The Iowa minimum wage hasn’t changed since 2008, while neighboring states like Illinois, Missouri, and Nebraska have rates that are twice or thrice as much. This puts restaurants in the Hawkeye State at a disadvantage when it comes to hiring and keeping talent.

As much as you want to pay your employees well, tight profit margins and rising food costs make it challenging to offer competitive wages. It’s important to understand labor wage laws to ensure compliance while having strategies to manage labor expenses amid potential wage increases.

What is the minimum wage in Iowa?

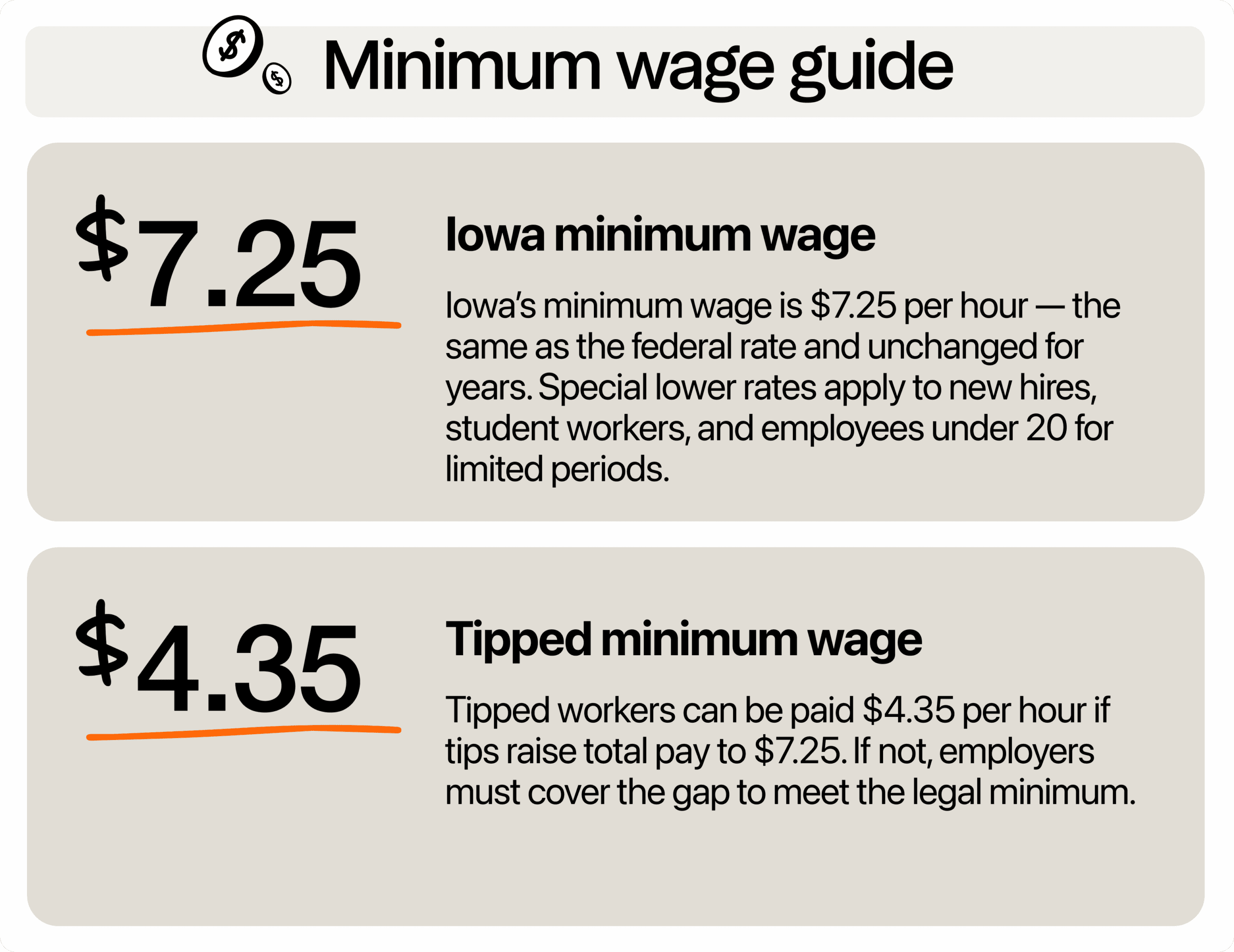

The minimum wage in Iowa is $7.25 per hour, or an annual rate of around $15,080, which is the same as the federal rate. For tipped Iowa workers, restaurant owners can pay $4.35 per hour with a tip credit of $2.90. If a server’s tips combined with wages don’t hit $7.25, you’ve got to make up the difference.

There are also a few special wage categories to take note of. For example, workers under age 20 can be paid $4.25 per hour for the first 90 days on the job.

