Last year, Michigan’s minimum wage went up twice, which put a lot of pressure on restaurant owners in the state. Then, in 2026, it went up again. There are also scheduled increases in the next few years, which makes it even more challenging to plan ahead for labor costs. Knowing what to expect and how you can adjust your strategies is important to stay profitable and sustain your business.

What is the minimum wage in Michigan in 2026?

Previously, in January 2025, Michigan’s minimum wage rose slightly from $10.33 to $10.56 per hour. Then, on February 21, 2025, the minimum wage rate jumped again—this time to $12.48 per hour, after a court ruling overturned a delayed wage hike from 2018.

So in just seven weeks, operators had to adjust their payroll twice: once for the new year, and again in February. Although it was not considered a “sudden” change, its impact put pressure on restaurants and other small businesses to quickly adjust their payroll and operational plans.

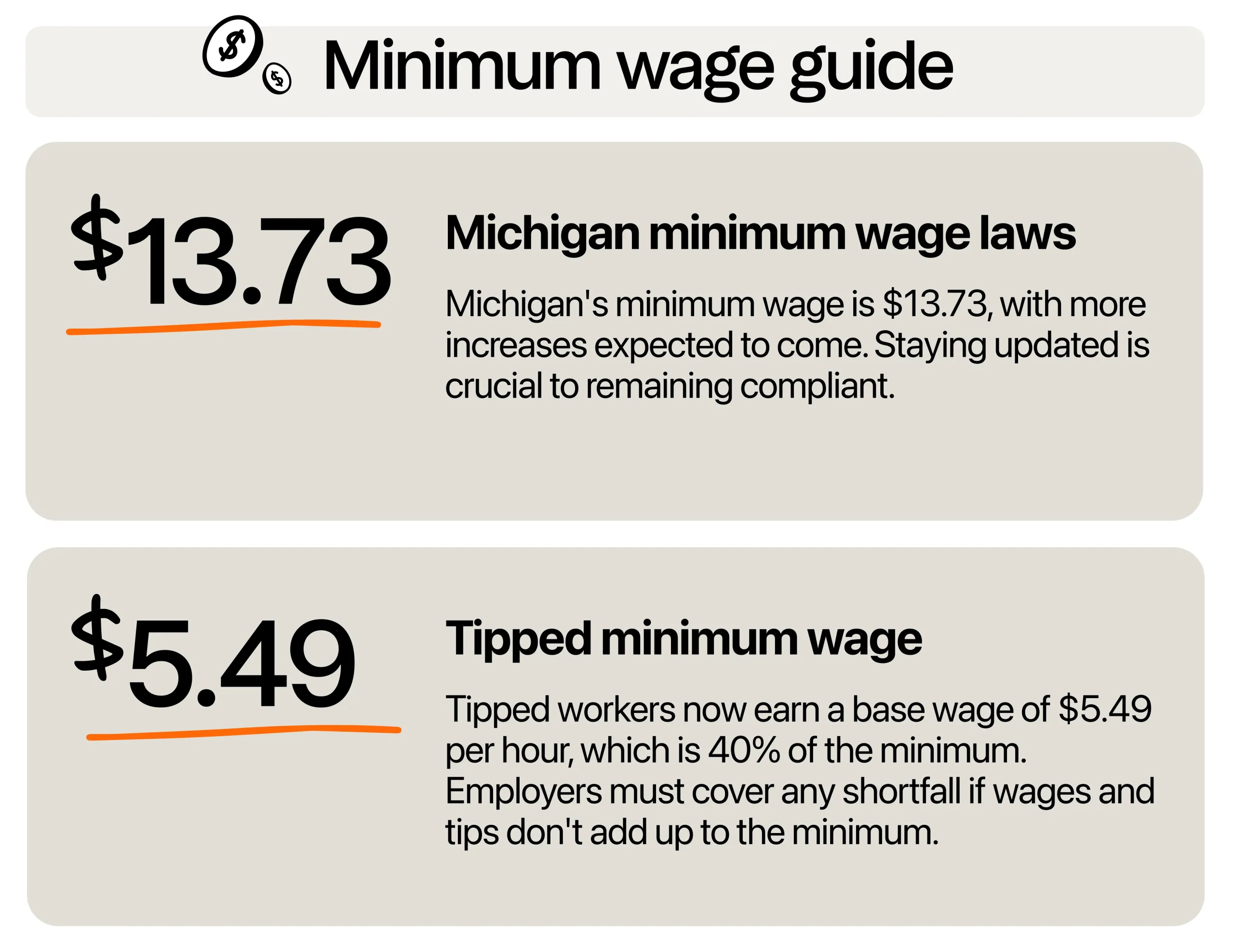

In January 2026, the minimum wage rose again, this time to $13.73 per hour. After the court ruling caused the jump to $12.48, the Michigan Legislature passed new legislation to provide a more predictable schedule. This law moved the annual increase date from February 21 back to January 1 for 2026 and beyond.

