The minimum wage in Nevada sits in the middle compared to neighboring states, which can be good or bad depending on your restaurant’s location. It could give you a hiring edge, or you’d need to offer competitive compensation to attract and keep talent. Either way, you need to understand current wage laws and have a plan to manage your labor costs and protect your margins.

What’s the current Nevada minimum wage in 2026?

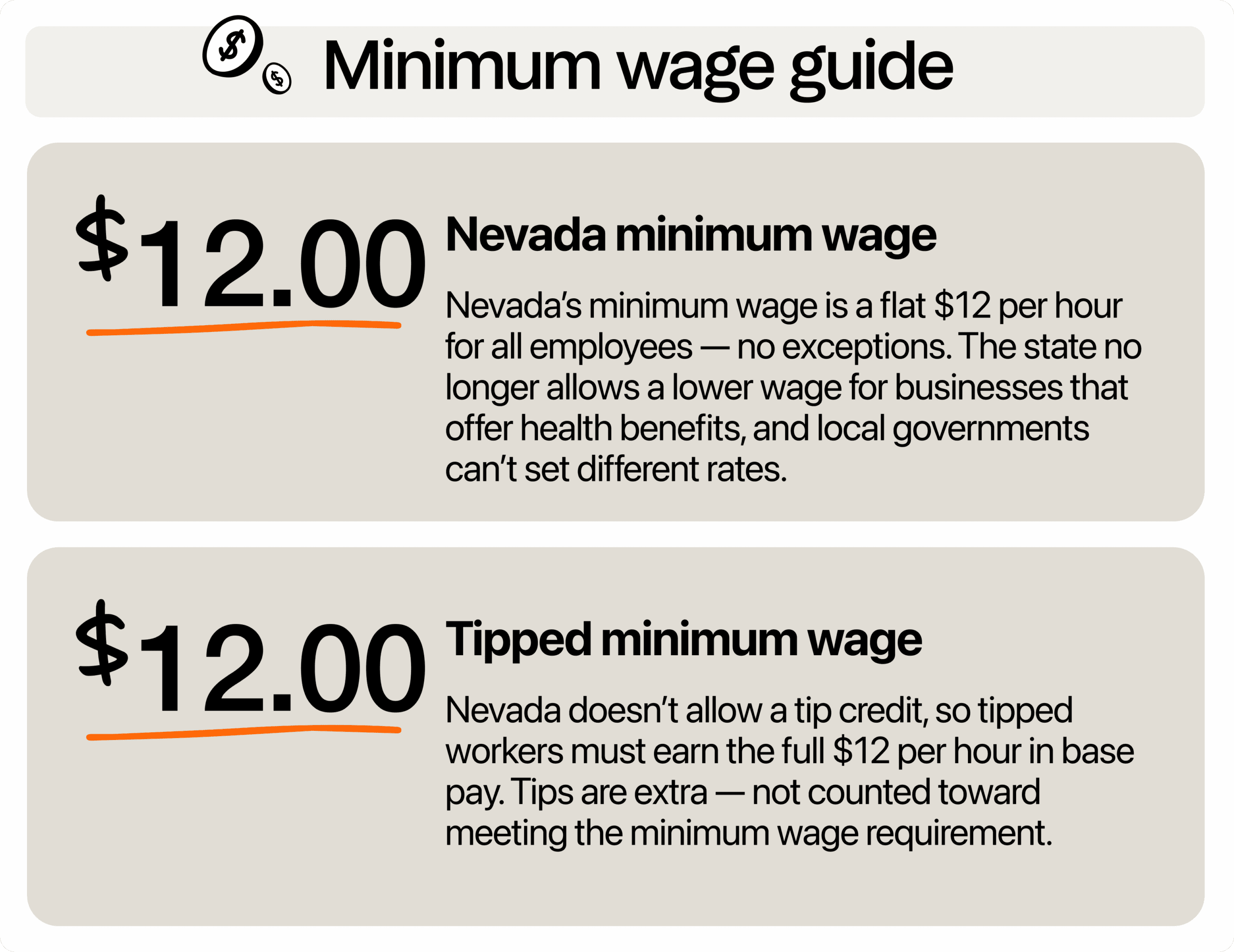

The current minimum wage in Nevada is $12 per hour for all employees, no exceptions. This statewide 2024 change removed the two-tiered minimum wage system the state had used for years. No city or county can set a higher or lower wage.

The previous system let businesses that offered health benefits pay $1 less per hour than those that didn’t. But now, whether your restaurant offers benefits or not, everyone must be paid at least $12 per hour.

Tip credit in Nevada

Unlike many other states, Nevada law doesn’t allow a tip credit. That means tipped workers, like servers, bartenders, and bussers, must still get the full $12 per hour in base pay, not counting tips. In fact, Nevada is one of only eight states that require this. Even if an employee makes hundreds in tips during a shift, you still need to pay them the full minimum wage.

Overtime rules in Nevada

Employers also need to pay close attention to overtime laws in the state. In Nevada, daily overtime kicks in if an employee works more than 8 hours in one day or more than 40 hours in a week.

This rule applies to any employee making less than $18 per hour. So, unless your team is making more than that, you need to track hours daily, not just weekly. Letting someone stay an extra 90 minutes to cover a shift might not seem like a big deal. But if that pushes them past the eight-hour mark, you’re required to pay 1.5x the regular rate.

For example, if one of your hosts works 9 hours in a single day at $12 per hour, their ninth hour must be paid at $18 per hour, not $12.

