Wyoming minimum wage is one of the lowest in the country—lower than the federal rate. For local restaurant owners and other businesses, this creates unique challenges when it comes to attracting and keeping staff, especially when nearby states pay almost double. It’s important to understand the current wage laws and how you can best compensate your employees in today’s competitive market.

What is the minimum wage in Wyoming in 2026?

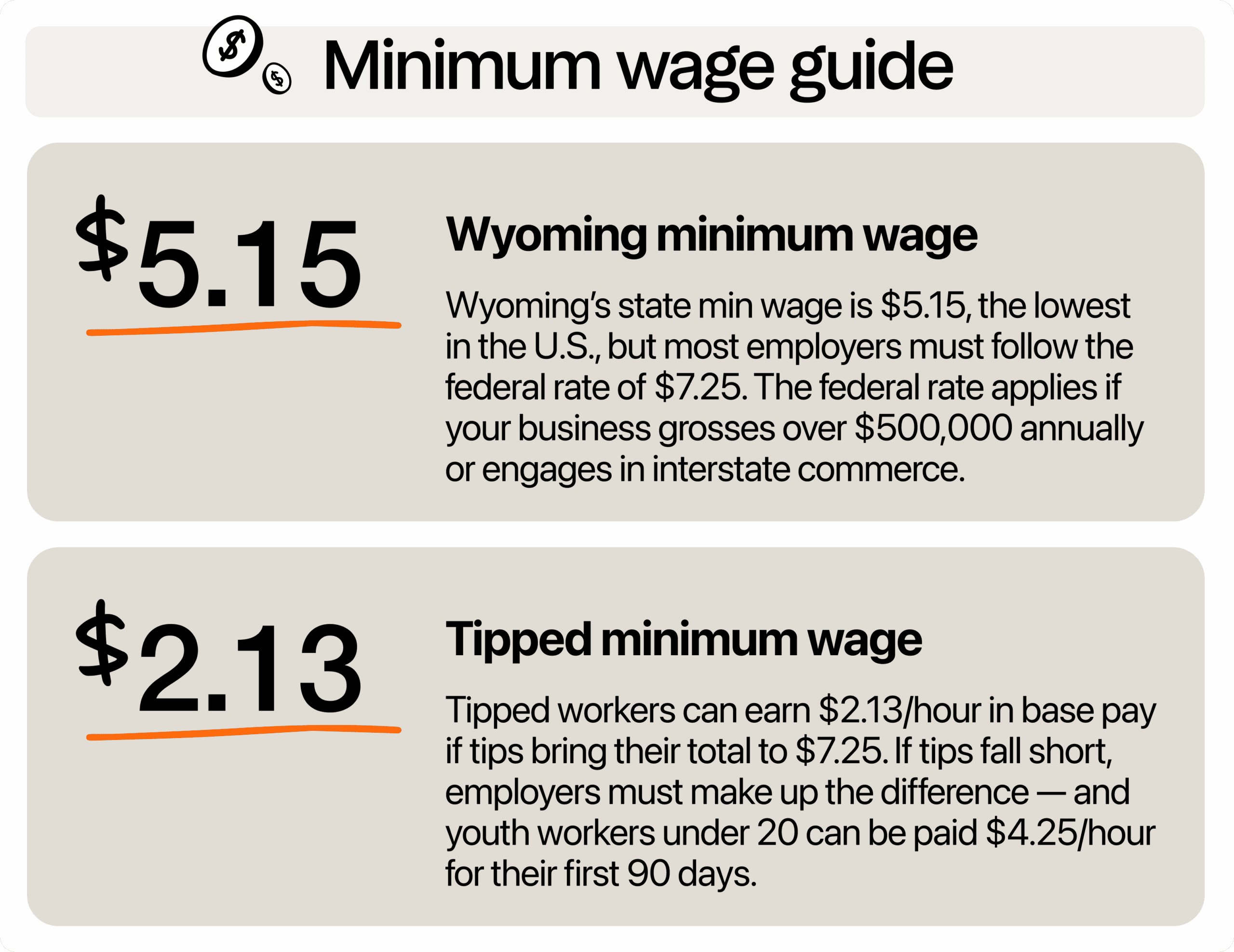

In 2026, Wyoming still holds the lowest state rate for minimum wage in the country at $5.15 per hour. However, employers subject to the Fair Labor Standards Act (FLSA) should follow the federal minimum of $7.25 per hour.

The local minimum wage is very low because of an older state statute that hasn’t been updated since 2002. That means the Wyoming wage law hasn’t kept pace with changes in the economy, despite rising living costs.

For tipped restaurant employees, like servers and bartenders, the rules work a little differently. Under federal law, the tipped minimum wage is $2.13 per hour, as long as tips bring the total to $7.25 per hour. If not, you’re responsible for making up the difference.

You may also encounter the training wage for younger workers. Employers can legally pay $4.25 per hour to employees under 20 years old for their first 90 days of work. After that, the standard minimum wage must apply. This rule is used occasionally in quick-service and seasonal restaurants hiring teens for summer shifts.

