If you’re planning to open a restaurant, cafe, or are already running a business in South Carolina, the topic of wages is something you can’t ignore. Labor is one of your biggest ongoing expenses. It directly impacts your ability to hire, retain, and motivate staff. The good news is that South Carolina has a simpler wage structure than many other states. But that doesn’t mean you can afford to ignore it.

What is the minimum wage in South Carolina?

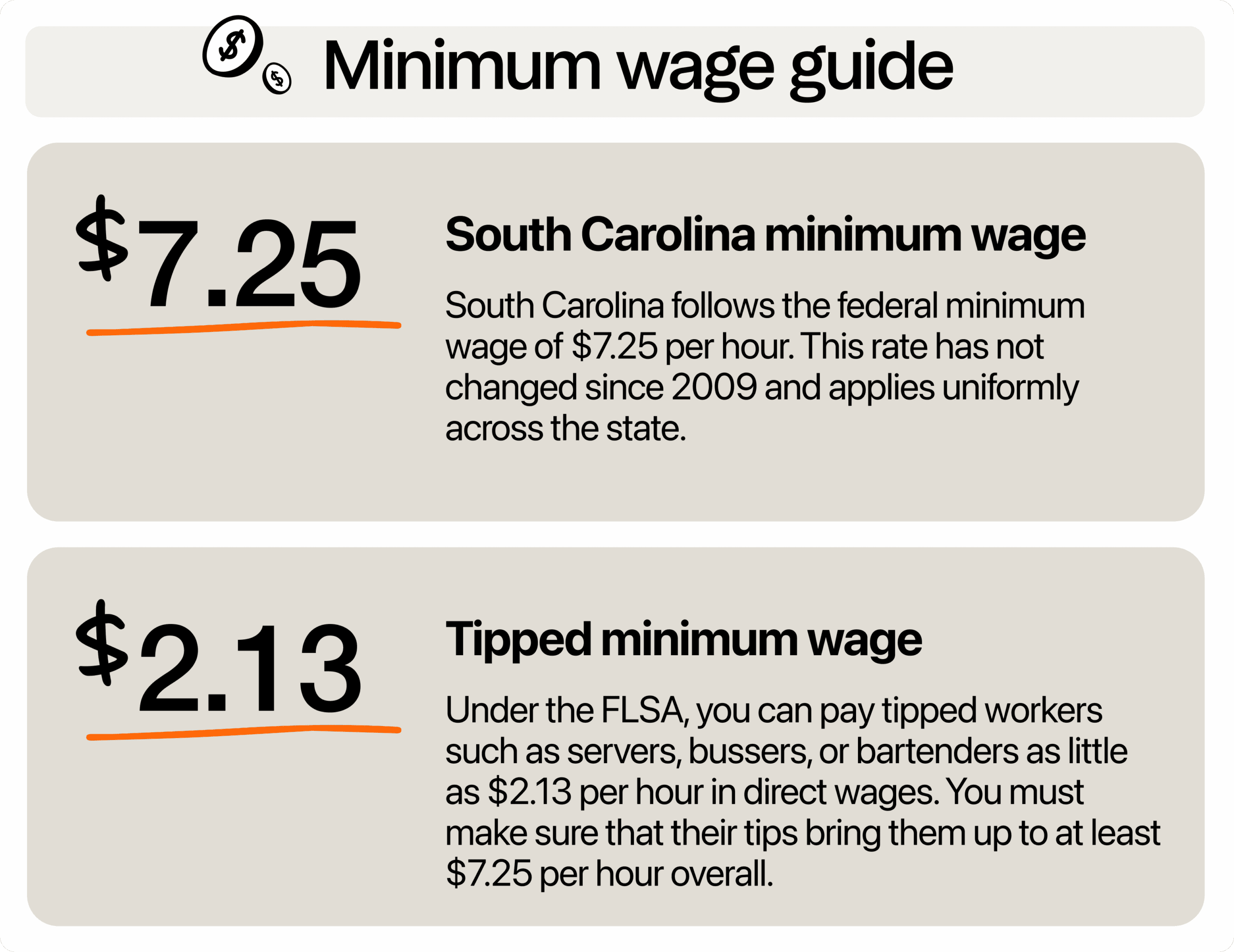

As of 2025, South Carolina follows the federal minimum wage of $7.25 per hour. This rate has not changed since 2009 and applies uniformly across the state.