Additional wage laws to remember

Tipped employees saw their wages increase, too. From $4.74 per hour in 2025, the rate increased to $5.49 per hour in 2025. This is now 40% of the standard minimum.

Under state law, employers are still responsible for ensuring that tipped employees make at least $13.73 per hour when base pay and tips are combined. If tips fall short, the employer must make up the difference. For example, if a server clocks 30 hours in a week at $5.49 per hour, their paycheck will only show $164.70 before taxes. If they make less than $247.20 in tips that week, you’re on the hook to make up the gap.

Minors (16-17 years old) are paid 85% of the minimum wage in Michigan, which works out to $11.67 per hour. The training wage of $4.25 per hour can be used for new hires under 20 years old for their first 90 days. It’s one way to manage costs when hiring hosts, runners, or dishwashers, but it comes with tracking requirements to avoid violating state wage law.

Meanwhile, Michigan follows the Fair Labor Standards Act (FLSA) for overtime. That means non-exempt employees must be paid 1.5x their regular wage after 40 hours per week.

Based on the new base minimum wage of $13.73 per hour, the overtime rate jumps to $20.60 per hour. If you’re using a manual system or eyeballing weekly totals, it’s easy to miss these calculations. A missed overtime payment, even by accident, can lead to back pay, penalties, and legal trouble.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Are there plans to increase Michigan’s minimum wage?

Michigan’s minimum wage is rising every year through 2027, with long-term changes that affect both standard and tipped employees. Starting January 2026, the minimum wage rate rose from $12.48 to $13.73 per hour. Then, it’s scheduled to hit $15.00 per hour statewide the following year.

In just two years, the base wage for a full-time, non-tipped employee will have grown by more than 40% from early 2025. As such, a dishwasher working 40 hours/week at the $12.48 per hour minimum would earn about $25,958 per year. By 2027, that same role will be making $31,200 per year, increasing by over $5,000 before overtime or bonuses.

These increases are part of Michigan’s wage act to support workers while keeping up with rising living costs. But they also create pressure for restaurants to adjust their labor strategy, pricing, and operations to stay profitable.

After 2027, things won’t slow down. Instead of fixed rates, Michigan’s minimum wage will be adjusted based on the Midwest Consumer Price Index (CPI-U).

Every October, the Michigan State Treasurer will review the CPI data, and will announce the new rate in November. It will then take effect in January of the following year. However, if Michigan’s unemployment rate reaches or exceeds 8.5%, the scheduled increase is put on hold for that year.

This approach makes wages more responsive to inflation, but it also means less predictability year to year for restaurant operators.

The tipped wage, currently $5.49 per hour, won’t stay flat, either. A new tip credit phase-out plan aims to raise it to 50% of the standard minimum wage by 2031.

In 2026, tipped employees must be paid at least 40% of the minimum wage. This rate bumps to 42% by 2027. From there, it increases by 2% each year until it caps at 50% in 2031.

How does the state minimum compare to its neighbors?

Across the Midwest, minimum wage rates vary widely, and Michigan sits near the top. At $13.73 per hour, The Great Lake State’s rate is higher than the Ohio minimum wage, which is at $11 per hour.

Michigan’s wages are also way ahead of Indiana and Wisconsin, both of which still follow the federal minimum. Meanwhile, Illinois minimum wage leads the region at $15 per hour (and higher in Chicago).

If you operate in Sturgis or Monroe, the wage gap can actually work in your favor. However, if your restaurant is in Michigan City, it can be easy for employees and applicants to go to Chicago, where they can easily earn a few more dollars per hour.

You’ll need more than a decent wage to compete. Offer consistent scheduling and fair tip policies, and highlight the benefits of staying local, like shorter commutes and better work-life balance.

How to manage higher labor costs with Michigan’s minimum wage

Raises in the state minimum are set to happen yearly, which means payroll will take up a bigger slice of your budget. You must take the time to analyze your current costs and look for ways to boost efficiency.

Reassess your labor strategy

With the expected increases to Michigan’s minimum wage, restaurant owners must view higher labor costs as the new normal. As such, it’s time for you to adjust your strategy.

First, review your prime costs, which are the total of your food and labor costs. On average, it should be around 60% of total sales. But with wages increasing every year through 2027, you may need to set lower targets, which you can easily adjust through labor.

