Rhode Island’s minimum wage is more than twice the federal rate. While this is definitely good news for local workers, it can be challenging to maintain good restaurant margins. Knowing the current labor laws, especially the impending wage increases, can help you plan and budget effectively.

What is the minimum wage in Rhode Island in 2026?

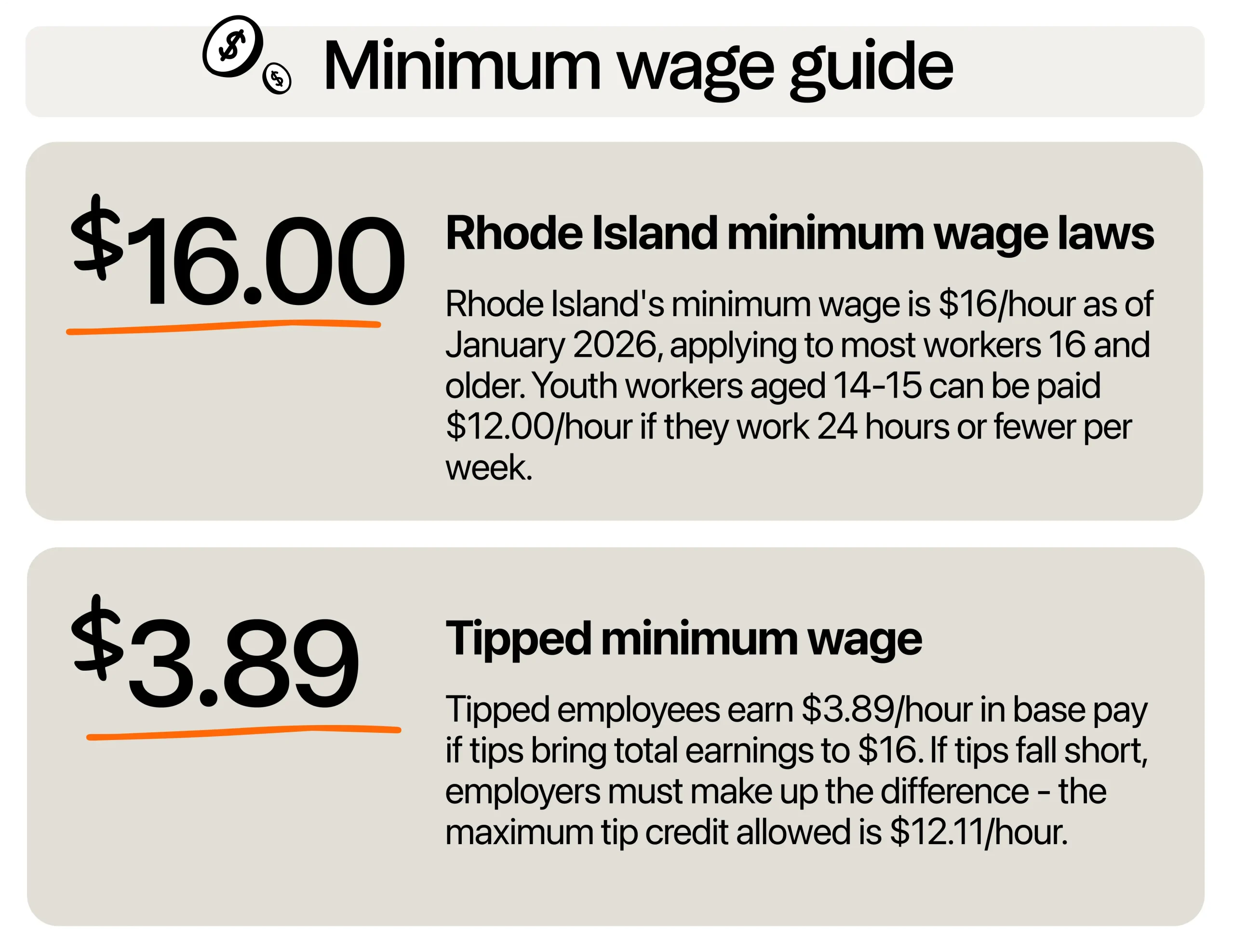

As of January 2026, the minimum wage in Rhode Island is $16 per hour. This change is part of a state law passed in 2021 that gradually increases wages over several years. For restaurant owners, this means higher base pay for most team members, including hosts, line cooks, dishwashers, and bussers.

The hourly minimum applies to nearly all workers who are 16 or older. Whether full-time, part-time, or seasonal, you’re required to pay them at least this wage rate, unless they fall under one of the exceptions.

Exceptions to the minimum wage

Tipped team members, like servers and bartenders, can be paid a tipped minimum wage of $3.89 per hour. But here’s the rule: you must make sure their tips plus wages add up to at least $16 per hour. If they fall short, you’re legally required to cover the difference.

For example, if a server makes $3.89 per hour in wages and $9 per hour in tips, you need to pay an extra $3.11 per hour to hit the required rate.

To qualify for the tipped wage, workers must earn at least $30 per month in tips. The tip credit you’re allowed to apply maxes out at $12.11 per hour. Anything below that and you need to pay more.

Additionally, if you hire 14- or 15-year-olds, they can be paid $12.00 per hour, which is 75% of the regular minimum wage. However, this only applies if they work 24 hours or fewer per week. If they go over that limit, they must be paid the full minimum wage.

Retail workers in Rhode Island are entitled to 1.5x pay on Sundays and state holidays. While this rule mainly applies to big box stores, some restaurants with attached retail or counter-service may fall under this. If your restaurant sells retail goods or to-go items in a self-service format, double-check your classification with the state.