In addition, all new employees (of any age) can be legally paid $6.35 per hour during their first 90 calendar days. Full-time high school or college students working up to 20 hours per week can also be paid $6.16 per hour.

When it comes to overtime, any hours over 40 in a single week must be paid at 1.5× the regular wage, so $10.88 an hour if someone is earning $7.25 normal time.

Is there a law to increase Iowa’s minimum wage?

Iowa hasn’t raised its minimum wage since 2008, remaining stagnant despite increasing living costs. There have been efforts to raise the minimum wage law in recent years, but none of them have been successful.

In the Iowa administrative legislature, laws like HF2293, SF235, and HF375 were introduced, but none made it past committee in 2023 or 2024. These proposals would have gradually raised wages a bit, but they didn’t gain traction.

On the federal side, the Raise the Wage Act of 2023 aims to raise the U.S. minimum wage to $17 per hour by 2028. If the law passes, it would override Iowa’s wage floor, but so far, it’s stalled in Congress.

How Iowa wages compare to neighboring states

Iowa’s rate puts it well behind its neighbors’ minimum wages. As of January 2026, Illinois minimum wage is much higher at $15 per hour, making it more than double Iowa’s rate. This means hiring in border towns such as Davenport or Burlington might become challenging for Iowa businesses, as workers could easily commute to Illinois for significantly higher wages.

Missouri also increased the minimum wage to $15 per hour in 2026, so candidates in Davis or Wayne County might shop around based on pay alone. Nebraska is also set at $15. Then, there’s Minnesota, which set wages at $11.41. While not as high as Illinois, it still beats Iowa by a good margin.

Meanwhile, Wisconsin minimum wage follows the same as the federal rate. As such, businesses in Dubuque and Clayton County won’t have to worry about wage differences.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

How does the current wage compare to the living wage

Based on the MIT Living Wage Calculator, a single adult in Iowa needs about $20.89 per hour to cover basic costs, which is nearly 3x as much as the current minimum wage.

If one parent cares for a child alone, that number jumps to $34.79 an hour, and in a family with two adults and two kids, each person needs around $39.73 per hour to make ends meet.

Iowa’s minimum wage is nowhere near enough for employees, which raises real concerns about turnover, stress on staff, and even your reputation in the community. You must find a balance between financial constraints and paying your workers fairly.

Why restaurant owners feel the pinch under Iowa administrative rules

Restaurant profit margins are already low enough to begin with, at 3% to 6%. This means there’s not much room to absorb higher wage costs. Plus, most restaurants rely on tipped workers, which makes wage compliance more complicated.

You must track both base wage and tips, and make sure staff reach at least the $7.25 minimum wage after tip credits. If tips fall short, the business is on the hook. That adds admin costs and compliance risk.

Turnover bites hard, especially when wages are low. In our restaurant staff turnover and retention playbook, Iowa restaurants had a 40.68% turnover rate, which is higher than Minnesota.

Wage theft, whether by accident or on purpose, is another big risk. In Iowa alone, up to $600 million is stolen annually from low-wage workers through underpayment or illegal deductions. Food service ranks among the most affected industries. That could mean costly audits and lawsuits, which are headaches you don’t need.

To make things more complicated, tariffs have increased food and supply costs for restaurants. Imported ingredients like seafood, produce, and kitchen equipment have seen significant price hikes.

“It’s really scary. This is one of the scariest times we’ve had since Covid in a lot of ways,” Iowa Restaurant Association president and CEO Jessica Dunker said.

What can business owners do to comply

First, know who must comply with wage laws. If your restaurant makes $500,000 or more in annual revenue, you must follow the federal wage and overtime rules under the FLSA.

It’s also in the law to pay your staff at least semi-monthly, so employees get a regular paycheck. Provide clear wage statements every payday showing hours worked, pay rates, tips, and any deductions. You should also be careful about pay deductions for slip-ups like register shortages or uniform costs unless employees give written permission.

Make sure to track hours worked, tips, overtime, wages, and deductions accurately. Additionally, keep these payroll records, like employee names, hours, pay, and deductions, for at least three years.

Use a restaurant management tool to automate time tracking. calculating overtime, and data storage. Having all-in-one software reduces errors, so you can focus more on running your restaurant efficiently.

How to pay fair wages

Paying a livable wage can help you keep your best team members happy with their jobs. Moreover, gaining a reputation for being a fair employer attracts better candidates and customers. But this poses a big problem: How can you offer better compensation if you’re struggling with thin margins? Fortunately, there are a few things you can do to pay your staff well without a price hike.

Adjust your menu

Cutting low‑margin or high‑waste items helps your bottom line and frees up budget for better pay. In fact, restaurants spend over $162 billion a year on food waste, often due to prep and portioning issues.

