New Mexico minimum wage has remained the same for two years, but it’s still more than the federal rate. Some cities, like Santa Fe and Las Cruces, also offer higher wages. This poses challenges for business owners who must balance budget constraints with fair compensation. By understanding wage laws and using the right strategies, you can manage labor costs effectively.

What is the minimum wage in New Mexico in 2025?

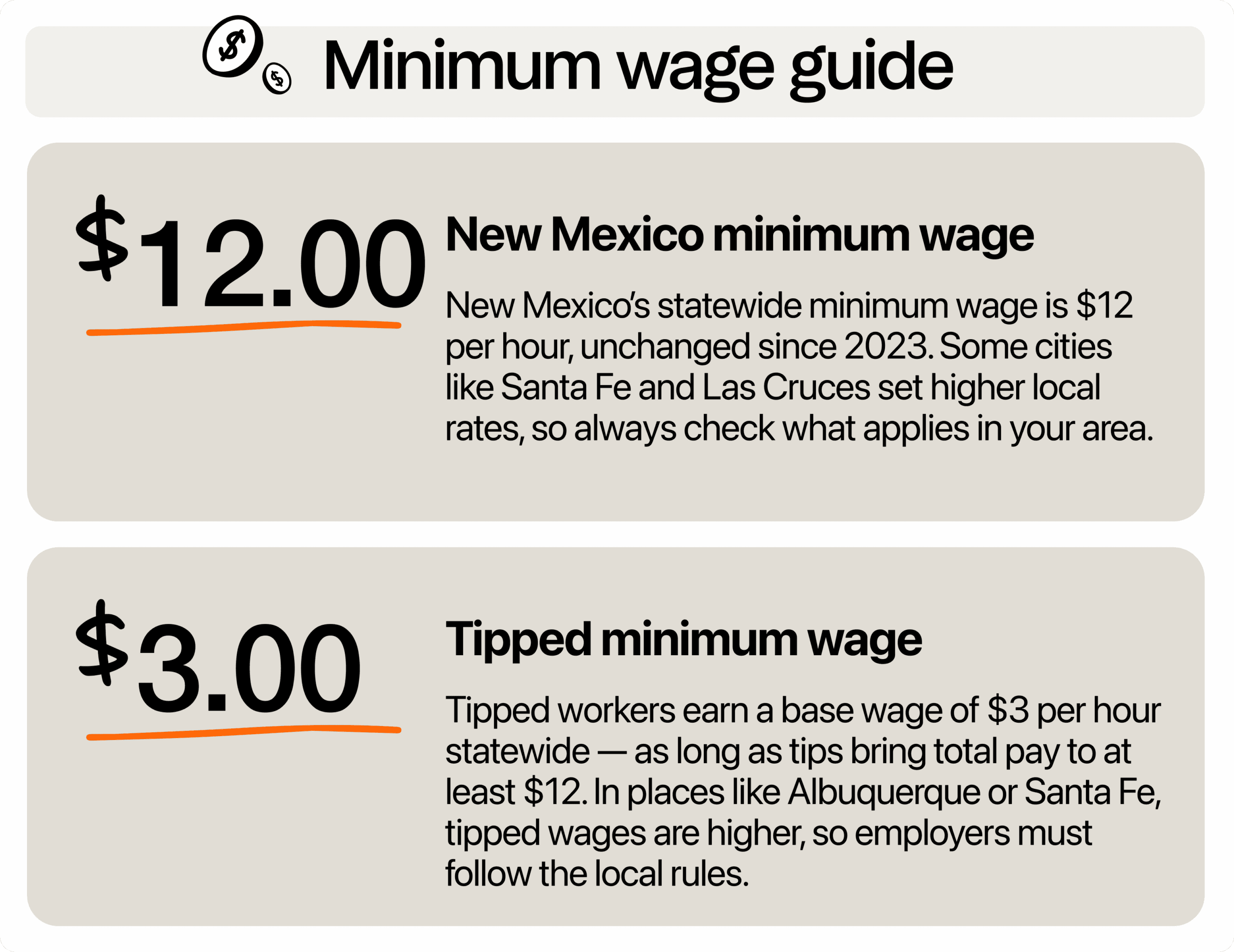

This year, New Mexico’s minimum wage is $12 per hour for most employees. The rate hasn’t changed since 2023 and still applies to every restaurant, café, bar, and food truck unless you’re in a city or county with its own wage ordinance.

For tipped employees, the minimum wage is $3 per hour, with employers needing to make up the difference if the total tips don’t help staff reach the minimum hourly rate.

There’s also a youth minimum wage of $10.50 per hour, but it only applies to employees under 18 during their first 90 days on the job. After that, they must be paid the full state minimum wage.

But things get more complex depending on your restaurant’s location. Some cities and counties have higher wage rates to reflect the local cost of living. For example, Santa Fe and Santa Fe County increased the minimum to $15 per hour, with a tipped minimum of $4.50 per hour. In Las Cruces, employees enjoy $13.01 hour, while the tipped wage is $5.20.

The Albuquerque minimum follows the state minimum, but with much higher tipped wages at $7.20.

How does the NM wage compare to neighboring states?

To the east, Oklahoma and Texas minimum wages both follow the federal-mandated $7.25 per hour for standard workers and just $2.13 per hour for tipped workers. If you’re running a shop in Clovis or Hobbs, you’re likely paying significantly more than restaurants just across the border.

It’s a different story on the west side, though. Arizona minimum wage rose to $15.15 per hour, with some cities paying even higher. Tipped employees must also be paid at least $12.15 per hour before tips. These rates are tied to inflation through the Consumer Price Index (CPI), which means they go up every year without needing new laws to pass.