As a general rule, if your business grosses more than $500,000 per year, or you engage in interstate commerce (like ordering supplies online from out-of-state), then the federal minimum wage law applies.

How does Wyoming’s minimum wage compare to neighboring states?

Nearby states offer significantly higher wage rates. In Colorado, the minimum wage is $15.16, more than double Wyoming’s official rate. Nebraska follows with $15, while Montana offers $10.85 and South Dakota pays $11.85.

Both Utah and Idaho, like Wyoming, default to the federal minimum of $7.25 an hour due to a lack of higher state mandates. These differences can have a direct impact on how restaurants attract and retain staff, especially near state borders.

Take Cheyenne, for example. It’s only about 10 miles from the Colorado border. That means your workers could earn nearly double the wages just by crossing into Fort Collins, where the minimum wage is $15.16. For a full-time employee, that’s a difference of over $16,000 per year.

This kind of pay gap leads to what’s called employment drift, which is when workers leave your business to find better-paying jobs in nearby cities or states. Even if you’re paying the federal minimum wage, you could lose good team members simply because the wage across the border is more competitive.

Is there a law to increase wages for workers?

As of 2026, there is no law in place that guarantees regular wage increases in Wyoming. Unlike some states that automatically raise their minimum wage based on inflation or cost of living, the state’s minimum wage has stayed the same for more than two decades.

The story behind this stagnant wage goes back to 2002, the last time the Wyoming Legislature updated the state statute. Since then, multiple efforts to raise the minimum wage have failed.

In 2015, House Bill 24 proposed increasing the wage to $9 an hour and raising the tipped employee rate to $5.50 per hour, but it died in committee. The next year, House Bill 4 suggested raising the wage to $9.50 an hour, adding a training wage of $7.50 per hour for employees with less than six months on the job, and increasing the tipped rate to $5.50 an hour. That bill failed in the House by a large margin.

House Bill 171 tried to bring back the same changes in 2018, but it didn’t even make it past introduction. Then, in 2019, House Bill 273 proposed an increase to $8.50 an hour, along with a $0.25 yearly increase through 2025.

It passed the House Labor Committee but failed when it reached the full House. In 2021, House Bill 206 called for a sharp jump to $15 an hour, but it was never considered for introduction.

These bills often fail because many lawmakers worry about how higher wages would affect small businesses, especially in rural parts of the state. They argue that since the federal minimum already applies to most workers, raising the state rate wouldn’t help much but could hurt industries like agriculture, hospitality, and retail.

At the federal level, there was a proposal that could change things. The Raise the Wage Act of 2023 would gradually raise the federal minimum wage to $17 an hour by 2028, with future increases tied to median wages.

If this passes, it would override Wyoming’s state law and force many restaurant owners to adjust their pay practices. As of early 2026, the bill has not passed.

Looking ahead, it’s unlikely Wyoming will raise its minimum wage on its own anytime soon. Restaurant owners should expect the federal minimum to stay as the main standard and plan for possible changes from Washington instead of waiting for state lawmakers to act.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

How can businesses care for employee well-being at the current rate?

Even with the low minimum wage in Wyoming, restaurant owners still have ways to support their teams without raising base pay. Simple changes in scheduling, communication, training, and recognition can create a workplace where people feel respected, supported, and set up for success.

Create a transparent and supportive tip structure

When minimum wage levels stay low, tips become a major part of a restaurant employee’s take-home pay. That’s why having a fair and clear tip pooling system is important for both team trust and complying with wage laws.

In many restaurants, confusion over how tips are shared can lead to frustration or even turnover. If workers don’t understand where their money is going or feel like tip-outs aren’t fair, they’re more likely to look for jobs elsewhere. This matters even more when you’re paying tipped employees just $2.13 an hour, and tips are what push their total pay up to at least $7.25 per hour.

Having clear tip policies can also help you stay compliant with restaurant tip pooling laws. Under federal rules, you can only include certain staff in a tip pool, and you must make sure no one falls below the required wage level. Errors here can lead to audits, fines, or back pay claims.

When your team sees that you have a fair and transparent system, they’ll feel more valued and committed. Consider creating a detailed tip policy document that explains exactly how tips are calculated, distributed, and tracked. You can also use tip pooling software to automate the process and reduce errors.

Offer flexible, predictable scheduling

Many restaurant employees work more than one job to make ends meet. If you can’t pay more than the minimum wage yet, offering flexible and consistent schedules can make a big difference.

Unpredictable shifts and last-minute changes create stress, especially for workers trying to juggle multiple jobs, childcare, or school. Burnout builds fast when staff don’t know what their week looks like.

Make sure you give your team as much notice as possible. Posting schedules at least one to two weeks in advance gives employees time to plan their lives. It also reduces shift swaps, call-outs, and no-shows, which protects your bottom line.

With a restaurant scheduling tool, you can assign shifts easily while factoring in availability and labor targets. 7shifts also has a feature where employees can swap shifts with each other through the app, giving them more control while keeping management informed.