Exemptions

Some employees are exempt from Nevada’s minimum wage laws, but only in very specific cases. These include:

- Minors under 18 working part-time or in training (like dishwashers in their first job)

- Trainees during their first 90 days, under a valid training program

- Workers with union agreements that include alternative pay structures

- Commission-based salespeople, like merch reps, if they earn over 1.5x the minimum consistently

Unless your employee clearly falls into one of those categories, the $12 per hour rule applies. Misclassifying workers to avoid paying the full wage can result in serious fines and can lead to state audits, especially in high-turnover industries like restaurants.

How does Nevada’s minimum wage compare to the federal minimum and other states?

The federal minimum wage, which hasn’t changed since 2009, is still $7.25 an hour. In the western U.S., Nevada’s minimum puts it right in the middle compared to nearby states. The Silver State offers more than Utah and Idaho, which still follow the federal rate.

On the other hand, Nevada’s wage is still lower than what neighboring Arizona, Oregon, and California pay. In 2026, Arizona’s minimum is $15.15 and California leads the region at $16.90 per hour. Oregon sets the standard minimum at $15.05, while the Portland metro area has a higher rate of $16.30 per hour.

For restaurant operators, this pay gap can make a big difference when it comes to hiring and keeping staff. If your business is in Laughlin or Pahrump, you risk losing employees to cross-border restaurants, especially seasoned team members like line cooks, baristas, or FOH managers.

Meanwhile, if you’re in West Wendover or Jackpot, employees could view Nevada’s minimum as a step up, making it easier to attract talent.

Is there a law after 2024 that increases the Nevada minimum?

There’s no new law scheduled for annual increases after 2024. Back in November 2022, Nevada voters passed Ballot Question 2, which changed the Nevada Constitution. This amendment set a statewide minimum wage, regardless of employer size or benefits

As mentioned, it also ended the old two-tiered minimum that allowed some businesses to pay $1 less if they offered health coverage. The changes became effective in July 2024.

Unlike states like Washington and Maine, which tie wage increases to the Consumer Price Index (CPI), future wage increases in Nevada must come through the Nevada Legislature or another ballot initiative voted on by the public. This makes it even more important for business owners to stay updated on proposed legislation or voter-led campaigns.

What can employers do to manage labor costs?

Even though no new law is locked in, it’s smart to plan ahead. If another increase hits, it could happen fast. A sudden jump from $12 to $13.50 or $15 could have a major impact on your restaurant budget.

Track labor costs in real-time

Labor costs are one of the biggest expenses, and they’re also one of the most unpredictable areas. In our restaurant labor costs playbook, we found that only 36% of owners hit their labor cost targets, while 44% spent more than planned. This makes sense, especially with rising wages, benefits, and overtime.

As such, it’s more important than ever to stay on top of how much you’re spending on your workforce.

Real-time tracking is the key. Instead of waiting for the end of the week or month to spot a problem, you can check labor costs by the hour or by shift. If you’re overstaffed during a slow afternoon or creeping toward overtime, you’ll know right away, and you can fix it before it costs you.

Use restaurant time clocking software to track attendance and compare data with your POS. This way, you can see how labor costs relate to your revenue.

For example, you might discover you need fewer servers during weekday lunch shifts or that your kitchen staff is more efficient during dinner service. This information can help you make the most of each shift and reduce unnecessary expenses.

Make sure to set up a weekly labor budget based on your forecasted sales. Then check your dashboard daily to make sure your actual costs are staying close to target.

If you notice you’re running high on labor early in the week, you can adjust schedules for the weekend or find tasks that make better use of extra staff, like deep cleaning or prep.

2026 Labor Costs Playbook

Increase your bottom line with insights from over 500 restaurant pros—learn the true cost of employee turnover, the best way to manage labor costs, and proven strategies to protect profits.

Build better schedules

Once you have the numbers down, you can start creating better schedules. Overstaffing during slow times eats into profits fast, and understaffing during rushes leads to burnout and bad service. The fix? Use tools that help you schedule based on real data.

Restaurant scheduling software makes assigning shifts easier by taking into account your team’s availability, roles, and skill sets. Then, you layer in forecasted sales and labor targets to make sure you’re not overspending on slow days or scrambling during peak hours. The result is a schedule that works better for your staff and your bottom line.

Some tools also let your team members swap shifts among themselves. This gives them more control over their schedules while reducing the burden on your managers.

Pay attention to overtime triggers

Small mistakes in tracking and calculating overtime can add to your labor costs. A single employee who works just 30 minutes over an 8-hour shift means an additional $9 in overtime pay. This can add up to $45 per week for that worker alone if you’re not careful. Multiply that across multiple employees and shifts, and you could be looking at hundreds in extra wages each month without realizing it.

You don’t need to micromanage every shift, just set the right tools in place. A time-clocking app can help you set automated alerts for overtime, flagging when an employee is about to exceed their scheduled hours.

Reassess menu and pricing

Take a second look at your menu and pricing. Cut slow-moving items or those that take too much time to prepare. Focus on dishes that can be served quickly, use shared ingredients, and deliver strong margins. This makes your team more efficient and keeps your BOH from getting stuck in the weeds.

Next, look at your pricing strategy. A small price bump, just 50 cents to $1, on popular items can help cover higher wage costs without hurting the satisfaction of your customers. If you haven’t reviewed prices in the last 6 to 12 months, now’s the time. Use POS data to find your top sellers and make changes where they’ll have the most impact.

Stay ready for what’s next

Nevada’s minimum wage is likely to remain the same, but that doesn’t mean you should be complacent in managing your labor costs. Staying competitive and paying fair wages means being proactive. Be prepared for future changes by implementing cost-efficient strategies now, so you can easily adjust when the next wage increase comes.

Look for restaurant payroll software that helps you oversee pay, time clocking, and scheduling in one app. It should simplify and automate tedious tasks, so you can focus on optimizing your operations and growing your business.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.