The same goes for Colorado, which is $15.16 per hour, with a tipped wage of $12.14. Like Arizona, Colorado also uses a CPI-linked system so that the hourly wage keeps up with the cost of living.

In short, New Mexico’s state wage sits in the middle. Nonetheless, cities like Santa Fe, Las Cruces, and Albuquerque offer competitive rates that can help attract and retain talent.

Are there plans to increase the state minimum in the coming years?

New Mexico doesn’t have automatic wage increases tied to inflation like some other states do. So unless lawmakers change the state law, the minimum will stay the same year to year, except in places like Santa Fe or Las Cruces, where city governments can set their own increases.

As of this writing, no increases are planned at the state level through at least 2026. That said, there was an effort to change the current process.

In early 2025, House Bill 246 was introduced in the state legislature. If passed, it would have raised the state minimum wage to $17 per hour starting January 2026. It also proposed eliminating the tipped minimum wage altogether, meaning restaurants would have to pay tipped staff the full $17 per hour, not rely on tips to meet that wage rate.

Even more importantly, HB 246 would have tied future increases to the CPI, making wage hikes automatic every year after 2026. But the bill didn’t pass. It was postponed indefinitely in February 2025 after some pushback from business groups and lawmakers.

Still, that doesn’t mean it’s gone for good. Lawmakers are expected to bring similar proposals back in future sessions. The ideas behind HB 246, raising wages and simplifying the pay structure, have strong support from many worker advocacy groups and community leaders across the state.

How does one stay profitable while paying fair wages?

Paying fair wages is something that any good restaurant owner should take seriously. It doesn’t mean your margins have to take a hit, though. Having the right systems and strategies can help you stay compliant and support your team.

Know your actual labor costs

If you want to protect your bottom line, you need to know exactly what you’re spending on your team, not just hourly wages. Labor costs go beyond the base rate. You also need to factor in overtime, paid time off, sick leave, payroll taxes, and tip make-up pay. If you’re only looking at base pay, you’re missing the full picture.

For example, say you schedule a line cook at $16 per hour for 45 hours this week. That extra 5 hours is overtime, which means you’re actually paying them $24 per hour for those hours. That bumps the week’s total pay, not to mention taxes, higher than expected. And if that same employee calls in sick next week and uses PTO, that cost still hits your labor budget even if no food gets made.

Check payroll reports weekly or twice a month. Look at wages by role, shift, and location, and compare them to your sales data. Track overtime trends and watch for patterns like certain days or teams consistently going over budget.

If you notice certain shifts or roles consistently pushing your labor costs over target, dig into the why. Is it a staffing issue, like too many people on during slow hours? Or are certain team members regularly hitting overtime because of poor schedule planning? Small changes, like adjusting start times or spreading hours across more team members, can help you stay on budget without cutting service.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Reevaluate your tip management process

Tips are a huge part of restaurant pay, but if you’re still handling them with spreadsheets or handwritten logs, you’re leaving room for mistakes and misunderstandings. A messy tip system can hurt team trust and trigger payroll issues. Moreover, it can put you at risk of violating the wage law.

First, use restaurant tip management software to automate the process. This cuts down on disputes and saves hours of manual work. By doing so, everyone gets their fair share based on hours worked, job role, or whatever rules you set. That consistency makes every shift fair and protects you if questions come up.

This tool also helps you stay compliant with NM minimum wage since tipped workers must earn a total of $12 per hour after tips. Tracking tip totals accurately and being transparent with your staff helps build trust, which, in turn, improves employee engagement.

Optimize schedules

Creating better schedules is one of the easiest ways to control labor costs. It involves checking historical sales and staffing data to see exactly how many people you really need for each shift.

For example, if you know your lunch rush picks up around 11:30 a.m. and dies down by 1:30 p.m., you can stagger your FOH team’s start and end times instead of keeping everyone on a full 6-hour shift. These small changes can save hundreds a month in labor.

Another big win? Reducing overtime. With restaurant scheduling software, you can spot overtime risks before they happen. If one of your cooks is about to hit 40 hours, you’ll get a heads-up and can adjust the next shift. That way, you’re not stuck paying time and a half when you don’t have to.

Invest in cross-training your team

Cross-training staff is the top labor cost management strategy that around 68% of restaurants are using, based on our restaurant labor costs playbook. When team members can handle more than one role, you don’t need as many people on the clock to keep things running smoothly.

For example, if your host can also run food, or if your dishwasher can help with prep during the rush, you can cover more ground without adding shifts. This is especially helpful when someone calls out at the last minute or business slows down unexpectedly.

Instead of scrambling to fill a shift, your cross-trained team can step up and keep the service running strong. It also means you can build leaner, more efficient schedules, without cutting corners on guest experience.

Employees also benefit from cross-training. It gives them new skills, keeps work from getting boring, and shows that you trust them to do more. Teams that feel valued are more likely to stay longer, work harder, and help out when needed.

Balance wages and margins

Minimum wage rules in New Mexico can be confusing, especially if you’re operating in different cities. You also have to think about how paying fairly will affect your bottom line. Luckily, you can be a compassionate employer and have a profitable business as long as you manage labor costs effectively.

Optimize your staff’s schedules with restaurant management software. 7shifts lets you build efficient shifts based on sales forecasts, staff availability, and historical labor data. Plus, real-time labor tracking lets you see exactly how your costs are trending during each shift, so you can make quick decisions to stay on budget.

Also read:

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.