A single payroll mistake can cost restaurant owners hundreds or thousands of dollars in penalties. There’s also the headache and reputational damage that no amount of money can truly compensate for. If you’re serving customers in the Prairie State, you should be aware of the minimum wage in Illinois and how it impacts your business.

What’s the Illinois minimum wage in 2025?

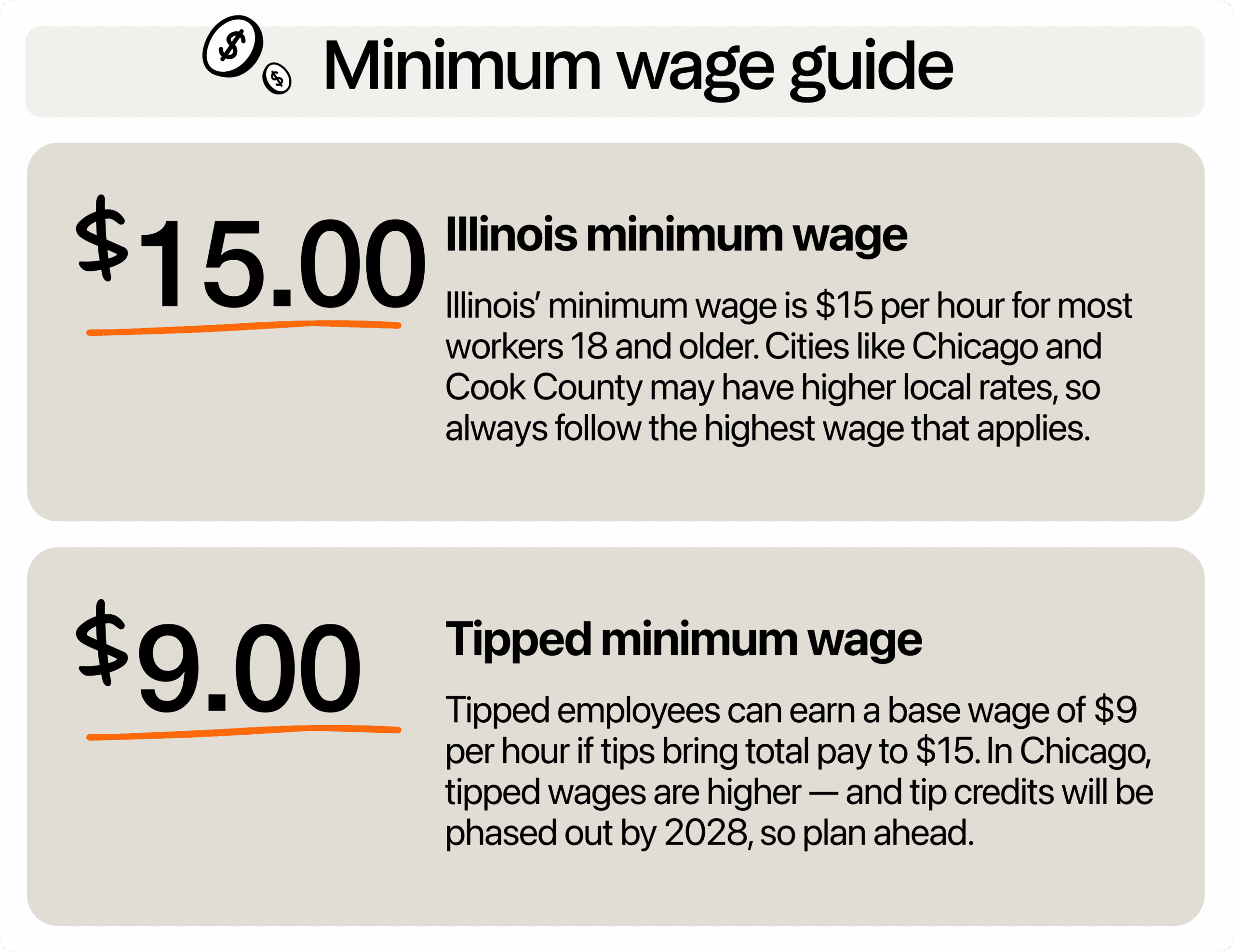

As of January 2025, the Illinois minimum wage is $15 per hour for most workers 18 and older. This is the final step in a multi-year increase passed in 2019 to help more people afford basic needs like rent, food, and transportation.

Keep in mind, though, that if you’re operating in cities like Chicago or Cook County, local wage ordinances may set even higher rates. You always have to follow the highest one.

For young employees under 18 who work fewer than 650 hours in a calendar year, the minimum is $13 per hour. Once they pass 650 hours, their wage must go up to the full $15 per hour.

If you’re hiring someone new who’s 18 or older, you can pay a training wage of $14.50 per hour during their first 90 days, as long as they’re not tipped employees. This gives employers time to onboard and train without immediately taking on the full wage cost.

For tipped employees, the base wage rate is $9 per hour. However, if an employee’s tips don’t bring them up to $15 per hour, the employer is legally required to make up the difference.

Chicago and Cook County minimum wages

The new Chicago minimum wage of $16.60 per hour for non-tipped employees was rolled out effective July 2025. That’s $1.60 more than the Illinois state rate, which matters when you’re managing labor across multiple locations.

For tipped workers in Chicago, the minimum base wage is $12.62 per hour. But the kicker is that tip credits will be phased out by 2028. That means you’ll need to start planning now to raise base wages and cover the gap, especially for roles that rely heavily on tips, like servers and bartenders.