To spot these profit-draining items, dig into your recipe costs. Break down each dish by ingredient and labor. Identify what you’re spending versus what you’re charging.

Items with tight margins (like steak or seafood dishes) or expensive ingredients that go bad fast should be red-flagged. Also, look at sales reports. If a dish costs a lot to make and barely sells, it’s time to cut or rework it.

Instead, lean into dishes that use shared ingredients. For example, roast chicken can be used across sandwiches, salads, and entrees. That keeps food costs low and reduces spoilage.

Prep once, sell multiple ways. Focus on high-margin items with lower waste, like grain bowls, tacos, or pastas. These are flexible, cost-effective, and usually crowd-pleasers.

You can also reduce plate waste by watching what’s left behind. If fries or side salads consistently go uneaten, shrink the portion or make them optional add-ons.

Get feedback from your team. Servers and dishwashers often know what gets tossed. A few small changes here can add up fast, freeing up hundreds or even thousands a month, which you can use to compensate your employees for their hard work.

Add service charges or automatic gratuities

Rolling out service fees or built‑in tips gives your staff steadier income. One service charge paid across all FOH roles, like servers, runners, and hosts, can reduce tipping gaps and make earnings fairer and more predictable.

First, you must choose whether to use a flat service charge (like 18% on every check) or a fixed per-person fee (like $3 per guest). Either approach works, but be sure to clearly explain it on your menu and receipts.

Transparency is important. Guests need to know what they’re paying and why. No matter what type of restaurant menu design you choose, you should include a short line like, “A 20% service charge supports fair wages for our team.”

Next, have a clear guideline on how the service charge will be distributed among your team. This can be split among all FOH roles based on hours worked, or pooled and shared with BOH based on a formula you set.

The goal is to create a consistent, fair payout that boosts take-home pay across shifts, not just on busy nights or from high-tipping tables. Document your system and communicate it with your staff so there’s no confusion or distrust.

Build better schedules

Stop paying people to wait around. Check your sales and foot traffic patterns to determine peak times. If Tuesdays consistently slow down after 2 p.m., there’s no need to keep two servers on the floor until dinner. Building schedules around real data helps you cut unproductive hours without hurting guest service.

However, if you do split shifts, you should reconsider since it leads to burnout and low morale. It’s best to assign longer, consistent shifts where possible.

Avoid stacking staff during slow periods just to “be safe.” One extra person for two idle hours can cost you around $40 to $50 per shift, which can add up quickly.

As much as possible, you should also set schedules in advance and make them visible to your team members. This creates a more stable work environment and helps employees plan their errands and other personal commitments.

You can find restaurant scheduling software to help you build better schedules and allow employees to set their availability or request time off easily.

Offer non-cash perks

Pay isn’t the only way to show your team you care. Simple, low-cost perks can go a long way toward improving morale and reducing turnover.

One powerful option is Earned Wage Access (EWA), which lets employees get a portion of their paycheck before payday. In high-turnover industries like restaurants, EWA has reduced turnover by 38% by giving employees more control over their money.

Another low-cost but high-impact gesture are paid birthdays off. It’s a small benefit, but it tells your team you see them as more than a line item.

If paid time off isn’t feasible, consider guaranteed shift swaps, giving staff a free pass to cover shifts without penalty. When your team feels trusted and supported, they’re more likely to stick around, and more likely to cover for each other when someone else needs a break.

Lastly, give your staff a clear path to growth. Whether it’s teaching a line cook to expo on a busy Friday or assigning a seasoned host to train new hires, opportunities to level up build confidence, and loyalty. These small promotions don’t require a big budget but can make a big impact.

Cross-train staff

Cross-training your team means teaching staff to step into more than one role. For example, you can train a host to run food during peak hours or a dishwasher to jump on prep when the line’s backed up.

In our restaurant labor costs playbook, we found that 68% of restaurants are using this strategy to manage labor costs. Now, if someone calls in sick or no-shows, you’re not left scrambling. You’ve got team members who can shift gears and keep service running smoothly. It can also boost morale since staff who learn new skills feel trusted and more engaged.

They take more pride in their role, feel like part of the bigger picture, and are less likely to leave over small frustrations. That’s a huge win when you consider how much it costs to replace even one hourly team member, which is $5,864 on average when you factor in time, training, and lost productivity.

Keep your team and your margins

The minimum wage in Iowa might be stuck at the federal rate, but you have the chance to beat competitors by offering better pay. There are real ways to support and motivate your staff without blowing your budget, such as tweaking your menu or cross-training your team. A few smart moves now can help you build a stronger, more loyal team that keeps your restaurant running smoothly for the long haul.

Make scheduling, record-keeping, law compliance and team management easier with 7shifts. Our restaurant management tool simplifies time tracking, automates wage calculations, and helps you create efficient schedules for maximum productivity.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.