Invest in employee training and development

A pay rise is good, but it’s not always feasible for small restaurant owners. Nonetheless, you can give your team something just as valuable: training and development. When employees see that you’re invested in their growth, they’re more likely to stick around and give their best on every shift.

Aside from saving on hiring costs, internal promotions are one of the smartest ways to build loyalty. If your dishwasher knows they could become a line cook, or your server sees a clear path to shift lead, they’ll be more motivated to stay and grow with your business.

You can also support your team with low-cost training programs. Offer food safety certifications, barista skills, or prep cook training to help your BOH and FOH staff build confidence. Some restaurants even set up leadership pathways for staff who want to move into management roles. It shows your team that you see their potential, even if you can’t offer a big wage increase right now.

Track employee engagement and satisfaction

When wages are low, like they are in Wyoming, it’s even more important to know how your team is feeling. Happy employees work harder, stay longer, and give better service. But if someone feels burned out or unheard, they may quit without saying a word.

In our restaurant staff turnover and retention playbook, we found that the average employee tenure is just 110 days or around three months. Many factors contribute to this issue, which is why regular check-ins and open communication are important.

Talk to your team about how they’re doing in their roles and even in their personal lives, if they’re comfortable sharing it with you. Consider implementing anonymous surveys or regular feedback sessions where staff can share their thoughts candidly. Getting this kind of sentiment data helps you spot problems early, before they turn into no-shows or resignations.

For example, if you see a pattern of low scores on Friday nights, it might mean your team is overloaded or needs better support during rush hours. With this info, you can adjust staffing or check in with your crew to fix the issue fast.

Give performance-based incentives

Small perks, when tied to good performance, can make a big impact on employee motivation and morale. And they don’t have to break the budget.

Simple rewards like free meals, picking preferred shifts, or earning a small bonus after a busy weekend can go a long way to decrease staff turnover. For example, giving your top server first choice on the schedule shows appreciation and encourages others to bring their best. You might also offer $25 gift cards, “employee of the month” perks, or extra break time for those who go above and beyond.

These perks help your team feel seen, valued, and motivated. In a low-wage state, that sense of appreciation can be just as important as the paycheck.

Should your business pay above the minimum wage?

Although paying more isn’t required by law, offering above the minimum wage helps you keep your best people. When your team feels valued, they stay longer, show up on time, and perform better. Higher employee morale often leads to better guest experiences, which can mean bigger tips and repeat business.

Losing employees is expensive, costing between $1,000 and $2,600 per person. This includes lost productivity, training, and hiring time. By offering slightly higher wages, you can reduce call-outs, avoid burnout, and build a stronger, more reliable team.

Take note that nearby states are paying way more than Wyoming. If you’re in a border town, like Cheyenne or Torrington, you’re likely competing with restaurants across state lines.

Of course, it’s understandable to hesitate about raising wages when margins are tight. Every dollar counts in the restaurant business. Fortunately, you can balance it out with smarter tools and better systems. For example, using 7shifts for scheduling, time tracking, and tip management helps your managers save over 12 hours a week and reduce overtime costs by over $1,000 per month. That’s money you can put back into your team with better pay, and still come out ahead.

How to build a wage strategy that works for your business

Wyoming’s minimum wage may not be increasing any time soon, but you should still have a good payroll strategy to control expenses and keep your best people from leaving.

Start by looking at the numbers. Use your scheduling or payroll system to run labor cost reports every week or month. These show you how much you’re spending on wages, overtime, and benefits. If costs are climbing, you’ll spot it early and can make changes before it hurts your bottom line.

Another area to check is overtime and other schedule inefficiencies. These can eat into your profits quickly. Watch for patterns, like the same people regularly going over 40 hours, and adjust your schedules to spread hours more evenly.

Additionally, research what other restaurants in your area are paying for the same roles. Wage benchmarks help you see if you’re competitive. If you’re paying less than nearby restaurants, you may struggle to keep good people.

Finally, make sure your payroll is accurate. Taxes, tips, and time entries should all be correct. Errors not only frustrate employees, but they can also lead to legal trouble.

In Wyoming, employers who fail to pay wages on time can face fines of up to $200 per day until the employee is paid, plus interest, legal fees, and court costs if the dispute escalates. Inaccurate tax withholdings or false payroll reports for workers’ compensation or unemployment insurance can lead to criminal charges. Misdemeanors for amounts under $500 and felonies for larger cases, with fines up to $10,000 and possible jail time.

Common errors such as employee misclassification or poor record-keeping can leave employers liable for back wages, taxes, benefits, and audit fines. That’s why keeping payroll records accurate is part of a good wage strategy.

Winning in a low-wage market

Wyoming’s low minimum wage creates real challenges for restaurant owners, but it’s still possible to build a strong, loyal team. The most successful operators focus on more than just meeting the minimum. They look for ways to give their employees stability, respect, and growth opportunities.

Make the most of every hour paid with restaurant management software that lets you create schedules, track tips, and process payroll easily. With 7shifts, you can cut down on overtime costs while keeping your team happy with regular work.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.