Whether you operate in Charleston, Greenville, Columbia, or any rural area, there are no state or local ordinances setting a higher wage. This keeps things simple from a compliance standpoint, but also limits flexibility when it comes to addressing rising living costs.

Tipped wage and tip credit rules

South Carolina is a tip credit state, which means it allows employers to count a portion of employees’ earned tips toward their minimum wage obligations. The state does not have its own tip credit rules, so it defaults to the federal standard.

Under the Fair Labor Standards Act (FLSA), you can pay tipped workers such as servers, bussers, or bartenders as little as $2.13 per hour in direct wages. You must make sure that their tips bring them up to at least $7.25 per hour overall. If they fall short, you’re legally responsible for covering the difference.

Tip pooling is allowed under certain federal guidelines, but always be clear about your policy with your team and include it in your employee handbook to avoid misunderstandings or violations.

Are there youth minimum rates and student rates?

South Carolina does not have its own separate youth wage law, so it defaults to federal standards. Under the FLSA, you may pay workers under 20 years old a training wage of $4.25 per hour during their first 90 consecutive calendar days of employment. This applies regardless of whether the position is seasonal or part-time.

Once the 90-day window ends, their wage must be bumped up to at least $7.25 per hour.

Additionally, South Carolina has no state-specific student wage or apprentice wage structure. All other eligible workers must be paid at least the full federal minimum wage, and any misuse of the youth training rate, such as rehiring the same individual multiple times to restart the 90-day clock, can result in legal consequences.

Rules on overtime pay

South Carolina follows the Federal Labor Act regarding overtime. Non-exempt employees must receive 1.5 times their regular rate for all hours worked beyond 40 in a single workweek. If your line cook earns $10 per hour and works 50 hours one week, those extra 10 hours must be paid at $15 per hour.

If your team members are working split shifts, covering for others, or regularly clocking in early, that all counts. Furthermore, misclassifying employees as exempt from overtime without meeting the salary and duties test could result in penalties and back wages.

The livable wage gap in the Palmetto State

Let’s be real—$7.25 an hour may be the legal minimum, but it’s nowhere near what workers need to survive, especially in the restaurant and service industry. According to the MIT Living Wage Calculator, a single adult in South Carolina needs about $22.15 per hour to cover basic living costs. That’s nearly triple the current minimum wage.

When employees work full-time but still can’t afford basic necessities, burnout sets in fast. You may start to notice signs: chronic lateness, high turnover, low morale, or inconsistent service. The wage gap doesn’t just hurt workers. It chips away at your business’s performance, reputation, and bottom line.

How South Carolina fares with its neighboring states

Legally, you are only required to pay $7.25 per hour to most employees. However, with inflation, rising rent, and everyday expenses, the state minimum wage rate simply doesn’t stretch as far as it used to.

Here’s an honest take: just because you can pay the state minimum doesn’t mean that’s the only rate you should be paying. Many businesses in South Carolina are already paying more than that to attract and retain good workers. The competition is real, especially if your business is near the borders of North Carolina or Georgia, where both states have employers offering rates above the minimum to stay competitive.

Let’s say you operate a small café in Rock Hill. Charlotte, North Carolina, is just across the state line, and many businesses there pay $9 to $15 an hour for similar roles. That’s a big difference when you’re trying to hire baristas, dishwashers, and line cooks. Workers will drive a few extra miles for better pay. If you’re sticking with the South Carolina minimum, you may struggle to find talent or keep them long term.

