to stay profitable while continuing to pay employees fairly. The good news is you have options. One of the most effective strategies is revisiting your pricing model.

Suppose you’ve raised wages to keep a great team or improved scheduling so your staff can perform better; that adds real value. A small bump in your pricing, whether it’s on your menu, service packages, or hourly rates, can help cover rising labor costs without scaring away loyal customers.

You might be surprised by how understanding people are. Today’s customers recognize that good service and quality products don’t come from cutting corners. They’re often willing to pay a little more if they know it supports fair wages and a better workplace. The key is communication. You don’t need to make a big announcement, but letting your values shine through on your website, in conversations, or through signage can go a long way.

So take a look at your margins, check what similar businesses are charging, and think about whether a small pricing adjustment could help relieve some pressure. You’re not just covering costs, but you’re investing in your business’s future, one fair paycheck at a time.

Could Arkansas raise wages again?

The short answer is that it’s definitely possible. While there are no active laws in motion to increase the rate beyond $11 right now, Arkansas has a clear track record of voter-led wage changes. For example, back in 2018, a strong 68.5% majority approved Issue 5, which gradually brought the minimum wage up to its current level.

Then, in 2025, the federal poverty level for a family of two became $21,150. A full-time worker earning $11/hour would make just over that amount annually, which means the wage only narrowly keeps small households above the poverty line. This situation could spark renewed public interest in pushing for a higher minimum wage in upcoming ballot measures, and there are already public talks about it.

We’ve seen similar efforts succeed in states like California and Florida, and Arkansas may not be far behind.

Now, that doesn’t mean you need to make sweeping changes to your business just yet. But it does mean it’s a good idea to stay ahead of the curve. Think of it as part of your long-term planning. If wage changes are coming, you’ll want to be ready to adapt without scrambling.

Here are a few ways you can keep your finger on the pulse:

- Follow Arkansas legislative sessions for any talk of wage reform

- Monitor potential ballot proposals that could go before voters in 2026 or later

- Watch labor cost trends within your industry and how your competitors are responding

You can also sign up for wage alerts through the Arkansas Department of Labor or have regular check-ins with your payroll provider. They often know about pending legislation or proposed changes before they hit the headlines. When you’re informed and proactive, wage adjustments feel less like a surprise and more like something you’ve already budgeted for.

Build a business that Arkansas people want to work for

You started your business with a vision. And a big part of that vision includes the people who help you run it every day. Paying the Arkansas minimum wage (or more) isn’t just about checking a box, but it’s about investing in your team and building a workplace where people want to show up. As business author Pooja Agnihotri wisely said, “When you invest in your employees’ development, they’ll spend their skills in your company’s development.”

When your team feels secure, they’re more likely to go the extra mile. And when that happens, everyone wins: your business, your customers, and your bottom line. Little things, like a clear schedule, a steady paycheck, and knowing someone’s looking out for them, make a big difference. Even something as simple as using a scheduling tool that avoids last-minute changes or confusion can help foster that sense of stability.

Minimum wage resources

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.