One of the biggest mistakes operators make is overstaffing during slow shifts. Check your previous schedules. Are you regularly running four servers on Tuesday lunch when two would do? Are kitchen staff clocking in early just to wait around? Even trimming one extra shift per week could save you over $650 per month under the new minimum wage rate.

Use your POS system to spot peak times, so you know exactly how many people you need per shift. It’s also best to use restaurant scheduling software to enhance the process of assigning your team.

For instance, 7shifts has a drag-and-drop feature that helps managers quickly create optimal schedules. It also lets team members swap shifts directly in the app, with manager approval. This reduces last-minute texts and no-shows, while giving your staff more control over their hours.

Another way to control restaurant costs is to cross-train your team. A host who can also expo or a line cook who can prep gives you flexibility without needing to add labor hours.

Update your menu pricing and design

Aside from looking into your labor strategy, you should also check your menu. Trim items that don’t sell as much. Every dish on your menu takes time, labor, and inventory to prep, even if only a few guests ever order it. So, cutting just three to five low-performing items can free up kitchen space and simplify operations.

Next, look at how you can make the most of your ingredients. Can the same roasted tomatoes go on both a sandwich and a pasta dish? Can one base sauce work across multiple entrees? Fewer unique ingredients mean less spoilage and lower food costs. These are two quick wins when you’re already paying more in wages.

Again, use your POS system to check sales data. Check what your top-margin dishes are and what popular but barely breaking even. Focus on promoting high-profit menu items and reconsider or reprice the rest. A $0.50 increase on five top sellers can help cover new minimum wage costs without scaring off guests.

Do some menu engineering, such as placing high-margin items in the middle or top parts of the page. Use visual cues like boxes or different fonts to draw attention to these profitable dishes.

And don’t be afraid to explain why prices are going up. A small note on your menu or website, like “We’re proud to pay our team fair, competitive wages,” can help guests understand the value behind the price.

Consider service charges or upgrade tipping policies

It may also be time to rethink how your restaurant handles tips and service charges. One option is adding a flat service fee, like 15% or 18%, to each check. This fee helps cover higher wages and can be used to support both FOH and BOH team members. It gives you more control than relying on traditional tips, which can be unpredictable and uneven.

For example, if your average ticket is $50 and you serve 500 tables a month, a flat 15% service charge adds $3,750 per month. That’s enough to cover almost 300 hours of labor at the current minimum wage rate.

You can also consider automatic gratuity for large groups, like parties of six or more. This helps protect servers from getting shorted on high-effort tables and maintains a baseline of income on busy nights.

But before you make any changes, always check state law and IRS rules. Take note that tips belong entirely to employees, while service charges are legally considered business income.

If you choose to share that revenue with staff, it must be processed as regular wages, subject to federal, state, and FICA payroll taxes, and included in overtime calculations. You also can’t use tips to cover operational costs like credit card fees.

Invest in your team

Although it may seem counterintuitive when labor costs are rising, investing in your team can actually help manage expenses. Employee turnover costs restaurants between $1,000 to $2,600 per employee, depending on whether they’re replacing FOH or BOH staff or managers.

This comes from productivity losses, like the resources needed to post job ads, going through the selection process, and then onboarding and training the new hire.

Show your employees some appreciation by recognizing top performers and publicly lauding their contributions to the team. You can offer small bonuses or other non-monetary incentives, such as the first pick of holiday shifts.

Doing this helps you create a positive work environment where staff feel valued and motivated. You should also provide training workshops to help them upskill. This way, they don’t just feel stuck in their current roles, but see opportunities for growth within the restaurant.

Another smart move is to promote from within. Training a brand-new employee takes time and money, especially when you factor in uniforms, paperwork, and mistakes made during the learning curve. But promoting a dishwasher to line cook, or a server to shift lead, saves costs and builds loyalty. They already know your systems, your team, and your standards.

Additionally, fair pay and consistent schedules go a long way toward building trust. When staff know they’ll get enough hours, and that they’ll be paid correctly, they’re more likely to stay.

Every time you keep a great worker from walking out the door, you avoid paying for another round of job ads, interviews, and onboarding. And when minimum wage rates are rising every year, keeping experienced, trained employees is a solid way to protect your investment.

Staying ahead with smart strategies

This year’s double increase is just one step in making Michigan wages more competitive for workers. For restaurant owners, that means more pressure on margins, but also a chance to build a stronger, more loyal team. With the right systems and strategies, you can run a profitable business without burning out your staff or cutting corners.

Stay on top of labor costs with the right restaurant management software. 7shifts helps you optimize each shift, making sure you deliver exceptional service while providing competitive wages.

Also read: Michigan tip laws for restaurants

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.