How to make better pay work for your business

You’re probably wondering where to get the money to provide better pay when margins are already tight. It’s a good thing there are smarter ways to make room in your budget and still stay competitive in a tough labor market.

Trim your menu to boost margins

Start by reviewing your menu. Are there dishes that barely sell, require expensive ingredients, or lead to high food waste? Simplify your offerings to focus on high-margin items that use shared ingredients and have predictable prep costs.

For example, if a signature steak dish costs $18 to make but only sells a few times a week, it might be hurting more than helping. Replacing that with something lower-cost but popular could free up cash you can put toward payroll.

Fix scheduling inefficiencies

You may be losing money without realizing it. If you’ve got staff clocked in during dead hours or doubling up on slow shifts, you’re paying for idle time. Review your sales data, foot traffic, and ticket times. Adjust shift schedules to match actual customer patterns.

Even shaving off two unneeded labor hours per week per staff member could add up to hundreds saved monthly. Those savings can go straight into hourly raises or shift bonuses without changing your prices.

Introduce service charges for predictable payroll

Instead of relying solely on customer tips, consider adding a fixed service charge of 15% or 18% to every bill. Many businesses are already doing this and using that money to supplement base pay.

This creates more consistent income for your front-of-house team and helps you budget payroll better across the board. Just be upfront with customers. A simple note like “This service charge helps us provide fair wages to our staff” goes a long way.

Offer perks that build loyalty

Pay isn’t the only thing your staff cares about. Small perks can make a big difference in how long they stay. You can offer free shift meals, flexible schedules, paid birthdays off, or even gas stipends for weekend shifts. You don’t need a big HR budget to keep your people happy. A little consideration goes a long way.

Start where you can, then build

You don’t have to jump to $22 an hour overnight. Start by offering a small raise or creating a plan for incremental wage increases tied to performance or time served. This gives your team something to work toward and helps you manage increases gradually.

Is there a state effort for wage increases?

As of 2025, South Carolina’s minimum wage remains at $7.25 per hour. However, legislation is now in progress to raise this to $10.10 per hour. This means there is no change for the current year, but you should begin planning now if you want to stay ahead of upcoming wage shifts.

The proposal has not yet been finalized, but it signals that South Carolina is finally taking steps to move beyond the long-standing federal rate. Businesses that start adjusting early by budgeting for higher wages, simplifying labor costs, or offering better incentives will be better prepared to handle the change when it arrives.

How to stay wage compliant in 2025

South Carolina’s wage laws may seem simple on paper, but that doesn’t mean you can afford to leave compliance out of the picture. Fortunately, staying compliant isn’t as complicated as it sounds, as long as you know where things can go wrong.

Track every hour worked, down to the minute

Relying on handwritten timecards or verbal check-ins opens you up to costly errors. Using timeclocking software can help you stay accurate and accountable. It logs when your employees clock in, clock out, and take breaks. This not only protects you if questions come up, but it also saves time from sorting through manual records or disputes later on.

Get payroll right the first time

Your team should receive regular paychecks with accurate breakdowns of hours worked, wages earned, overtime (if any), and any deductions. If your payroll process is manual or outdated, it’s time to update.

Consider using a modern payroll system that calculates everything based on real hours worked. It takes care of regular time, overtime, and different pay rates without manual input, and it creates clear pay stubs that keep both you and your employees on the same page.

Follow tip credit rules

Since South Carolina is a tip credit state, you need to be especially mindful of how tips are tracked and reported. Use tip management software that tracks exactly how much each employee earns in tips per shift. It helps confirm that everyone is meeting or exceeding the $7.25 hourly requirement, and it gives you detailed records in case your payroll is ever audited.

Good pay builds good business

Just because South Carolina’s minimum wage structure is simple doesn’t mean you should treat it as a ceiling. When you offer fair, consistent pay, even if it’s just a few dollars above the minimum, you put your business in a better position to attract motivated employees, reduce turnover, and build a stronger team.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.