The restaurant industry is unpredictable.

There are dozens of costs associated with running a restaurant, and many of them remain out of your direct control: rent, utilities, insurance—etc. But the bulk of a restaurant’s costs can be controlled. Those are your food costs and your labor costs, and together they make up your prime costs.

What are prime costs?

Prime cost is the sum of direct labor costs and the cost of goods sold (CoGS). Cost of goods sold is the raw material cost of your beverages and food, and labor cost is made up of payroll, employee benefits, taxes, and bonuses.

Prime costs are the most important key performance indicator in your restaurant. Why?

- They are your largest restaurant expenses and ensures you stay profitable

- They can be controlled by implementing labor and F&B cost control measures—and by using the right tech tools.

- They affect almost every aspect of your restaurant

Simply put: Prime costs demonstrate profitable your business is.

We had the chance to get together with our friends over at xtraCHEF by Toast on the Restaurant Growth Podcast, where we sat down with Steven Downer, a member of the xtraCHEF team. Steven helps restaurants use tech tools to keep their food and beverage costs under control with tech tools that unlock adjustments that would otherwise be impossible or too time-consuming. By combining inventory management tools with restaurant employee scheduling software, you can get a better grip on the costs you can control.

Here are a few ways to keep both parts of your prime costs under control with tools from 7shifts and XtraChef:

Food and Inventory Costs

The first half of your prime costs is your cost of goods sold, or COGS. It’s a critical restaurant metric on its own, doubly so when included in your prime costs.

What are CoGS?

COGS is the cost of ingredients used by a restaurant over a certain period to create the menu items being sold—factoring in waste, theft, shrinkage, and more. Restaurant COGS should float around 31%, but they can vary depending on the concept or season.

Many restaurants don’t spend enough time focused on their COGS. A target COGS ratio is typically established upon opening or revamping a menu, then that’s it.

The reality is that restaurants need to track their COGS on at least a monthly basis—weekly COGS monitoring allows for more flexibility and dynamic decision-making.

How Technology Can Help

COGS is a great high-level overview— it’s half the equation for calculating Prime Costs!—but restaurants need a more precise, detailed overview of their spending. This is especially true with rising food costs, inflation worries, supply chain disruptions, and a host of other price impacts.

Accurately tracking restaurant food costs has typically been too time-consuming and error prone. Food cost control comes down to tracking vendor price fluctuations, which means capturing product prices, units of measure, and other critical invoice details for all your orders. To stay on top of all that would be nearly impossible to do manually, whether it’s by spreadsheets or on paper.

But there is a better way.

Invoice processing automation systems, such as xtraCHEF by Toast, take the pain out of invoice processing. You can simply snap, scan, or upload your invoices, and the platform extracts all the valuable details.

You can use this clean, consistent data on product prices to start making more informed decisions.

For example, you can get accurate recipe costs, or plate costs. Simply drag and drop items from your product catalog and set the quantity. xtraCHEF will pull in invoice product prices, factoring in quantities so that you know exactly how much each ingredient costs per recipe.

With precise recipe costs that update with each new vendor order, you can ensure your prices are on level to hit your profit goals.

Hopefully, you can see the value in tracking COGS as well as the importance of drilling down to invoice-powered food costs.

The other half of prime costs: Labor and Payroll

After food and beverage, the biggest expense in your restaurant is labor—aka the cost of payroll, benefits, and benefits.

Like food costs, the cost of labor can fluctuate rapidly. When you run the same schedule week over week, there will be some inefficiencies that end up costing you, and your gut instincts aren’t always correct. Scheduling using best practices and with data is a proven way to optimize labor costs and grow your bottom line.

Recommended Reading: Five Signs You Need to Switch from Excel to Scheduling Software

How Technology Can Help

Controlled labor costs start at the scheduling level, and if you’re still making schedules on Excel or by hand, those schedules aren’t working hard enough for you.

Employee scheduling software like 7shifts can help you make smarter schedules that save up to 3% on labor costs. In an industry with razor-thin margins, that could be the difference between being in the black vs. in the red.