How does Rhode Island’s rate compare to its neighbors?

Rhode Island’s minimum wage matches Massachusetts, but falls behind Connecticut’s. However, MA has phased out its Sunday and holiday premium pay for most industries, including restaurants. That means employers in Massachusetts don’t have to pay extra for weekend or holiday shifts, while in Rhode Island, many businesses still do.

Meanwhile, Connecticut’s minimum wage is $16.94 per hour, with a $6.38 tipped wage. The state adjusts its rate based on the Consumer Price Index (CPI), so it rises with inflation each year. While this makes pay predictable, it also means yearly wage hikes are automatic, giving operators less time to adjust.

Are there plans to increase the minimum for workers?

Yes, the minimum wage in Rhode Island will continue rising over the next two years under a law signed by Governor Dan McKee. The next scheduled increases will be in January 2027 ($17 per hour). That’s a total $4.75 per hour increase since 2021, when the state minimum was $12.25 per hour.

While the current law is set through 2027, some lawmakers are pushing for even faster increases. In early 2025, Senate Bill 2475 proposed raising the minimum to $17 per hour in 2025 and $20 per hour in 2026, skipping the planned step-ups. Although that bill hasn’t passed, it signals a strong interest in reaching $22 per hour in the near future, especially with inflation and cost of living at the top of mind.

If the $17 per hour rate holds for 2027, a full-time employee working 40 hours a week would earn $680 per week, or $35,360 annually, not including overtime, tips, or shift bonuses. But there’s more to plan for.

With the state’s Sunday and holiday pay rule, a $17 per hour regular shift would become $25.50 per hour on weekends and holidays. A single double shift on a Sunday could cost you $400+ in wages for one team member. If wages increase to $20 or $22 per hour, that same shift could easily hit $33 per hour.

How to manage labor costs with Rhode Island’s mandated wages

Labor costs are one of the biggest expenses for restaurant operators, especially in Rhode Island, where the minimum wage is more than twice the federal rate.

Fortunately, paying fairly doesn’t have to mean lower profits. With smart strategies, you can keep your team engaged and efficient.

Rethink your scheduling strategy

Wage increases can affect your bottom line even if your staffing levels stay the same. That’s why it’s time to rethink how you schedule. Instead of using fixed shift blocks, match your labor to real-time demand.

Look at when your restaurant actually gets busy. Are lunch rushes heavier on Fridays? Are Tuesdays always slow? Try breaking down traffic by parts of the day (morning, lunch, dinner, and late night) instead of treating each day the same. This lets you staff up for peak hours and scale back when it’s quiet.

For example, if your lunch rush runs from 11:30 a.m. to 1:30 p.m., you might only need two servers before and after that window, not four. Trimming even four hours per week per employee at $15 per hour saves you over $3,000 per year, per person.

Cross-train your team to do more with less

Take a page from 68% of restaurants that have used cross-training as a labor strategy. According to our restaurant labor costs playbook, these businesses are equipping their staff to handle multiple roles instead of firing people.

Let’s say your line cook knows how to prep, or your host can also run takeout. That means fewer people on the clock during slow periods, and no scrambling when someone calls out. It also means you’re not paying two people when one could handle both tasks during overlap hours.

Cross-training also keeps your team more engaged. Workers who learn new skills tend to stick around longer, reducing turnover and rehiring costs. Teaching a dishwasher how to bus tables or a cashier how to work expo could save you thousands.

Make better use of part-time staff

Hiring part-time workers and training them to be efficient can help you stay profitable without cutting corners. You can do split shifts or staggered start times so you’re only paying for coverage when you truly need it.

For example, if your weekday rush is between 12 p.m. and 2 p.m., there’s no reason to have a full staff clocked in at 10 a.m. Bring in part-timers just before the peak and send them home after. Even trimming one to two hours per shift can add up. At $15 per hour, cutting just 10 extra hours a week saves $600 per month.

Part-time staff can also help you avoid overtime pay, which kicks in after 40 hours a week. Keeping your full-time team below that cap prevents extra costs, especially since overtime in Rhode Island means paying 1.5x the regular wage, or $24.00 per hour.

Adjust operating hours or menus strategically

It may be time to take a hard look at your operating hours and your menu. If certain shifts bring in little profit, like slow weekday afternoons, it might make sense to reduce hours instead of running at a loss.

Let’s say you open at 11 a.m., but the first table doesn’t arrive until noon. That’s an hour of labor, utilities, and prep time that may not be worth the spend.

You can also lower costs by simplifying your menu. A smaller, more focused menu reduces prep and cooking time as well as inventory waste. Fewer items means fewer hands needed in the kitchen, especially during off-peak hours.

Budget now for the next round of wage hikes

Rhode Island’s minimum wage is already set to rise again next year, which means you can expect even higher labor costs. The best move is to plan for it now.

Check your numbers. If you have 10 full-time staff working 35 hours a week, jumping from $16 to $17 per hour adds nearly $18,200 per year to your payroll. That’s before overtime, tips, or taxes. Knowing that today gives you time to adjust your pricing, hours, and overall business strategy.

Balance fair pay with healthy margins

You might not be able to control wage increases in Rhode Island, but you can plan ahead and employ smart strategies. This way, you can adapt your restaurant to remain profitable while still providing fair compensation to your team.

Protect your margins with an all-in-one restaurant payroll solution. Use 7shifts to create an efficient schedule easily and track actual hours. The built-in communication feature can also help keep your team engaged and updated.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.