Youth workers (under 18) in Chicago also get a bump. Non-tipped youth employees must earn at least $16.50 per hour, while tipped youth workers must make $12.54 per hour. These rates are updated every year based on inflation, so make sure you’re checking them regularly.

In Cook County (outside of Chicago), the minimum wage is still $15 per hour for non-tipped employees and $9 per hour for tipped employees, matching the state minimum wage. However, not every town in Cook County follows the county law. Some municipalities have opted out, which means your exact wage law might be different based on your address.

How do overtime, tips, and breaks work?

In Illinois, most employees must be paid time-and-a-half when they work more than 40 hours in a week. That means if your line cook makes $15 per hour, they must earn $22.50 per hour for every hour over 40.

This overtime rule applies to most employers with four or more employees, even if they’re part-time or seasonal. The only exceptions are very specific job categories like certain commission-based roles or agricultural workers, but these are rare in restaurants.

If your staff earns tips, it’s important to follow both federal and Illinois regulations. State restaurant tip pooling law says that tips belong to the employee, not the employer. Owners can set up a tip pool that shares tips between FOH employees who usually earn them, like servers and bussers.

Even if you use tip credits to pay tipped workers a lower base wage, you still need to make sure they earn at least the full minimum wage after tips. If they don’t, employers must make up the difference. Skipping this step opens you up to penalties, back pay, and even lawsuits.

Additionally, make sure to follow break rules. One 20-minute unpaid break is required when an employee works 7.5 hours or more. If someone works more than hours, they must get a second 20-minute unpaid break, and those under 16 get a 30-minute break after 5 hours of work.

You must track breaks properly and make sure employees take them. Missed breaks can lead to compliance issues and labor disputes. Use restaurant time clocking software to track hours and automate alerts to make break compliance easier.

What happens if you don’t comply?

Not following current minimum wage laws in Illinois can get expensive fast. If your restaurant underpays staff or misses required wage steps, the state can hit you with steep fines, interest, and even hold owners personally responsible.

Non-compliance can cost 5% interest per month on all underpaid wages. That adds up quickly if you miss a pay correction for just a few employees.

There’s also a 1% per day penalty if you delay fixing the error after getting a demand letter from the Illinois Department of Labor (Illinois DOL). That’s 30% in one month.

So, if you miscalculate wages for just 10 employees at $500 each, you could owe $5,000 in back wages plus an additional $1,500 in monthly penalties. You also need to think about administrative fees of $250 to $1,000, depending on how much is owed and how many workers were affected.

If the situation worsens, you can expect to pay 3 times the amount and possible reimbursement of legal fees if the case goes to court and you lose. The most surprising (and worrying) is that corporate officers, like owners, partners, and managers, can be held personally liable for unpaid wages. That means your own finances could be on the line.

Of course, mistakes do happen. Maybe you misclassified a salaried employee, missed a wage increase, or forgot to factor in tips properly. But Illinois law doesn’t give much wiggle room. Once you’re out of compliance, the clock starts ticking on fines and legal risks.

One thing to remember is that compliance isn’t just about avoiding fines. Establishing a reputation for paying correctly and on time helps you build trust, which reduces turnover and keeps your team motivated.

How the minimum wage impacts Illinois restaurants

Having higher rates, compared to neighboring states, like the Wisconsin minimum wage, has both upsides and real challenges for restaurant operators in the Prairie State.

First, higher wages mean better financial stability for your team. When employees earn more, they’re less likely to jump ship for another $0.50 an hour elsewhere. That’s a big win with high restaurant turnover rates.

Aside from higher pay, our employee engagement report found that flexible hours contribute to job satisfaction among 62% of employees. If increasing pay isn’t feasible yet, you might want to offer non-monetary perks, like adaptable schedules, to stay competitive.

On the other hand, paying line cooks and dishwashers $15 to $16.60 per hour, plus factoring in overtime, breaks, and tip balancing, can eat up your profit margins. To manage it, some restaurants are raising menu prices or reducing the items they offer to cut back on prep time and food waste. Another option is to have a lean workforce or trim hours for your employees.

How to prepare for yearly wage increases

Even though the Illinois minimum wage is now $15 per hour statewide, that’s not the end of the story. It’s particularly true in Chicago, where local wage rates continue to rise every year based on inflation.

For restaurant owners, staying ahead of these changes can make the difference between a smooth year and a surprise budget crunch. Start by reviewing your labor costs every quarter.

Look at how much you’re spending on wages, including overtime, tips, and training wages. If your payroll percentage is climbing, flag it early so you can adjust your staffing strategy.

Second, build wage increases into your restaurant menu pricing strategy. A small bump, like $0.25 to $0.50 per item, can make a big impact when spread across hundreds of covers. Just be sure to set enough time to announce the changes so the new prices don’t come as a shock.

Next, forecast staffing needs around your seasonal shifts. If summers are busy and winters slow down, staff accordingly and avoid over-scheduling during off-peak weeks. Restaurant scheduling software can help you assign shifts based on sales forecasts and historical labor data.

Lastly, use a labor cost calculator to model “what if” scenarios. For example, what happens if the Chicago minimum wage increases by another $0.75 in 2026? Can you absorb it, or do you need to reduce hours or raise prices? Having a proactive approach to wage planning helps restaurant owners stay nimble and competitive.

Stay ahead of wage challenges

Rising rates and changing policies can make it challenging to manage your restaurant finances effectively. By arming yourself with the right information and planning proactively, you can protect your business and keep your team happy.

Control labor costs with a restaurant management tool that lets you track hours and automates alerts to make break compliance easier. This way, you can stay compliant without getting bogged down in manual calculations.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.