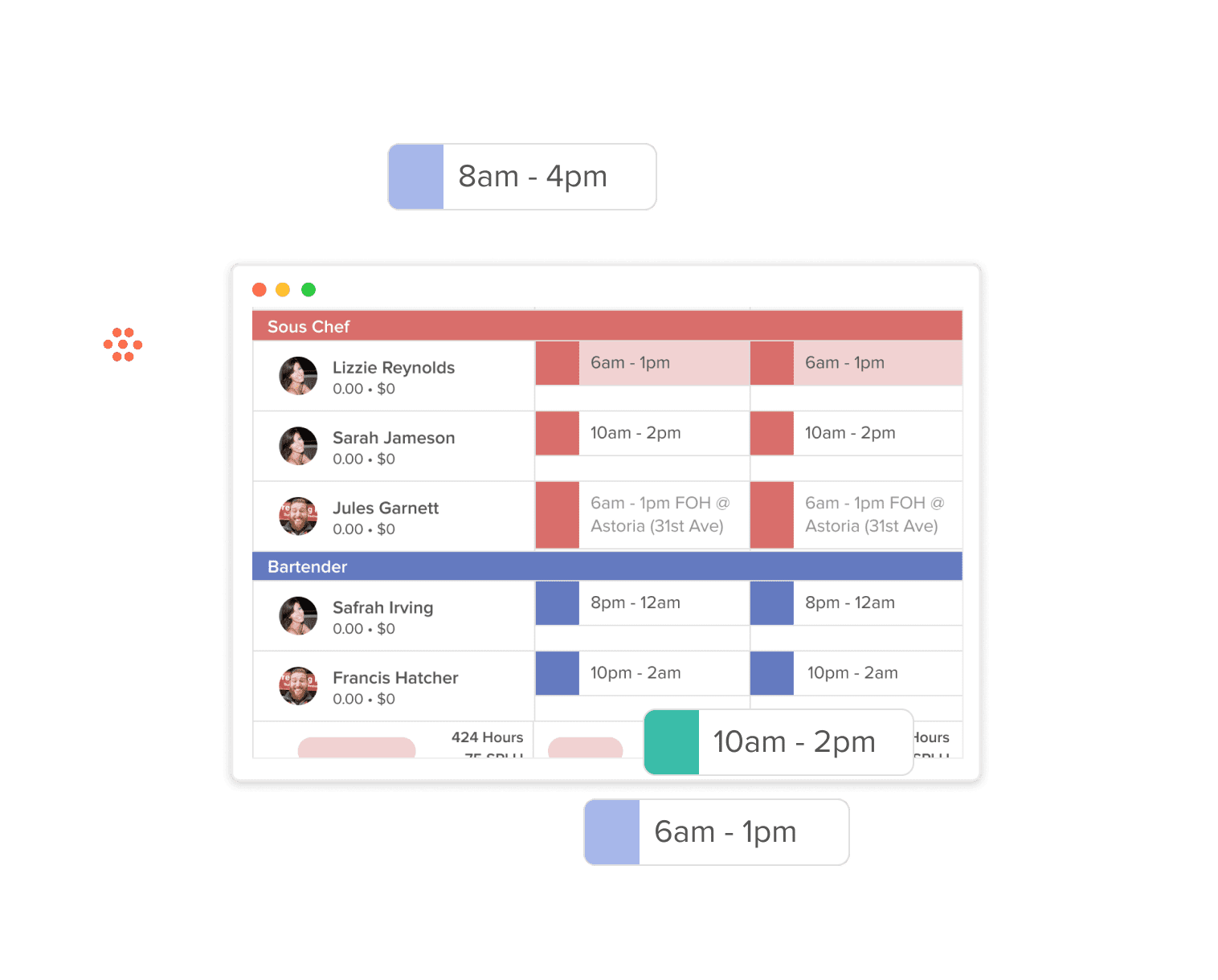

7shifts Drag & Drop Scheduling Editor

Restaurant scheduling software allows you to easily make schedules and track your employees’ time and attendance (making restaurant payroll easier, too!).

The real advantage comes when you pull data from your POS to track labor against sales and get a more accurate picture of your labor cost. This allows you to schedule who you need when you need them, and cut unnecessary hours and shifts that end up putting you over your labor targets.

7shifts Scheduling and Overview Dashboard

This task goes beyond your typical “Friday is our busiest night, so we’re sure to staff up.” Scheduling software allows you to look more closely at how sales change on holidays or seasonal events. You can look into what hour it gets busy on Fridays, and arrange your schedule to reflect that. This is the kind of micro approach that is made possible by the scheduling software.

DJ Costantino, Content Writer

DJ Costantino

Content Writer

Hi! I'm D.J., 7shifts' resident Content Writer. I come from a family of chefs and have a background in food journalism. I'm always looking for ways to help make the restaurant industry better!